If you’re desperate for cash, Uprova’s website looks like the perfect solution. The promises are outstanding. Start your journey to financial success! A roadmap to a healthy financial future! Bad credit borrowers welcome! Does the product live up to the promises? Read on to find out.

Hot take: Uprova is a tribal lender that offers short-term personal loans from $300 to $5,000 (with no credit check) repaid over terms ranging from nine months to three years. It’s owned and operated by the Habematolel Pomo of the Upper Lake Tribe of Pomo Indians. Tribal lenders don’t have to follow state laws capping loan interest rates, and the rates charged by Uprova are often the equivalent of 1,000% APR — or even higher. Don’t try to borrow from Uprova until you’ve exhausted all of the more-traditional alternatives

Featured Alternative: DebtHammer

- Break the borrowing cycle

- Can help with many types of debt, including payday and tribal loans

- Friendly and helpful customer support – no judgment

Table of Contents

What You Need to Know About Uprova Credit

Uprova is an online lender. Their website says they make installment loans from $300 to $5,000. They state that their goal is “to help borrowers level the financial playing field and improve their financial health.”

The Habematolel Pomo of the Upper Lake Tribe of Pomo Indians owns Uprova. The tribe’s reservation in northern California is a federally recognized sovereign nation, which exempts Uprova from state laws and regulations.

Uprova only makes online loans.

Is Uprova Licensed?

Uprova holds a license from the Habematolel Pomo of the Upper Lake tribe. The only regulatory authority it acknowledges is that of the Habematolel Pomo of Upper Lake Tribal Consumer Financial Services Regulatory Ordinance.

The fine print at the bottom of the Uprova site states, “By obtaining services from this site you are submitting to the jurisdiction of the Habematolel Pomo of Upper Lake.”

That means that Uprova is regulated by its owners. It has no license from any state or federal banking regulator.

READ MORE: Need money now? Here’s how to make some quick cash

What to Expect if You Borrow From Uprova

If you choose to apply for a loan from Uprova, you will follow these steps:

- Fill out an online application. You’ll have to provide personal and financial information.

- Uprova will review your information. If they decline your application, they may refer you to their affiliate, Mountain Summit Financial.

- Uprova may approve your application. If they do, they will send you an offer.

- If you accept the offer, Uprova will make an ACH transfer to your bank account.

- Uprova states that “some loans” report payments to the major credit bureaus.

- You pay the loan back.

Uprova describes the process on its website. However, many customer reviews—we’ll discuss those later—suggest that what happens may be different.

Uprova is a Tribal Lender

Tribal loans are not issued by banks, credit unions, or traditional lenders. The money is lent by Tribal Lending Enterprises (TLEs), owned by recognized Native American Tribes. TLEs use this loophole to offer loans and engage in business practices that would be illegal under most state laws. Tribal loans sound a lot like traditional payday loans, but they’re significantly more dangerous. Because these are longer-term installment loans, the interest adds up quickly. Many customers report that they’ve paid more than double the borrowed amount.

It is often unclear where the financing for TLEs comes from. State officials and consumer advocates have accused tribal lenders of using “rent-a-tribe” arrangements, in which the tribal-owned lender is a front for a non-tribal predatory lender and the tribe receives only a tiny percentage of the profits.

READ MORE: What is a tribal loan and lenders to avoid

State Laws Don’t Apply to Uprova

The U.S. Constitution and many legal precedents affirm that Native American tribes have the right to govern themselves. Part of this right is tribal immunity: tribal officials acting in their official capacity are immune to lawsuits. That is why tribal lenders typically specify (usually in the fine print) that their officers are tribal officials acting in their official capacity.

Tribal immunity effectively means you have no recourse if the lender is abusive or changes the loan terms without warning.

Applying tribal immunity to tribal lenders making loans outside tribal territory is a legal grey area. Many regulators believe that tribal business activities outside the tribal territory should be subject to state law. Tribal lenders disagree. The Supreme Court may have to resolve the issue.

In the meantime, tribal lenders can do what they want without regulation or legal responsibility.

Typical Loan Terms with Uprova

Uprova’s website describes these terms.

- Scheduled automatic payment options

- No origination fee or prepayment penalty

- Loans from $300 to $5,000, even for first-time borrowers

- Terms from 9 to 36 months.

