When you need cash right away, and your credit score is less than perfect, your options for borrowing are severely limited. Short-term lenders like Fox Hills Cash seem like the only option.

Fox Hills Cash offers loans of up to $500 for first-time borrowers. Repeat customers can borrow up to $1,000.

But is the lender safe to work with, or will they end up causing more harm than good?

Our take: Fox Hills Cash is wholly owned by the Wakpamni Lake Community, meaning the company is a tribal lender and doesn’t have to follow state laws that cap interest rates. Fox Hills Cash doesn’t provide an interest rate range for its loans, but the annual percentage rate for Fox Hills Cash loans can equal as much as 780%. That’s significantly higher than traditional payday loans. If a high-interest short-term loan is your only option, you’re better off choosing another lender.

Featured Alternative: DebtHammer

- Break the borrowing cycle

- Can help with many types of debt, including payday and tribal loans

- Friendly and helpful customer support – no judgment

Table of Contents

What is Fox Hills Cash?

Fox Hills Cash offers short-term installment loans. Their target customers are people struggling financially due to some surprise expense, especially those who can’t qualify for traditional banking options due to poor credit.

Essentially, their loans are supposed to be a stopgap between paychecks, as their website states: “Sometimes bills are due before you get your paycheck and you need cash to avoid penalties and fees.”

If that sounds familiar, it’s because it’s the same strategy that payday lenders have used for years. Truthfully, the two products are functionally identical. The qualifications are easy — all you need is a bank account and proof of steady income — but they charge borrowers an arm and a leg for the privilege of borrowing a few hundred dollars.

Installment loans give borrowers more time to repay their loans than payday loans. Unfortunately, because of their excessive interest rates, that usually backfires.

The only way to make payday loans even remotely affordable is to pay them off immediately to prevent interest from accruing. Even Fox Hills Cash admits it: “To minimize the total cost of your loan, we strongly recommend that you either pay your loan in full or pay as much as you can to reduce the principal balance.”

Of course, doing so is almost impossible, as payday loans have shown repeatedly. A quarter of payday loans roll over at least nine times, trapping borrowers in a cycle of debt. Unfortunately, these installment loans are no better. The high interest rates make them very difficult to repay as scheduled, even over a longer repayment period.

READ MORE: Tribal loans and tribal lenders to avoid

Is Fox Hills Cash Licensed?

Fox Hills Cash is based in South Dakota, but they don’t have a license from the state. On paper, they operate out of a local Native American reservation as an extension of the Oglala Sioux Tribe, so they don’t have to obtain a state lending license.

You will see this at the bottom of their web page:

They’re a tribal lender, meaning they follow the rules and regulations set forth by their tribe, not the state where they do business. That doesn’t sound inherently dangerous, but it almost always works out poorly for those who do business with them.

According to the website, Fox Hills Cash is a member of the Online Lenders Alliance. The OLA is a lobbyist group that significantly influences federal policy, usually in ways that favor the lenders rather than consumers. The OLA is a vocal opponent of the Military Lending Act, a federal law that caps interest rates for military servicemembers and their families.

Lawmakers in some states have stepped in, passing laws to protect consumers. But tribal lenders like Fox Hills Cash have no obligation or inclination to follow those laws. Instead, they use their tribal status to charge interest rates far above state limits.

Their website discloses this: “By entering into a transaction with WLCC Lending FHC d/b/a Fox Hills Cash, you are agreeing to have the law of the Ogala Sioux Tribe govern this Loan. The law of the Ogala Sioux Tribe relating to lending does not limit the rate of interest or fees that may be charged.”

