You may have seen TV commercials for National Debt Relief — “Lindsay H. reduced debt by 40%,” or “Michelle V. reduced debt by 35%.”

Sounds great, right?

National Debt Relief is a well-known and accredited debt settlement company. Unfortunately, despite the much-touted success stories, there are a lot of people who say “National Debt Relief screwed me.”

If this happens, what can you do? Read on to learn how to protect yourself.

Table of Contents

Key Points

- If you’re thinking “I signed up for National Debt Relief, did I make a mistake?” it’s not too late to exit the program

- You can cancel at any time without fees or penalties

- Debt settlement companies like National Debt Relief don’t charge fees until your debts have been settled, so you won’t lose money if you change your mind

- National Debt Relief has been awarded an A+ rating and 4.72 out of five stars by the Better Business Bureau, but the company has also racked up 279 complaints over the past three years

Featured Alternative: DebtHammer

- Can help with many types of debt, including payday and credit card

- Extremely transparent process, no shadiness

- Friendly and helpful customer support – no judgment

How National Debt Relief’s Program Works

National Debt Relief’s program works like this — customers with about $10,000 or more in unpaid debts who sign a contract with NDR will be asked to stop making debt payments until a debt settlement agreement has been reached. Instead of making payments toward debt, they will send a monthly payment to NDR, which will hold it in an escrow account. The money will eventually be used to make your settlement payments.

But many unhappy customers appear to be unclear about the specifics of how the process work. They complain about aggressive sales procedures and extra fees for legal protections.

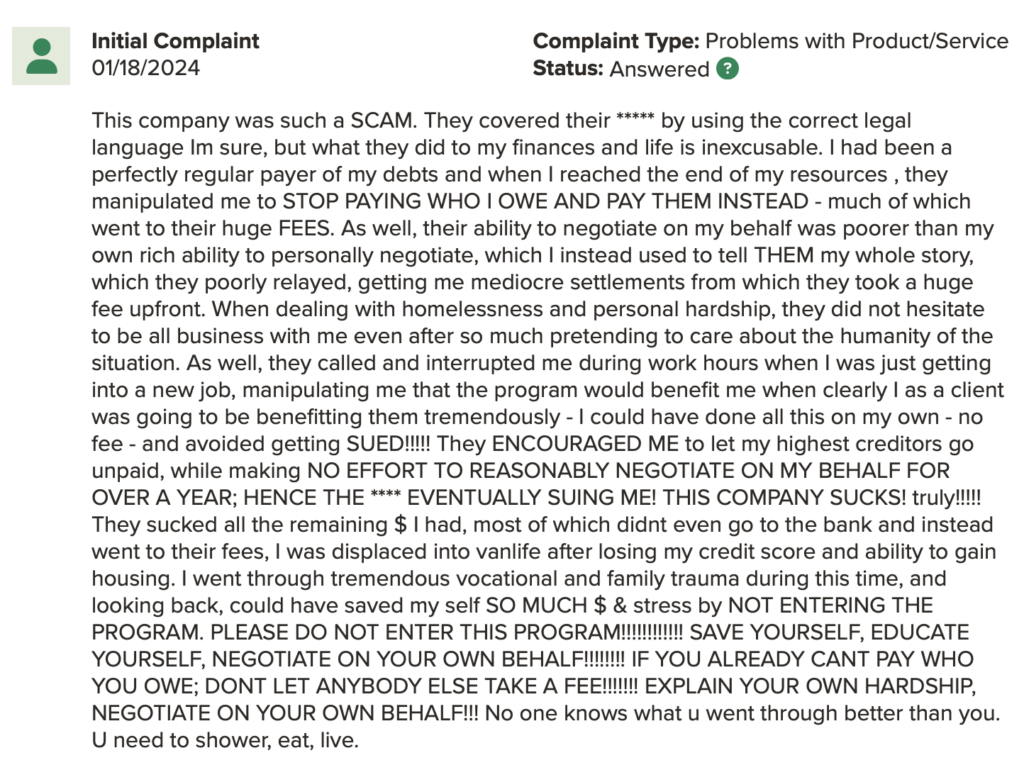

Common Customer Complaints

National Debt Relief has an A+ rating with the Better Business Bureau. However, that doesn’t stop some customers from complaining about the company, its sales procedures and its success (or lack thereof) in helping them out of debt. More than 100 complaints have been filed in the past year, and the company has racked up 100+ one-star reviews.

