When you run into financial trouble and need cash fast, lenders like 500FastCash can seem like the answer to your prayers. They have a short application, a fast approval process and promise that, if you are approved, you can “have the funds you need typically within 24 hours!” Sounds pretty awesome, right? Trust us when we tell you that this loan and others like it are more trouble than they are worth.

Featured Alternative: DebtHammer

- Break the borrowing cycle

- Can help with many types of debt, including payday and tribal loans

- Friendly and helpful customer support – no judgment

Table of Contents

What is 500FastCash?

According to their website, 500FastCash “provides fast and convenient loans to people in need every day.”

Basically, 500FastCash is a short-term installment loan provider. They have extremely relaxed lending criteria and, unlike typical payday loans—which require you to pay your balance due in full by your due date — allow borrowers to pay their balances off over time. The company’s website even says that

By customizing your own extended repayment schedule, you can choose how you repay your loan to best fit your individual needs.

The idea is that, by making it possible to pay back the loan over time, the payments will be more affordable for the borrower and increase their ability to pay back the loan in full — eventually.

This is where things get tricky. The truth is that 500FastCash has more in common with a typical payday loan than it does with a loan offered through a traditional bank or credit union. Like payday loans, the interest rates on a loan from 500FastCash are incredibly high. They also charge their borrowers exorbitant fees (more on those later). When all is said and done you will likely end up paying far more to 500FastCash than you initially borrowed — and you will definitely wind up paying more to borrow from them than you would a properly licensed lender.

Is 500FastCash Licensed?

500FastCash is located in Miami, Okla., but is not licensed by the state. A search for the organization that owns and does business as 500FastCash, the Modoc Tribe Financial Services Authority, also didn’t turn up any licensing by the state.

Instead, 500FastCash, under the name of its “parent” company, the Modoc Tribe Financial Services Authority, is licensed by the Modoc Tribe of Oklahoma.

The Modoc Tribe is originally from an area along what is now the Oregon/California state border, but they were forced to move to a reservation in Oklahoma in the late 1800s. Now, the small tribe (fewer than 500 members, according to their website) lives in dozens of different states around the country, though they are still “headquartered” in Oklahoma. They only finally received Federal Recognition in 1978.

That Federal Recognition provides the tribe with a variety of sovereign rights, including the ability to be recognized as a tribal lender.

What is a Tribal Loan

A tribal loan is a loan that is issued by a tribal lender. A tribal lender loans money the same way a “traditional” lender does. The only difference is that a tribal lender is protected by its tribe’s sovereignty and is not required to adhere to licensing requirements dictated by state or federal governments. It has what is called “tribal immunity.”

What is Tribal Immunity?

Tribal lenders are allowed to use ‘tribal immunity’ to create—and to change! —the rules and regulations of lending practices as they see fit. They can follow the federal laws that have been put in place for consumer protection if they want, but there is no penalty if they choose to thwart them. Many tribal lenders use their immunity as an excuse to ignore those laws, often to the consumers’ detriment. For example, they will:

- Charge interest rates that are way above state imposed limits

- Provide loans that carry balances higher than state minimums require

- Break the terms of their loan agreements with consumers

In this case, 500FastCash is financially backed by the Modoc Tribe. As such it is subject only to whatever rules that tribe decides to pass — whenever they decide to pass them.

The Supreme Court and the Consumer Federal Protection Bureau (CFPB) are both working to try and crack down on the predatory practices of tribal lenders, but the process has been slow going. Tribal lenders are insistent that they are not subject to any laws outside of their own. Meanwhile, lenders like 500FastCash continue to offer loans that violate Oklahoma state laws and ruin the financial stability of many desperate borrowers — most of whose credit is poor and who have little money to spare.

In General, Here’s What to Expect When Taking Out a Loan From 500FastCash

This is the part of the review where you are probably hoping to find specific information like:

- APR

- lending limits for first time and repeat customers

- repayment schedule options (including whether there is a penalty for extending the repayment period)

- fees for late payments, finance charges, etc.

- whether or not there are penalties for paying the loan off early

Unfortunately, 500FastCash does not provide any of that information on its website. Instead, it forces you to actually apply and be approved for the loan before you can see any of the terms or conditions of the loan.

This means that you have to submit the following information about yourself before learning anything about your loan:

- Name

- Address

- Home Phone

- Cell Phone

- E-mail address

- Date of birth

- Driver’s License Info

- SSN

- Banking information

- Contact information for two people you know

That’s a lot to hand over upfront just to see if you like the terms of the loan or not!

What’s the Difference Between a Tribal Loan and a Payday Loan?

The primary difference between a tribal loan and a payday loan is in who regulates the lender. A tribal loan is regulated only by the tribe that governs the lending company.

A payday loan, on the other hand, is regulated by the state in which the lender operates. This means that a payday lender must follow all the rules and regulations set out at the federal and state level. Much to the payday lenders’ consternation, those rules and regulations are created to protect the borrower.

Another major difference, particularly in the case of 500FastCash, is that a payday lender will tell you in advance what your loan’s terms and conditions are likely to be. Even if those terms vary depending on your individual qualifying factors, you can still usually find a range for them listed on the lender’s website or in reviews, etc.

This doesn’t mean that you should apply for a payday loan, though! On the contrary! Payday loans are illegal in multiple states because, even with all the consumer protections in place, these lenders can practice predatory behaviors and take advantage of desperate borrowers!

READ MORE: Are you facing a financial crisis? Here are your top options for an emergency loan

Typical Loan Terms With 500FastCash

Unfortunately, there is no way to tell what a “typical” loan term with 500FastCash looks like. They simply will not provide any of that information until you apply. The company is not accredited by the BBB.

