If you’re looking for some fast cash, online payday and installment loan providers seem like an appealing resource. You can get through their applications quickly, qualify without a credit score, and get your money as soon as the next business day.

There’s a catch, though, and it’s a big one: They are one of the most expensive sources of funding in the country. They may not send someone to break your leg, but they will cripple you financially (forgive the pun). Be sure to do your research before doing business with them. To that end, check out our Arrowhead Advance review before you borrow from them.

Featured Alternative: DebtHammer

- Break the borrowing cycle

- Can help with many types of debt, including payday and tribal loans

- Friendly and helpful customer support – no judgment

Table of Contents

What You Need to Know About Arrowhead Advance

Arrowhead Advance is an online, short-term installment loan provider. Much like traditional payday loans, they’re supposedly a resource for people who just need a small loan to cover an unexpected financial emergency. Arrowhead Advance’s slogan is: “When you need cash fast, without hassles, think Arrowhead Advance.”

That’s not the only thing they have in common with traditional payday lenders. Their loan products also have annual percentage rates (APRs) that reach the high triple digits. In contrast, even expensive credit cards max out around 36% APR.

The primary difference between Arrowhead Advance’s products and traditional payday loans is that borrowers can pay off their debts over several months instead of a couple of weeks. Having the extra time can sometimes make it easier to pay the loan off as a whole. Unfortunately, it doesn’t save anyone any money. If anything, installment loans tend to cost more since their principal balances are usually higher. Furthermore, the annual percentage rate (APR) on an Arrowhead Advance loan can be astronomical. Just to be clear, there isn’t a state in the United States of America that regulates short-term loans and allows an interest rate as high as 961 percent.

Is Arrowhead Advance Licensed?

Arrowhead Advance is in South Dakota, but they don’t have a license from the state. For that matter, they’re not registered with the federal government either. Arrowhead Advance is what’s known as a tribal lender.

Tribal lenders are extensions of federally recognized Native American tribes. Arrowhead Advance is an arm of the Wakpamni Lake Community Corporation (WLCC), which belongs to the Oglala Sioux Tribe. As a result, they adhere only to the rules and regulations set forth by the tribe. That doesn’t sound inherently sinister, but it almost always works out poorly for their customers.

Tribal lenders use their “tribal immunity” as an excuse to ignore laws that are in place to protect consumers. For example, they will:

- Charge interest rates far above state limits

- Provide loans with balances higher than state maximums

- Break the terms of their loan agreements

While the Supreme Court and the Consumer Financial Protection Bureau (CFPB) are both attempting to crack down on tribal lenders, it’s a slow process. Tribal lenders are holding fast to their position that they are not subject to any laws but their own. In the meantime, lenders like Arrowhead Advance continue to offer loans that violate state laws and ruin the financial well-being of many desperate, poor credit borrowers who are strapped for cash.

Typical Loan Terms

Arrowhead Advance is a little cagey about their loan terms. For example, they give a range of possible APRs, but it’s so large that it becomes impossible to predict the actual finance charge until after the application process.

In general, here’s what to expect when taking out a loan from Arrowhead Advance:

- An APR between 233% and 961%

- Principal balances between $100 and $1,000 for first-time borrowers

- Loans up to $2,250 available to repeat customers after they make enough successful payments

- Biweekly or semi-monthly payment schedules available

- Repayment terms somewhere on the order of seven months

- No prepayment fees for borrowers who want to pay loans off early

- Late fees of an undisclosed amount for missed payments

These terms are pretty typical of tribal lenders, but that doesn’t mean it’s a good idea to work with Arrowhead Advance. It just means it’s a good idea to stay away from the rest of the industry, too.

One thing to pay special attention to is the undisclosed late fee. That could be particularly dangerous with loans like these that many people likely won’t be able to keep up with. On an installment loan of $100, paying a late fee of $15 (even just once or twice) could quickly double the APR on the loan.

Online Reputation

It’s always best to research what people have to say about a business before working with them. To save you some time, we’ve done the legwork for you.

