If you’re looking for an instant loan and have bad credit, many search results may start to look pretty similar.

- GUARANTEED PAYDAY LOANS — NO MATTER BAD CREDIT SCORE!

- Receive funds typically within 30 mins, 24/7/365!

- Loans Up to $2,500 With No Prepayment Penalties!

You’ve entered the world of online tribal payday loans, and there’s danger ahead.

What is a Tribal Payday Loan?

You may not be familiar with the term “tribal loans” or its meaning. Tribal loans are often presented as payday loans, but they’re far more dangerous.

Tribal loans are short-term online loans issued by lenders based on tribal land. Like a standard online payday loan, tribal payday loans are a poor financial decision for most borrowers. Because the lenders are based on tribal land, they have federally-protected sovereign immunity, which grants them the right to self-govern and sidestep state laws.

This is because the U.S. Constitution recognizes Native American reservations as sovereign nations. The companies offering the loans are subject only to tribal regulations and federal laws. These regulations are weaker than those of many states — especially states with robust consumer protections. Tribal loans can be difficult to recognize. The web sites are designed to make it look like you’re applying for a traditional short-term installment loan.

To help recognize tribal lenders, look for notations in the fine print of the lender’s home page. You will often see a notice like this one:

Opichi Funds, LLC d/b/a eLoanWarehouse is a sovereign enterprise, an economic development arm and instrumentality of, and wholly-owned and controlled by, the Lac Courte Oreilles Band of Lake Superior Chippewa Indians (the “Tribe”), a federally-recognized sovereign American Indian Tribe. This means that the Opichi Funds installment loan products are provided by a sovereign government and the proceeds of our business fund governmental services for Tribal citizens. This also means that Opichi Funds is not subject to suit or service of process. Rather, Opichi Funds is regulated by the Tribe.

While traditional payday loans charge annual percentage rates of 300% or more, tribal loans often charge financially devastating APRs of 700% – or even higher.

Borrowers of tribal payday loans will also have a more challenging time discharging the loan in bankruptcy, refinancing the loan and asserting their rights when lenders request payment.

READ MORE: Same-day loans that aren’t payday loans

Tribal Loans vs. Payday Loans: What’s the Difference?

According to the Consumer Financial Protection Bureau (CFPB), payday loans are typically short-term loans of $1,000 or less that are repaid from your next paycheck. These loans nearly always have very high interest rates, making repayment difficult.

Payday lenders offer online loans, but you can also get one at a local storefront. Tribal loans are exclusively online loans.

Payday lending and tribal lending have a few key things in common: The loan applications are simple, qualification requirements are minimal, there’s no credit check and the money is usually available no later than the next business day. Many turn to these lenders when they face an immediate financial need that can’t wait, like a car repair or medical bill.

READ MORE: How payday loans work

There’s No True Definition for Tribal Lending

The CFPB doesn’t define tribal payday loans; the term has no specific legal meaning. Tribal lending is a loophole that allows lenders to take advantage of Native American tribes’ ability to set their own laws by basing the lending companies on the tribe’s reservation. This means lenders can sidestep state laws restricting payday loans, so tribal lenders are unregulated and usually unlicensed.

Tribal loans usually aren’t repaid in full on the next payday. Instead, they’re short-term installment loans, usually repaid over several months.

Tribal loans carry extra risk for borrowers. They have a significantly higher interest rate than an ordinary payday loan since tribal lenders don’t care about state laws.

Pro tip: Neither payday nor tribal loans are a good long-term financial solution. Please explore other loan products and forms of credit, such as personal loans or credit card cash advances.

The Dangers of Tribal Loans

Unfortunately, tribal payday loans share all of the pitfalls and dangers of standard payday loans and then some.

According to the Federal Trade Commission (FTC), tribal payday loans are frequently offered by disreputable lenders who use false advertising, fraudulent billing practices, and other shady techniques to take advantage of borrowers.

Tribal Lenders are Unlicensed

Many tribal lenders are not licensed by their state’s banking regulator. Instead, they will post a “license” issued by the tribal lending entity.

Tribal Lenders Don’t Have to Follow State Laws

As previously mentioned, if you live in a state where payday loans are illegal or the interest rates are capped, you may be led to believe that your loan terms will be within those parameters. However, unlicensed tribal lenders aren’t obligated to follow state laws. This means that many customers walk away believing that they were approved for a loan with a 36% interest rate (or whatever their state’s legal maximum is) when in fact, they’re paying 700%.

