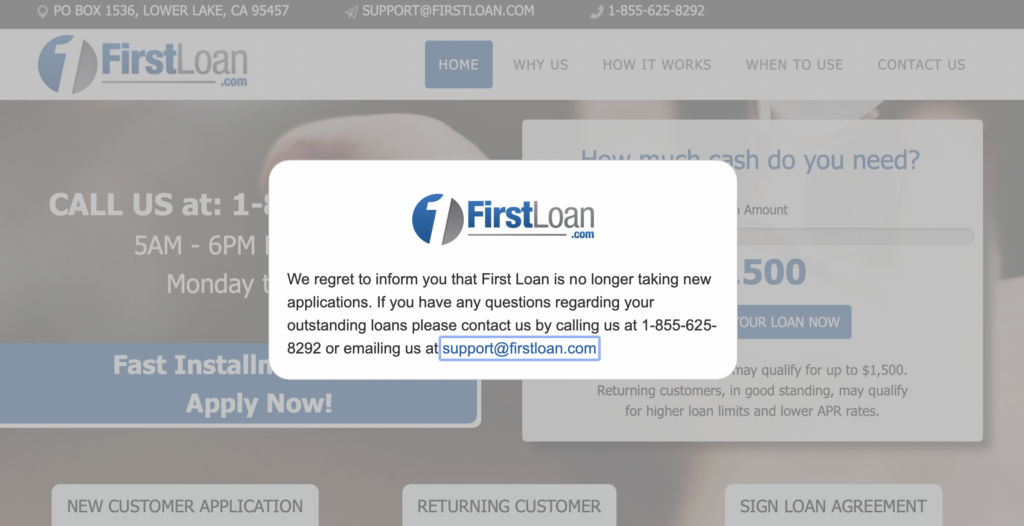

If you’re looking for information on borrowing money from FirstLoan, you’re out of luck.

FirstLoan is no longer accepting new applications. To learn about better alternatives, or to find out more if you still have an outstanding loan with FirstLoan, read on.

Featured Alternative: DebtHammer

- Break the borrowing cycle

- Can help with many types of debt, including payday and tribal loans

- Friendly and helpful customer support – no judgment

Table of Contents

What Is First Loan?

FirstLoan is an online, short-term installment loan provider. They admit to being a “very expensive form of borrowing” that people should only use to pay for their short-term needs. For example, people may need to cover medical emergencies, home repairs, or their rent. That’s eerily similar to the excuses that payday lenders use.

That comparison would be bad for business, though, so FirstLoan addresses the parallels. They claim that their loans are superior because they “offer more flexible repayment options while still providing the cash when you need it.”

The truth is, there’s virtually no difference between the two types of loans in practice. Payday loans come due more quickly, but they have just about everything else in common. They’re both extremely costly, come in relatively small principal amounts, and exist supposedly to help with emergencies. They’re also both easy to qualify for, even for applicants who probably can’t afford to pay them back.

READ MORE: Tribal loans and lenders to avoid

Is First Loan Licensed?

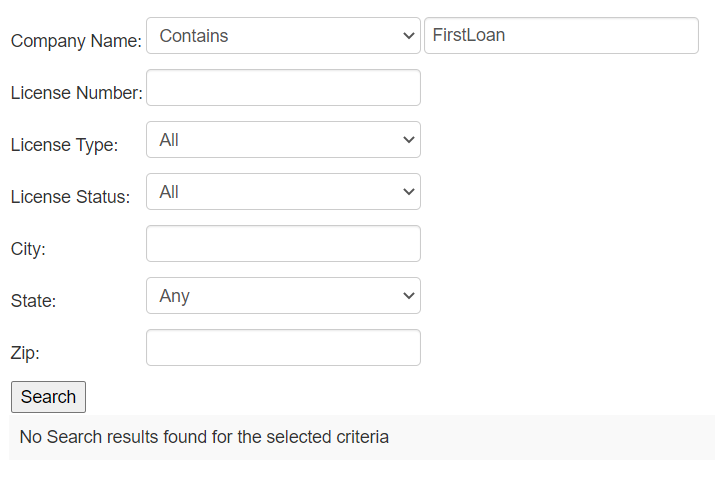

First Loan lists a mailing address in California, which means that they’re supposed to register with the Department of Business Oversight. They don’t have a license with the state, though, because they’re what’s commonly known as a tribal lender.

This is what you find when you try to search for FirstLoan licensing information:

That means they are an extension of a Native American tribe, operate (supposedly) out of their land, and adhere only to their tribal regulations. Because of “tribal immunity,” they don’t necessarily have to respect the rules put in place by states or the federal government. That leads to them frequently charging interest rates far above state limits. For example, California’s limit is 460% APR, but First Loan’s sample rate on their website is 778% APR.

READ MORE: Facing a financial crisis? Here are the best emergency loan options

Better Alternatives

Besides a lack of cash, one of the most common reasons people turn to a lender like First Loan is that they have low credit scores. Many applicants assume that they can’t qualify for a loan from a bank. They think that means their only options are providers who charge an arm and a leg.

That doesn’t have to be the case. Payday lenders and tribal lenders claim that their rates are necessary to make money given the risks they take, but that’s not true. There are plenty of lenders out there who lend to risky borrowers and have APRs that are far, far below what First Loan charges. Here are some of our favorites:

- Credit unions: Unions are one of the best sources of support for people who don’t have the best credit scores. They require a membership to receive one of their loans, but their rates are often much more affordable than other providers, even with a poor credit history.

- Secured personal loan providers: Lenders are often unwilling to give loans to people who have demonstrated that they’re not the best at repaying their debts. They don’t want to risk not making a return on their money. However, they may be willing to loan to people with bad credit who put up collateral, such as their car or house. Just be sure to repay secured loans to avoid losing the asset.

- Cash advance apps: For those who just need a little bit of money to make it to their payday, cash advance apps can be a great option. Earnin, for example, allows people to receive funds for their work the day they do it instead of waiting for their paycheck. Even better, there are no mandatory fees or interest when paying the balance back.

- Home equity loans: Because these loans use the equity in your home, the interest rates are usually lower than traditional personal loans, and the credit score criteria is a little more lenient.

Any of these options would be safer for most people who need cash than First Loan. If it’s at all possible, use one of them before resorting to a tribal lender.

The Bottom Line

If you were hoping to borrow money from FirstLoan, you’re out of luck. They’re no longer issuing new loans. But before you turn to another tribal lender, there are several better alternatives to try.

Better yet, see if you can solve your problems without taking on new debt in the first place. If you can reduce your expenses or make a little extra income on the side, it might save you from ever having to take on another loan again. If you’d like some help, a credit counselor can be a powerful (and affordable) asset. Reach out to a local counselor to get started today!

FAQS

If you have any questions regarding your outstanding loans you can reach them by phone at 1-855-625-8292 or by email at support@firstloan.com

If you’re trying to contact FirstLoan because you suspect an account has been fraudulently opened in your name, first try support@firstloan.com. If you don’t get a response, try posting on the FirstLoan Better Business Bureau page, or file a complaint with the Consumer Financial Protection Bureau, the Federal Trade Commission or your state attorney general.

You will not go to jail simply for failing to repay a loan. That’s a civil matter, not a criminal one. However, you could end up going to jail for other reasons, like ignoring a court order. If you get a court summons, don’t ignore it.