For someone who needs some extra cash now, an online installment loan may seem like the best option. After all, online lenders like National Small Loan offer installment loans with minimal requirements, which makes them seem like an easy fix.

But, like payday loans, installment loans come with some major drawbacks. Many of these short-term loans have sky-high interest rates, hidden fees and poor repayment terms. For many people, taking out an installment loan is more trouble than it’s worth.

Still, if you’re considering an installment loan, it can be hard to sift through all the information online and choose the best lender. If you’re considering National Small Loan, check out this in-depth review before you decide.

Drowning in online payday loan debt?

Credit Summit may be able to help.

Table of Contents

What Is National Small Loan?

National Small Loan (aka Midaaswi, LLC) is an instrumentality and limited liability company established in 2015. The Lac du Flambeau Indians of the Lac du Flambeau Reservation in Wisconsin own and operate this lender.

Although it’s based in Wisconsin, the lender does not comply with state law. Instead, it adheres to federal consumer finance laws as incorporated by the tribe. This makes it a tribal lender.

National Small Loan offers fast, easy installment loans online in every state except:

- Wisconsin

- Pennsylvania

- Virginia

- West Virginia

- Washington

- New York

- Arkansas

- Connecticut

These loans range from $100 to $1,200, with a maximum limit of $500 for first-time borrowers. Borrowers can repay their loan over time in preset installments. This makes them different from payday loans, which must be repaid in one lump sum.

Unlike some of its competitors, National Small Loan provides consumers with the option for a customized payment plan. This plan allows individuals to borrow the exact amount they need with several payment options. Not only that, but this tribal lender does not charge fees for early repayment or additional payments.

Although it may seem great on the surface, National Small Loan is not very transparent with its lending practices or the fine print.

For example, the lender mentions the risks of payday loans (ex. debt trap), but it doesn’t clarify how its installment loans are better. The lender is also vague on other details, including its loan terms and interest rates. Much of this information is only provided after the application for a loan is approved.

National Small Loan may be an option for those who need extra cash to cover a short-term financial emergency. But borrowing any kind of short-term loan – installment or payday – comes with its share of financial risk, especially for those without a solid financial plan to repay it.

Is National Small Loan Licensed?

Many online lenders are licensed by the state – or states – they operate in. However, like most other tribal lenders, National Small Loan is not state-licensed.

Instead, the lender has a Financial Services License through the Lac du Flambeau tribe. This is a federally recognized tribe that’s been around since 1745.

Because National Small Loan operates under tribal law, it is not subject to Wisconsin’s state laws. As a result, the lender has potentially uncapped interest rates and cannot be sued for unlawful practices. This gives the consumer less protection than licensed lenders.

The Lac du Flambeau tribe owns and operates multiple enterprises, including a fish hatchery, casino, gas station, campground and a smoke shop. The tribe also appears to own other online tribal lenders. Some of the active lenders are:

- Bright Star Cash

- Amplify Funding

- Lendgreen or Niiwin, LLC

- Sky Trail Cash

- Radiant Cash

These lenders provide short-term installment or payday loans with an emphasis on express, easy funding. Each lender is licensed by the tribe, but not by the state.

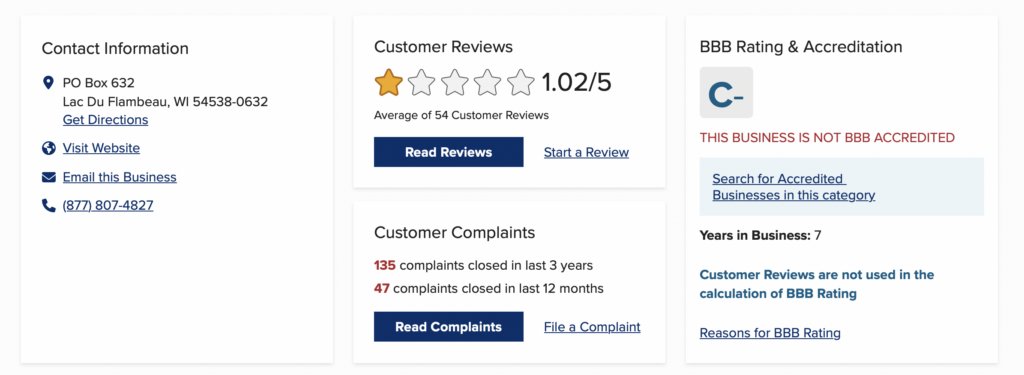

Along with other lenders that operate under the Lac du Flambeau tribe, National Small Loan is also not accredited by the Better Business Bureau (BBB).

Tribal Loans: What You Need to Know

Many tribal lenders market themselves as a better alternative to traditional short-term loans. This, along with low qualification requirements, makes tribal loans seem like a good idea for those in a financial pinch.

