Many cash advance apps use Plaid to connect with your bank before you can borrow money. If your bank doesn’t work with Plaid, you may have difficulty using some of the most popular cash advance apps, and this can be frustrating for people trying to avoid payday loans.

Cash advance apps are ideal because they allow you to borrow small amounts of money until your next payday. They are interest-free loans. You only have to pay a small membership fee.

But you still have a few options if you’ve been shut out from cash advances simply because your bank and Plaid aren’t compatible.

Table of Contents

10 Apps That Don’t Require Plaid

If your bank doesn’t connect to Plaid, you have ten options. These are:

- Best overall: Dave

- Best for free transfers: B9

- Best for multiple access options: Venmo

- Best for regular Cash App users: Cash App Borrow

- Best if your employer participates: BranchApp

- Best for small advances: Beem

- Best if you also need tax help: Grid Money

- Best if you work for a company that offers access: DailyPay

- Best for daily fee structure: Quick Benjy

- Best for its free trial: FrontPay

Pro tip: CashMaster is another app that doesn’t require Plaid. However, in Credit Summit’s analysis, we found that it was lacking in several areas (more on this below.) Use this app at your own risk.

Disclaimer: Credit Summit may be affiliated with some of the companies mentioned in this article. Credit Summit may make money from advertisements or when you contact a company through our platform.

Read on for a breakdown of what you need to know about each.

Dave

Dave is a well-known banking app that has added “ExtraCash,” which allows users to borrow up to $500.

While Dave does use Plaid, it also uses Galileo to transfer information between the platform and your financial institution, providing an option for subscribers whose bank accounts aren’t compatible with Plaid.

Users with the Dave Debit Mastercard can even get instant access to these advances. There is no waiting period or lengthy application process and no direct deposit into a Dave account is required. You will repay the loan on the date specified when you request your “ExtraCash” (usually the date of your next paycheck), but Dave doesn’t charge late fees or other hidden fees if you miss your repayment date.

You will, however, have to sign up for Dave and pay the $1/month subscription fee.

Dave offers some other notable features, including:

- Access to your paycheck up to two days early

- Help to find side hustles to earn even more extra cash

Pro tip: Dave also has no direct deposit requirement, making this an ideal option for gig workers or others who have a steady income but don’t always have a steady paycheck.

To sign up:

- Open the app and tap Join Dave

- Create a sign-in ID using your email address and create a strong password

- Agree to Dave’s privacy policy

- Enter your first and last name

- Enter your mobile phone number (this is required for two-factor ID)

B9 App

B9 offers advances up to 100% of your paycheck (for the premium plan) and up to 15 days early. You’ll open an account through B9 and receive a debit card with cash-back rewards. There’s no credit check, overdraft fee, or minimum balance.

B9 is not a bank and accounts are offered through an FDIC-insured partner bank. You will need to have your paycheck deposited directly to your B9 account to draw cash advances, and your account will have to be verified.

In other to apply, you must meet the following requirements:

- Valid phone number and email

- Full name and date of birth

- Mailing address

- Social Security number or ITIN

- Government-issued photo ID

B9 offers two plans.

- The basic plan costs $9.99 a month and offers cash advances up to $300, along with free transfers to other members, free ACH transfers, and a rewards debit card.

- The premium plan costs $19.99 a month with a discount for a 3-month package. You can advance up to 100% of your paycheck and get access to credit reports and scores, along with the features of the basic plan.

Cash advances are deposited directly to your B9 account, where you can access them with your debit card or transfer them to another account.

Venmo

Venmo uses Plaid, but if your bank does not connect to Plaid, you can still use Venmo with manual verification. You will have to provide your account number and the bank’s routing number, and Venmo will confirm the account with two micro-transfers.

Venmo does not offer a cash advance function, but there are ways to get a cash advance through Venmo.

- If you have an American Express card, you can use Venmo to send money to yourself with no transaction fee or interest as long as you pay it back by your card’s due date

- You can take a cash advance if you have a Venmo Visa card. You’ll pay $10 or 5% of the advance, whichever is higher

- You can’t get a cash advance from a Venmo debit card, but you can use it to make purchases beyond what you have in your Venmo account. Venmo will draw the money from your linked bank account. You will have to enable the “reload” feature

READ MORE: How to get a cash advance through Venmo

Cash App

Cash App lets you send and receive money, make payments, and even invest in stocks or cryptocurrency. There’s an optional Visa debit card that you can connect to your Cash App account.