READ MORE: States where payday loans are illegal

They’re Even More Costly Than Payday Loans

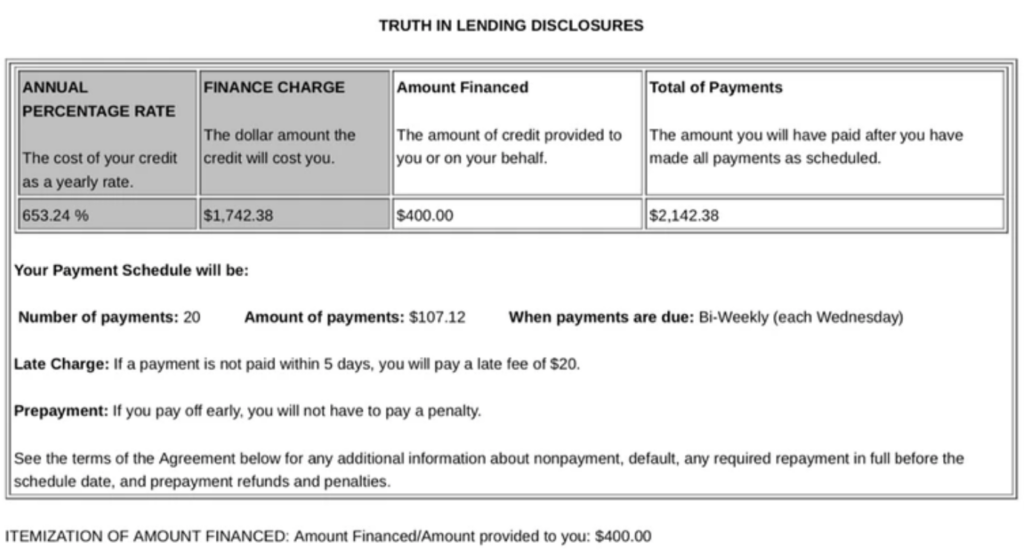

It’s complicated to calculate the true tribal loan APRs because the loans aren’t repaid in a lump sum. They’re repaid in installments over several months. Lenders show calculations over a calendar year that trick borrowers into believing they are paying a 36% APR. Once you get to your loan agreement, they are legally required by the federal Truth in Lending Act to disclose the full cost of your loan. By that point, it is usually already too late to undo the damage unless you can repay your loan in full immediately.

You’ll typically see something like this on your loan agreement:

Fees are high

If you can’t repay your loan as scheduled, your lender may offer to extend your loan term for an additional fee. There may also be hidden fees for payments lower than your minimum or non-payment fees if you miss a payment, and, of course, the interest will continue to accrue.

Tribal Lenders Charge Biweekly Payments

This makes it seem like your payments are lower when reviewing the loan paperwork. Many borrowers failed to realize they would have to make two monthly payments. This can be financially devastating, particularly once you start adding up the payments and realizing you’ll have to repay more than twice what you’d originally borrowed.

The Loans are Technically Legal – For Now

Tribal loan borrowers who live in states with strict interest rate caps often find themselves frustrated and confused when they find out they’re paying 700% APR and that their loans aren’t illegal. That said, states are starting to take legal action against them. When that happens, tribal lenders simply refuse to issue any loans at all in those states.

READ MORE: Already stuck in the payday loan debt trap? Here’s how to get help

Tribal Lenders Won’t Issue Loans to Military Service Members

The Military Lending Act caps the interest rates that service members and their families can be charged at 36%. Because the MLA is a federal law, tribal lenders must follow it. But rather than cap their interest rates, they simply refuse to lend money to servicemembers. If you notice that a lender won’t loan money to those in the military, look for a different lender.

You Will Have to E-Sign Your Loan Contract

By now, most people are familiar with e-signatures. This is a code that acts as a legal signature. It is considered more secure than faxing documents. However, an e-signature leaves a digital trail. If you argue that you were coerced into signing, want to try sending a 609 letter to have an unpaid debt removed from your credit reports or a debt collector takes you to court, it is easy to prove that you legitimately signed the loan documents. This is why it’s very important to read the terms and review the Truth in Lending Disclosures before you sign.