Typical Loan Terms

Here’s what borrowers can expect when they take out a loan from Fox Hills Cash:

- Principal balances between $100 and $500

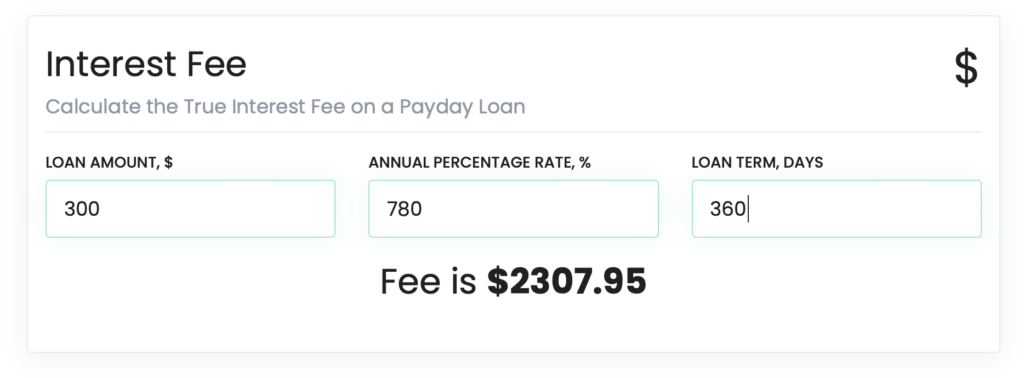

- An APR of approximately 780%

- Bi-weekly repayment schedules

- Repayment terms of up to a year, depending on the size of the principal balance

- No prepayment fees for borrowers who wish to pay off their balance early

- $25 charge for each instance of late payment or non-sufficient funds

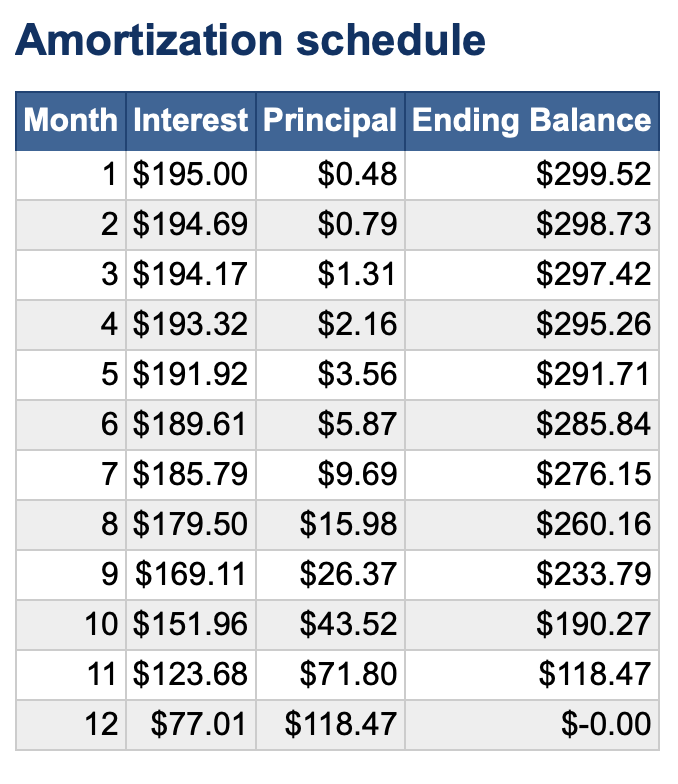

For context: A $300 loan with an interest rate of 780% that’s paid off over a year will cost $2,307.79 in interest. Here is a breakdown of how much of each $195.48 monthly payment will go toward interest

Online Reputation

Fox Hills Cash has existed since at least 2014, but they have a relatively thin online presence. They’ve earned a B rating from the Better Business Bureau, but the few reviews and complaints are resoundingly negative, and they earn one out of five stars.

