How much do you have in savings for surprise bills? A good rule of thumb for a healthy emergency fund is to have the equivalent of three months’ worth of expenses. Unfortunately, that’s an ambitious goal for many Americans. As many as 60% of Americans fail to meet that benchmark. It’s understandable, then, that there’s so much continuing demand for short-term loans. Before you work with a lender, though, you need to do some research into their background. If you’re currently shopping around for a small loan, take a look at this ZocaLoans review before you borrow from them. There’s a lot you need to know.

Featured Alternative: DebtHammer

- Break the borrowing cycle

- Can help with many types of debt, including payday and tribal loans

- Friendly and helpful customer support – no judgment

Table of Contents

What You Need to Know About ZocaLoans

ZocaLoans is a short-term installment loan provider that operates strictly online. There’s not a lot of fluff on their website, just the promise of “simple, small loans.” Their marketing is less aggressive than most tribal lenders, which is refreshing. Many in the industry paint such a rosy picture of their products that someone who doesn’t even need funding might think it’s a good idea to take out one of their loans.

Like many short-term lenders, though, they still position themselves as an option for people who are in a cash bind and simultaneously admit they’re not the most affordable option. Their website says: “This is an expensive form of borrowing and is not intended to be a long-term financial solution. ZocaLoans loans are designed to assist you in meeting your emergency borrowing needs.” They don’t really address the contradiction of their helping people with cash emergencies only to create another one.

Is ZocaLoans Licensed?

ZocaLoans’ mailing address is in South Dakota, but they don’t have a license from the state. They’re a tribal lender, which is the latest form in the neverending evolution of payday lenders attempting to evade the law. ZocaLoans is a subsidiary of Rosebud Lending, an entity that ultimately belongs to the Rosebud Sioux Tribe.

By doing business under the tribal sovereignty of a Native American tribe, these lenders are mostly immune to lawsuits. They frequently abuse that privilege to their advantage, disregarding both state and federal law as it suits them. Most notably, they ignore state laws that limit interest rates on short-term loans.

Most tribal lenders provide this information in a disclaimer at the bottom of their home pages, but ZocaLoans buries it in their terms and conditions, which states:

“The laws of the Rosebud Sioux Tribe (“Tribal Law”) will govern these Terms and Conditions, without regard to the laws of any state or other jurisdiction, including the conflict of laws rules of any state[…] Because we and the Tribe are entitled to sovereign immunity, you will be limited as to what claims, if any, you may be able to assert against us.”

In other words, there’s very little that borrowers can do if ZocaLoans somehow violates their rights as a consumer.

Typical Loan Terms

Short-term installment loans sound appealing in theory, but most of them are shockingly expensive. ZocaLoans is similar, with APRs that are even higher than those of most payday lenders. Here’s what to expect:

- Principal balances between $200 and $1,500

- An APR of approximately 795%

- Biweekly payment schedules

- 6-month repayment terms, on average

- No fees for paying loan balances off early

- Additional $25 fees for non-sufficient funds and late payment (after two days)

ZocaLoans isn’t all that transparent about the full range of their loan terms. Borrowers only get the full details in their loan agreements. However, their rates are in the ballpark of other tribal lenders, which means that they’re far too expensive for most borrowers to repay.

Online Reputation

ZocaLoans has been around since at least 2016, which is long enough to establish a verifiable track record. They’ve done business with enough customers for people to report on their experiences and give quite a bit of insight into their patterns. Here’s what other ZocaLoans review pages have to say.

