Kikoff Credit is a service that promises to boost your credit score for a small monthly fee.

This may sound ideal if you have a short credit history or your credit score needs some work.

But is the service legitimate? Does it work? The team at Credit Summit signed up to find out.

Hot take: Kikoff is an excellent credit-building platform as long as you understand its limitations. Basically, you’re paying $5 a month for a $750 “line of credit” that you won’t be able to spend and the ability to save $10 a month as a credit-builder loan (which you will redeem at the end of your year as $120 in savings). If your credit score needs significant work, this is an inexpensive way to boost it. But if your credit score is already in the good to excellent range, it won’t make enough of a difference in your score to justify the monthly fee.

Table of Contents

What is Kikoff and Will It Help Build Credit?

Kikoff is a credit-builder service. You pay $5 a month for access to “Kikoff Credit,” which you can use for items in the Kikoff store, except you cannot use this to purchase Kikoff credit-building plans. You’ll have to make that minimum monthly payment of $5 to build credit with the major credit bureaus.

Kikoff reports your payments to Equifax, Experian and Transunion. However, the credit bureaus Kikoff reports to will depend on which product you use. The Kikoff Credit Account reports to Equifax and Experian, while the Credit-Builder Loan reports to Transunion and Experian.

Kikoff at a Glance

| Physical locations | None |

| How to get started | Sign up with Kikoff. You’ll need to be 18 years old and have a Social Security number. As of July 2023, the service is available in all 50 states |

| Monthly service fee | $5, or $20 for the premium service |

| Credit check | No |

| Is this a credit card? | No |

| Which credit bureaus does Kikoff report to? | All three, but it depends on the product you use |

| Are there interest charges? | No |

| Is there a prepayment penalty? | No, but it will be difficult to cancel your membership until your year is up |

| Notable features | There are two kinds of accounts: Kikoff Credit Account is a basic account to improve credit scores Credit Builder Loan: Optional add-on to further build credit |

| Sign-up bonus | Earn $200 cash with qualifying deposits when you sign up for the Credit+ Cash Card |

How Much Will Kikoff Boost Your Credit Score?

Though it depends on the products you use and your starting credit score, Kikoff says customers with credit scores under 600 increase their credit scores by 58 points.

Our take: When we tried Kikoff, we signed up for both a line of credit and a credit-builder loan. We saw a score increase of about ten points, but also started with a credit score of 800. However, Kikoff did make a difference.

Kikoff Accounts

They have two types of accounts and one credit-builder loan product:

- Kikoff Credit Account: This is the standard product for all new Kikoff customers. This account builds monthly payment history and helps reduce your credit utilization. The Credit Account gets reported to Equifax and Experian every month and costs $5 per month.

- Kikoff Credit Service Premium: The new premium service offers a larger credit line — $2,500 — that’s reported to the credit bureaus. This will help lower your credit utilization, bumping your score higher. It also reports to TransUnion, meaning the account will be reported to all three credit bureaus once per month. The total cost for premium service is $20 per month.

- Kikoff Credit-Builder Loan: This is an optional add-on for customers who want to build even more credit. Kikoff Credit-Builder is a one-year savings plan for $10 a month. You can add this product after your first payment with the Kikoff Credit Account.

READ MORE: How to Check Your Credit Report

What Makes Kikoff Stand Out?

Here are a few of the notable features that make Kikoff stand out:

Revolving Line of Credit

Kikoff can help people who otherwise wouldn’t qualify for a credit card. The Kikoff Credit Account is a revolving line of credit that functions similarly to a credit card. It has a $750 credit limit that you can draw against to make purchases. Once you pay your balance off, you can reuse the funds. Note that all purchases must be made through the Kikoff store, which has a few disadvantages. You cannot use the $750 to make practical everyday purchases like groceries.

READ MORE: Insufficient credit or no credit score: What’s the difference?