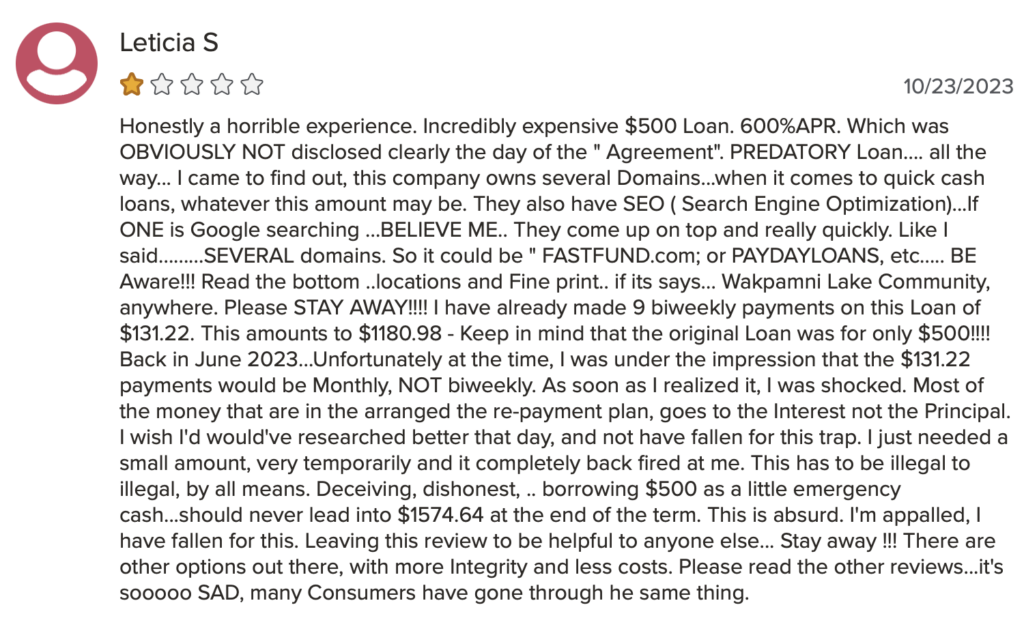

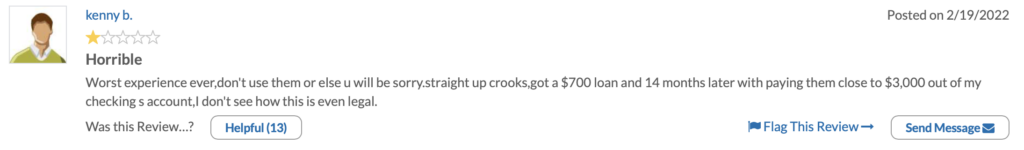

Unsurprisingly, the reviews for the lender are universally negative. They all accuse the company of being a scam, though for various reasons. They have the following complaints:

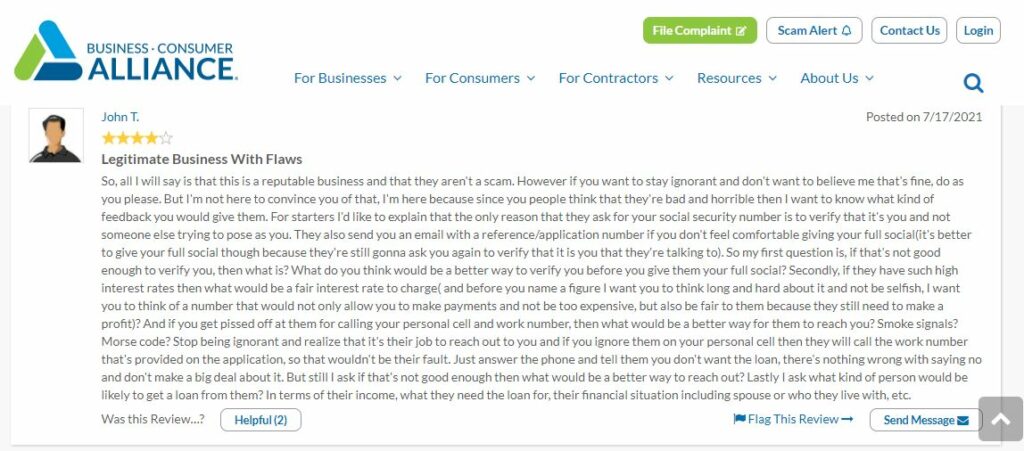

The Business Consumer Alliance also has a crowdsourced review page for the tribal lender.

