With the rise of online lending, it’s tough to separate the good from the bad.

Bridge Lending Solutions offers installment loans up to $2,000. But is it worth it? Here’s what you need to know.

Hot take: Bridge Lending Solutions takes advantage of people with limited options and charges them outrageously expensive interest rates. If a borrower takes out a loan and doesn’t pay it off in full immediately, they’ll likely pay double or triple the balance of the loan in interest (regardless of your state’s laws capping interest rates). They have a license from the tribe but not the state’s banking regulator. They also don’t issue loans in every state.

Featured Alternative: DebtHammer

- Break the borrowing cycle

- Can help with many types of debt, including payday and tribal loans

- Friendly and helpful customer support – no judgment

Table of Contents

What You Need to Know About Bridge Lending Solutions

Bridge Lending Solutions is a consumer lending company specializing in online, small-dollar installment loans. They have very liberal underwriting processes and are willing to work with borrowers with bad credit.

Unfortunately, they charge quite a bit for their services. Even they acknowledge that they’re only financially helpful to people whose backs are against the wall. For example, they say they might be a viable solution when someone can’t afford rent, car repairs, or medical expenses. If that sounds familiar, it’s because payday lenders make the same claims. The difference between a payday loan and this form of installment loan is negligible.

The only significant variation between the two types of loans is that installment loans have longer repayment terms. Bridge Lending Solutions doubles down on distinguishing its products that way by emphasizing their repayment flexibility. They have several repayment schedules that supposedly encourage borrowers to pay off their loans as quickly as possible (and avoid interest).

Not everyone can borrow from Bridge Lending Solutions. The following alert appears on the website:

Biboon LLC dba Bridge Lending Solutions does not lend to residents in the following states: Arkansas, Colorado, Connecticut, District of Columbia (D.C.), Georgia, Illinois, Maine, Maryland, Massachusetts, Minnesota, Montana, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Oregon, Pennsylvania, Washington, Wisconsin, Vermont, Virginia, or West Virginia.

**Lending Exception for the States of Ohio and Washington: Will lend to returning customers only.

These are states that, in general, have more robust consumer protections.

Is Bridge Lending Solutions Licensed?

Bridge Lending Solutions’ headquarters are in Wisconsin, but they operate out of a Native American reservation in Lac du Flambeau. As a result, they don’t have (or think they need) a license from the state.

They’re a tribal lender, which means that they’re an extension of a Native American tribe and only respect their rules and regulations. Bridge Lending Solutions belongs to the Lac Du Flambeau Band of Lake Superior Chippewa Indians, and their only license is from the tribe.

As an extension of a Federally Recognized Indian Tribe and Sovereign Nation, they have “tribal immunity.” In simple terms, that means it’s almost impossible to sue them. Most tribal lenders use their status to avoid state regulations, especially those that limit the interest rates they can charge.

Pro tip: Like most online tribal lenders, Bridge Lending Solutions only discloses what their tribal status means in the fine print, which notes the following: “We are in full compliance with tribal lending laws and applicable federal lending laws. We are not required to follow state laws and you will be bound by the terms of the agreement with Bridge Lending Services including tribal laws.”

Federal regulations don’t do much to protect consumers from usurious lenders. That responsibility lies with the states, so the fact that Bridge Lending Solutions willfully ignores state laws is dangerous.

Typical Loan Terms

Bridge Lending Solutions is less forthcoming with its terms than many of its competitors. They don’t provide a range of rates on their website or even an example of a typical loan. Borrowers won’t know most of the pertinent details until they get a copy of their loan agreement.

Here’s what they do disclose ahead of time:

- Principal balances between $250 to $2,000

- Maximum principal balances for first-time customers of $700

- An expensive interest rate, likely in the mid to high triple digits

- Flexible repayment schedules, including the ability to prepay at will

- The ability to repay a loan via ACH, cashier’s check, or money order

Most tribal lenders give an example of their average loan, but Bridge Lending Solutions doesn’t seem to want to share their rates. It’s likely because they don’t want to scare people off by revealing how expensive they are. Whatever their reasoning, it’s risky to apply to a lender without knowing what they will charge for their services.