Credit-Builder Loan Option

After you commit to paying the $5 a month fee for 12 months, Kikoff members have the option to sign up for a Kikoff credit-builder loan. You can set up automatic or manual transfers from your bank account to deposit $10 monthly into the credit-builder loan. At the end of the year, Kikoff will give you the $120 you paid in. This can be a pretty easy way to build a small emergency fund and add a few extra points to your credit score, particularly if you don’t have the discipline to save the $10 on your own. The extra payment will add a few points to your credit score a year.

READ MORE: Here are the seven best credit-builder loans

Kikoff Credit+ Cash Card

If you set up your paycheck to be directly deposited into your Kikoff account, you’re eligible for Kikoff’s “Cash Card,” a MasterCard that works like a debit card. You can’t spend more than the total that’s in your account. The card offers access to your paychecks two days sooner than with a traditional bank account.

There’s even a sign-up bonus: When you set up direct deposit on your new Kikoff Cash Card, Kikoff will deposit $200 into your account after three months of normal usage.

- Deposit $50+ and your monthly spend will be reported to all three credit bureaus

- No hidden fees or interest

- Get cash-back rewards at grocery stores, restaurants, and more

- With direct deposit, overdraw up to $20 without fees — the amount will increase the longer you keep your banking service with Kikoff, up to $200

- Spend only the money you have (like a debit card) and avoid debt and missed payments

- Your purchases are eligible for MasterCard fraud protection

- The Cash Account is FDIC-insured up to $250,000 through Kikoff’s partner bank

Reports to Some of the Credit Bureaus

Kikoff reports your monthly payments to Experian and Equifax — two of the three major credit bureaus. Kikoff says they report your payments to TransUnion only if you’re “new to credit,” upgrade to the premium plan or if you hold the Credit+ Cash Card.

READ MORE: Which credit bureau, report or score is most accurate?

Identity Theft Protection

If you fall victim to identity theft, Kikoff reimburses your expenses and helps cancel and replace ID and credit cards.

Spending Limits

When you sign up for Kikoff, you will be assigned a revolving credit limit. You’ll see a listing for Kikoff Credit Account on your Equifax and Experian credit reported as a $750 revolving line of credit.

However, you will not receive $750 cash and cannot spend the $750 limit on purchases outside of Kikoff. Kikoff is not a spending account, and there is no physical card.

Instead, you are limited to making purchases from the Kikoff store. This will not be useful if you hope to use the $750 revolving line of credit to help with groceries or emergency car repairs.

