An unexpected bill has come up and you need money right now. A quick internet search turns up Mountain Summit Financial, which promises short-term loans of up to $1,500. But before you apply for that loan, it’s important to get the full story, or getting out of debt could end up being an uphill climb.

Featured Alternative: DebtHammer

- Break the borrowing cycle

- Can help with many types of debt, including payday and tribal loans

- Friendly and helpful customer support – no judgment

Table of Contents

What is Mountain Summit Financial?

Mountain Summit Financial isn’t technically a payday lender, but the loans it offers aren’t far off from payday loans. The company offers short-term installment loans of up to $1,500 for first-time borrowers. If a person borrows from the company again, they can take out a loan of up to $2,500.

People apply for loans from Mountain Summit Financial online. The company says it will approve qualified applicants quickly and that it’s possible to get the loan money as soon as the next day.

During the application process, the company verifies the applicant’s financial and personal information. It also runs a credit check through a “specialized credit bureau.”

Borrowers make payments on their loans from Mountain Summit Financial on a set schedule, with the goal of paying the loan in full by the maturity date. A borrower can set up ACH transfers so that payments come directly from their checking accounts or pay with a debit card. Mountain Summit Financial doesn’t accept payment via credit card.

The company’s website is vague on how long a “short-term installment loan” lasts, and doesn’t provide any information on typical loan term lengths. It does say that it allows people to pay extra on their loans and to pay off their loans early, without a penalty.

Mountain Summit Financial is owned by Habematolel Pomo of Upper Lake, California, a federally recognized tribal group. The company claims that offering short-term installment loans to consumers online allows members of Habematolel Pomo to increase their economic stability and financial independence.

Is Mountain Summit Financial Licensed?

A lender should be licensed before it offers loans to consumers. The type of license a company needs to have depends on the type of loans it offers and the states where it provides its services.

Mountain Summit Financial isn’t licensed by any states. Since it is owned by the tribal group Habematolel Pomo, it claims that all of the services and transactions available through its website are offered on the tribal group’s sovereign land and are exempt from state or federal licensing requirements.

The company’s status as a “tribal lender” means that it can (or at least, thinks it can) skirt certain regulations other short-term lenders need to follow. In some cases, states and the federal government disagree.

In 2017, the Consumer Financial Protection Bureau (CFPB) went so far as to sue Mountain Summit Financial and three other online lending companies. In the lawsuit, the CFPB stated that the lenders were trying to collect debts they weren’t legally owed. The CFPB claimed that the loans violated interest rate caps and licensing requirements in at least 17 states, making the loans null and void.

Washington State Department of Financial Institutions (DFI) issued a consumer alert about Mountain Summit Financial, following a complaint by a consumer. In the alert, the DFI warned that the tribal lender wasn’t licensed in the state nor was it registered to do business in Washington State. The DFI cautioned consumers to avoid working with any unlicensed or unregistered companies.

Typical Loan Terms from Mountain Summit Financial

Reading through Mountain Summit Financial’s website, it’s difficult to discover what their loan terms are. The site is perplexingly vague on the amount of interest it charges and on the length of its short-term loans.

Notably, it does provide information on the amounts available to borrow. First-time borrowers can borrow between $300 and $1,500. For subsequent loans, a person can borrow up to $2,500.

Borrowers who decide to work with Mountain Summit Financial can have one loan with the company at a time. The lender also limits the total number of loans people can have with it and other lenders. Borrowers with more than two loans in repayment can’t get a loan from Mountain Summit Financial.

To find out the terms of the loan, a person needs to begin the application process with Mountain Summit Financial. Once they are approved, they will receive a loan agreement that outlines the annual percentage rate, fees and repayment terms.

While Mountain Summit Financial isn’t forthcoming about the interest rates it charges, the CFPB’s lawsuit against the company noted that two of the lenders in the suit typically charged rates between 440 and 950%. The lawsuit described the loans from Mountain Summit Financial as charging similar rates.

