Millions of people take out payday loans in hopes the money will help them with an emergency financial situation. But these short-term, high-interest loans often cause more harm than good.

Payday loans do not help people escape financial trouble; they trap them with even more debt. Fortunately, several companies can help you.

Table of Contents

4 Best Companies When You Need Payday Loan Relief

It’s easy to get caught in a trap set by payday loan lenders but very difficult to escape. Here are some of the top companies that could help you out.

Top Pick: DebtHammer

Based in Texas, DebtHammer provides debt resolution services to those struggling with predatory loans. The company uses tried-and-true methods and a simple but effective process to get people out of the payday debt trap. They also have an impressive array of financial education resources for people looking for ways to pay down and stay out of debt.

Most debt relief companies specialize in a single debt relief strategy. When you contact them, they have a strong financial incentive to direct you to that option, even if it’s not right for you. The “counselor” you talk to could be a salesperson in a thin disguise.

DebtHammer avoids that by offering multiple debt relief options and coaching you through the entire consultation.

DebtHammer works with clients who experience many different types of debt problems, including the following:

- Credit cards

- Personal loans

- Medical bills

- Debt in collections

- Payday loans

- Tribal loans

DebtHammer offers a free consultation. Their team will review your financial situation and discuss your options.

Online, DebtHammer has positive customer reviews. This includes an A+ rating from the Better Business Bureau

READ MORE: DebtHammer review

What people are saying:

Do You Need Payday Relief?

Get lower payments and interest rates with a payday loan consolidation program.

Accredited Debt Relief

Established in 2011, Accredited Debt Relief specializes in creating custom debt relief programs to help people reduce how much they owe in unsecured debt. They help with debt consolidation, management, debt settlement, and bankruptcy. Historically, they have successfully settled debt by as much as 50% within 12 months, faster than most competitors.

The company is accredited with BBB and has an A+ rating of 4.86 out of 5 stars. It’s a verified company on Trustpilot, with 4.9 out of 5 stars out of 6,000+ reviews.

What people are saying:

Freedom Debt Relief

Founded in 2002, Freedom Debt Relief is one of the country’s leading debt relief and consolidation services. In the past 20 years, they’d worked with over 800,000 customers to settle more than $15 billion in debt. This company specializes in unsecured debts such as personal loans, credit cards, and medical bills.

Freedom Debt Relief is BBB accredited and has an A+ rating. On Trustpilot, it has 4.6 out of 5 stars.

What people are saying:

JG Wentworth

Established in 1991, JG Wentworth offers debt consolidation, a structured debt settlement program, bankruptcy help, and annuity purchasing. The company deals with most forms of unsecured debt.

JG Wentworth is accredited by the American Association for Debt Resolution (AADR). The company has an A+ rating with BBB.

What people are saying:

4 Top Credit Counseling Agencies

InCharge Debt Solutions

Established in 1997, InCharge Debt Solutions has helped millions of consumers find debt relief through debt consolidation, Debt Management Plans and free credit counseling. This nonprofit company is also a National Foundation for Credit Counseling (NFCC) member.

On their website, they mention a 97% customer satisfaction rating, which is consistent with their generally positive reviews. The company is BBB accredited with an A+ rating, but it has 3.15 out of 5 stars. On Trustpilot, it has 4.8 stars out of 5 with 1,955 reviews.

What people are saying:

Cambridge Credit Counseling Corp.

Cambridge Credit Counseling Corp. is a nonprofit company with a team of highly experienced credit counselors. They offer credit counseling, reverse mortgage counseling, bankruptcy counseling, student loan counseling, and debt consolidation. According to their website, the average program takes 48 months, and the typical consumer sees a total interest savings of over $18,000.

The company has overwhelmingly positive reviews online with an A+ Better Business Bureau rating and 4.8 out of 5 stars on Trustpilot.

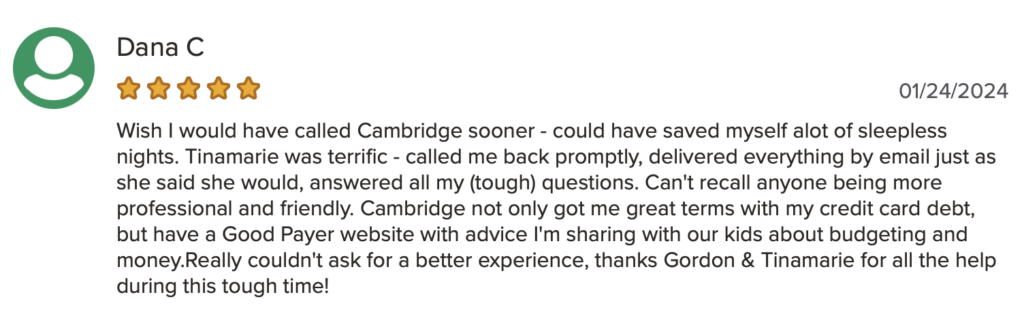

What people are saying:

GreenPath Financial Wellness

Founded in 1961, GreenPath Financial Wellness is a nonprofit company offering an extensive array of financial services, including credit counseling and debt management plans. They also specialize in debt counseling, bankruptcy support, and housing counseling.