However, tribal lenders are like traditional lenders in many ways. Their short-term loans usually come with high interest rates and short repayment periods. These lenders also rarely report to the credit bureaus. Some lenders don’t even check a customer’s credit score before approving their loan application. With minimal qualification requirements, it is easy for most consumers to take out a loan.

There is one key difference between tribal and traditional lenders. Whereas traditional lenders usually must comply with state or federal laws, tribal lenders often claim sovereign immunity through their tribe. This means they operate solely under tribal law and consider themselves exempt from most state or federal lending laws. As a result, they pose a higher level of risk to consumers than traditional options.

Tribal Immunity

Indian or Native American Tribes operate under tribal sovereignty, which means they have the right to govern themselves without interference by state or federal governments.

Tribal immunity is a key part of tribal sovereignty and applies to the tribe, its people and any entities it owns. In other words, lenders like National Small Loan claim immunity from lawsuits and cannot be sued.

Tribal lenders often use their so-called tribal immunity as an excuse to ignore existing laws that protect consumers. For example, they may:

- Charge interest rates that are far above state limits

- Offer loans with balances that are higher than state minimums

- Break the terms of their loan agreements without justifiable cause

Since National Small Loan operates under the Lac du Flambeau Band of Lake Superior Chippewa Indians, it may claim tribal immunity.

The Consumer Financial Protection Bureau (CFPB) and the Supreme Court are both attempting to crack down on tribal lenders. The CFPB has even sued many tribal lenders for predatory lending practices.

Unfortunately, it’s a slow, difficult process because many tribal lenders argue that they are not subject to any laws but their own.

Meanwhile, tribal lenders like National Small Loan continue to approve short-term loans that may violate state laws and bring about greater financial hardship to consumers already strapped for cash.

Here’s What to Expect When Taking Out a Loan from National Small Loan

National Small Loan’s terms and rates are not readily available on their website. However, here are some of the main things you can expect when taking out an installment loan with this lender:

- $100 to $500 borrowing limit for first-time borrowers (up to $1,200 for returning customers)

- Estimated APR in the triple digits (rates not disclosed until after approval). Some customers mention APR as high as 725.4%.

- No prepayment fees

- $30 late fee

- $25 insufficient funds fee

- Vague repayment terms but likely less than 1 year

- Required weekly or monthly payments, depending on the specific loan terms

- Possible hard inquiry on credit report

READ MORE: Facing a financial crisis? Here are the best options for emergency loans

What’s the Difference Between a Tribal Loan and a Payday Loan?

Tribal lenders usually offer short-term installment loans as an alternative to payday loans. This means the borrower will have to pay back the loan in payments over a set period of time.

As mentioned, payday loans are also short-term loans, but they must be repaid in one lump sum, usually on or before the borrower’s next payday. Many payday lenders will tack on $15 or $20 per $100 borrowed. Plus, they come with high APR, which makes them more expensive the longer it takes to pay them back.

Payday loans and installment loans come with high interest rates and strict repayment terms. With installment loans, customers can repay the loan over time. That said, the sooner they pay off the loan, the lower the overall cost in interest.

Online tribal loans are available nearly everywhere, though some lenders only operate in certain states. Payday loans, however, are illegal in many states.

Despite being an alternative to payday loans, online installment loans are extremely expensive. Some lenders, like National Small Loan, even state on their website that these loans are not meant as a long-term financial solution.

Online Reputation

On BBB.org, National Small Loan has a C- rating. It also has an average of 1.02/5 based on 54 customer reviews.

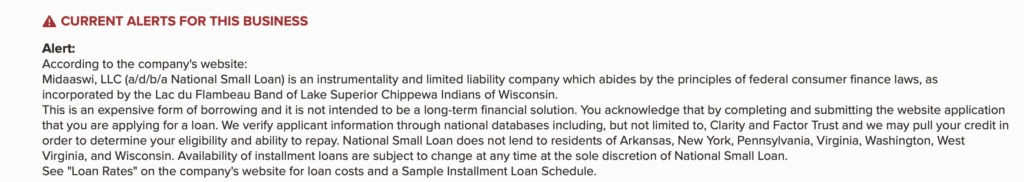

This alert is posted on the BBB page:

There have been 126 complaints on BBB in the past 3 years. The bulk of these complaints are related to billing and collections or a problem with the loan itself. Most of these complaints have been resolved, but many customers are still dissatisfied with their experience.

Common complaints include:

- Shady business practices and a lack of communication and cooperation

- Harassment by the lender even if the individual didn’t apply for a loan

- Lack of satisfactory customer service

- Inability to get through to customer service even during business hours

- Difficulty making online payments or closing accounts due to a lack of responsiveness

- Extremely high interest rates

- High weekly or monthly payments

Customer review of National Small Loan

“Deceitful They market this as affordable. They do not disclose the >800% interest rate until all information is filled out and accepted. After seeing the predatory rate I did not sign. They started calling at 6 AM and emailed four times to get me to sign fast. Now want my social # sent via email to close. Just don’t do it.”

