Teaching kids to save money and build healthy financial habits can be a good foundation for a bright financial future. It is never too young to start laying solid financial foundation practices that will cause them less financial stress in the future.

Before kids can save money, they need to make money and understand how to manage it, and this isn’t a skill that’s traditionally taught in schools. Here are some tips to start them working toward a stable financial future.

Table of Contents

15 Easy Steps to Teach Kids About Spending vs. Saving

Children learn by example. When you show a child how to create a household budget, you set them up for financial success. According to the Consumer Financial Protection Bureau, children are “developmentally capable” of saving at age five.

1. Provide a Place to Save

For young kids and preschoolers, this may be a piggy bank. For older kids, perhaps a savings account targeted toward kids, like GoHenry or FamZoo, and in high school, a debit card. Teach them the difference between the spending money they need to get through the week and more long-term savings.

Fun, cool apps like the Nickel app have grown in popularity because it replaces the traditional paper-money allowance without the drawbacks of other digital payments. Nickel is a prepaid, reloadable MasterCard debit card where a budget can be auto-loaded each week or month.

Kids can’t take cash from the card giving parents complete control. Parents can track day-to-day spending, which individual retailers can break down. Parents can transfer additional money to the card when chores are completed, and the card can be placed on hold if it’s lost or the child loses spending privileges.

There’s the Nickel Pocket component where kids can opt to take money from their card, saving it for future use. Parents can also provide the reward of interest on the saved money after some time.

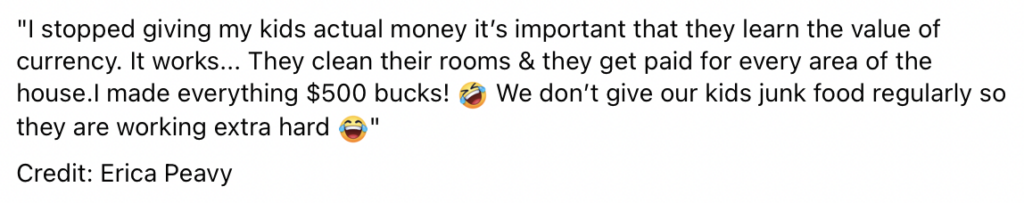

2. Set Up Your Own Store

As your kids learn basic life skills (like saying please or thank you or routine hand-washing for the younger kids and cleaning up after themselves for the older kids), open your own store. Hand out play money when the kids go above and beyond, do something unprompted or have to go through something unpleasant, like a doctor’s appointment or trip to the dentist.

Keep small items at various price points, from a small treat to middle-priced items like books and a big-ticket item, like a voucher to choose a lunchbox or backpack (or whatever else your kid has been wanting.) This can teach valuable life skills like taking on extra work to earn money for the items you want or not squandering money on items that only items that provide only instant gratification, like candy or soda.

3 Set Goals (and Track Progress)

If they want to buy a $75 video game and get a $15 per week allowance, help them calculate how long it will take to reach their goal. Have your kids write down their goals and track progress. Let them pick up extra chores to get to their goal faster. Offer small rewards for hitting goals.

4. Teach Them About Wants vs. Needs

A simple trip to the grocery store can be an excellent financial lesson about items you need to buy versus items you want to buy. Go over different things in the home to teach the differences; is a television in every room essential? You can further lead them to clip digital coupons on their cellphones like a game. Using Ibotta or Rakuten offers cash back that can go straight to their account.

5. Let Them Earn Their Own Money

Getting an extra job like pet sitting or mowing a neighbor’s lawn can quickly add to their bank account. Two-thirds of parents say their kids earned an allowance in 2019, according to a survey from the American Institute of Certified Public Accountants (AICPA). Kids raised an average of $30 per week based on five hours of chores.

6. Help Them Track Spending

Have them write down their daily purchases, including everything, down to what they spend on snacks at school. At the end of the week, add them up. It can be eye-opening. Then show them how much faster they can save if they adjust their spending habits. You can review what you think is a need versus a want and add up the savings if you eliminate wants for each week.

7. Offer Savings Incentives

Has your kid set a big savings goal? If they’re saving to buy a big-ticket item like a $600 gaming system, offer to match a percentage of what they save or a bonus whenever a target is hit, like $50 when they save $300.

8. Leave Room for Mistakes

Kids will make spending mistakes. Using them as teachable moments rather than making them feel guilty or as if they’ve misbehaved is essential. You want them to learn good habits for the future and become savers. Saving shouldn’t be perceived as a punishment. Letting them learn from mistakes is a valuable experience.

9. Act as a Creditor

If your kid wants to buy something but is impatient and feels it can’t wait, loan your kid the money and charge interest. Then subtract payments from their allowance. Don’t take away the entire allowance until the item is paid. Instead, reduce it by 15% to 25%. Ensure the kid has enough money to cover any necessities the budget is expected to cover, for example, if the allowance is intended to cover school lunches.

Acting as a creditor can help them learn important lessons about compound interest and the savings benefits of delayed gratification.

10. Talk Openly About Money

Make money chats a regular part of your routine, periodically addressing savings goals and where they stand. Discuss the family budget. Money shouldn’t be a taboo topic, and kids should be able to talk about their goals and spending habits openly.

According to T. Rowe Price, a little over 40% of parents don’t like to talk to their kids about money. Too many parents are counting on schools, employers, or even peers to teach personal finance education, which is not going well.

