When you’re desperate for cash, a payday loan might seem like the only solution, particularly if your credit score is less-than-perfect.

They seem like the ideal option for people who need money fast – the funds are usually available by the next business day and the requirements are extremely basic. Almost anyone is eligible.

Table of Contents

What Does It Take to Qualify for a Payday Loan?

Most payday lenders ask for the following basic requirements:

- An active checking account

- Proof of income (pay stubs, etc.)

- Valid ID

- Be age 18 or older

Some lenders will also require a Social Security number.

Pro tip: Basically anyone 18 or up with a steady income qualifies. The income doesn’t even have to be from a job. Social Security payments count. There’s no credit check, so your credit score won’t matter.

Though it isn’t an eligibility requirement, most payday lenders will require applicants to provide one of the following:

- Access to electronically debit their bank account on their next payday

- A post-dated check for the full loan balance plus fees

This ensures that the lender has access to some form of repayment.

Close to 12 million Americans fall victim to payday lenders each year. Most of them are financially vulnerable people who live paycheck to paycheck and have no savings account or credit card. The industry’s growth has been swift: there are now more payday lending storefronts than McDonald’s and Starbucks.

READ MORE: Payday loan alternatives

Who Won’t Qualify for a Payday Loan?

Despite the minimal requirements, not everyone is eligible for a payday loan. There are still a few situations where your application may be denied. This includes people who:

- Can’t prove their income

- Earn less than the required minimum

- Can’t prove that they have a steady income (independent contractors or part-time workers)

- Don’t have an active bank account

- Already have at least one past-due payday loans

- Aren’t U.S. citizens

- Are younger than 18 (or, in some cases, 21)

- Are active-duty military service members or their dependents

- Live in a state where payday loans are illegal (though the illegal status isn’t always a deterrent)

Pro tip: The reason active-duty military service members and their families may not be eligible for payday loans is because of the Military Lending Act (MLA). The MLA is designed to protect military families from predatory lenders, including payday and title lenders. It caps the interest rates these families can be required to pay. Because of this, some payday lenders won’t issue loans to military families at all.

Aside from the military exception, most payday loan denials occur because lenders don’t believe they’ll be repaid on the due date. For example, suppose you don’t have an active checking account. In that case, the payday lender can’t automatically debit your account when your next payday rolls around, or – alternatively – you can’t provide a post-dated check that they will cash from your next paycheck. This is a common requirement to ensure the payday lender has a way to be repaid.

READ MORE: Payday loan interest rates

Other Types of Loans are Better Alternatives

Before you take out a payday loan, explore every possible alternative. For most people, payday loans are financially devastating. Even if you have no insurance and are facing urgent medical bills, car repairs, or other sudden expenses, stay away from payday lenders. There are better options.

Obviously, the best alternative to a payday loan would be to avoid needing a loan in the first place. That’s tough for most Americans, considering that the average debt is $96,371 per household, according to Experian. According to CNBC, 53% have little to no savings for emergencies.

If you have lived with a poor credit score, an empty checking account, and high-interest debt for many years, breaking out may take a lot of effort. Once you succeed, however, you can enjoy higher financial security and a safety net of emergency savings.

Even if you vow to get your financial situation back on track, you still may need an urgent loan. But you have better options that payday lenders.

READ MORE: Step-by-step guide to payday loan consolidation

Payday Alternative Loans

These small-dollar loans offered through credit unions are similar to payday loans with a few key differences: the interest rate is capped and the loan repayment period is longer.

READ MORE: Payday Alternative Loans

Cash Advance Apps

If you have a regular paycheck and need urgent cash, you might consider using a low-fee cash advance app (also sometimes called paycheck advance apps). After confirming your employment, the app may offer you an advance of a few hundred dollars on your next paycheck.

READ MORE: Best cash advance apps

Installment Loans

Though traditional loans from financial institutions will generally have the best interest rates, they will also have the highest credit score requirements. If you need a personal loan but have bad credit, try an online loan from a lender like personalloans.com or badcreditloans.com.

READ MORE: Payday loans vs. installment loans

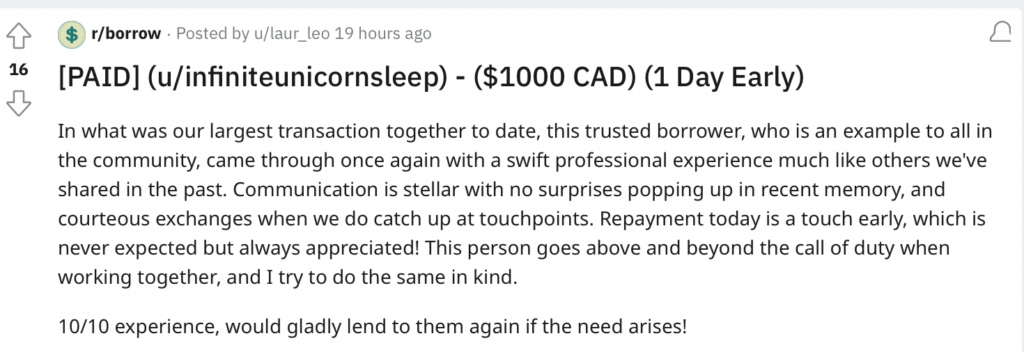

Borrowing on Reddit

Another peer-to-peer loan option comes through the social media platform Reddit. Using the subreddit r/borrow, potential borrowers will post a request outlining how much money they want to borrow, how it will be spent and the total the borrowers will repay.