Loan Terms from Mountain Summit Financial

- Loan amount: $300 to $1,500, up to $2,500 for subsequent loans

- Fees: Unspecified

- Application fee: none

- Interest rate: Unspecified

- Loan term: Unspecified

- Prepayment penalty: None

READ MORE: Facing a financial crisis? Here are your best emergency loan options

Online Reputation

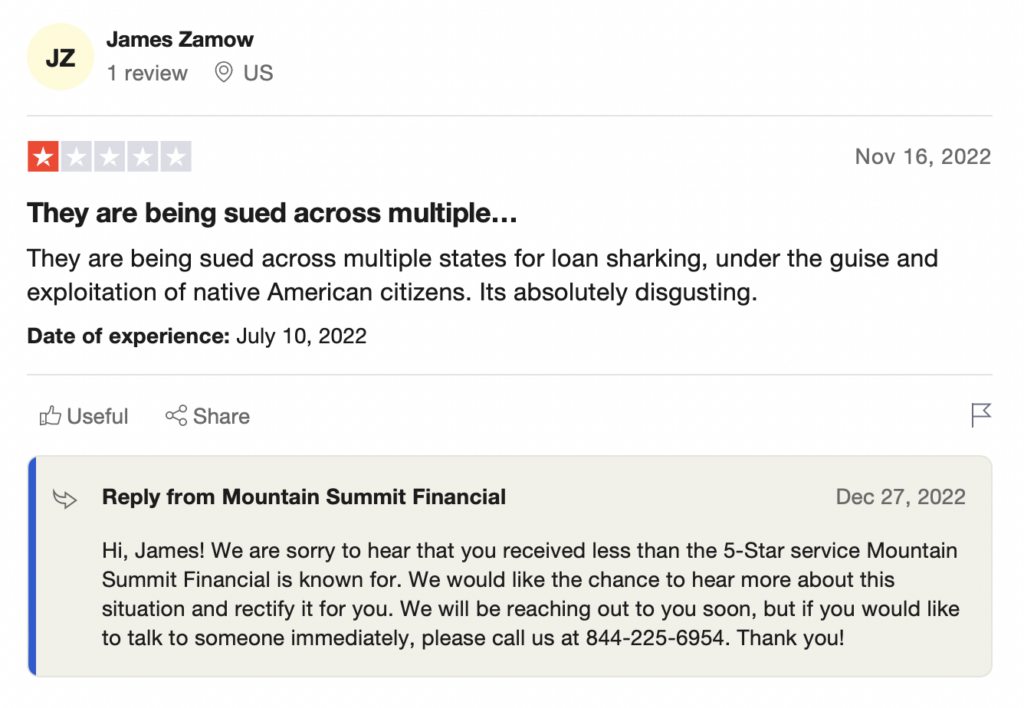

Mountain Summit Financial tries to present itself as having a stellar reputation and thousands of five-star reviews. The review section on its website highlights thousands of positive reviews from TrustPilot and Google.

But a closer look paints a different picture. First, there’s a lawsuit from the CFPB and the warning from Washington State DFI to consider.

Next, there’s the quality of the reviews. Many of the positive reviews seem to be from people who recently got money from Mountain Summit Financial. They were in a financial bind and are relieved to have gotten cash to bail them out.

The less positive reviews typically come from consumers who have started to repay their loans and who have discovered that their monthly payments barely make a dent in the amount they owe the company. Many of the negative reviews note that the lender pulled a bait and switch, quoting a low interest rate, only to end up charging astronomically high rates.

Mountain Summit does sometimes comment on the reviews, but you can decide for yourself how useful these replies are.

Pros

The appeal of a short-term loan from Mountain Summit Financial is that it provides a borrower with cash when they need it most. The company’s website outlines some of the potential reasons a person might need to apply for a short-term tribal loan, such as paying for a car repair, unexpected travel expenses or medical bills.

The loans get funded quickly, which can be helpful when someone is in a pinch. Many approved borrowers get their money the day after they apply, which can be a godsend during a financial emergency.

For a borrower with a low credit score, a tribal loan might seem like the best of several bad options. At first glance, it seems less predatory than a payday or car title loan.

Cons

In many cases, the cons of a loan from Mountain Summit Financial far outweigh the pros. As online reviewers and the CFPB have noted, the repayment structure of the loans and the sky-high interest rates makes it difficult to reduce the principal balance.

Many borrowers have stated that they ended up paying three or four times more than they borrowed in the first place. A $1,000 loan ended up costing one borrower well over $3,000, for example.

Another drawback of working with Mountain Summit Financial is that it’s difficult for borrowers to know what they are getting into before they begin the loan application process. Many states have laws that either ban payday loans or that require companies to clearly disclose their interest rates and fees.

Since Mountain Summit Financial is a tribal lending company, it believes it can avoid state laws and often keeps potential borrowers in the dark.

Better Alternatives to Mountain Summit Financial

For borrowers who need cash ASAP, there are less expensive options available. Some alternatives to Mountain Summit Financial include:

- Getting a cash advance from a credit card

- Signing up for a cash advance app

- Selling a valuable possession

- Applying for a personal loan from a credit union or bank

- Using a home equity loan or line of credit

- Borrowing from a family member or friend

- Getting financial assistance from a local charity or aid organization

The Bottom Line

While alternatives to a short-term tribal loan also have their pros and cons, they’re usually less expensive and can help you avoid falling into a debt trap when you’re in a tough situation. It’s best to exhaust all of your other options before committing to a loan from a tribal lender.

FAQs

You can reach Mountain Summit by phone at 855-819-6999 or email customerservice@mountainsummitfinancial.com

Mountain Summit Financial is based in Upper Lake, California.

Mountain Summit says it utilizes a secure 128-bit SSL certificate for all input items and several different security services to prevent hacking or data intrusion.