The World Bank says at least two-thirds of households with children have lost income since the COVID-19 pandemic hit two years ago. Talking to your kids about the importance of saving is even more heightened during these unsettling times.

11. Lead by Example

Include your children when paying bills online to help them better understand where your money goes each month.

Show the kids anticipated costs and the total you hope to spend. Include them when weighing a significant purchase, like a vacation. Then choose a travel location and break down the costs, looking for ways where you can save money so there’s room in the budget for a memorable experience or treat.

12. Teach Them About the Connection Between Work and Money

Money isn’t a freely given gift; it is earned through work. Chores are the simplest way to teach this lesson. You can pay for each completed task or provide an allowance when all their weekly chores are completed.

13. Use Family Game Nights to Build Life Skills

Old-school board games can include valuable lessons about personal finance and other life skills. Use game night to have fun and make it a learning experience by choosing games such as Monopoly, Payday, or Game of Life.

14. Start a 529 Plan

A 529 plan is a state or state agency-sponsored college investment account that offers tax benefits when used to pay for qualified education expenses for a designated beneficiary. Kids can use savings for tuition, books, and other eligible costs at most educational institutions.

Kids can use the money in their 529 for many educational expenses, including college expenses, K–12 tuition, certain apprenticeship costs, and even student loan repayments.

Explain the benefits of savings accounts. Discuss with your children how you’re saving for their education through these investment accounts. Teach them how to contribute to their accounts and how it will benefit them after high school.

Withdrawals from a 529 plan account can be taken at any time, for any reason. But, if the money is not used for qualified education expenses, federal income taxes may be due on any earnings withdrawn. A 10% federal penalty tax and possibly state or local tax can also be added. There are some exceptions.

15. Give Them a Credit Card – And Teach Them About the Risks

Kids won’t qualify for a credit card of their own until they turn 18, but you can add them to your account as an authorized user, get them a debit card or use a prepaid card. Giving them credit or debit cards can teach them to manage credit and provide them with some peace of mind, knowing that they have a fallback if they need an unexpected gas tank fill-up or have a sudden and unforeseen expense.

Explain the difference between a credit card and a debit card and why it’s best to use a debit card versus a credit card.

Teach Them That Giving is Important, Too

Giving is one of the most important of the three categories because you’re teaching them to feel the impact of helping others at a young age. If your child is old enough to start having money conversations, the three-jar system is an excellent place to start.

But for kids, sharing it’s a whole different experience. It doesn’t take much for them to understand the concept of “mine,” while teaching them to “give” or “share” is a real challenge. The key is to let children experience how good it feels to bring happiness to others.

Tell them to pick a charity, church, or even someone they know who might need help.

The Importance of Teaching Kids About Money

Money lessons and financial education will be important when kids need to be financially independent. Many college students feel overwhelmed by student loans when they finally graduate. Developing long-term goals and good savings habits can help out in the real world.

Watch as personal finance guru Dave Ramsey reviews some ways you can teach your kids about money:

The Bottom Line

Children often see adults exchange coins and bills when they buy things. As children grow and start to make choices, they learn that people, things, and money have value. These concepts form the foundation for understanding the importance of spending, sharing, and saving.

Using these tips as guidelines to implement with your child about saving will take them long into a brighter financial future.

FAQs

You can’t get a credit card account at 16 because the law prohibits issuers from offering credit cards to anyone under 18 years old. And 18 is the legal age in most states to be considered an adult.

Consumers can apply for credit cards starting at age 18. However, some credit card issuers allow kids younger than 18 to be authorized signatories on the credit card. Still, the law requires them to have an independent income or a co-signer unless they can demonstrate enough independent income to make monthly bill payments.

The best credit cards for teens to help teenagers 18-19 build credit and save money are Capital One Platinum Credit Card, Bank of America Travel Rewards Credit Card for Students, Capital One Quicksilver One Cash Rewards Credit, and the Secured Stable ONE Credit Card. The best credit cards for teenagers are usually college student credit cards or cards for people with no credit, known as starter credit cards. The best way to get a credit card for younger teens is to become an authorized user on an adult’s account.

Greenlight Kid’s Debit Card is a secured debit card that allows them to tie allowances to chores or set up a direct deposit. It also pays up to 2% on interest savings, and you can set savings goals together and reward them for their excellent money habits. It provides 1% cash back on smart spending that gets added to their savings, and there is investing for the whole family through Exchange-Traded Funds (ETFs) that operate much like an investment fund through pooled investment securities.

ETFs are great for stock market beginners and experts alike. They’re relatively inexpensive, available through robo-advisors and traditional brokerages, and tend to be less risky than investing individual stocks.

The GoHenry Debit Card is another winner in our books. They are noted for being the best in customer service. You can personalize your credit card design. The smart financial app grows with your kids and helps guide, motivate, and encourage kids and teens with app experiences tailored to their age.

FamZoo is another great prepaid card for kids, teens, and parents. They are recognized as the best for financial education.

Plus, parents have a companion app, too. You can track progress, set flexible boundaries & goals, and get real-time spending notifications. You can also accelerate their learning with in-app Money Missions. Through Money Missions, kids learn skills through videos, quizzes, and more in the app. As they unlock each mission, they’ll make their way through the K-12 Personal Finance Education National Standards, all while earning points and badges.

Learn more here.