Eligible Cash App users can use the app to borrow from $20 to $200. Eligibility is determined by your state, your credit history, your cash app history, and whether you receive your salary through Cash App. If you are eligible, you will see the “borrow” option on your account.

Cash App Borrow is still a pilot feature with limited availability. Active Cash App users may be more likely to qualify.

Loans from Cash App Borrow must be repaid in four weeks with a one-week grace period for an effective five-week term. You’ll pay a 5% fee, translating into a 60% APR. If you don’t pay the loan in five weeks, you’ll pay an additional 1.25% weekly. While that’s higher than a typical credit card APR, it’s significantly lower than what you’d pay a payday lender or title lender.

Cash App uses Plaid, but as with Venmo, there’s a manual account linking option that allows you to set up an account without using Plaid.

READ MORE: How to borrow money through Cash App

BranchApp

Branch is an earned-wage app that allows you to take advances on wages you have earned before your scheduled payday. You won’t be able to use the app unless your employer uses it.

You won’t pay interest, and there are no fees. You will be prompted to give an optional tip.

The Branch digital wallet comes with built-in cash rewards on purchases of food, fuel, and other categories.

How To Apply

- Confirm that your employer uses Branch

- Download the Branch App

- Create a Branch Wallet

- Find the Instant Pay tab. If you’re eligible for an advance, you’ll see the borrowing amount available here

- Tap “Take Advance”

- Enter the amount you want to borrow

- Confirm the loan total and payback date

- Swipe up on the screen and you’ll get a “Money in the Bank” notification

Advances are deposited to your Branch digital wallet. You can use them immediately.

Beem (formerly Line)

Beem offers cash advances with no credit checks and no interest. You get a personalized overdraft and NSF (nonsufficient fund) alerts and a full range of credit monitoring and identity theft protection services. Line is only available in the U.S.

How to Apply

- Download the Beem app

- Create an account

- Apply for pre-approval: You’ll need to provide a phone number and answer a few questions

- Complete the application: You will need to include personal information including your Social Security number, date of birth, employment details and bank information. Line may also ask to review your income and expenses

- Qualification: Line will inform you of whether you meet the qualification criteria

- Subscribe: Choose a plan and link your debit card to pay for it. You must have sufficient balance to pay the subscription fee

Beem offers three plans:

- The basic plan costs $2.47 per month. You can access cash advances up to $50

- The plus plan costs $5.97 a month and access paycheck advances up to $500

- The pro plan is $12.97 per month and offers access loan amounts of up to $1,000

Grid Money

Grid is a money management app that offers three primary services.

- Grid Tax analyzes your pay stub and tax return to optimize your withholding amount. If your withholding amount is too high, you can add up to $250 monthly to your pay by adjusting it. You’ll need to submit an updated W-4.

- Grid Advance offers advances up to $200 against your salary.

- Grid Card is a debit card linked to your Grid account. Grid will “spot” your purchases briefly and report the transactions to the credit bureaus, which could help you improve your credit.

The Grid Tax service is free. To access the other services you will need to open an account and pay a fee of $10 per month. There is no credit check and you will not need a cosigner. There are no fees or tips.

How to Apply

You’ll need a Grid account to get a Grid cash advance.

- Download the app

- Follow the directions to set up an account

- Set up direct deposit of your paycheck to your account

You’ll need to use the app consistently, make a minimum of $1,000 in deposits each month, and spend a minimum of $1,000 per month through the app to gain access to cash advances.

Grid is a relatively new company and provides very little information on its website. Reviews on both Apple’s App Store and Google’s Play Store are strong, but there are complaints of customer service and account problems and their Facebook page has numerous complaints.

DailyPay

DailyPay offers what’s known as early wage access. In other words, you can access your next paycheck without waiting until the pay period ends. It doesn’t use Plaid, but you can only use the service if your employer participates.

It allows you to request up to 50% of your earnings without affecting your credit score or connecting to a bank account.

Kroger, Dollar Tree, McDonald’s and T-Mobile are some companies that have partnered with DailyPay. This app allows you to track your earnings and request up to 50% of them in advance at any time without affecting your credit score or requiring the use of Plaid. There is no application process.