Customer Reviews

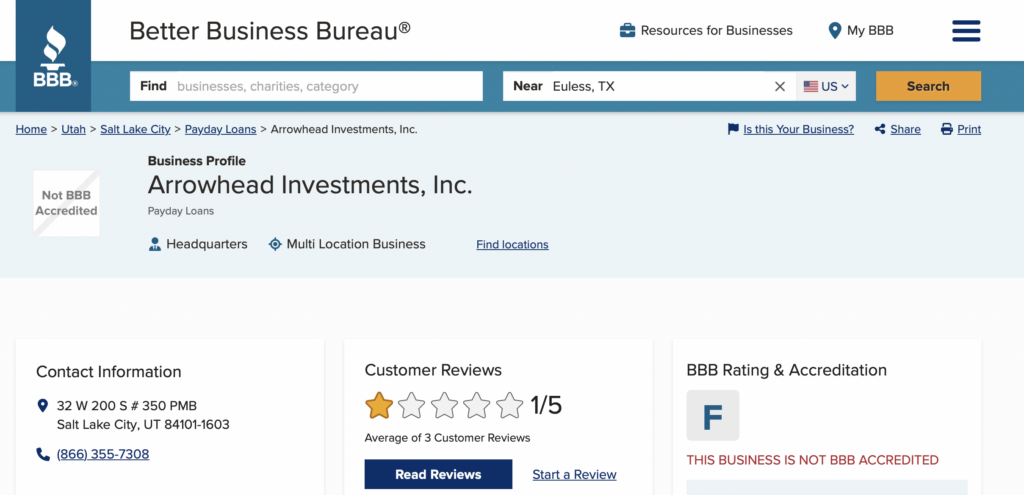

First, there’s the Better Business Bureau (BBB). Many crowdsource-style review sites are vulnerable to review manipulation. They have fake reviews or let the business in question gatekeep opinions. The BBB does a much better job than most of combating those issues. That makes them a much more reliable source for accurate reviews and complaints than their competitors.

Arrowhead Advance’s BBB profile shows that there are more risks to working with them than just the astronomical cost. The complaints on the website point out several undesirable and dishonest practices, including:

- Changing the terms of repayment plans after the borrower signs a contract

- Gathering sensitive data in their application that is irrelevant to a borrower’s creditworthiness then denying their request for a loan

- Reneging on their approval of borrower’s application

They also do a poor job of addressing these complaints, which indicates a poor customer service system. The BBB rates them an F for their lack of responsiveness.

Most refer to the lender as a scam. Unfortunately for borrowers, Arrowhead Advance is not a scam. It’s a legitimate lender that has figured out a way to sidestep consumer protections.

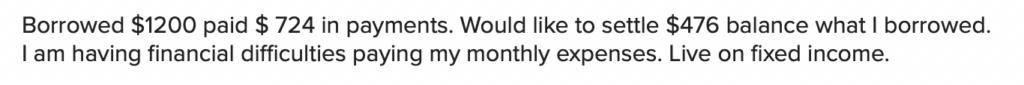

At least one complaint is based on a borrower not reading the terms and conditions before accepting the loan:

If you’re considering this lender, please read the terms before you apply.

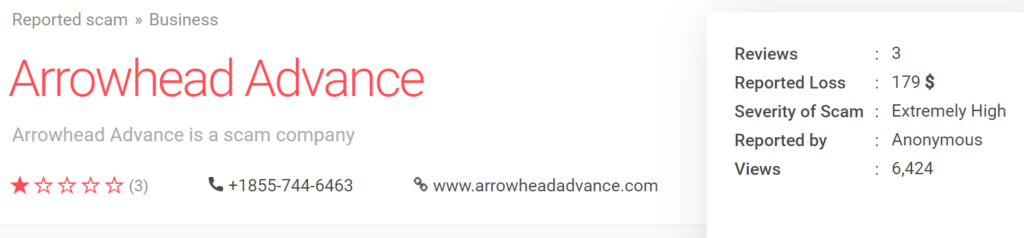

Googling “Arrowhead Advance reviews” also turns up a hit on the Dirty Scam website, which is obviously not a good sign. The profile doesn’t have too many reviews, but they’re universally negative. All of them contain complaints about the unreasonable interest rates on the lender’s products.

Other Arrowhead Advance review sources have similarly negative opinions. The jury is out on whether they steal customer data or money, but there’s no question that they’re an overly expensive source of funding. Avoid them and use cheaper alternatives whenever possible.

Pros

Arrowhead Advance loans are so expensive that they’re almost never the right move. That said, there are reasons that people turn to them for financial support, especially if they don’t take the time to read the price tag. For example:

- Their application process is quick and easy.

- It’s easy to qualify with a low or non-existent credit score.

- They may fund loans as quickly as the next business day.

- Their loans come in small amounts that are perfect for covering small emergencies.

To people who are unaware that Arrowhead Advance is so much more expensive than other lenders, their loans sound like free money. It might seem like everyone would know better after reading their loan agreement, but online reviews say otherwise. Many of the complaints on Arrowhead Advance’s BBB profile are from people who were surprised by how much they had to pay in interest and fees for their loans.

Cons

Despite the ease and accessibility of these loans, they’re not a good idea. These are the biggest problems with using an Arrowhead Advance installment loan:

- Unreasonable APRs: There’s a significant gap between their upper and lower limits on their APRs, but even the lower end is more expensive than other types of credit. Unfortunately, most borrowers seem to report ending up on the higher end of the spectrum. The example on their website demonstrates how ridiculous this is. At a 773% APR, a loan of $300 would cost $1,136.96 in interest over a seven-month repayment term.

