Many Americans have razor-thin margins between their income and expenses. The slightest shift in one or the other can have costly repercussions. In 2020, roughly 70% of Americans said that it would be difficult for them to pay their bills if their paycheck was late by a week. When your finances are out of balance like that, debt is often the only thing that can save you, at least temporarily. However, not every lender is dependable. Is First Day Loan one of those that you can trust, or would you be better off with another provider? If you’re looking for the answer to those questions, read on.

Featured Alternative: DebtHammer

- Break the borrowing cycle

- Can help with many types of debt, including payday and tribal loans

- Friendly and helpful customer support – no judgment

Table of Contents

What is First Day Loan?

First Day Loan is a short-term installment lender. They only operate online, so borrowers can’t go into a storefront to do business with them. They cater primarily to people struggling with financial emergencies that can’t use traditional banking routes because of their poor credit scores.

For example, First Day Loan claims to be best for people who have found that they need to avoid “late fees, utility reconnect fees, and bank overdraft charges.” These can all be extremely expensive when viewed as an annualized rate. First Day Loan uses that to justify their prices.

As they state multiple times on their site, “These loans are not intended to meet long-term financial needs.” Borrowers who are facing anything other than an emergency shouldn’t bother even considering them.

Is First Day Loan Licensed?

First Day Loan is technically located in South Dakota, but they don’t have a license from the state. They operate from the reservation of a sovereign Native American tribe and consider themselves an extension of the group.

That makes them a tribal lender, which has several significant implications. Most importantly, it grants them a general immunity to lawsuits and gives them the right to disregard state regulations when it suits them.

Unfortunately, it’s almost entirely state regulations that keep lenders in check. The federal government provides some protections for consumers, but state governments decide what lenders can charge their customers.

First Day Loan’s frequently asked questions page explains the implications of their tribal status: “By agreeing to loan terms, you do however give up the right to take legal action against FIRST DAY LOAN in a state court. You are also effectively waiving your right to trial by a jury.”

Doing business with the tribal lender requires agreeing to let the Oglala Sioux Tribe have the final say on all disputes between the consumer and the tribe, which is clearly a conflict of interest.

READ MORE: Tribal loans and lenders to avoid

Typical Loan Terms

Tribal lenders have become increasingly secretive about their loan terms. First Day Loan is one of those that have taken their interest rates off their website, likely so as not to scare off potential applicants. Borrowers will have to wait until they receive a loan agreement to see the exact details of their loans.

That said, it’s possible to get more insight into things using the Wayback Machine, which shows what websites used to look like in years past. The First Day Loan page used to include more details on their products. They may have changed slightly over the years, but probably not much.

Here’s what borrowers can expect:

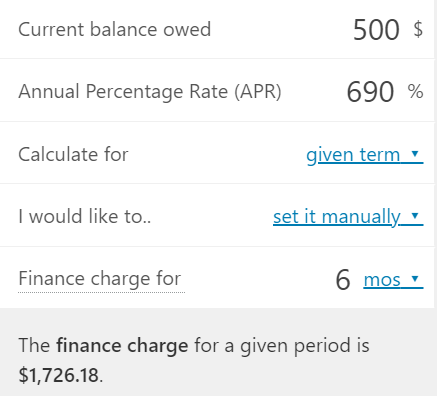

- Principal balances between $100 and $1,000

- Annual Percentage Rates (APRs) between 36% and 690%

- Undisclosed late fees for missing a payment (waived for the first offense)

- No fees for prepayment of the loan balance at any time

These are pretty standard loan terms for a tribal lender, but that’s not a good thing. A $500 loan at their highest interest rate of 690% would end up costing a borrower $1,701 in interest over a six-month repayment period. They would take payments of $183 every two weeks.

Online Reputation

When considering whether or not to work with a lender, one of the best ways to decide whether to trust them is to check out customer reviews. With businesses that have been around as long as First Day Loan, there’s usually an easily verifiable track record.