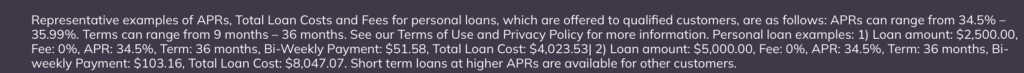

- APRs from 34.5% to 35.99% (in theory)

The website states that “short-term loan rates vary” and “complete disclosures of APR, fees, and payment terms are outlined in the loan agreement.” Reading and understanding the agreement before agreeing to the loan is essential. Its terms may be different from those advertised on the website.

Note the last sentence in the fine print above. This means Uprova can be an expensive way to borrow, particularly if you don’t have an ideal credit score. Customers complain that despite claims of an annual percentage rate ranging from 34.5% to 35.99%, they are being charged APRs of 500% or more, which makes repayment very difficult.

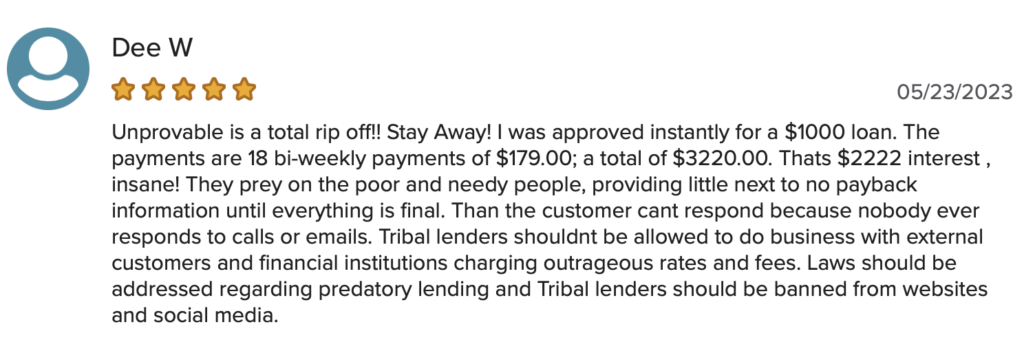

For example, here is one complaint that was filed with the Better Business Bureau:

I was approved for a loan and signed the loan docs thru electronic signature. At no point was I made shown or made aware that the interest rate was OVER 500%! Every 2 weeks they are withdrawing $260 as payment, and I have made 5 payments already with ONLY $62 going towards principal. I was not told about this ridiculous rate, nor could I see the information until after I signed and the funds deposited. This business practice is the definition of PREDATORY and should not be legal. Matter of fact, I will be reaching out to a lawyer regarding this.

Customer Reviews

Uprova’s website looks friendly and appealing.

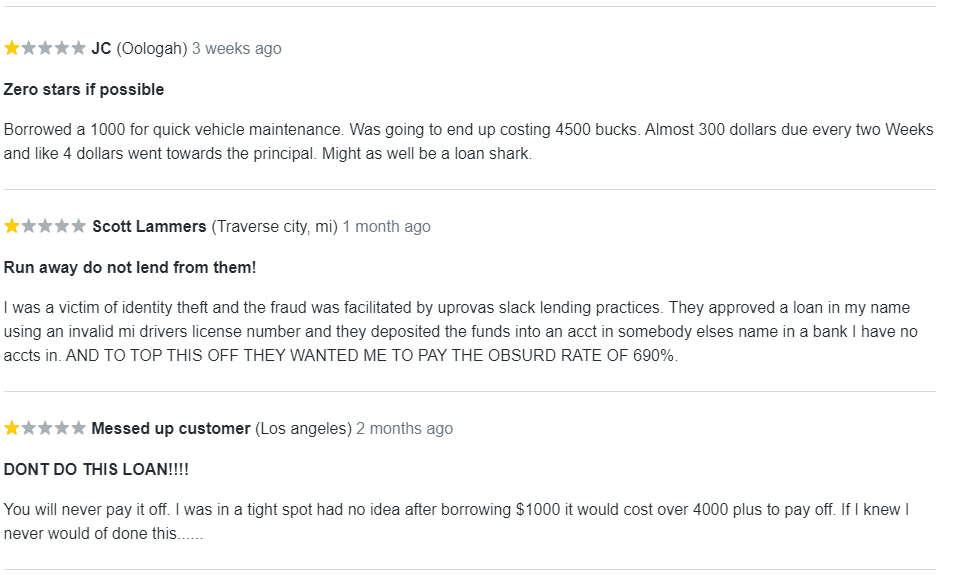

Customer reviews are not great.