Here are some of the most common complaints against National Debt Relief filed with the Better Business Bureau.

Undisclosed Fees

A debt settlement company will charge you between 15% to 27% of the total enrolled debt. However, you do not have to pay until each debt is settled.

Protect yourself: Make sure to discuss fees during your initial consultation. While the fees may sound high, the American Association for Debt Resolution says that on average, debt settlement customers save 30% of their total debt after fees.

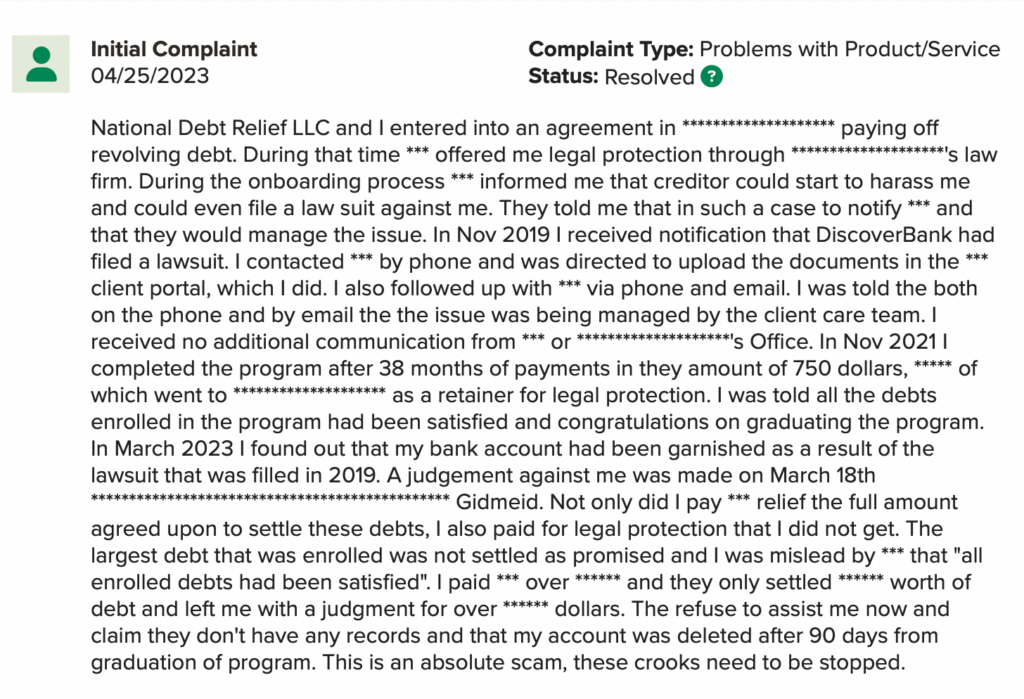

Unresolved Lawsuits

Several customers have complained about lawsuits filed during the debt settlement process, including a person who said they completed the National Debt Relief program only to have their wages garnished because of a lawsuit that had been filed during the settlement process. Since the fees charged by National Debt Relief are supposed to include legal protections, that customer was understandably upset.

The customer felt that National Debt Relief was untrustworthy because he had been told all debts were settled when wage garnishment had been ordered in one case.

Protect yourself: Be proactive. Check your credit reports to ensure all debts are noted as “settled.” (It’s free at annualcreditreport.com). Contact your debt settlement company if you don’t see the proper notations on your accounts.