While there aren’t many reviews on the site, their consistency paints a pretty convincingly negative picture of Fox Hills Cash.

Every review listed is a one-star review, except for a single four-star review:

Pro tip: While some of the comments here in defense of Fox Hills Cash’s interest rates are questionable, a good point is raised. If you get a call from a lender you don’t recognize and have not submitted an application, do not offer any personal information, regardless of whether it’s a legitimate lender. Just politely request that the lender not contact you again and hang up.

Lawsuits

Another way to verify a lender’s trustworthiness online is to search for any legal action against them.

A proposed class action lawsuit against Fox Hills Cash claims the lenders’ owners are behind an illegal “rent-a-tribe” scheme and have issued loans with illegal interest rates to residents of Illinois.

The suit names as defendants:

- WLCC President Geneva Lone Hill

- WLCC Director of Compliance Bret A. Crandall

- WLCC CEO Raycen Raines III, (also known as Raycen American Horse Raines)

According to the filing, the company has operated under several other names, including:

- Fast Day Loans

- Bison Green Lending

- Explore Credit

- Good Loans Fast

- Rapid Loan

- Title Loan Fast

- MyBackWallet

- TheGanEdenGroup.com

- CheckAdvanceUSA.net

- Consumer First Credit

- Green Circle Lending

- Rolling Plains Cash

- Cash on Cloud 9

- Easy Cash Online Store

- BaysideCash.com

- Whisper Rock, LLC

- BeachsideCash.com

- BlvdCash.com

- Fast Money Store

- FiresideCash.com

- Seaside Dollar

- SeasidePayday.com

- Merit Financial Trust

- Ocean Park Funding

A separate case was filed in Florida but was settled out of court.

Pros

Taking out a loan from Fox Hills Cash is almost always a mistake, but it’s not surprising that their target market does so as often as they do. They’re the perfect trap for people who are in financial distress.

They lure people in with the following:

- An online application that seems harmless to fill out given how easy it is to complete

- Virtually nonexistent underwriting requirements that encourage just about every working adult to apply

- Loans with principal balances as low as $100 let borrowers receive only what they need

- The ability to fund loans as quickly as a single business day

If it weren’t for their excessive price tag, these loans would be the perfect resource for people with bad credit and low incomes needing financial support.

Cons

Fox Hills Cash is an unexceptional tribal lender. They suffer from all the same problems as the rest of their industry, each of which is significant enough to make borrowing from them dangerous. In combination, they should send just about everyone running in the opposite direction.

Here are the downsides to working with the lender:

- A loan of even a few hundred dollars can take a year to pay back and cost over a thousand dollars in interest and fees

- Their owners have a history of breaking state laws whenever it suits them, resulting in significant legal trouble

- Every customer that’s reviewed their interactions with the company indicates a negative experience

- Their tribal immunity removes almost all legal leverage that a borrower might have in other lending relationships

If possible, borrow money from some other lender, preferably one with a license and respect for state laws. Those with no alternatives (or have already taken out a loan) should try to pay the balance off as soon as possible to limit interest costs.

