If you’re looking for a payday loan from Blue Trust, you’re too late. They’ve transitioned to eLoanWarehouse.

What does that mean? It’s hard to say because there isn’t any other information offered about the transition. But both are owned and operated by the same parent company, LCO Financial Services.

Hot take: eLoanWarehouse (formerly Blue Trust Loans) is a tribal lender owned and operated by Lac Courte Oreilles Financial Services (the same company that operated Blue Trust loans). They charge annual percentage rates that are often higher than 600% APR, or even more. According to customer complaints, the loans are close to impossible to pay off. If you need a quick loan and have bad credit, look elsewhere.

Featured Alternative: DebtHammer

- Break the borrowing cycle

- Can help with many types of debt, including payday and tribal loans

- Friendly and helpful customer support – no judgment

Table of Contents

Is eLoanWarehouse Legitimate?

Yes, eLoanWarehouse is a legitimate lender. That’s one of the FAQs the company sees so often it’s answered on its web page. It states:

This site is owned and operated by Lac Courte Oreilles Financial Services II, LLC. Our management team has over 20 years of experience in online lending and we are members of the Online Lenders Alliance (OLA), which supports the review and establishment of best practice standards in this industry.

The Online Lenders Alliance (OLA) is a lobbyist group. They have spent millions of dollars in Washington, D.C. fighting to protect the predatory loan industry. Due to lax federal oversight, several states have passed laws in an effort to protect borrowers. However, because the U.S. Constitution allows tribal communities to set their own laws, lenders affiliated with Native American tribes are not obligated to follow state laws. This means that you can (and will) be charged exorbitant interest rates, even if you live in a state with a strict interest rate cap on payday loans or where payday loans are illegal.

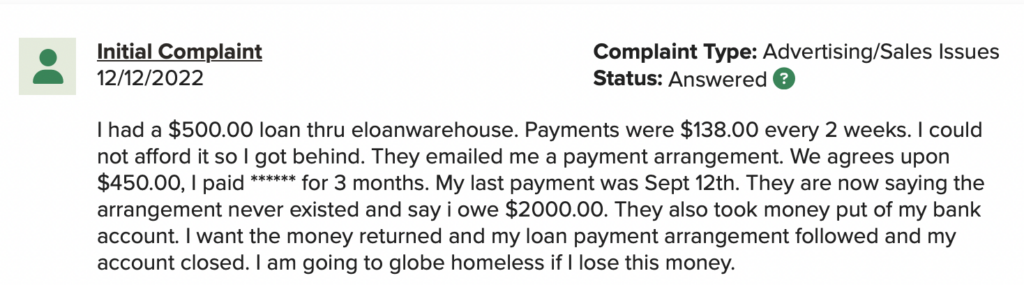

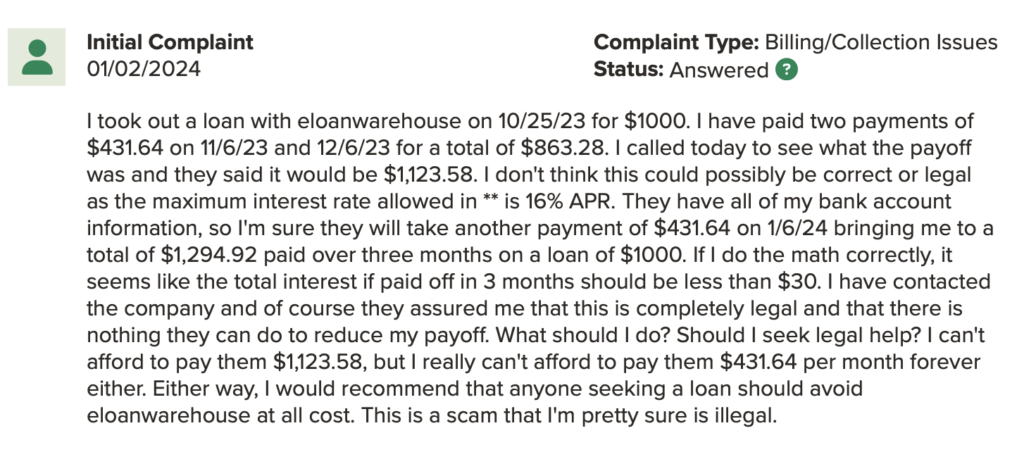

You can see from this online complaint that not everyone is clear about the tribal lending status and how it works:

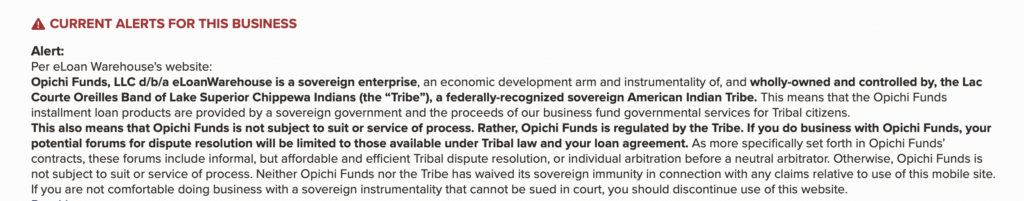

eLoanWarehouse is a Sovereign Enterprise

When approved for a loan, you are doing business with a sovereign enterprise. This means that eLoan Warehouse is what’s known as a tribal lender. The U.S. government has granted sovereign immunity to Native American tribes, so the lenders are not bound by state laws, including laws that cap interest rates. The eLoanWarehouse does not disclose the interest rates it charges, but they will be high. Much higher than what you’d pay a traditional payday lender.