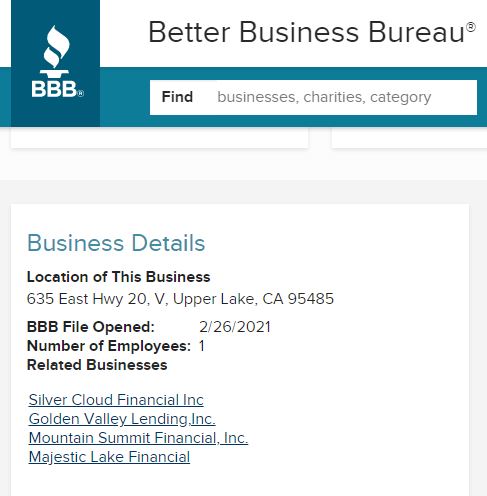

It’s difficult to tell much from Uprova’s Better Business Bureau page. While the rating is a B-, there are only 48 customer reviews and 168 complaints over the past year. The reviews are resoundingly negative, even some of the five-star ones.

The BBB does include a list of related businesses. It’s worth taking the time also to check reviews of these lenders because those could indicate the kind of service you can expect from Uprova.

Reviews on Trustpilot are uniformly positive, but they provide little or no detail on the customer’s experience.

The reviews on Finder.com are a bit less positive and more specific.

Given the wide disparity in the reviews, it would be wise to be cautious and read the loan offer carefully.

Lawsuits

Uprova was named in Hall v. Ascend Loans, LLC et al., filed on March 20, 2023. Both Ascend Loans and Uprova are owned and operated by the Habematolel Pomo of Upper Lake, a federally recognized Indian tribe.

The complaint alleges the defendants engaged in a “rent-a-tribe” scheme, charging Illinois residents illegal interest rates.

Defendants named in the case are:

- Ascend Loans, LLC

- Uprova Holdings LLC

- Upper Lake Processing Services, Inc.

- Pomo One Marketing, Inc.

- Habemco, LLC

- Genel Ilyasova

- Michael Scott Hammer

- Sarah Marie Himmler

- David Stover

- Denise DeHaemers

Pros and Cons of Uprova

There are a few positives but quite a few negatives.

Benefits

- Fast funding

- No minimum credit score requirement

- Easy application process

- Pay in installments

Drawbacks

- Very high interest rates

- You’ll need a steady income

- You’ll give out personal details

- Direct deductions from your bank account

- Payments may be bi-weekly

- Lenders may apply payments entirely to interest

- No legal recourse

How to Apply for a Loan From Uprova

If you apply for a loan from Uprova, you’ll use an online application. You’ll have to meet these qualifications.

- You must be age 18 or older

- You’ll need a US address

- You will need a regular source of income

- You must have a bank account

- Loans are not available in all states

Be prepared to provide your address, phone number, Social Security number, employment details, and bank details.

Better Alternatives

If you have poor credit and you need cash quickly, tribal lenders and payday lenders may seem like the only alternatives. That’s not always the case. Consider these loan products and alternatives first.

- Borrow from friends, family or employer

- Use a home equity loan or line of credit (HELOC)

- Use your 401(k)

- Use a credit card

- Ask your credit union or bank

- Paycheck advance apps

- Peer-to-peer lending

The Bottom Line

We can’t recommend Uprova loans. Even the best interest rates are equal to what you’d pay a mainstream loan provider like Upstart or Upgrade, and chances are, you’re not going to qualify for Uprova’s best rates.

Research loan companies that aren’t affiliated with Native American tribes (many lenders are willing to work with borrowers with bad credit). You may be surprised at the number of options you have.

FAQs

You can reach Uprova by phone at (866) 362-3444 or email at customerservice@uprova.com. You can also message them through uprova.com.

Uprova’s mailing address is 635 E Hwy 20 V Upper Lake, CA, 95485.

Funds are usually deposited into your account within 30 minutes, depending on your bank.