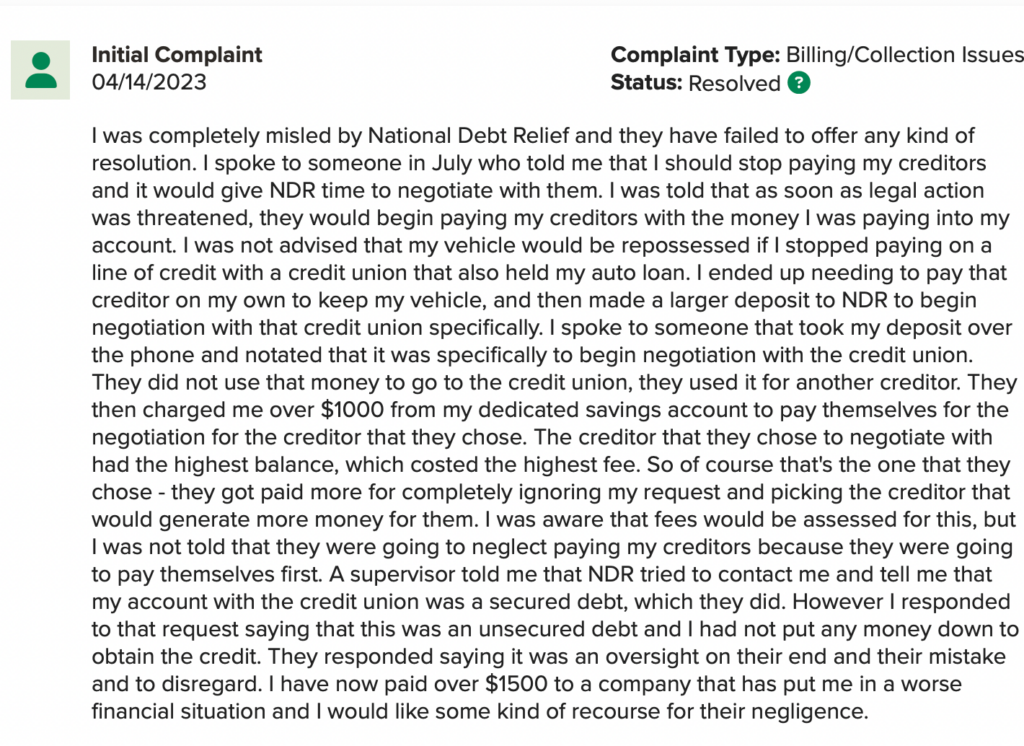

Miscommunication

One customer complained that his vehicle was repossessed after National Debt Relief told him to stop paying his bills during settlement.

There are a few different issues here.

- Car loans are secured by your vehicle, so they cannot be settled. Debt settlement only works for unsecured debts like medical bills, credit card debt and private student loans. NDR should have disclosed this, and it sounds like they tried.

- Debt settlement works by stopping payment on unsecured debts until they’ve been charged off. At that point, creditors are usually willing to negotiate a settlement because the alternative is to get no money, particularly if the borrower files for bankruptcy. So the process National Debt Relief followed was not unusual, but it sounds like the customer was not completely clear on the debt settlement process.

- The customer complained that NDR chose to focus on settling the largest loan first. Since debt settlement companies are paid based on the total debt settled, they earn the most money for settling the largest debt. However, starting with the largest debt is also a popular repayment strategy known as debt avalanche. The idea is to start with the loan that is racking up the most in interest charges.

Just because you didn’t put money down on your car does not mean the car loan is unsecured. The loan is secured by the car itself, and any missed payments leave borrowers at risk of repossession.

Protect yourself: If you aren’t sure, ask. If you get a notice warning that your car may be repossessed, contact your debt settlement company. Remember that debt settlement only works for unsecured debts, and all car loans are secured debts.

READ MORE: Debt settlement qualifications

Unsolicited Phone Calls

There’s no real explanation for this because most legitimate debt settlement companies will not contact anyone who did not request information.

