The need for a personal loan – to consolidate debt, grow a business or manage an emergency – doesn’t just fall to people with good credit scores. Online peer-to-peer lending can provide loan options for borrowers with credit scores lower than what typical banks or credit unions may accept.

But before seeking a peer-to-peer loan, it’s important to understand what peer-to-peer loans are, how they work and some of the most trustworthy sites for borrowing.

Table of Contents

Best Peer-to-Peer Lenders for Bad Credit

An internet search for peer-to-peer lenders will turn up ample results. We’ve broken down a few of the top platforms based on several features, including length of time a lender has been in business, pre-qualification criteria, competitive interest rates and fees and online reputation.

Here are a few top peer-to-peer lending platforms:

Credible

- Loans from $600 to $100,000

- Rates from 5.40% to 35.99% APR

- Minimum credit score of 670

- You could get multiple offers from lenders

- Credible does not charge fees, but the lender you’re matched with may

- To qualify, you should be at least 18 years old and a U.S. citizen with a valid Social Security number

- Allows co-signers

- Loan funding could take up to seven days depending on the lender you match with

Lending Club

- Loans up to $40,000

- Interest rates from 6.34% to 35.89% APR

- Approved borrowers will receive offers from multiple lenders outlining terms

- Borrowers need a credit score of 660 or higher and a low debt-to-income ratio

- No application or repayment fees

- Borrowers need a verifiable bank account

- Takes borrowers two to four days to get their money once a loan agreement is reached

- Not available in Iowa

Lightstream

- Fixed-rate loans from $5,000 to $100,000

- Rates range from 3.49% to 19.99% APR

- Loan terms from two to eight years

- Minimum credit score of 660

- Loans can be funded the same day you’re approved

- No origination, prepayment, or late fees

- Offers a joint application option and an autopay discount

Peerform

- Loans available between $4,000 and $25,000

- Rates range from 5.99% to 29.99% APR

- Borrowers need a credit score of at least 600

- Applicants receive a borrower score from AAA to DDD, which is used to calculate APR

- Qualified borrowers can choose from multiple loan offers

- Origination fee of 1% to 5%

- Check processing fee of $15 per payment if borrower opts not to use electronic payments

- Late payment fee of $15 or 5%, whichever is higher

- Failed payment fee of $15 for electronic payments that don’t clear

Prosper

- Loans available between $2,000 and $35,000

- Rates range from 6.99% to 35.99%, with lower rates given to borrowers with better credit histories

- Terms range from three to five years

- Origination fees between 2.41% and 5%

- Borrowers must have a credit score of 630 or higher

- Borrowers have flexibility in setting payment dates

- Next day funding available on approved loans

SoFi

- Loans available between $5,000 and $10,000

- Rates between 7.99% and 19.63%

- Terms between two to seven years

- Borrowers need a credit score of 670 or higher

- Borrowers must have a job, job commitment or sufficient source of income, as well as a sound financial history and a good ratio of income to monthly expenses

- No origination, late payment or early repayment fees

- Is FDIC insured and SIPC protected

Upstart

- Loans available between $1,000 and $50,000

- Rates range from 8.27% to 35.99% APR

- Three- and five-year terms available

- Funds received next day

- Borrowers need a credit score of 600 or higher

- Lenders make decisions based on the applicant’s education, work history and credit record.

Universal Credit

- Loans available between $1,000-$50,000

- Rates range from 11.69% to 35.93% APR

- Three- and five-year terms available

- Funds received next business day

- Borrowers need a credit score of 560 or higher

- Charges an origination fee ranging from 5.25% to 8%

- Loan requirements include a maximum debt-to-income ratio of 75% and a minimum credit history of two years.

- No minimum income requirement

Peer-to-Peer Lending for Small Businesses

Peer-to-peer lending allows small businesses to raise money without approaching traditional lenders such as banks and credit unions, where they might not qualify for small business loans. This model helps potential business owners by providing an online loan platform to solicit funds directly from potential investors.

Top Pick for Small Businesses: Funding Circle

- Loans available from $5,000 and $500,000

- Rates range from 12.18 to 36% APR

- Term lengths from three months up to 10 years

- Decision as fast as 24 hours and funds in as few as 3 days

- To qualify, borrowers will need a credit score of 660 or higher

- No impact on personal credit

How does Peer-to-Peer (P2P) Lending Work?

Peer-to-peer lending companies use different channels than traditional personal loans. Rather than lending money through a bank or credit union, peer-to-peer lending platforms connect borrowers with individual investors.