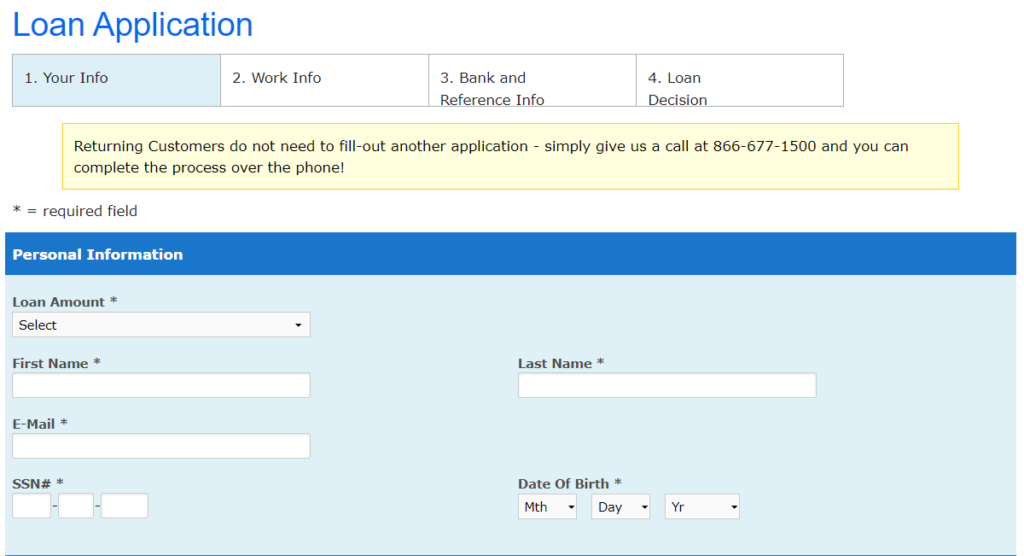

How to Apply for a Fox Hills Cash Loan

While we’d never recommend going through with it, filling out Fox Hills Cash’s application is a simple and easy. Again, it’s all online, and most people should be able to complete it in just a few minutes.

Their FAQ page states that all it takes to qualify for a loan from them is the following: “You must receive regular income and have an active bank account that has been open for at least ninety (90) days. You must also receive an income of at least $1,500 per month. Military personnel and individuals with dependents in the military are not eligible.”

These requirements shouldn’t rule out most working adults. A $1,500 monthly income amounts to just $18,000 a year, which puts someone in the bottom 19%.

For those who meet these minimum requirements, filling out the application is as easy as providing the following information:

- Personal information: name, contact info, Social Security Number, and military status

- Work information: source of income, frequency, and amount

- Bank and reference details: bank account details to allow fund transfers back and forth

Pro tip: Remember that a simple application doesn’t mean your personal data isn’t at risk. It’s always a risk to share these details. Fox Hills Cash could easily abuse it themselves or sell it to a third party that would.

Better Alternatives to Fox Hills Cash

Most people who resort to payday loans or installment lenders like Fox Hills Cash are desperate for funds. They don’t have access to savings, a personal support network, or even traditional bank loans.

While these people have fewer borrowing options than someone with a healthier credit score, they still don’t have to resort to usurious lenders. Here are some much better alternatives:

- Paycheck advance apps

- Peer-to-peer lending platforms

- Payday Alternative Loans (PALs)

- Secured personal loans

These alternatives would be superior to a Fox Hills Cash installment loan. They’re almost as accessible to people with bad credit but don’t cost an arm and a leg.

The Bottom Line

Don’t borrow money from a tribal lender unless you’ve exhausted every other option. The out-of-control interest rates will leave you in a worse position.

Instead, try a cash advance app like Dave or a peer-to-peer lending platform like Lenme or SoLo Funds. Or talk to a credit counselor if you need help. But whatever you do, don’t put yourself at risk of long-term financial damage if you have any better option at all.

FAQs

If this is your first call to customer service, call 866-677-1500 or email support@FoxHillsCash.com. If you have already contacted customer service and still need additional assistance, please contact the Wakpamni Lake Community Consumer Complaint Tribe Hotline at 1-800-677-3860 or email compliance@wlcccompliance.com.

Fox Hills Cash is based in Batesland, South Dakota.

Fox Hills Cash loans range from $200 to $500. Returning customers may be eligible to borrow up to $1,000.