Have you ever done the math to see how long you could pay your bills without bringing in any money? For most Americans, the answer is less than a month. In 2020, 70% of the respondents in a survey stated that they would have difficulty keeping up with their financial responsibilities if they had to go an extra week without receiving a paycheck. It’s living that close to the edge that generates demand for short-term loans like the ones that Greenline Loans provides. Before you take a loan out from them, though, you need to do your due diligence. This Greenline Loans review will tell you everything you need to know about the company to decide if it’s worth doing business with them.

Featured Alternative: DebtHammer

- Break the borrowing cycle

- Can help with many types of debt, including payday and tribal loans

- Friendly and helpful customer support – no judgment

Table of Contents

What is Greenline Loans?

Greenline Loans provides short-term installment loans to people with poor credit. They market themselves primarily to people who are struggling financially due to some cash emergency, such as a necessary car repair, medical care, or work-related travel expenses. Their application process is lightning fast, they don’t check applicants’ credit scores, and they’ll get approved borrowers the funds they need in a matter of hours.

If that sounds too good to be true, it’s because it is. There’s a catch, and it’s a big one. Greenline Loans charges borrowers an arm and a leg for the privilege of taking out one of their loans. They address the issue in their fine-print disclaimers, which state:

“This is an expensive form of borrowing. Greenline Loans are designed to help you meet your short-term borrowing needs[…] This service is not intended to provide a solution for longer-term credit or other financial needs. Alternative forms of credit, such as a credit card cash advance, personal loan, home equity line of credit, existing savings or borrowing from a friend or relative, may be less expensive and more suitable for your financial needs.”

Is Greenline Loans Licensed?

Greenline Loans does business from Wisconsin, but they don’t have a lending license from the state. Supposedly, they operate out of the Lac du Flambeau reservation in Wisconsin. They’re a tribal lender, which means that they’re an extension of a Native American tribe and operate under their rules and regulations. Greenline Loans is an extension of the Lac du Flambeau Band of Chippewa Indians.

As a business entity that belongs to a Native American tribe, Greenline Loans benefits from their tribal immunity. That means that they’re almost impossible to sue and that they don’t have to pay attention to state regulations. They use that to their advantage and charge rates that are often far higher than what’s legal in a given state.

Most tribal lenders don’t like to make a big deal out of this, so they share the information in separate disclaimers and small print. Greenline Loans does the same and simply states:

“Greenline Loans are offered by Waawaatesi LLC, dba GreenlineLoans. Waawaatesi LLC is a Native American owned business created by and for the Lac Du Flambeau Band of Chippewa Indians, a Federally Chartered Sovereign American Indian tribe.”

Note that while they disclose their status as a tribal lender, they don’t point out its significant implications for consumers.

Typical Loan Terms

In the last couple of years, tribal lenders have been becoming less forthcoming about their loan terms. It used to be commonplace for them to provide a range of interest rates or at least a sample loan on their websites, but more of them are now opting to withhold that information until borrowers get their loan documents.

Fortunately, using the Wayback Machine to see what the site looked like in days past, it’s possible to find more details on Greenline Loans. Here’s what borrowers can expect from them:

- Principal balances between $100 and $300

- An APR of roughly 762.33%

- Biweekly repayment schedules

- Repayment terms of roughly a few months, depending on the principal balance

- No prepayment fees

- Late fee up to 10% of the late payment after five days late

- Additional fees for non-sufficient funds

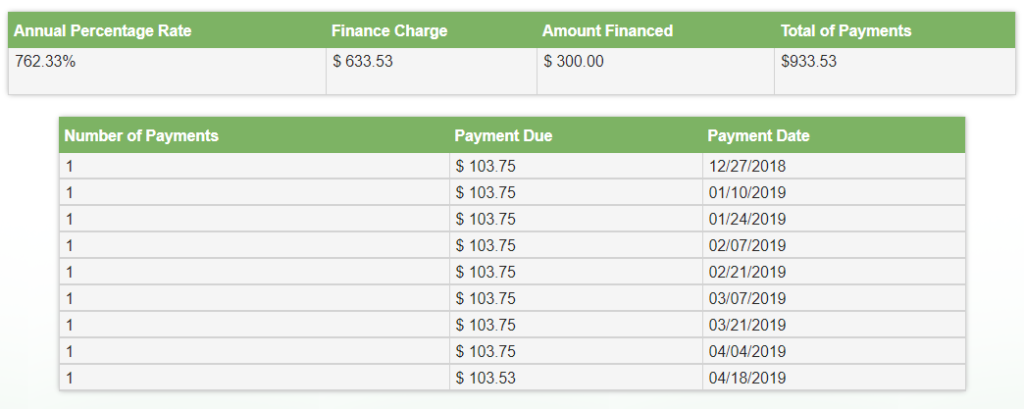

In their sample loan, they show how much a borrower would have to pay for a $300 loan at 762.33% APR, and it’s astounding. For just $300, that borrower would end up paying $633.53 in interest alone, over double the original principal balance. Greenline Loans’ rates may have changed since they took them off their website, but it’s not likely.

Online Reputation

The Better Business Bureau (BBB) is a great place to begin looking into a company’s track record online. They do a better job than most of screening out false customer reviews, and they also use the complaints that customers make (and company responses) to create their own ratings.

Surprisingly, Greenline Loans’ BBB profile is thin. Their original page has just three reviews and no complaints despite the business having been around for almost a decade. However, the BBB redirects visitors of that page to Quick Help Loans’ profile, which they say has absorbed Greenline Loans.

Unfortunately, that page doesn’t have a lot to offer, either. There are only two reviews, one positive and one negative. There are six complaints. One borrower discusses their confusion over which lender they’re doing business with, as the Lac du Flambeau Band of Chippewa Indians seems to be shuffling their business entities around. The transfer of Greenline Loans to Quick Help Loans isn’t the first time.

Most of the complaints are about the high cost of borrowing.

The details of the rest of the complaints aren’t public, but all of them are about the business’s billing and collections process. Because of their proactivity in addressing these complaints, the BBB gives Quick Help Loans an A- score.

Expanding the search for reviews to the rest of the internet doesn’t turn up much, either. That’s surprising, but it probably means that Greenline Loans doesn’t do as much business as some of the other Lac du Flambeau’s lending companies. While the lack of negative reviews might seem like a plus, it’s more likely a reason to stay away. There are plenty of businesses out there to borrow from that have proven their trustworthiness.

Lawsuits

Another helpful way to get insight into a business’s track record is to look for a history of lawsuits. Finding some is usually a red flag, and it’s worth taking the extra step for a business with such a bare track record.

While there are no results for lawsuits against Greenline Loans itself, we’ve seen that it’s the Lac du Flambeau leaders who are the power behind the entity. Unfortunately, there has been at least one lawsuit against them for their illegally high interest rates. In 2019, a man sued the leaders of the tribe for breaking the limits in his state (Pennsylvania).

Suing a tribal lender is difficult due to their tribal immunity, but going after the tribe is worse. The courts dismissed the lawsuit and upheld that the tribe could ignore state regulations due to their immunity.

Pros

Borrowing from Greenline Loans is a costly mistake for most of the people who do business with them. At first glance, though, they look like they’d be helpful for people who are struggling with some financial emergency. Here’s what they have going for them:

- An entirely online application process that people can finish in just a few minutes

- Qualification requirements that virtually any working adult can meet

- Loans for as little as $100, so borrowers don’t have to take out more than they need

- Rapid fund transfer, often as soon as a single business day

Truthfully, if not for their outrageously high interest rates, these would be a perfect means of support for their intended market.

Cons

Greenline Loans has all of the typical problematic qualities of a tribal lender. It can be tempting to work with them for those who don’t understand them, but it’s going to be an expensive mistake in the vast majority of cases. Here’s why people should probably take their business elsewhere:

- The cost of the loan is orders of magnitude higher than other forms of borrowing, even for those with bad credit.