The drawback is that unless you work for a company that has partnered with DailyPay, this app won’t be able to help you at all.

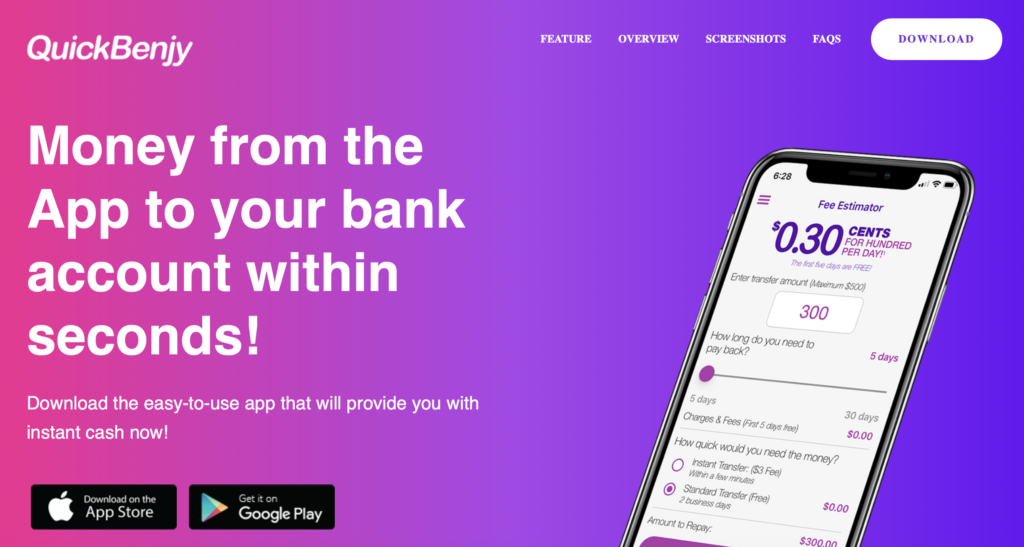

Quick Benjy

Quick Benjy’s structure is a little different than the other apps. Quick Benjy will loan you up to $500 for up to 30 days with no interest rates, but you pay a small daily fee. The first five days are free, so you won’t pay anything if you repay your loan within five days. After that, it costs 30 cents per $100 borrowed per day. So if you borrow the maximum of $500 for thirty days, you’ll have to pay a fee for 25 days that will total $37.50 (the equivalent of about 90% APR, which is higher than a credit card cash advance or personal loan, but significantly lower than what you’d pay most payday lenders.

Quick Benjy doesn’t use Plaid to link your bank account. Instead, it uses a platform called Finicity, a North American provider of real-time access to financial data and insights that are operated by Mastercard.

How to apply

Quick Benjy’s application process is simple. You will need to download the app, provide some personal information and verify your identity. After that, you’ll link your bank account, and you should be ready to go.

FrontPay

FrontPay offers small cash advances of up to $100 with no interest charge and no credit check. FrontPay also offers a free trial from when you sign up until your next paycheck. After that, you’ll automatically be charged the $14.99 subscription fee.

FrontPay has a few requirements:

You must receive a qualifying direct deposit in your linked account. (This means a recurring electronic deposit of wages from an employer or government benefits of at least $400 that has been deposited into a linked account at least twice.) ATM deposits, paper checks, cash transfers and paychecks with irregular pay schedules do not qualify.

FrontPay also requires that your bank account meets several factors to determine your “financial health.” Note that there is no guarantee that you’ll qualify for an advance, even if you pay the membership fee.

FrontPay does not require Plaid. Though you can link your account via Plaid, you can also confirm your bank accounts by uploading statements. However, your application could take a few days to be approved.

Use Caution with CashMaster

An additional app, CashMaster, also reportedly doesn’t use Plaid. However, CashMaster details are scarce and the app is only available to Android users. Because of that, we have been unable to try it out or gather valuable information about the platform. Therefore, we cannot recommend it. It appears to offer installment loans with high fees. If you choose to proceed with CashMaster, please use caution.

Hacks to Bypass Plaid

If your bank doesn’t use Plaid, here are a couple of tips and tricks to try.

Manually Enter Your Checking Account Number

If you prefer to use a particular payday advance app, try this hack that allows you to sign up using checking account information.