- Shady business practices: While the official price should be enough to discourage working with Arrowhead Advance, borrowers may also have to pay fees that aren’t in their agreement (or find themselves with rates higher than they agreed to).

- Poor customer service: Their reviews and rating on the BBB are clear indications that their customer service team isn’t particularly proactive. With so much money on the line, it’s risky to work with a lender that doesn’t address complaints or help borrowers out when they have issues.

There are very few instances in which it’s a good idea to work with a tribal lender, and Arrowhead Advance is no exception. It’s a significant risk to take out a loan that expensive, especially from someone who may not stick to the letter of the law or even uphold their agreements.

Arrowhead Advance Lawsuit

In April 2022, a class action lawsuit was filed alleging that the lender made usurious loans residents of Illinois while attempting to hide behind the Oglala Sioux Tribe’s sovereign immunity.

How to Apply for an Arrowhead Advance Loan

Arrowhead Advance boasts that their application process should take less than two minutes, but that just means that there are almost no qualification requirements. Even with no credit score and a limited cash flow, most people can easily qualify for an Arrowhead Advance loan.

Unfortunately, they don’t have a pre-qualification tool. That means applicants have to give up their bank account details and Social Security number with no guarantee that they’ll receive a loan in return.

Their application will ask for the following:

- Account information, including an email address and a password

- Home state and address to verify they provide loans in that area

- Bank verification including routing and account numbers so they can transfer and remove funds

- Income and employment details (they may call employers to verify this information)

- Timing of the borrower’s paycheck to sync up repayment dates

- Identification details including SSN to make sure the applicant is who they say they are

It’s best not to start the application without being 100% committed to completing it. Arrowhead Advance may be able to track keystrokes on their website and save visitor data, even from those who don’t end up submitting their request for a loan.

Better Alternatives to Arrowhead Advance

Before you resort to taking on more debt, try to scrounge up some money in other ways. For example, earning a bit of extra cash or cutting back on an unnecessary expense can help many people avoid having to take on the burden of a loan.

People who don’t have the time or the room in their budget to avoid taking on debt shouldn’t feel guilty about needing a loan, though. They just need to apply for accounts that they can be sure they’ll repay. A loan that’s too expensive to pay back will only cause an even greater cash emergency when it comes due.

There are so many better alternatives to Arrowhead Advance that there almost no scenarios in which we’d recommend working with them. They’re far too expensive, even potentially dishonest. Here are some safer and more affordable options:

- Upgrade: Tribal and payday lenders give online loan providers a bad name, but that doesn’t mean they’re all untrustworthy. Upgrade is an example of an online lender with affordable terms, even for borrowers with less than stellar credit scores. Their APRs don’t exceed 36%, which is far below even the minimum threshold of Arrowhead Advance’s loans. Because they’re willing to lend to people with credit scores as low as 580, they’re a convenient option for people that can’t qualify for traditional funding.

- PenFed Loans: Credit unions are often another great source of affordable financing for people with bad credit. PenFed Loans is open to anyone, and their members can receive rates that are far more competitive than the rates Arrowhead Advance offers.

- Paycheck Advance Apps: A number of financial planning apps offer short-term cash advances. Many of them don’t have fees for the advance, but you may have to pay a monthly fee to use the app. Check out Dave, Cleo, Earnin, Brigit, or MoneyLion if you are looking for a Plan B for future short-term needs. Advances are often limited to $100 or $250.

Online lenders and credit unions will almost always be more willing to lend to people with bad credit than traditional banks. Even better, unlike Arrowhead Advance, they’re open to working with people who don’t have a good credit history and manage not to charge them unreasonably high rates.

The Bottom Line

If you’re looking for an Arrowhead Advance review that makes a simple yes or no recommendation, we’re happy to give it to you: Don’t take out a loan from Arrowhead Advance. They’re unnecessarily expensive, and if that’s not enough, they may also resort to underhanded or illegal tactics.

Try to stay away from payday and tribal lenders in general. They all have similar issues and can land you in long-term financial trouble that’s tough to escape. Consider the options we listed above instead if you need fast cash.

FAQs

Existing customers should contact (800) 677-3860 | 9AM – 5PM MST, Monday – Friday, while first-time callers should call (888) 459-1315. You can also visit the website at arrowheadadvance.com.

Arrowhead Advance’s headquarters are located at Arrowhead Advance’s headquarters are located at PO Box 231, Batesland, South Dakota, 57716, although the Better Business Bureau page says the company is based at 32 W. 200 S # 350 PMB, Salt Lake City, UT 84101-1603.

To borrow from Arrowhead Advance, you must:

–Earn at least $1,000 per month

–Be 18 years of age or older

–Be a U.S. resident with a valid SSN

–Have a current checking account

–Currently have a steady source of income