What are the Pros and Cons of a Loan with National Small Loan?

Pros

- Fast, easy application with same-day funding if approved before 2 p.m. ET on a weekday

- Small loans for short-term financial problems

- No penalty for early repayment

- Option to pay in installments or in a lump sum

- No need for great credit (but may require good credit)

- Higher loan limits (up to $1,200) for returning customers in good standing

Cons

- Sky-high interest rates that are not disclosed prior to approval

- Fees for insufficient funds, returned payments and late payments

- Only available in 42 states

- Predatory lending practices

- Lack of transparency and vague loan terms

- May result in a credit report inquiry

- No reporting to the credit bureaus (so no credit-building)

How to Apply for a Loan from National Small Loan

Since National Small Loan is an online lender with no storefront locations, the application is completely online. The eligibility requirements are simple:

- 18+ years old

- U.S. citizen with a social security number

- Active bank account in good standing

- Reliable source of income (employment, pension, etc.)

- Good credit

- Basic contact information – email, phone number and physical address

If you meet these requirements, the online application is straightforward and takes just a few minutes. The approval process usually takes a few days. Once approved, the lender will contact you via email or phone and send you an electronic contract with all the details of the loan.

Before signing the contract, make sure you calculate the total cost (including interest) to make sure you’ll be able to pay it off.

Better Alternatives to National Small Loan

Many people who take out tribal loans end up in debt because they can’t afford the high interest rate and other fees. Before you choose a lender like National Small Loan, review your options to make sure this is the best financing option for your unique situation.

Here are a few more affordable options to tribal loans that might work for you:

- 401(k) Loan: A 401(k) loan isn’t exactly a loan, but it is a low-cost, convenient option if you’re in a tight financial spot or if the stock market is down. It is non-taxable. Plus, any interest you pay ends up back in your account (if you make on-time payments). Keep in mind that any money you withdraw will impact the overall growth of the investment account until returned.

- Peer-to-peer lending: P2P lending is a type of short-term financing in which you can take out an unsecured loan without using a third-party financial institution. P2P loans often have better interest rates and terms than other options. One P2P option is through the subreddit, r/borrow. Other reputable options to consider are Peerform and Upstart.

- SoFi: If you need a larger personal loan and have a credit score of 680+, SoFi may be an option for you. It is a reputable online lender that offers personal loans ranging from $5,000 to $100,000. The average APR is between 5.99% and 18.85%, making it more manageable than installment loans. SoFi’s online application is easy and secure with most customers receiving funds within a few days.

- PenFed Credit Union: PenFed (aka Pentagon Federal Credit Union) offers small personal loans ranging from $500 to $20,000. On average, the APR is between 5.99% and 17.99%, which is comparable to many major credit cards. This makes it a good option for those who have a 700+ credit score.

- Home equity loan: A home equity loan is a fixed loan that uses your home as collateral. With it, you can tap into the home’s equity at a lower interest rate than other loans or lines of credit. However, if you default on the loan, the lender may foreclose the home.

- Home Equity Line of Credit (HELOC): This works like a credit card and has a predetermined limit. Unlike a home equity loan, it may have a variable interest rate. It is also secured by the home.

- Credit card advance: A credit card advance is an option if you need a small lump of cash now. You can take out an advance from a local ATM or the bank. Your financial institution may charge a flat fee for the advance or a percentage. The average interest rate on a credit card advance is around 20.64%.

- Paycheck Advance App: If you need an extra $100 or so before payday, a paycheck advance app may be an option for you. These apps allow you to borrow money from your next paycheck before it arrives. But, unlike installment or payday loans, most cash advance apps are completely free and charge minimal to no interest. If you need a small loan with the option to raise your maximum withdrawal amount later, check out Klover.

Besides these installment loan alternatives, consider borrowing from family or friends. Alternatively, if you’re a member of a credit union, contact them for short-term financing options.

The Bottom Line

If possible, don’t take out an installment loan with National Small Loan or any other tribal lender. These lenders use shady lending practices and offer loans at exceptionally high interest rates that could leave you in a debt trap for months or years to come.

Instead, consider an alternative source of short-term funding like a P2P loan or a personal loan through a reputable online lender.

FAQs

You can reach National Small Loan by phone at 1-877-807-4827 or by email at support@nationalsmallloan.com.

National Small Loan is based in Lac de Flambeau, Wisconsin.

National Small Loan does not lend to residents of Arkansas, Connecticut, Georgia, Illinois, New Mexico, New York, Pennsylvania, Virginia, Washington, West Virginia, and Wisconsin.