Online Reputation

Bridge Lending Solutions has been around since at least 2017, which means it has had time to develop a verifiable reputation online. Here are some of the highlights:

Customer Reviews

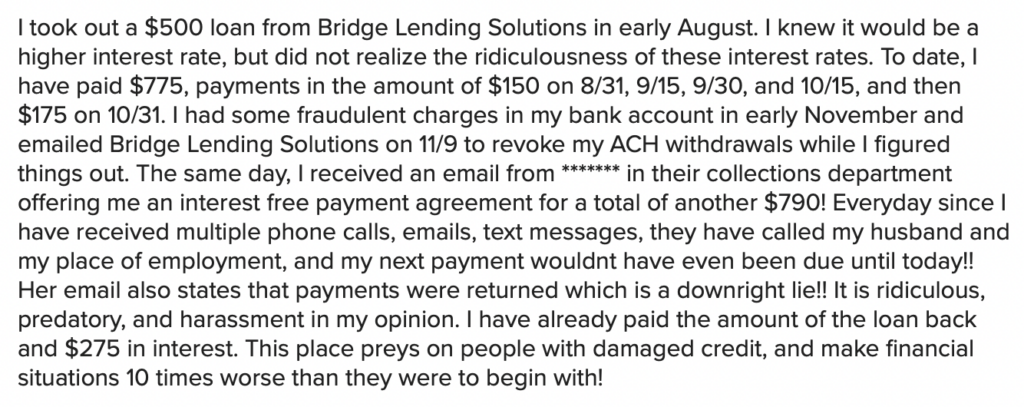

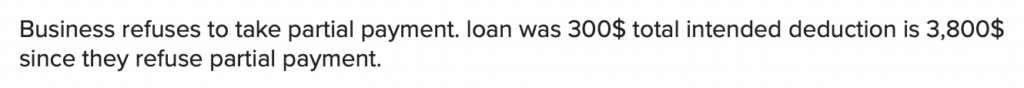

Bridge Lending Solutions has earned a B grade from the Better Business Bureau. It has 25 customer reviews and 38 complaints on its profile, with an average score of 1.64 out of 5 stars. The few positive ones reinforce the idea that the company is safe as long as borrowers know what they’re getting into and pay their loan off before the interest accrues.

The rest of the reviews are negative and primarily cite the unreasonable interest rates, but they also reference several other undesirable practices, including:

- Acquiring consumer contact information through a third party and marketing to them aggressively (including phone calls at work)

- Making it unreasonably difficult for a borrower to pay off their loan in advance

- Promising a loan, stealing applicant information, then breaking contact

Here are some sample complaints:

Lawsuits

Another great way to get a feel for a business’s track record is to look for any previous or outstanding lawsuits against them.

Knotts v. Biboon et al, LLC

Bridge Lending has been named in a class action lawsuit in Indiana that was filed in 2022.

The complaint alleges: “The Indiana Uniform Consumer Credit Code … establishes a maximum loan finance charge or 36% per annum for consumer loans other than supervised loans.” However, certain loan companies have attempted to circumvent these usury laws by entering into agreements with Native American tribes who are not bound by these state laws on their own lands.

The complaint alleges that the lender violated Indiana state laws and the Racketeer Influenced and Corrupt Organizations (RICO) Act.

Ferris v. Biboon et al, LLC

They were named in a similar lawsuit in November 2023 with another complaint that the lender violated Indiana state laws and the RICO Act.

There are also records for cases against the Lac Du Flambeau Band of Lake Superior Chippewa Indians.

- In June 2023, the U.S. Supreme Court ruled against the tribe, holding that the U.S. Bankruptcy Code repeals the sovereign immunity of all governments, includuing federally recognized tribes.

- In 2019, Isiah A. Jones III sued the tribe’s leaders in federal court for their activities under another lending entity, RadiantCash (the tribe operates several other lenders, including Loan at Last). RadiantCash has since stopped issuing loans.

Pros

Borrowing from Bridge Lending Solution should only be considered a last resort. Even in dire circumstances, it’s very likely that taking out one of their loans will end up causing more problems than it solves. That said, there are understandable reasons why people work from them, such as:

- Their application process is short, easy to complete, and entirely online.

- They have minimal qualification requirements, so people with bad credit can still receive a loan.

- They can transfer funds to approved applicants in a single business day.

- Their small principal balances are just what people need when they have minor cash emergencies.

Without knowing the exact cost (which Bridge Lending Solutions is careful not to state explicitly), these loans would appear helpful for people who need some fast cash.

Cons

At first glance, Bridge Lending Solutions can seem tempting to their target market, but it’s a trap. They’re just as dangerous as traditional payday lenders, if not more, due to their more significant principal balances and tribal immunity. Here are the most significant reasons that people should do their best to stay away:

- Previous customers report their interest rates as triple-digit (far higher than any other form of credit except payday loans).

- They have a history of breaking state laws, including the caps on interest rates and licensing regulations.

- When Bridge Lending Solutions does something against state law, consumers have little to no legal recourse against them.

These are the typical downsides to working with a tribal lender, and Bridge Lending Solutions is virtually identical to many of its peers in the industry.