How to Get Out of Tribal Payday Loans

Because tribal lenders aren’t typically licensed, a tribal lender will do whatever it takes to settle the issue out of court. However, if the debt is sold to a debt collector, they will absolutely be willing to sue you in an effort to collect the debt. Try to deal with the debt before it’s handed over to a debt collection agency.

Here are some steps to take:

Revoke authorization for withdrawals from your bank account.

Close your bank account and open a completely new account (This is because some tribal lenders may try to debit your account using the name of a different lender that’s affiliated with the same tribe).

Stop making payments: Your credit score will likely fall once the loan default is reported to the credit bureaus.

Deal with debt collection calls: You can demand that they stop calling you by sending a cease and desist letter. The Consumer Financial Protection Bureau explains how. Just remember that this doesn’t mean you don’t owe the money.

Check your paychecks carefully: Some shady lenders have contacted borrowers’ employers demanding wage garnishment. They do not have this authority and this is not legal, but sometimes it slips through the cracks, particularly with large companies with complicated payroll systems. According to the Federal Trade Commission, they also cannot demand that you appear in a tribal court that does not have jurisdiction where you live.

“Debt collectors cannot garnish consumers’ wages without a court order, and they cannot sue consumers in a tribal court that doesn’t have jurisdiction over their cases,” said Jessica Rich, a former director of the FTC’s Bureau of Consumer Protection. “Regardless of tribal affiliation, debt collectors must comply with federal law.”

Contact the lender and offer a settlement: If you borrowed $800 and have already repaid more than the total amount borrowed, they likely will be willing to consider a smaller settlement. Offer them a lump sum in exchange for noting that the loan was paid in full.

READ MORE: What happens if you don’t repay a payday loan

Pro tip: Some borrowers have been able to get settlement offers simply by writing complaints or reviews on the lender’s Better Business Bureau page. If the lender is responsive to BBB complaints, try documenting the specifics of your loan, including how much you borrowed, how much you’ve repaid, the interest rate and how much the loan would ultimately cost you. (Don’t include any personal information) and they may contact you directly through the BBB.

Tribal Loan Horror Stories

Tribal lenders’ customers have posted countless reviews and complaints. May have reported:

- Having to pay significant late payment fees

- Confusing loan agreements

- Losing loan collateral due to inability to repay

- Damage to credit scores

- APRs over 100% of the loan’s value

- Having a bank account locked due to activity by the lender

- Becoming trapped in a cycle of debt

- Being forced into bankruptcy

Here are some complaints that were submitted to the Better Business Bureau about various tribal lenders:

I took out a loan for $800. My first payment was at the beginning of September. I have made nine payments so far, and almost every payment has gone 100% to interest. I have paid off only $18.00 on this loan so far. I have had a loan with them before and did not have this problem. My payment is almost double what it was before. I have paid over $1300 on this loan, and to only pay off $18 does not seem right.

I took out a loan with *********. I didn’t realize that their interest rates are higher than what is legal. By the time I pay off this loan, I will have paid triple the amount of the loan. I would not take another with this company.

Absolutely 0 on this consumer’s review, however that’s not an option. If I could it would be a 0. I thought this was something to help me catch up on my bills. It had the exact opposite result. The compounding interest is simply price gouging and all it does is set people up for failure. This should be criminal.

In April 2023 I contacted ************* about a loan and was approved. Weeks later I reached out for additional funding and was told that I qualified for a line of credit, which I was told would be better. I asked how would the line of credit work and was told by a representative that I would pay it back the same way I would any other credit card. This, in fact, was a lie. Over $200 every two weeks comes out of my bank account. That is, in fact, not how credit cards work. Today, I called ************* and inquired how much it would be if I paid in full today. the representative told me $1400. I verified the original loan amount from April 2023. He stated that I borrowed $1200. I was lied to about the line of credit. Predatory lending at its finest.

READ MORE: Payday loan alternatives and organizations

Better options

The Bottom Line

Payday loans are a bad option. Tribal loans are even worse. Before you submit any loan application, make sure you’ve checked out the lender. If you’re uncertain, find a different lender. It won’t help your financial situation if your loan sets you up to fail.

Online Tribal Lenders to Avoid

Most tribal lenders aren’t easily recognizable. Here are some of the most popular ones (based on search volume).