Surprisingly, First Day Loan seems to be an exception. Despite being over seven years old, there aren’t any reviews from previous customers online, either positive or negative.

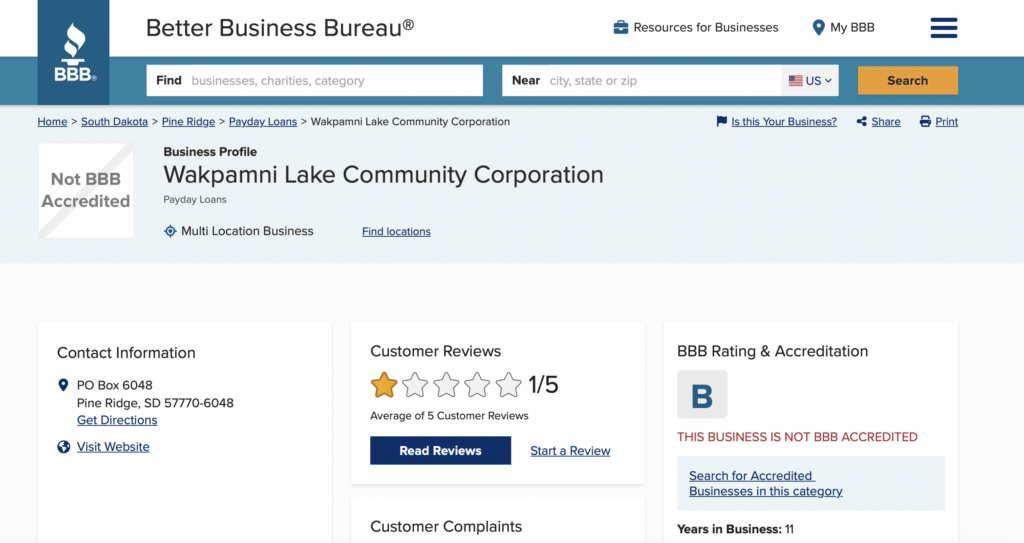

While there aren’t any First Day Loan review pages, they aren’t a complete ghost on the internet. They’re a subsidiary of the Wakpamni Lake Community Corporation (WLCO), and there are some reviews of the parent corporation.

Their Better Business Bureau (BBB) profile only has a few reviews, but all of them are for the lowest score possible. They all cite generally deceitful practices and accuse the WLCO of being a scam artist.

There are also more than 40 complaints in the past three years, almost all of which are about their billing/collections process or problems with their loan products.