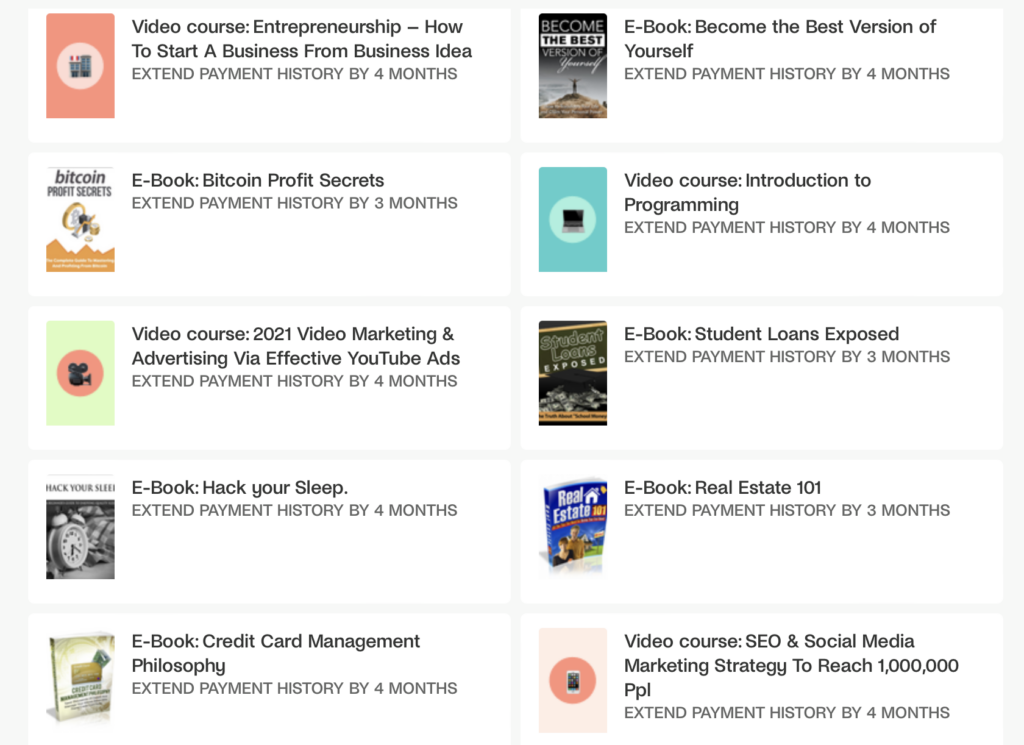

What Can You Buy from the Kikoff Store?

Options at the Kikoff store are extremely limited — currently, it offers an array of video tutorials and ebooks. And instead of deducting the items you purchase from your revolving credit limit, Kikoff extends your payment term. For example, if you purchase one video tutorial, your payment will be extended to $5 monthly for 16 months rather than the initial 12 months. But the extension will add a few extra points to your credit score. Unfortunately, the store sells a very limited number of items.

Here are some of the options listed:

For maximum value, Kikoff needs to add a few practical options to help people struggling to pay day-to-day expenses, like gas or meal credits.

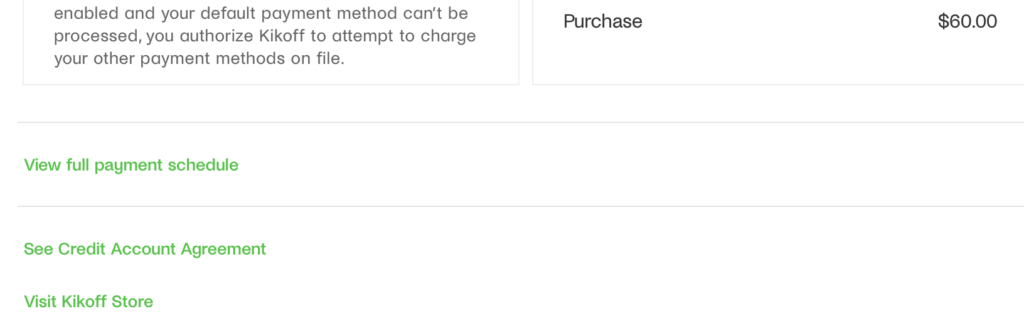

The Kikoff store is difficult to find. It’s buried on the mobile app at the bottom of the page with your credit card information under Visit Kikoff Store. It looks like this:

Pro tip: If you’re signing up for Kikoff, you will be paying the monthly fee solely to boost your credit score and lower your credit utilization. At this point, the store offers minimal value.

READ MORE: How to get a free credit score

Build Credit Responsibly

They have intentionally designed Kikoff products to help you build credit responsibly (and not increase your debt). Your $750 limit enables you to achieve a lower credit utilization rate, which benefits your credit.

READ MORE: Why Did My Credit Score Drop?

Limited Scope

Kikoff is not a bank. It offers a limited number of products, all of which are pretty bare bones. Customer service is responsive, but an average question took about three days for a response.

Update: As of July 2023, Kikoff is available in all 50 states. Previously it was unavailable in Delaware and Indiana.

Fees and Penalties

Kikoff doesn’t charge interest, so if you don’t pay off your balance, you won’t accrue any interest charges.

Kikoff also doesn’t charge fees — aside from the $5 monthly service fee — but missing a payment can hurt your credit score. Though there are no late fees, paying any bill 30 or more days late can seriously damage your credit, and Kikoff is no exception. If you go 180 days with no payment, your Kikoff account could be closed and you’ll be unable to reopen it.