- First, you will have to log in using a PC browser.

- Look for an option to sign up or link your bank account.

- When you get to the page to link with Plaid, scroll to the bottom and see if there’s an option to click “Bank not in this list.” If so, click on it.

- The next screen should allow you to sign up by entering your routing and account numbers.

Pro tip: This won’t work with every app but it’s worth trying if there’s one particular app you prefer to use.

Change Your Direct Deposit

If you want to sign up for a cash advance app with banking services (like Albert), you can bypass Plaid by asking your employer to deposit part of your paychecks directly into that account. Many employers will allow you to split direct deposits, so you can route some of your pay to your traditional bank account and the rest to your new account, which you can then use to pay a few bills and establish a pattern of use and regular income. This will allow you to borrow cash advances, get them instantly and spend them using the debit card linked to the app providing the cash advance.

Sign Up with a Banking App

Two of the most popular mobile banking apps, Chime and Varo, offer small cash advances to people who bank with them. If you have a steady source of income, consider opening a savings account with one of these platforms and set up direct deposit. Because you already have a checking account directly in the app, you won’t have to worry about linking an external account. Within a few weeks, you’ll be eligible for small cash advances until payday with no monthly membership fee. Chime’s overdraft protection program is called SpotMe and Varo’s program is called Varo Advance.

What is Plaid?

Plaid is a company that provides a software platform to connect different financial accounts and services. Plaid’s platform allows developers to connect with users’ bank accounts, credit cards, and other financial accounts to access financial data, initiate payments, and provide various financial services.

Plaid’s technology is used by many companies in the financial services industry, including banks, lenders, investment firms, and fintech startups.

Cash Advance Apps That Require Plaid

Many of the most recognizable cash advance apps require Plaid. This is a massive source of frustration for people looking for a short-term loan whose banks don’t work with Plaid.

These apps include Albert, Brigit, Cleo, Earnin, Empower, FloatMe, Hundy, Klover, Possible Finance and MoneyLion Instacash.

Why Do Apps Require Plaid for Cash Advances?

Plaid is an intermediary that connects your bank account to financial apps. The mobile apps need to be able to monitor your account balances. Since they’re loaning you money with no interest rates, they use your deposit patterns to assess whether you have the ability to repay the loans. This allows them to lend money to people with bad credit.

Plus, some apps offer additional budgeting tools, and for those to be effective, the apps must have access to your banking data.

Different banks and financial institutions have different account management systems and it’s very difficult for each app to integrate with thousands of different banks.

Plaid allows an app to connect to a large number of banks and other financial institutions through a single portal.

Banks That Don’t Use Plaid

Plaid serves over 10,000 financial institutions, but not all banks will connect to Plaid.

Some of the major banks that do not currently use Plaid include:

- Wells Fargo

- PNC

- JPMorgan Chase

- Bank of America

- Capital One

- American Express

If your bank is not part of Plaid’s network or is unable to connect to Plaid, you will not be able to use apps that rely on Plaid to manage their connections to user accounts. This includes the most popular cash advance apps, including Dave, Albert and Brigit.

Cash advance apps are accessible even to people with poor credit. They have emerged as popular and valuable alternatives to predatory payday loans, title loans and tribal loans.

The Bottom Line

Cash advance apps can provide a way to bridge these gaps without resorting to predatory lenders that will only make your situation worse.

Many cash advance apps can’t serve you if your bank doesn’t connect to Plaid. If your bank doesn’t work with Plaid, you’ll either have to limit yourself to the apps that are compatible with your bank or consider opening a new account with a banking app (like Chime or Varo) that offers its own cash advances.

FAQs

Possible Finance relies on Plaid to connect to customer bank accounts. If your bank does not integrate with Plaid you cannot borrow from Possible.

Cash App uses Plaid, but you can bypass the Plaid requirement by linking your account manually or using your debit card to connect to Cash App. You don’t have to link a bank account at all: you can use your Cash App card to withdraw funds through an ATM.

Venmo uses Plaid to connect to your bank account. If your bank does not connect to Plaid, you can still use Venmo by using manual verification. You must provide your account number and the bank’s routing number, and Venmo will confirm the account with two micro-transfers.

Chime requires Plaid to link to your bank account, and you cannot use Chime without a Plaid-compatible bank account.