GreenPath is BBB accredited with an A+ rating.

What people are saying:

DebtWave

DebtWave Credit Counseling, Inc. is a nonprofit credit counseling service specializing in helping people get out of debt and improve their long-term financial situation. They also offer bankruptcy help, credit coaching, and debt management.

They’ve assisted over a million consumers pay off over $7 million in credit card debt. Unlike other credit counseling companies, they also have a community outreach team that offers free educational workshops to low-income families, military personnel, and the youth.

On BBB, they have an A+ rating.

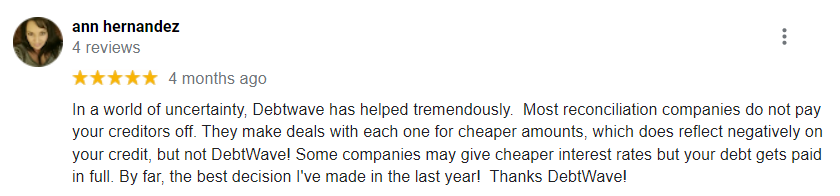

What people are saying:

READ MORE: Best payday loan consolidation and relief companies

How Payday Loan Consolidation Works

Payday loan relief comes in many forms, including debt settlement, consolidation and credit counseling. So, the way it works depends on the method you choose.

Some options, such as debt consolidation, help you save money or make payments more affordable by combining several high-interest loans into one with a lower interest rate. Other methods, like credit counseling, give you the tools to start improving your finances while tackling debt.

The payday loan relief strategy you choose depends on your financial situation. With that in mind, here are the best methods for those seeking relief from their payday loans.

- Debt consolidation lets you roll several high-interest, unsecured debts like payday loans or credit cards into one fixed monthly payment. Done right, this strategy can streamline your monthly payments, reduce what you owe in interest, and even help you pay off your debts faster.

- Debt settlement calculates how much you owe and persuades your creditors or lenders to decrease the total balance. This process is usually handled by a for-profit debt resolution company. The company will attempt to negotiate with your creditors to reduce how much you owe. Debt settlement companies usually charge between 15% and 25% of your enrolled debt for their services. They cannot, however, require you to pay anything until after they’ve completed the settlement process. If a company does request upfront payment, look elsewhere.

- Credit counseling involves working with a certified counselor to sort out your finances and find ways to manage your money. Services include budget creation, financial education workshops, and Debt Management Plans (DMPs). Most companies are non-profit and offer their services for free or at a low cost.

- DIY: This is for people who prefer a more hands-on strategy. Start by estimating how much debt you want to consolidate. This could include payday loans, medical bills, credit cards, or certain other unsecured debts. Next, make a budget based on your total monthly income and expenses. Once that’s done, consider your options. Do you want a personal loan, debt consolidation loan or a balance transfer credit card? Whatever you choose, the interest rate should be lower than the payday loans. You should also be able to afford the new payments.

READ MORE: Step-by-step guide to payday loan debt consolidation

Pros of Payday Loan Relief

Depending on the strategy, there are quite a few pros to payday loan relief, including:

- Lower monthly payments

- Decreased interest rates

- Longer repayment period

- Potentially hundreds or thousands of dollars are saved over the life of the loans

- Effective strategies to become debt-free

- No more automatic debits

- Escape from the payday loan cycle

- Reduced chance of being sued

- Lower chance of missed or late payments, meaning fewer late fees

- Long-term credit score improvement

- Peace of mind knowing you’re on the right track to paying off your debts

Cons of Payday Loan Relief

Depending on the strategy, there are also a few risks or downsides to payday loan relief. These include:

- Negative impact to credit score if told to stop making payments to lenders

- Late fees can add up

- Delinquent accounts

- No guarantee of success, especially with debt settlement

- Potential pressure to sign up or make a snap decision

- High eligibility requirements for a debt consolidation loan or personal loan

- Prevalence of scam companies

- Account setup and monthly fees can be high when struggling with finances

- Doesn’t work if you take out more payday loans

What to Look For When Choosing a Payday Loan Relief Company

If you’re trying to find the best payday loan relief company, here are some things to look for:

- Customer reviews online — check Trustpilot, BBB, Google, etc. to see what people are saying and how responsive they are to complaints

- Legitimacy of their services

- Whether they offer a free consultation or a moneyback guarantee

- Any testimonials on their main page

- If they charge upfront costs

- Any other fees

- Enrollment or eligibility requirements

Payday Loan Alternatives

Payday loans are meant for emergencies, though many people fall into the habit of using them for other short-term expenses. If you’re looking for a more affordable alternative, consider a cash advance app or payday alternative loan (PAL).

- Cash advance apps

- Payday alternative loans

- Debt consolidation loans

- Installment loans

- Personal loans

- Peer-to-peer (P2P) loans

- Credit card balance transfe

The Bottom Line

Payday loans are costly and, more often than not, lead to a lasting cycle of debt. However, if you’re trying to find payday loan relief, you have options ranging from debt consolidation to debt settlement.

With some financial planning and dedication, you can eventually become debt-free. But don’t hesitate to ask if you need more direct guidance or help.