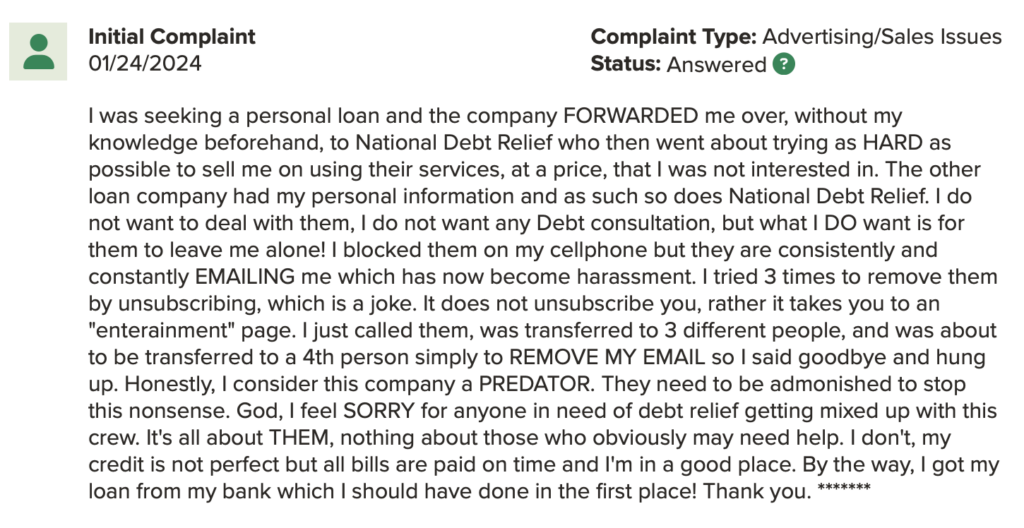

This complaint seems particularly troubling, since the potential customer did not reach out to NDR but was instead looking for a personal loan:

Protect yourself: If you’ve never requested a phone call, ask to be removed from the call list and register your phone number with the National Do Not Call Registry. If you continue to receive calls from legitimate companies a month after joining the registry, file a complaint online or by phone at 1-888-382-1222.

Creditors Sometimes Refuse to Settle

When you commit to a debt settlement program, it’s important to understand that creditors are under no obligation to settle. In fact, some refuse to even negotiate. However, a legitimate debt settlement company should know which creditors are open to settlement offers and should have a good idea from the free initial consultation whether they will be able to help you.

Protect yourself: Ask your debt settlement company if they’ve worked with your creditor in the past. Also, be aware that if no settlement is reached, you do not pay the company’s fee for that debt.

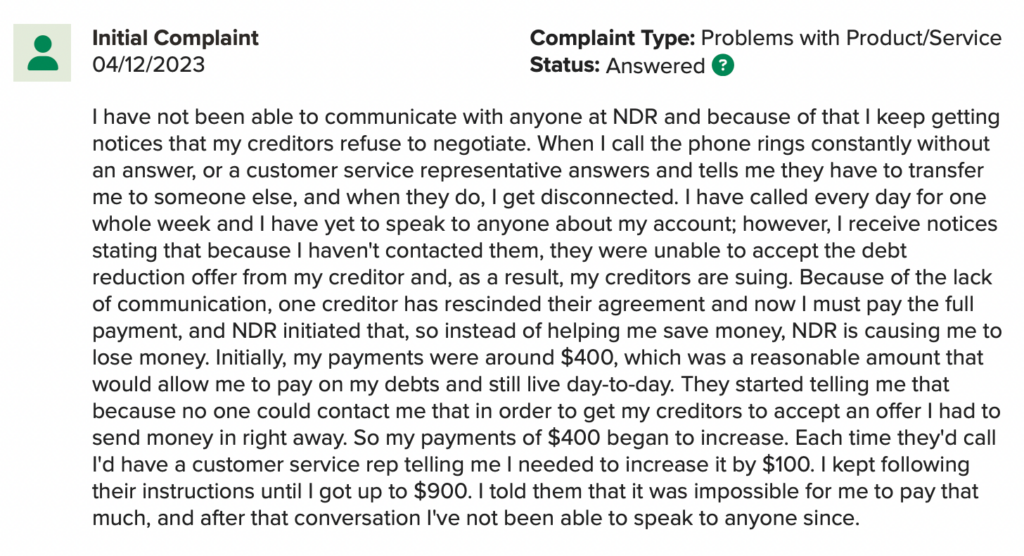

Lack of Communication/Difficult to Contact

Being able to contact your debt settlement company is essential. No debt can be settled without the final approval of the client. Some lenders will rescind the settlement offer if you cannot contact the company to approve the settlement.

Protect yourself: Read customer reviews and look for complaints. Find a different company if the company regularly sends your calls to voice mail or doesn’t respond to live chat. If something doesn’t seem right, trust your instincts.