Potential borrowers should know that in 2012, the Tulsa World reported that 500FastCash’s tribal financier, the Modoc Tribe was named in a lawsuit filed by the FTC against several Oklahoma and Nebraska tribes for violations of the Federal Trade Commission Act, the Electronic Transfer Act, and the Truth in Lending Act.

Then, in 2018, the organizer of 500FastCash (as well as several other companies affiliated with tribal lending agencies), Scott Tucker, was sentenced to “more than 16 years in prison for running $3.5 billion unlawful Internet payday lending enterprise.” Among the many charges levied against Tucker and his attorney, Timothy Muir, was that the pair made deals with several tribes (Including the Modoc) to create “sham ownerships” of their lending companies. The intent here was to thwart federal and state regulatory practices.

As of this writing, 500FastCash is still licensed by the Modoc Tribe and lists the tribal financial services authority as its owner. Make of that what you will.

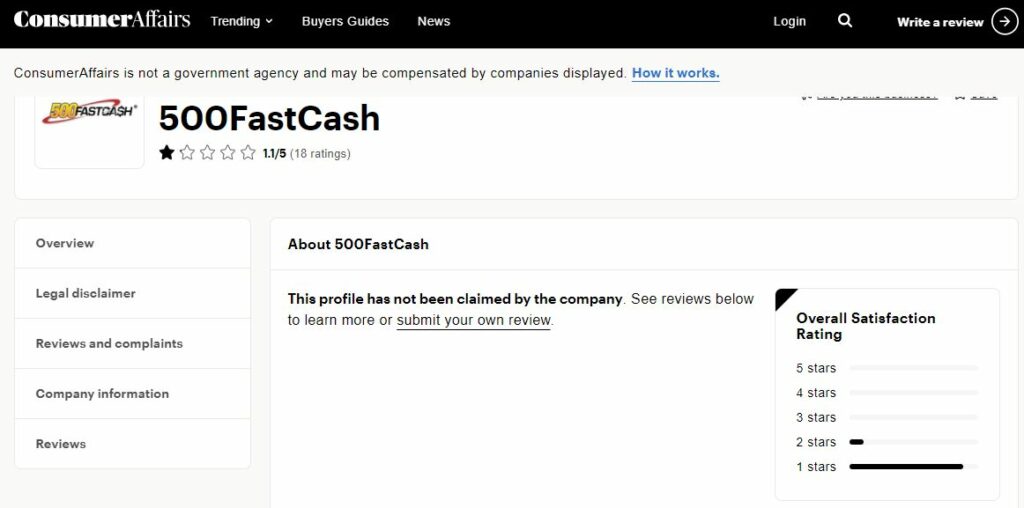

Online Reputation

It shouldn’t be surprising that 500FastCash’s reputation is really bad. There was only one good review, and it didn’t sound like it was from an actual borrower. One review in particular stood out. On Consumer Affairs, Juan of Sacramento, Calif., wrote:

“If you are like most you’re going to have to need a loan once on your life, if you do please be aware and never get it here. I borrowed 650 because I was in desperate need. I have been paying them off the minimum of 200 for 1 year. My remaining balance is 1040. I have no job at the moment. My only income is child support. I call them trying to come up with an agreement because I am tired of paying the minimum and not going towards the principal balance. They give me my 2 options which is pay the minimum or pay the remaining balance. Spoke to a few agents none could help me, spoke to the manager even worst. So I’m stuck in the same cycle with no help just because I borrowed 650. There should be a law against this.”

The Better Business Bureau has very little history and no rating for 500FastCash, zero reviews and only three complaints logged over the past three years. That’s unusual for a business that’s been around that long, and it should raise a red flag.

What are the Pros and Cons of a Loan with 500FastCash

Pros

- Quick application process

- Minimal borrowing requirements (you basically have to be 18, have a job and a checking account, and know a couple of people)

Cons

- Everything else. Presumably. It’s hard to list them here since they won’t share their terms or rates.

How to Apply for a Loan from 500 Fast Cash

Borrowers can apply for the 500FastCash loan online. The application is super quick—you’ll input your basic information (name, DOB, etc.), your employment information, your bank information and then provide the names of two people who can act as personal references. It takes about a minute to fill out (maybe two, depending on your typing speed). After that, you wait for them to approve or deny and then if you are approved you get to see the terms and conditions of your loan and decide whether you want to agree to them. If you agree, the website says that your funds should be deposited into your bank account within 24 hours.

Better Alternatives to 500 Fast Cash:

If you’re desperate for money, a tribal loan can seem like salvation, but there are many better options out there. Here are a few:

- Avant (Investopedia listed them as their top online loan for bad credit in 2021)

- PenFed Credit Union: they recently opened their membership and offer a variety of borrowing options to those who qualify

- Peer-to-peer (P2P) lending: Lending Club is a good option if your credit score is over 600

- Borrowing from people you already know — using a portal like GoFundMe or PayPal’s Fundraise feature can make this easier

- Credit card advance or low-interest balance transfer offer

- Home equity loan or home equity line of credit

- 401k loan — be careful with this one, there are often penalties for borrowing against a 401k!

- Paycheck advance app, like Dave or Brigit

The Bottom Line

500FastCash’s website proclaims “60 seconds can make a world of difference.” That’s true. Take those 60 seconds and use them to search for a loan with better terms. That 60 seconds could end up saving you hundreds of dollars and months of regret.

FAQs

500FastCash can be reached by phone at 1-800-507-5859 or by email at customerservice@500FastCash.com.

500FastCash is based in Miami, Oklahoma

As soon as you complete your loan application, it is sent to the processing department for review. If the loan is approved by 2:00pm CST and no further information is needed, the money will be sent to your account on the next business day.