How to Apply for a Bridge Lending Solutions Loan

Like many tribal installment lenders, Bridge Lending Solutions doesn’t care much about an applicant’s creditworthiness. Their qualification requirements are minimal, and most working adults have a good chance of receiving a loan. To apply, you must:

- Be at least 18 years old

- Have a bank account in your name

- Have a working email address and phone number

- Be a U.S. citizen or permanent resident

- Not be active military or a dependent of someone in the military

- Receive a steady income

They don’t mention credit scores or a lack of other debts. That makes them sound appealing to those already in financial trouble, but it usually backfires for them. Traditional lenders vet borrowers because they want them to be able to pay back their loans. Bridge Lending Solutions isn’t helping consumers by skipping that part of the process.

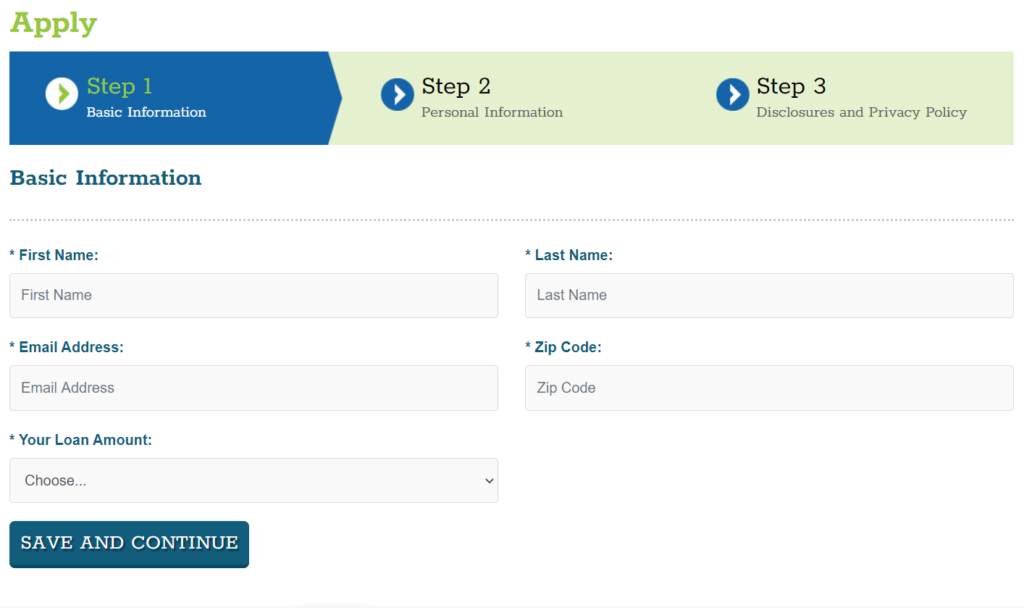

Filling out their application is also simple; most people can complete it in just a few minutes. The only three sections are:

- Basic Information: Name, zip code, email, and loan amount

- Personal Information: Income, bank numbers, address, and references

- Disclosures and Privacy: Social Security Number, driver’s license, and consent

Don’t think that just because the application is a breeze it’s okay to fill it out on a whim. Sharing this data is always risky, even with a trustworthy party, which may or may not include Bridge Lending Solutions. Remember, a business might not do anything sinister with it, but it could still fail to protect it from someone who will.

Better Alternatives to Bridge Lending Solutions

Many would-be borrowers apply for loans from providers like Bridge Lending Solutions because of their low qualification requirements. People with bad credit still need loans sometimes. If anything, they may need debt more than financially stable people since their net cash flows are naturally lower.

Unfortunately, Bridge Lending Solutions takes advantage of people with limited options and charges them outrageously expensive interest rates. If a borrower takes out a loan and doesn’t pay it off in full immediately, they’ll likely pay double or triple the balance of the loan in interest.

Fortunately, there are other options out there for people with bad credit that are much more affordable. Here are some of our favorites:

All of these options are far superior to loans from tribal lenders. While they might not be quite as accessible, they’re still viable for people with bad credit.

The Bottom Line

If you want the honest truth about Bridge Lending Solutions, here it is: stay away. They’re far too expensive to be an acceptable option in most cases. You’d be much better off with virtually any other lender.

FAQS

You can contact Bridge Lending Solutions by phone at 1-866-572-0720 or by email at customerservice@bridgelendingsolutions.com.

Bridge Lending Solutions’ mailing address is P.O. Box 481, Lac Du Flambeau, WI 54538-0481

When you apply for a new loan, Bridge Lending Solutions usually won’t check your credit score. However, if you don’t repay your loan as scheduled, the lender could report your missed payments to the credit bureaus, meaning your credit score could fall.