P2P loans became popular for borrowers after the financial downturn in 2008, when many traditional banks tightened lending requirements. Peer-to-peer loans offered borrowers with less-than-ideal credit a better chance of getting money.

For most P2P lending sites, borrowers fill out an initial application to determine whether or not they qualify. That application is scored based on the strength of the borrower’s credit. It’s then sent out to potential lenders.

Interested lenders then send loan offers to the borrower. The borrower chooses the loan with the best terms for them and completes the application process.

Some loans are funded by multiple lenders but are repaid through a single payment.

Because P2P loans connect borrowers with individual investors, these types of loans also are called social or crowdfunded loans.

Approval for many P2P loans depends on traditional factors, such as the borrower’s credit score and income level compared to debt.

However, because the loan applications go before individual lenders, borrowers with poor credit histories can often win loan approval through other factors, such as steady work history, an investor’s gut instinct or a particularly good reason for seeking the loan.

Should You Borrow on Reddit?

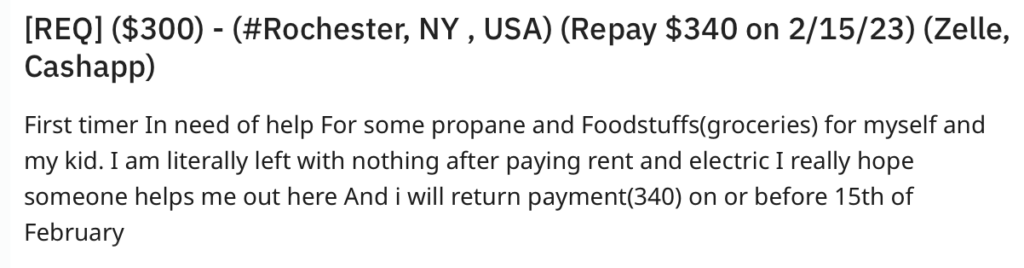

Another less formal peer-to-peer loan option comes through the social media platform Reddit. Using the subreddit r/borrow, people who want to borrow money post a request. The request outlines how much money they want to borrow, how the money will be spent and how much the borrowers will repay.

Borrowers often ask for money for emergencies, to tide them over to payday or deal with unexpected expenses, such as critical home improvements, a high heating bill or vet bills.

Individual investors choose whether or not to fund a request, then the loan is usually sent and repaid through cash apps like PayPal or Venmo. Repayment terms are flexible. And because you’re borrowing from an individual, there are no prepayment penalties.

It is recommended that loans be kept below $1,000, and the subreddit moderators caution that loan requests for more than $200 may be difficult to fund. Nevertheless, there are many cases of peer-to-peer Reddit loans for much higher amounts.

A typical request looks like this:

Loans are meant to be short-term, and the subreddit administrators recommend an interest rate of no higher than 30% for loans shorter than 30 days. They suggest a 1% per day increase in interest rates for loan terms beyond 30 days. Generally, loan rates on the borrow subreddit fall between 10 and 25%.

But the model seems to be working. According to The Atlantic, about 60% of loan requests are funded and of those, 70% are repaid. For comparison, about 46% of people who use a payday loan will default within two years of the first loan.

Rules for Borrowing Through the r/borrow Subreddit

While loan terms are determined strictly between the borrower and lender, Reddit’s r/borrow does have a few rules for peer-to-peer lending. Not following the rules can result in a ban from the subreddit. The subreddit borrowing rules include:

- To be eligible for a loan, borrowers must have a Reddit account that is at least 90 days old and a combined karma and comment score of at least 1,000.

- To make a loan request, borrowers must post in the subreddit with their request. It must include the borrower’s location, which lenders may verify by asking to see the borrower’s ID or piece of mail.

- Borrowers and lenders negotiate via private message, and the terms of the loan are posted in the subreddit.

- Payments and nonpayment are documented within the subreddit.

- Redditors cannot send unsolicited messages regarding a loan.

- Borrowers cannot post more than one request in 24 hours.

- Borrowers cannot post the same request on multiple subreddits.

- Loan requests can’t be made for someone else.

- There can only be one account used in the subreddit per person.

- Borrowers who don’t repay their loans are banned from the subreddit and reported to the r/UniversalScammerList.

- Lenders are reminded to follow their state’s usury laws against extreme interest rates.

For more information, check out the official rule page.

Borrowing Through Reddit Instead of a Payday Lender

One Reddit user posted a request to borrow $200. It was successfully repaid. Over the next few months, the borrower needed a few more loans to make it to the next payday. The same Redditor funded all of the loan requests and was repaid every time. Because the lender didn’t charge any interest or a fee, the borrower has saved hundreds of extra dollars that an online payday lender would have charged for the same loans.