Pro tip: Kikoff uses Plaid to connect to your bank account. You can’t just set it and assume that your payment will be made each month. You will need to log in periodically to ensure that your bank account is still connected. For some reason, Plaid will unlink your bank account over the course of a few months. And if your bank isn’t compatible with Plaid, you won’t be able to sign up for Kikoff.

READ MORE: Cash advance apps that don’t use Plaid

Pros and Cons of Kikoff

Kikoff has some potential advantages but also a few disadvantages:

Pros

- It may help you build credit

- No credit check

- No interest

- No additional fees beyond the monthly subscription

- Officially recognized by the big three credit bureaus

- 100% commitment to data protection and security

- Easy to use — just set it up and forget it

- Customer service is responsive

Cons

- Not available in all states

- The credit line is capped at $750

- Can only use credit line at Kikoff store

- $5 monthly subscription fee

- The Kikoff store is not accessible through mobile apps, only through desktop

- Kikoff store products are difficult to find on their site and selections are extremely limited

- No phone support

- The subscription fee is set to renew each year automatically. You must manually disable it if you only want the service for one year.

Does Kikoff Offer Cash Back?

No, Kikoff does not offer most traditional banking features. However, if you sign up for Kikoff’s credit-builder program, you will give them $10 a month, and after a year, they will send you $120. That’s your money being returned, but the credit-builder plan can boost your credit score and help you build a small nest egg.

The Kikoff App

Kikoff has both Android and iOS apps. Their app is the best way to get updates and ensure you get the best Kikoff experience, but you cannot access the Kikoff store through the apps. The store can only be accessed through desktop. Kikoff also has strong ratings on both app stores. It has a 4.9-star rating on the iOS app store, for example, with 31,000+ reviews, and a 4.7-star rating on the Android app store, with 22,600+ reviews.