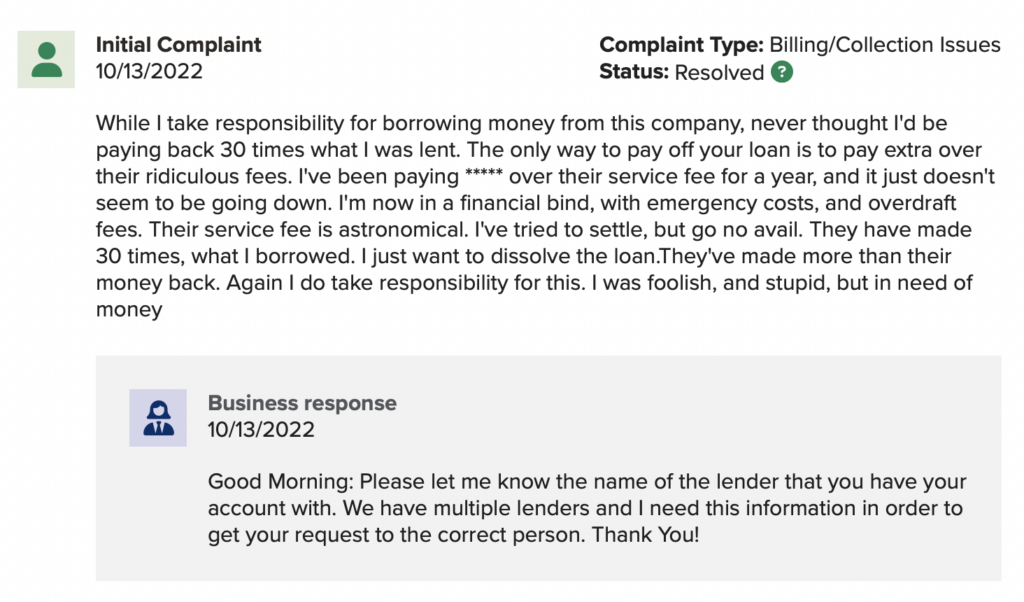

Here is an example of a customer complaint and business response:

In light of these issues and the WLCO’s responses, the BBB rates their customer service at a B.

The corporation has also been in several lawsuits, most of which reflect poorly on them. Where there’s so much smoke, there’s usually fire. Their suits were over racketeering, corruption, and falsifying their connection with the Oglala Sioux Tribe to get away with charging illegal interest rates.

Pros

While it’s almost always a mistake to take a loan from a tribal lender like First Day Loan, it’s not surprising that so many people continue to do so. At first glance, they look like the perfect resource for someone who needs some fast cash.

They can offer:

- A short and convenient application form that anyone can complete online

- The ability to fund approved loans within as little as a business day

- Low qualification requirements that almost any working adult will meet

- Principal balances as low as $100, which is perfect for covering surprise emergencies

If it weren’t for the shockingly high APRs, First Day Loan would be the perfect financial resource for the working class.

Cons

First Day Loan is a typical tribal lender, and they suffer from all of the same flaws as their peers in the industry. The list of cons is relatively short, but each one poses a significant danger and should probably be a dealbreaker on its own.

The issues with borrowing from First Day Loan are:

- Unreasonable interest rates that are significantly higher than other forms of credit

- Their interest rates do not have to adhere to state laws.

- Their tribal immunity, which means that consumers are at an extreme legal disadvantage in any disputes

Borrowing from First Day Loan is always risky. The chances of borrowers being able to afford the loans are low, and they can never enter the loan agreement from a position of any power.

READ MORE: Facing a financial crisis? Here are your best emergency loan options

How to Apply to First Day Loan

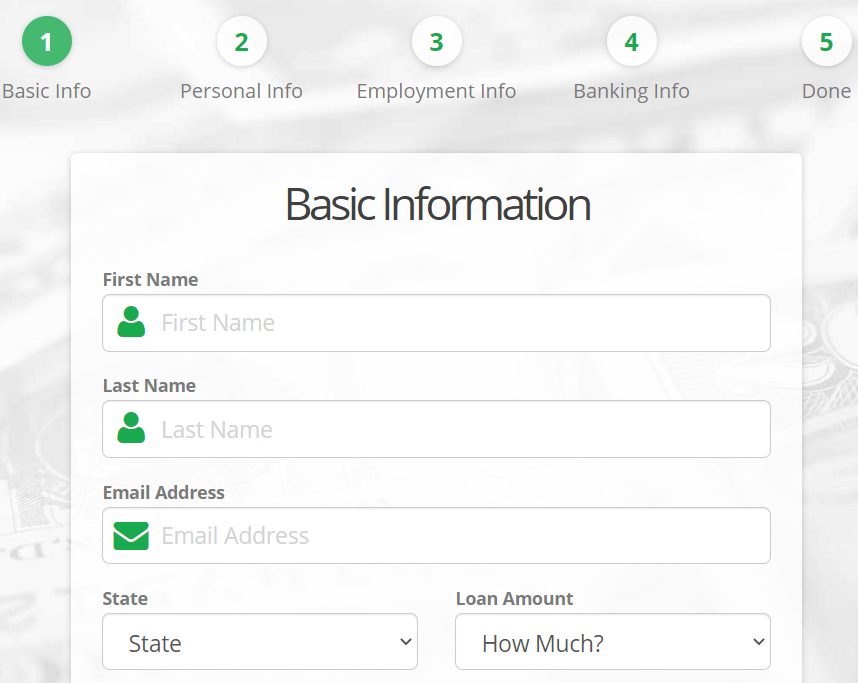

For those who still want to apply for a First Day Loan, the process is, at least, an easy one. It’s all online, and most people should be able to fill it out as quickly as ten minutes or so.