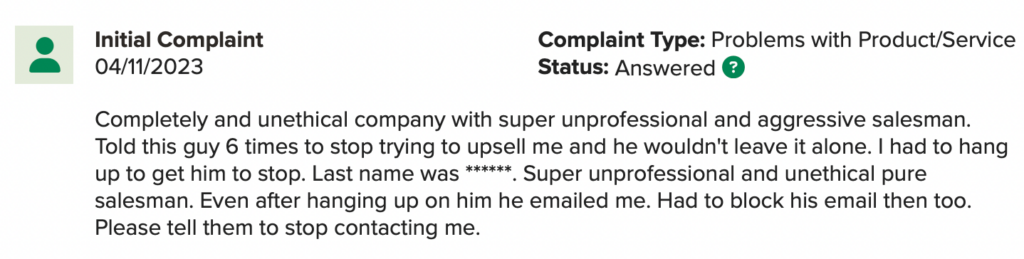

Too Aggressive

Customers complain of aggressive salespeople. Debt settlement does involve a sales process, but it shouldn’t make you uncomfortable.

Protect yourself: If you’re uncomfortable with the person you’re working with or feel they’re trying to push you into the wrong direction or force you to pay extra for services you don’t need, you’re better off trying a different company.

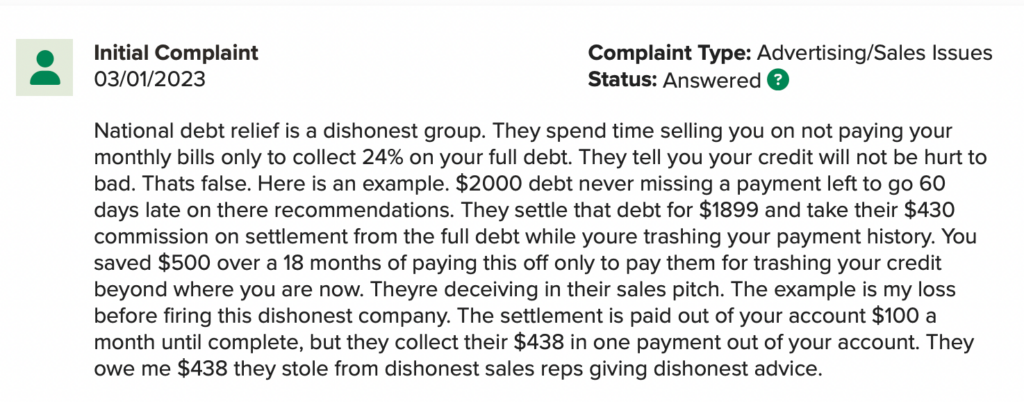

Credit Score Damage

It’s common knowledge that debt settlement will initially hurt your credit score. Though debt settlement can be one of the fastest ways to get out of debt, it will hurt your credit score until the first settlements start to be paid off. The extent of the damage will vary from person to person depending on their current credit score and other factors, like credit utilization.

Debt settlement won’t be the best choice for everyone. If you’re worried about the impact on your credit score, you need to bring that up with the company during your initial consultation. For example, if you are trying to settle debt and have never had a late payment or have a 700+ credit score, the hit your credit takes will be much more significant than the impact to a client with a 550 credit score. Before your initial consultation, be sure to check your credit scores and know where you stand so that you can get an honest assessment.

Protect yourself: Learn more about the impact debt settlement will have on your credit score.

Other Common Complaints

- Monthly payment increases: National Debt Relief requires you to make monthly payments into an escrow account. However, that payment could increase if settlement amounts are higher than estimated. This could be an unpleasant shock for clients who can’t afford the increase. If you’re struggling, you could ask whether you could extend your payment plan.

- Debt collection calls: When you stop making your debt payments, debt collectors will call. Some NDR customers appear to be unaware of this. They will stop, but not until a settlement has been negotiated.

- Tax consequences: Some customers are shocked when they get a bill from the IRS. Settled debts are considered taxable income. Your debt settlement company should alert you to this in advance so that you aren’t surprised when the IRS Tax Form 1099-C arrives in the mail.

- Not available in all states: National Debt Relief does not offer services in Georgia, Connecticut, Kansas, New Hampshire, Maine, Oregon, Vermont, South Carolina, or West Virginia

Have You Had Issues With National Debt Relief?

If a company leaves you hanging, you could have more problems than when you started.