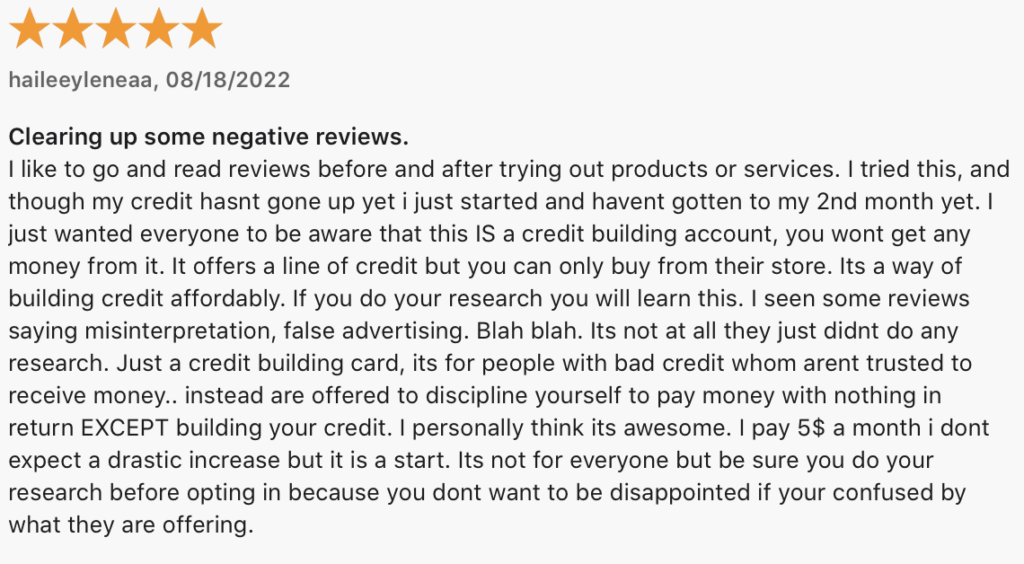

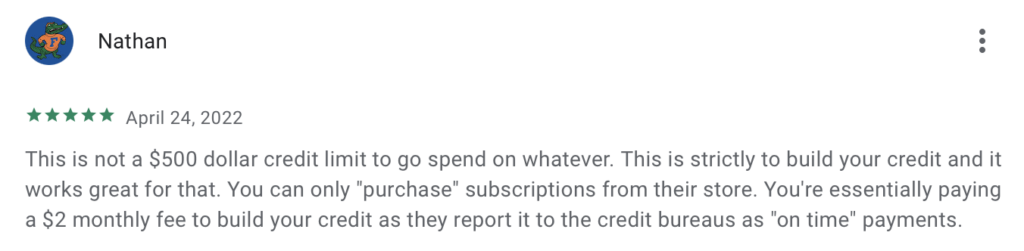

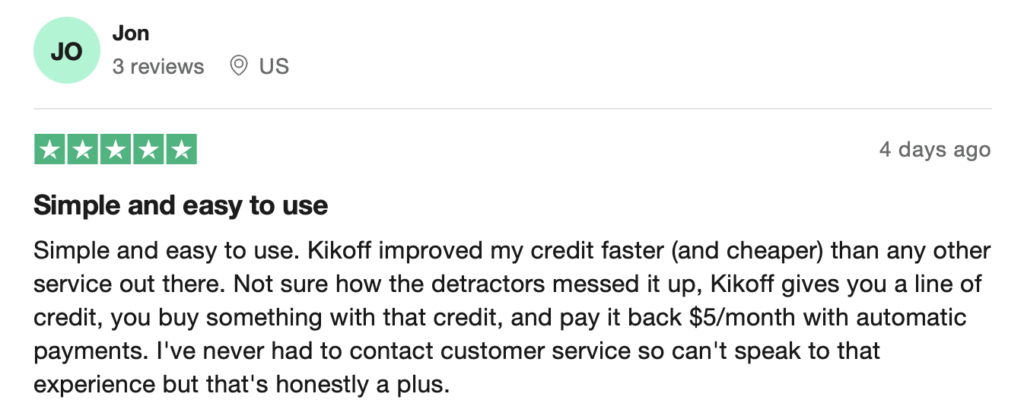

Here is a review from Apple’s App Store detailing some of the misconceptions people have:

This review from the Google Play store clears up some of the confusion about how Kikoff works:

Is Kikoff Trustworthy?

Kikoff’s site says they are 100% committed to your data privacy and security. They always use bank-level encryption in all data transmissions, use your data for identity verification with the credit bureaus, invest in fraud prevention, and comply with federal laws. They vow never to share or sell your data to third parties without explicit consent.

Kikoff Customer Service

Kikoff does not offer phone support, so if you have questions or problems the only option is to contact them by email. While a lot of reviewers claim that customer service is not responsive,

What are Customers Saying about Kikoff?

Kikoff’s file with the Better Business Bureau (BBB) opened on July 13, 2021. Kikoff is rated B- with 3.99/5 stars by the BBB.