The lender is willing to work with people of all credit levels, so it’s not difficult to meet their application requirements. They claim that they’ll verify banking history and employment, but that’s about all that’s necessary to qualify.

Here’s the information they ask for in their application:

- Basic: Name and contact details

- Personal: Identification details including Social Security Number

- Employment: Source and amount of earnings

- Banking: Account and routing numbers to distribute and collect funds

Just because the application is easy, though, doesn’t make applying a good idea. In fact, it’s probably a mistake even for those who plan to wait to decide whether they’ll accept the loan until reading the proposed agreement.

Sharing sensitive data with any company is always a risk, and it’s even more so with one like First Day Loan. At the very least, they may use it to badger applicants into taking a loan by harassing them with phone calls. Even if they don’t do so themselves, they’ll likely sell the information to someone else who might.

Better Alternatives to First Day Loan

For people with a solid credit score, short-term lenders like First Day Loan shouldn’t even be on the radar. There are plenty of readily available lending options that blow them out of the water in every possible way.

However, for those without access to traditional banking routes, tribal and payday lenders may seem like the only viable option. There are better alternatives, though. There are fewer of them, but they’re out there.

Here are some solid places to start:

- Paycheck Advance Apps: Paycheck advance apps offer a lot of the same benefits as payday loans without unreasonable costs. They allow people to access part of their earnings ahead of their paycheck for a small monthly fee that’s usually no higher than $10. With Earnin, for example, there’s no cost except what you tip.

- Payday Alternative Loans (PALs): Short-term loans like payday loans and installment loans address a genuine societal need, but the lenders who hold them are usurious and abusive. To remedy that, federal credit unions provide a similarly structured loan product called PALs. They provide similar benefits, but they follow strict regulations that keep the terms affordable.

- Peer-to-peer lending: Those who can’t get a loan from a traditional bank can turn to their peers and receive funding from another private individual on a site like Prosper or Lending Club. The rates aren’t going to be cheap for people with bad credit scores, but they won’t be anywhere near those of First Day Loan.

Before even considering working with a tribal lender like First Day Loan, make sure to try these other options first. They’re much more affordable and often just as accessible, even with bad credit.

The Bottom Line

By this point, you’ve probably realized that we would recommend borrowing from a different lender. They cost far too much to do anything more than worsen an already-bad financial situation. In almost any case, it probably isn’t worth taking the risk of working with a lender that doesn’t have to follow state regulations — even if they didn’t charge triple-digit interest rates.

If possible, try to avoid having to borrow money in the first place. Start a side hustle, work extra hours, or implement a tighter budget to start cash flowing positively. Debt is rarely a long-term solution, and it won’t save someone if your financial situation has spiraled out of control. To get help with your finances, reach out to a credit counselor. Their expertise will help you turn things around, and their services are free. Reach out to a counselor near you today!

FAQs

Call 855-876-8584 to reach customer service, or email clientservices@firstdayloan.com. If you have already contacted Customer Service in an attempt to resolve an issue or concern and still need additional assistance, please contact the Wakpamni Lake Community Consumer Complaint Tribal Hotline at (800) 677-3860.

First Day Loan is based in Batesland, South Dakota.

In short, no. The website says they follow federal laws, so wherever a state’s laws are consistent with federal laws, First Day Loan will honor them. The U.S. Constitution grants tribes the same powers as a state. Both are sovereign governments. This means that state-mandated interest rate caps don’t apply for First Day Loan.