Borrowers often ask for money for emergencies, to tide them over to payday or to help deal with unexpected expenses like critical home improvements, a high heating bill or vet bills.

Individuals choose whether or not to fund a request, then the loan is usually sent and repaid through cash apps like PayPal or Venmo. Repayment terms are flexible. And because you’re borrowing from an individual, there are no prepayment penalties.

Pro tip: Potential borrowers need to meet minimum reddit participation requirements, including at least 2,000 Karma points. If you suspect that you may need to borrow at some point, it’s best to build your Karma in advance.

How Payday Loans Work

Payday loans are small loans repaid from your next paycheck. They seem like a fast and easy solution when you need money to tide you over until the next payday. The fees and finance charges are designed to sound reasonable. However, when you calculate it out, the annual percentage rate for such a short-term loan can be very high. In some states, like Texas, it can even be more than 600%. The payday lending industry is considered so dangerous that there are many state laws in place to prohibit them or cap interest rates.

The Consumer Financial Protection Bureau enforces some consumer protections against predatory lenders. You can learn more about how to protect yourself at cfpb.gov.

READ MORE: Are online payday loans safe?

Why are Payday Loans So Bad?

Let’s use a hypothetical situation that many of us have experienced at some point:

Steve urgently needs cash to fix his car. He has no savings and the next paycheck is two weeks away. His parents and friends can’t afford to loan him the money. Steve borrows $500 from a payday lender, committing to repay the loan plus $75 in interest as soon as he gets his paycheck. That’s 15% in interest for two weeks.

But then it gets worse. The due date is only a maximum of 14 days from the time he got the loan. When Steve’s next paycheck comes in, the payday lender automatically gets $575. This doesn’t leave Steve enough money to pay for rent, utilities, and food that month. What does Steve do? He may see no choice but to get another payday loan. This is called a rollover loan. Soon, he’s firmly locked into a cycle of loans, abusive interest rates, and debt.

Steve will continue paying interest as the loan rolls over every couple of weeks. Over a year, the $75 interest paid every two weeks will balloon to almost $1,900. That’s a potentially devastating total for someone who only needed $500.

Pro tip: Payday loans are considered so predatory that they are outlawed in several states.

READ MORE: Learn the dangers of payday loans

Payday Loans are Heavily Politicized

The government enforcement agency designed to protect consumers from predatory lending practices like payday loans and title loans – called the Consumer Financial Protection Bureau – has been constantly mired in political turmoil for the past several years. With each change in the country’s leadership, the independent agency’s mission, focus and leadership also change.

For example, in 2020 the CFPB rolled back an Obama-administration requirement that payday lenders assess the borrower’s ability to repay the payday loan (or mandatory underwriting provision) was revoked after opposition from the Trump administration.

Pro tip: This means there is little to no government help repaying payday loans, and federal regulations are constantly subject to change.

Congress is seeking to take over oversight of the agency, which means the politicization could further intensify. Right now the agency’s funding is not set by Congress, but a bill seeks to change that. This could potentially lead to extreme budget cuts or even the elimination of the sole agency designed to protect you, the borrower.

The payday loan industry is very lucrative, meaning the stakes are very high for lobbyists aiming to influence Congress. Members of Congress who oversee the payday loan industry have gotten more than $3.4 million in political contributions from payday lenders, and lobbyists spent more than $4 million in 2021.

READ MORE: Is a payday loan installment or revolving?

The Bottom Line

A payday loan is almost always your worst option and you should only consider these when you’ve exhausted every other alternative. No one plans to spend two years paying off a 14-day loan, but unfortunately, that’s how it ends up for many payday loan borrowers.

Don’t get caught in the debt trap. Use a Payday Alternative Loan, cash advance app or a personal loan instead.

FAQs

While specific payday loan maximums depend on the state in which you live, they often range from $100 to $1,500. Some states have lower or higher limits. In some states, the loans aren’t legal at all, while others, like Ohio, cap the interest rates at 36%. Some states, like Texas, have no caps at all. In Texas, payday loan annual percentage rates can exceed 600%.

Yes. However, the terms will be even less favorable. Because you already have a payday loan, the lender will charge you a higher annual percentage rate. And because payday loans are already very difficult to pay back from your next paycheck, having more than one raises the risk of getting trapped in a cycle of debt. Instead, try a cash advance app like Dave to see if that is enough to solve your immediate problem.

Depending on the state in which you live and your lender’s policies, you might have the option of rolling over your payday loan or getting an extension. The two options are not the same. With a payday loan rollover, the borrower is required to pay an upfront fee for additional time to come up with the total payment. The lender may change the terms of the loan at this time, and the borrower will have to sign a new loan agreement. With an extension, the borrower is granted more time to repay the original payday loan under the original terms and conditions. You may be asked to sign an amendment that includes the new payment due date.

Yes, payday loans are legal in California. However, they are heavily regulated under the California Deferred Deposit Transaction Law.

Under California law, the maximum loan amount for a payday loan is $300. The loan term cannot exceed 31 days, and lenders are not allowed to charge fees exceeding 15% of the total loan amount. Additionally, borrowers are limited to only one loan at a time.