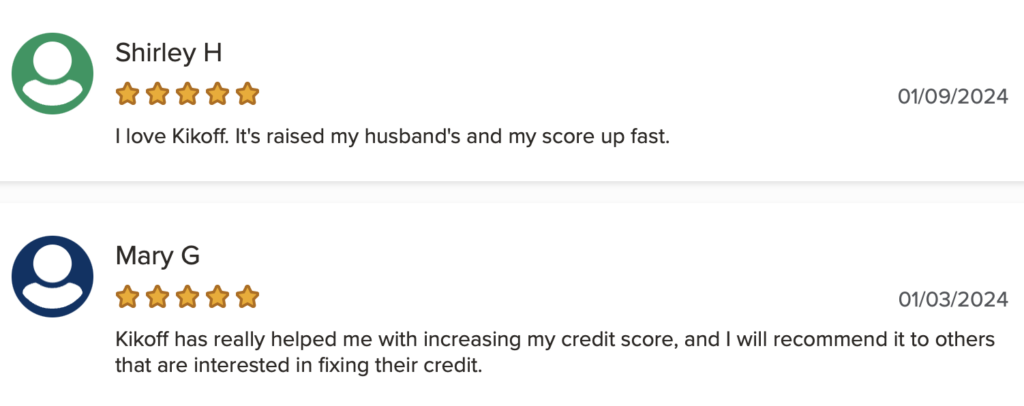

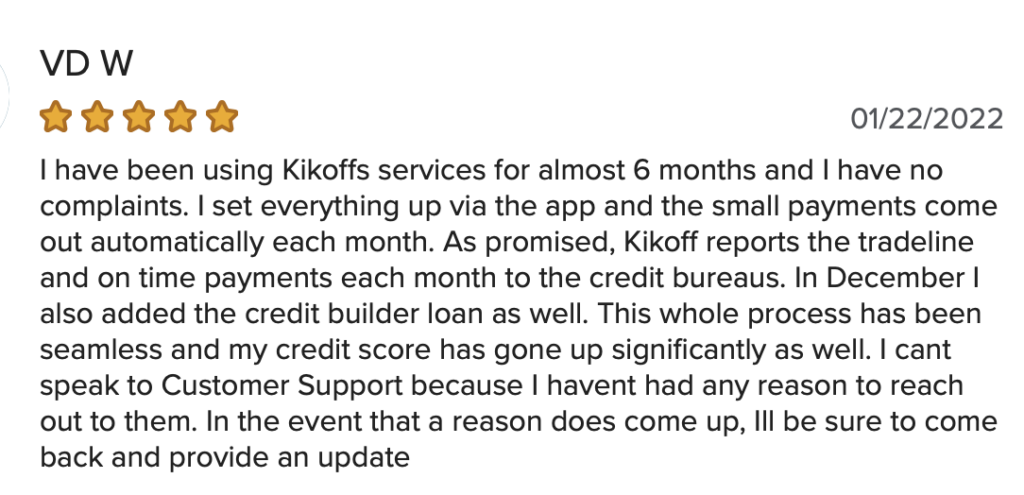

Plenty of people who use the service claim they’ve seen improvements to their credit scores:

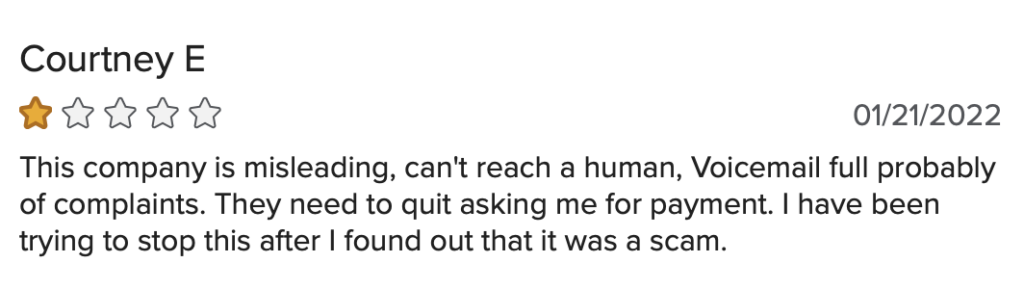

Most negative reviews are geared toward confusion about the service and/or limited customer service. One person mailed a money order, learned Kikoff doesn’t accept money orders and then said the money order disappeared. There appear to be quite a few customers who sign up assuming that uses for the $750 revolving credit limit would be a bit more flexible. Other people said they never signed up for the service at all or tried to cancel once they found out the limited scope of the service. Some tried to stop payments and ended up hurting their credit scores.

It’s important to note that Kikoff is NOT a scam. It is a legitimate service, although the terms of how it works are unclear until you’ve signed up, and by that point you’re committed to giving them $5 a month for the entire year. If you try to stop those payments before your year is up, Kikoff will report your account as delinquent.

There have been a few people who’ve benefitted from Kikoff’s service:

Trustpilot ratings have them at a 4/5. About 76% were five-star ratings, and 13% were one-star ratings.