The website explains this in some lengthy legalese.

Opichi Funds, LLC is owned by Lac Courte Oreilles Financial Services II, LLC (LCO Financial Services II) is a sovereign enterprise, an economic development arm and instrumentality of, and wholly-owned and controlled by, the Lac Courte Oreilles Band of Lake Superior Chippewa Indians (the “Tribe”), a federally- recognized sovereign American Indian Tribe. This means that a sovereign government and the proceeds of our business fund governmental services for Tribe citizens provide the Opichi Funds’ installment loan products.This means that a sovereign government and the proceeds of our business fund governmental services for Tribe citizens provide the Opichi Funds’ installment loan products. This also means that Opichi Funds is not subject to suit or service of process. Rather, Opichi Funds is regulated by the Tribe. If you do business with Opichi Funds, your potential forums for dispute resolution will be limited to those available under Tribal law and your loan agreement. As more specifically set forth in Opichi Funds’ contracts, these forums include informal, but affordable and efficient Tribal dispute resolution, or individual arbitration before a neutral arbitrator. Otherwise, Opichi Funds is not subject to suit or service of process. Neither Opichi Funds nor the Tribe has waived its sovereign immunity in connection with any claims relative to use of this website or for any forums other than those specifically set forth in Opichi Funds’ contracts. IF YOU ARE NOT COMFORTABLE DOING BUSINESS WITH A SOVEREIGN INSTRUMENTALITY THAT CANNOT BE SUED IN COURT, YOU SHOULD DISCONTINUE USE OF THIS WEBSITE AND YOU SHOULD NOT BORROW MONEY FROM OPICHI FUNDS.

READ MORE: What is a tribal lender and tribal lenders to avoid

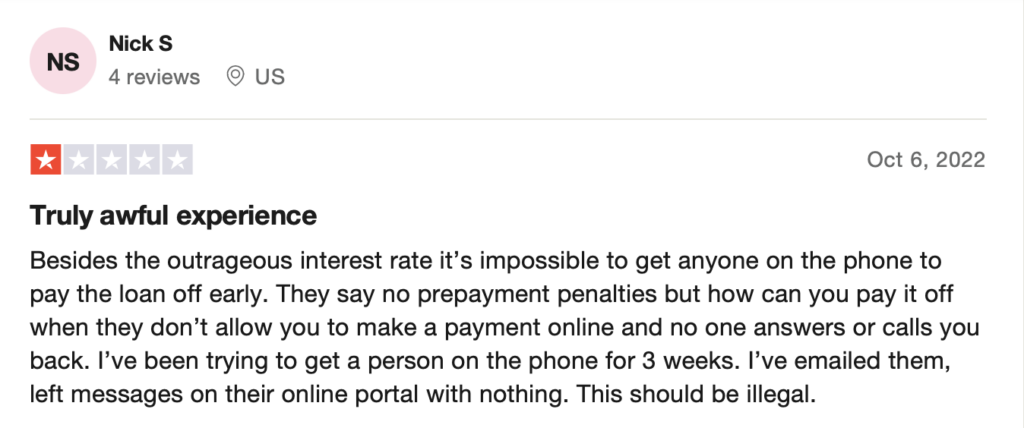

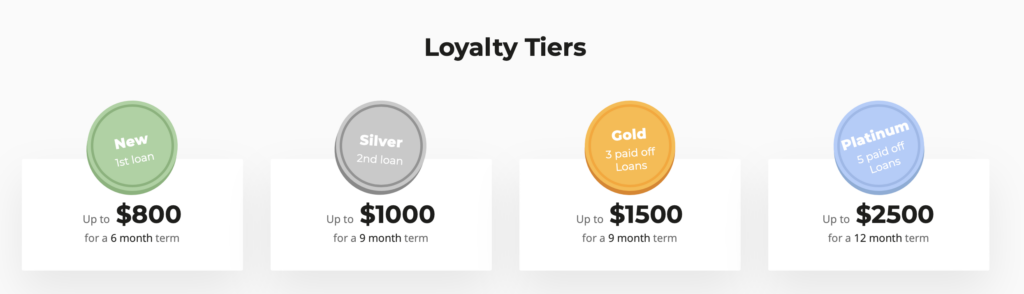

eLoanWarehouse touts a quick, easy application and no penalties if you pay your loan off early. In fact, there’s a tiered “loyalty program” that offers incentives for repeat borrowers. Repeat customers are awarded with the opportunity to borrow larger amounts of money, and pay the lender even more interest.

Few Qualifications for Approval

You won’t need good credit to borrow from eLoanWarehouse.

You need:

- A verifiable source of direct deposit income

- An open checking account that meets its “bank account minimum opened duration” requirements

- To be at least 18 years old and a United States resident

- A take-home pay that meets their minimum income requirements

- You must not currently be a debtor in a bankruptcy case or have imminent plans to file for bankruptcy

- You (or a family member) must not be in the military

Pro tip: Refusal to lend money to military servicemembers and their families is a massive red flag. It means the lender is not willing to adhere to the interest rate caps as set by the Military Lending Act, a federal lending law.

Warning! Don't take a tribal loan just yet. See what better options you may be eligible for.

I acknowledge that I have read and agree to the Terms of Service, and agree to be contacted about my situation by email, sms, and / or phone including automated dialers by Credit Summit and its affiliates.

Tell us about your loans

Please enter the lender and the approximate amount you owe. Don't worry if it's not exact.

Connecting You With a Debt Expert

Please stay with us for a moment so we can review your options.