Customer Reviews

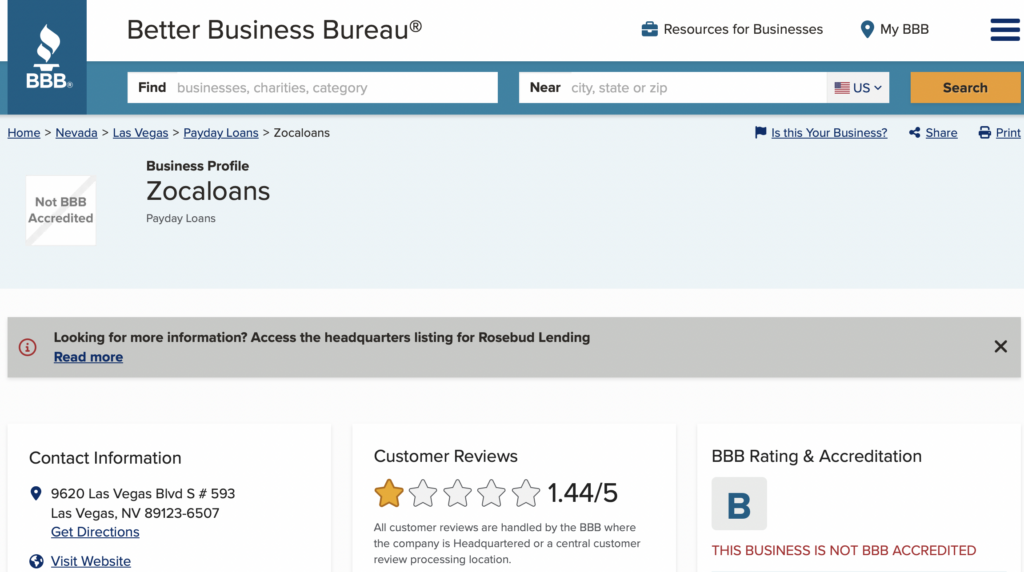

The Better Business Bureau (BBB) is one of the best places to get insight into a business’ customer service function. Not only does the BBB include crowdsourced reviews, but they also provide their own rating on how businesses handle interactions with customers.

Better Business Bureau

ZocaLoans gets a B rating from the BBB, which is a decent grade. The BBB rewards them for being proactive and responding to the complaints that their customers have. Oddly, though the ZocaLoans BBB page says customers have left 56 complaints, when you try to read them, you’re rerouted to the page for Rosebud Lending. In the past, ZocaLoans had its own BBB reviews and complaints pages.

Not all of the reviews at crowdsourced review sites are going to be accurate. There are sometimes fake profiles or false reviews, which can skew results, but the sheer amount of voices can usually provide a decent picture.

Customer Reviews

Not every business is on every site, though, so it can take some digging to find the best source for a given business. The site with the most ZocaLoans review results is PissedConsumer (which is probably not a great start).

Not all of the reviews at crowdsourced review sites are going to be accurate. There are sometimes fake profiles or false reviews, which can skew results, but the sheer amount of voices can usually provide a decent picture.

People began reporting ZocaLoans’ to PissedConsumer in early 2017, and there have been 400 reviews since then. The average customer rating for the business is 1.5 out of 5. It’s difficult to sort the site’s reviews, but the trends are similar to those at the BBB.

Consumers tend to contact ZocaLoans because of issues with the:

- Product or service

- Payments and charges

- Requests for information

To top it off, ZocaLoans’ overview on the site states that consumers have reported over $300,000 in losses in the last few years.

Lawsuits

It’s not easy to make a lawsuit stick against a tribal lender, but people still try. The trick is usually to prove that the lender is not truly an extension of the Native American tribe as they claim to be. Many tribal lenders just do a bit of paperwork wizardry to form a connection between the two entities, which won’t always hold up in court.

There’s currently a class-action suit against ZocaLoans for their interest rates. They exceed the legal limit in many of the states that they operate in. If the suit succeeds, ZocaLoans will have to pay a significant amount in penalties and restitution.

Pros

Borrowing from a tribal lender will almost always turn out to be more trouble than it’s worth, but it’s not surprising that so many people do it. On the surface, these loans sound like virtually free money, especially to people who don’t understand the implications of a triple-digit APR.

ZocaLoans has many of the same tempting qualities. What usually draws people in are their:

- Fast, simple, and online application process

- Lack of a credit check and willingness to loan to people with bad credit

- Principal balances as low as $200, which is helpful during cash shortages

- Transfer of funding as soon as the next business day

If not for the price tag, these loans could do a lot of good. Unfortunately, the bill always comes due, eventually, and it is far too high.