- Your debt will be more significant due to penalties and accrued interest

- Your credit score will be lower

First, determine whether you can opt out of National Debt Relief’s program.

National Debt Relief says you can cancel the program if you aren’t satisfied with the service. Based on the company’s terms, you should be able to cancel without paying any penalties or cancellation fees, and since you don’t pay a debt settlement company until your debts have been settled, you should not be out any money.

In fact, National Debt Relief’s website states:

“If you’re not satisfied up to the point of us settling your debts — for any reason — you can cancel anytime without any penalties or fees other than any fees earned associated with prior settled debts.”

How to Get Out of a Debt Settlement Contract

The contract is a legally binding document, so there are some steps you’ll need to follow.

- Review your contract – it should specify any fees you’ll have to pay

- Contact the company and ask about the cancellation process – some may require notice in writing

- If you’ve given the company permission to automatically debit your bank account, contact your bank and rescind that access

- Pay any penalty fees

After completing these steps, you should receive a refund for the deposits you’ve made to your escrow account.

Once your contract has been voided, you’ll have a few options to resolve your debt:

- Find a new debt resolution company: Contact some of your original company’s competitors to see if they can help you recover. If you aren’t sure where to start, check out our list of the top debt settlement companies

- Talk to a credit counselor: See if they can advise you on debt consolidation options or other payment strategies. Note that they work primarily with credit card companies, so this isn’t a good option if most of the debt you need to settle is personal loans, medical bills or student loans.

- Negotiate with your creditors: Since your debts are already delinquent, call your creditor on your own. If you can offer valid reasons for missed payments, the lender may be willing to work out a settlement directly with you.

- File for bankruptcy: If you qualify, an automatic stay will be issued as soon as you file. This protects you from debt collectors and other collection efforts. Some of your debts may be permanently removed from credit reports.

However, bankruptcy:

- Stays on your credit report from seven to ten years

- Could leave a co-signer responsible for your debts

- Won’t discharge unforgivable debts like alimony and child support

READ MORE: Is debt settlement the fastest way to get out of debt?

Pro tip: You may need to contact a debt settlement attorney for advice if you encounter problems getting out of your debt settlement contract.

What You Need to Know about National Debt Relief

National Debt Relief is a legitimate debt settlement company. They do not provide credit counseling, debt consolidation loans, or other debt relief services, although they may be able to refer you to a tax adviser or bankruptcy attorney in some states.

The National Debt Relief program is a form of debt consolidation: you will replace all your debt payments with one single payment to your settlement account. The difference from other forms of debt consolidation is that you will stop making payments without the consent of your creditors.

If you stick with the debt settlement process – it can take two to four years – your debts can be reduced by an average of 25%, including fees.

READ MORE: National Debt Relief review

Employee Insights

A former National Debt Relief employee posted this company assessment on Reddit. While it isn’t unusual for ex-employees to be disgruntled, look for a company where the people you deal with seem relatively content.

The comment says:

“I am former employee and I do not recommend to go that route. Your credit gets destroyed, you will likely get sued as creditors may not accept to work with them. And they do not forgive whatever you don’t pay you will pay income taxes on.”

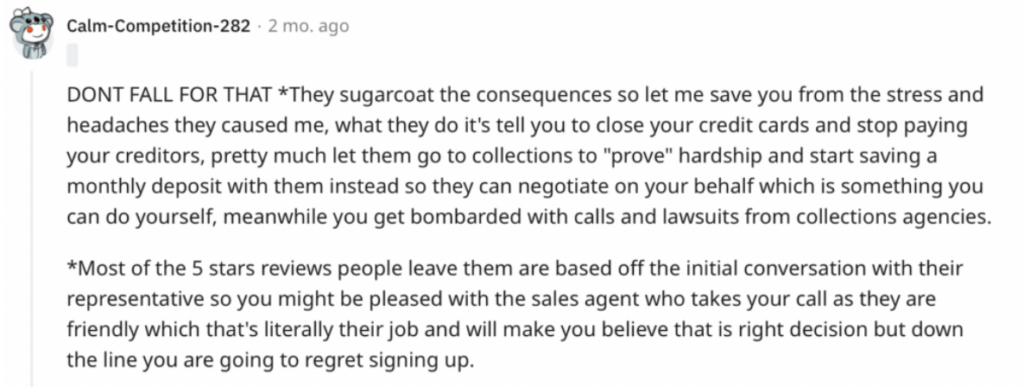

Calm-Competition-282 on Reddit

And another comment from the same former employee says:

Debt Settlement Success Story

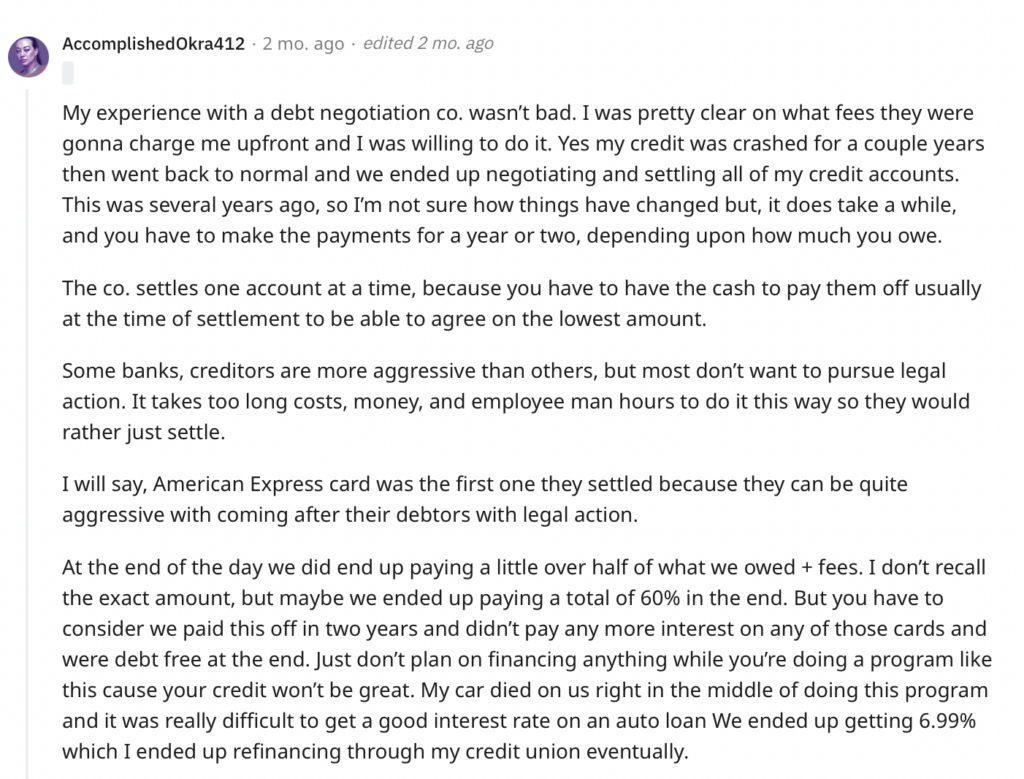

One Reddit poster countered the points the former NDR employee raised to explain how debt settlement worked for their particular financial situation.

This is a good example of how a program will work in your favor, but you must be completely clear on how it works and choose a company you trust to help you.

READ MORE: Debt settlement pros and cons

Is National Debt Relief a Scam?

No. National Debt Relief is a legitimate debt settlement company has been awarded a Better Business Bureau rating of A+. The company has been in business since 2009 and has served over 400,000 clients. There is no indication that the company is a scam.

Customer reviews are usually positive. However, some of their salespeople may be overly aggressive and the information provided to clients may be a bit unclear, leading to confusion and unhappy customers.

READ MORE: How to choose a legitimate debt settlement company

Warning Signs of a True Debt Settlement Scam

- They charge upfront fees

- They promise credit repair

- They promise instant results

- They guarantee that companies will settle

- They cite vague “government programs”

Other Debt Relief Options

- Debt consolidation loan

- Personal loan

- Debt Management Plan

- Home equity loan or line of credit

- Bankruptcy

READ MORE: Best debt relief companies

The Bottom Line

Everyone’s financial situation is different. Though National Debt Relief has helped thousands of people become debt-free, quite a few clients have walked away unhappy.

Be sure to carefully read reviews, consult multiple companies, and ensure the company you choose is easy to contact in case any questions or problems arise.