- Greenline Loans’ rates set a precedent of them breaking the state regulations that are in place to protect consumers.

- Their tribal immunity allows them to get away with breaking the rules, virtually with impunity.

Greenline Loans are much more likely than traditional personal loans to send borrowers into a cycle of debt. Much like payday loans, the chances of someone needing several hundred dollars then being able to pay back that amount plus several more hundred dollars in a matter of a few months are slim.

For those who do decide to take out one of these loans, the best course of action is to pay it off immediately. They should reach out to Greenline Loans and try to settle the account as soon as possible so that the interest doesn’t have much time to accrue.

How to Apply to Greenline Loans

As we’ve alleged throughout this Greenline Loans review, it’s probably a bad idea to fill out an application for one of their installment loans. That said, for those who want to do it anyway, it’s not very difficult.

These are the requirements people need to meet to qualify for Greenline Loans:

- Be employed (or receive a regular income)

- Earn at least $1000 per month

- Be at least 18 years of age and a U.S. citizen

- Have a checking account

- Live in the states where they operate (see their site for a full list)

These should be no problem for the vast majority of working adults. $1,000 a month is just $12,000 a year, which is below the poverty line ($12,880).[2] It just goes to show that Greenline Loans doesn’t care very much whether their borrowers will be able to pay back their loans that they’re willing to lend to people with such low incomes.

In any case, for those who meet these qualifications, applying is a breeze. Here’s what they’ll ask applicants to provide:

- Profile Details: name, contact information, and Social Security Number

- Income Information: employment or another source of income details

- Banking Information: routing and account numbers to enable transfers

Be careful not to share this information with Greenline Loans lightly. Applying for one of their loans, even without signing a loan agreement, gives them a lot of power. At the very least, they’ll probably start sending out emails and calling repeatedly.

Better Alternatives to Greenline Loans

People have a habit of resorting to lenders like Greenline Loans because they don’t think they have any other alternative. They probably can’t draw on savings, their family and friends, or a standard bank loan.

While it might seem like there are no other options for these people, there are. Here are some great ones:

- Paycheck Advance Apps: These apps are the perfect alternative to a Greenline Loan. They allow users to tap into their earnings during a pay period and collect them before the actual payday without paying any interest on the amount. Greenline Loans only go up to $300, and most apps can equal or exceed that amount. They’re also fast, so users can get access to funds in an emergency.

- Credit Unions: Borrowers don’t have to rely on banks to get affordable loans. Credit unions often offer better deals to their members, though it will take some time to become one. For those who know they will be going through financial trouble in the future, it’s probably worth becoming a member of a federal credit union like PenFed.

- Secured Personal Loans: Lenders don’t like to give money to people they think won’t pay them back. Providing them with collateral as insurance makes them much more likely to agree to a loan, even if the borrower has bad credit.

All of these options would be better than taking a Greenline Loan. They’re infinitely less expensive and almost as easy to qualify for. The paycheck advance apps are also just as fast.

The Bottom Line

If you were looking for a Greenline Loans review that would summarize in a sentence whether you should work with them or not, then here it is: Don’t bother borrowing from Greenline Loans. They’re too expensive and have an unproven track record. Even among tribal lenders, they’re among the bottom of the barrel. Better the devil you know than the one you don’t.

If you have to take on debt to support yourself, try one of the options that we mentioned above before you consider a tribal or payday lender. Better yet, try to cut your spending or earn a little extra cash to avoid taking on debt at all. If you need help figuring out the best way to improve your cash flows, talk to a credit counselor. Their services are free, but they’re experts in managing money and credit. Find one near you today!

FAQs

You can contact Greenline Loans at (877) 596-1337 or though the website at Greenlineloans.com.

Greenline Loans is based in Lac du Flambeau, Wisconsin.

Greenline Loans does not lend to residents of Arkansas, Colorado, Connecticut, Georgia, Illinois, Maryland, Minnesota, Montana, New Mexico, New Hampshire, New York, North Carolina, Pennsylvania, Puerto Rico, Vermont, Virginia, Washington, West Virginia, and Wisconsin.