Cons

ZocaLoans products and processes have all of the same tempting advantages that most tribal lenders possess, but they also have all of the same downsides. Here’s why people should stay away:

- The interest and fees are higher than other products by an outrageous (and technically illegal) margin.

- ZocaLoans rates establish a precedent of breaking the laws that are in place to protect consumers when it suits them.

- Reviews and complaints show that the business will pursue borrowers aggressively if they don’t pay, using debt collectors and lawsuits.

Many consumers who apply for these loans find the costs surprising. It’s at least partially their responsibility to understand what they’re getting into, but some of that fault also lies with the ZocaLoans. There’s no excuse for consistently damaging people’s financial lives by giving them these loans and then blaming them for it.

All of these issues are on top of the fact that ZocaLoans has all the power in their relationships with their clients. They can take money directly out of a borrower’s bank account at will, but there’s no way to sue them effectively if they do something illegal.

How to Apply for a ZocaLoans Loan

We don’t recommend filling it out, but ZocaLoans’ application process is quick and easy. Their requirements are also much less stringent than most lenders (except for other tribal and payday lenders). Here are the qualifications necessary to get approval for one of their installment loans:

- A stable income that can cover the loan payments

- A viable checking account with a history of verified direct deposits from an employer (The bank account must accept unlimited debits and credits)

- Live in one of the states that they lend to (37 of the 50 states)

There are no other public requirements on their website. Presumably, they also have the minor requirements that other lenders do (age 21 with a phone number and email address). Anyone who meets that checklist can apply in as little as five minutes. They’ll need to have their:

- Driver’s license number

- Checking account (ABA) number and routing number

- Debit card number

The application will ask for those details as well as some personal identifiers and contact information. They’ll want a borrower’s Social Security Number, address, and phone number.

Note that a decent credit score is conspicuously missing from ZocaLoans’ requirements. That makes them viable to people who have bad credit, but it also can be dangerous. People with poor credit are often least able to afford more debt, especially a loan as expensive as ZocaLoans’ installment loans.

Better Alternatives to ZocaLoans

Most people who turn to ZocaLoans are probably struggling to get a loan because of their poor credit scores. Bad credit can make some forms of lending inaccessible, but there are still better options available. Here are some of our favorite ways to get fast cash for people with bad scores:

- Paycheck Advance Apps: Paycheck advance apps — also called cash advance apps — are much more affordable than a payday or installment loan. They let users access the funds that they’ve earned but not yet received in their paycheck. Some, like Earnin, have neither interest nor fees.

- Sell Some of Your Stuff: It’s tough to part ways with valuables, but most people also have things lying around that they don’t particularly need or want anymore. There’s also no need to resort to a pawnshop. Many online market places are free and easy to use, like OfferUp and Facebook Marketplace.

- Payday Alternative Loans: If a loan is an absolute necessity, consider taking out a loan from a credit union called a Payday Alternative Loan (PAL). They have many of the same benefits as payday loans without the high cost.

Any of these options would be a better source of funding than ZocaLoans. They’re all much less expensive and just as accessible, even with bad credit.

The Bottom Line

If you just wanted a ZocaLoans review to tell you that you should or should not borrow from the company, here’s your direct answer: Stay away from ZocaLoans and other tribal lenders whenever possible. Not only are they an unnecessarily expensive source of financing, but they’re prone to underhanded tactics that only ever end poorly for borrowers.

In any case, taking on more debt to cover financial emergencies is a losing proposition. It happens sometimes, but it should never be a consistent issue. If you find yourself needing to resort to debt more than once to save yourself, there’s probably an imbalance in your finances somewhere. Consider seeking out an affordable credit counselor to get help.

FAQs

Contact ZocaLoans by phone at 1-888-980-1532 or email support@zocaloans.com.

ZocaLoans’ mailing address is Rosebud Lending LZO, PO Box 1147, 27565 Research Park Dr. Mission, SD 57555

It can be confusing since ZocaLoans’ Better Business Bureau page routes customers to Rosebud Lending. ZocaLoans is a subsidiary of Rosebud Lending, a tribal lender operated through the Rosebud Sioux Tribe.