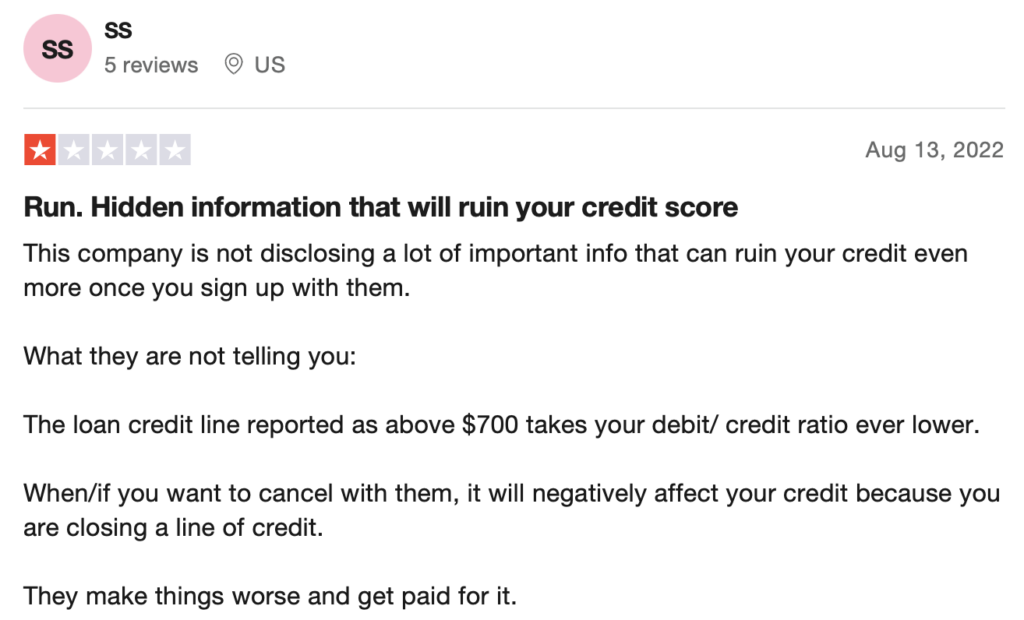

Not everyone on TrustPilot has had such a positive experience:

This reviewer raises an interesting point about credit utilization ratios. The way the service works is that you sign up for this service, use it to build your credit score, then close the account. When the account is closed, your credit report will indicate that the $750 revolving line of credit is also closed. This will cause your credit utilization ratio to increase and your average age of credit to decrease. These are both key factors in determining your credit score. To prevent your credit score from temporarily falling, you will probably need to maintain the service until you boost your credit score enough to qualify for new credit account. Once you’ve opened a new account (and use it responsibly for a couple of months), you can cancel your Kikoff service without damaging your credit score.

READ MORE: Credit score statistics

Is Kikoff a Scam?

Kikoff is not a scam. It is a legitimate company that will help you boost your credit score. But it will only help you if your score is already significantly damaged or you’re just starting with credit. If you already have good to excellent credit, it won’t be worth the service fee because your score will only increase by a handful of points.

Pro tip: Keep in mind that while Kikoff is issuing you a line of credit, you technically can’t use it to buy day-to-day items like groceries. It’s really only a credit line on paper. There is not much in the Kikoff store right now that’s worth buying.

More Credit-Builder Loan Options?

The Bottom Line

Overall, Kikoff is a solid product that lets you build better credit simply and for a very low price. It is one of the lowest-priced credit-building services out there right now. There’s almost no reason not to use Kikoff if you want to improve your credit — as long as you’re clear on how it works and willing to shell out the $5 fee.

Kikoff isn’t the only tool available to boost your credit. Consider additional options such as secured credit cards, rent reporting, signing up for products like Experian Boost, Perch Credit, and Grow Credit Mastercard. By taking a more balanced strategy toward building your credit, you’ll be able to consistently improve your credit scores and enjoy a brighter financial future.