Pros of Reddit Loans

Reddit loans can be beneficial for some borrowers. Pros include:

- No credit check, so creditworthiness doesn’t matter

- Quick access to money

- Reasonable rates for short-term loans

- Direct connection to the lender

Cons of Reddit Loans

Reddit loans should be used with some caution. Risks of borrowing via the r/borrow subreddit include:

- There are no real ramifications for loan default. Generally, the worst that happens to a borrower who fails to repay is a red “unpaid” flag on the post.

- Sharing personal information over social media can put a borrower at risk of having someone use their personal information for financial gain.

- Harassment upon nonpayment. Lenders frequently ask for borrowers’ social media tags as part of their background checks. Many lenders will use this information to contact the borrower’s friends and family when loans aren’t repaid.

- No legal protection. Reddit loans don’t come with formalized contracts or other legal protections that you might get through traditional banks.

- No credit score boost. Because peer-to-peer loans aren’t reported to the major credit bureaus, repaying these loans by the due date will not help you build credit.

A Repaid Reddit r/borrow Loan

As usual, another excellent pair of transactions with this trusted borrower. Both installments were made on time and communication was good when they requested a loan from a different lender during the loan period (also paid on time). A pleasure to work with!

This post covers both of our outstanding loans, which are now fully paid.

10/10 experience, would gladly lend to them again if the need arises!

Pros of Peer-to-Peer Loans

Peer-to-peer borrowing has benefits for many borrowers, including:

- Online application process. You don’t have to leave home.

- Competitive interest rates. Many peer-to-peer loans have similar or better rates than personal loans from traditional financial institutions or credit unions. Many sites offer loans with APRs between 5.99 and 35.99%. Many peer-to-peer loans have similar – or even better – rates than personal loans from traditional financial institutions or credit unions. Many sites offer loans with APRs between 5.99 and 35.99%. Rates depend on the borrower’s credit score, amount of money requested, and length of the loan repayment.

- Lower lending requirements. P2P sites are known for funding loans for people with lower credit scores, and some sites aim to specifically help those borrowers. Borrowers with credit scores as low as 580 may have luck getting a personal line of credit from a peer-to-peer site. You also might be able to get a higher loan amount because of the lower requirements.

- Raising credit scores. Most peer-to-peer lending sites report loan repayments to the credit bureaus. That means if P2P loan payments are made on time, loans can help improve credit scores, which will help you down the road when you want to get a credit card. The pre-approval process also does not hurt credit scores, using only a soft pull of an applicant’s credit history. If a loan offer is accepted, the lender likely will do a hard pull of the borrower’s credit score. That’s not necessarily harmful, but too many hard pulls of a borrower’s credit report can lower their FICO score.

- Quick processing. Online lending can be lightning fast. Working through the loan application process on peer-to-peer lending sites typically takes only a few days. Money is also quickly available once a loan agreement has been reached. Most sites advertise that money will be available in one to four days, but some do advertise same-day money transfers.

- No collateral. Peer-to-peer personal loans are considered unsecured loans. That means borrowers do not have to guarantee loans with a personal asset, such as their house or car.

Here’s a quick explainer of the steps to getting a peer-to-peer loan:

Cons of Peer-to-Peer Loans

Despite their benefits, peer-to-peer loans are not without risks. Some of the cons of peer-to-peer loans include:

- Fees. Like traditional and payday loans, you’ll need to stay up-to-date with your monthly payments. Peer-to-peer loans can come with fees for late payments or missed payments, early repayment or origination. It’s important to read any terms listed by the peer-to-peer lending site plus any terms listed within individual loan agreements sent by potential lenders.

- Lower credit scores due to late payment or default. While consistent, on-time payments of P2P loans can boost credit scores, defaulting on a loan, missing payments or paying late will bring credit scores down.

- Security. Because individuals fund peer-to-peer loans, they do not come with the same governmental or institutional protections as loans from banks and credit unions.

- Availability. Due to state laws, peer-to-peer loans are not offered in all areas. Borrowers will have to research different P2P lenders to find options available where they live.

Need a Peer-to-Peer Lender? Here’s What to Look For

All lenders are different, so you’ll need to do some homework before you borrow. Be sure to check:

- Lending requirements: Is there a minimum credit score? What are the requirements for credit history, income, etc.?

- Loan types: mortgages, car loans, personal loans, etc.

- Loan amount: What’s the minimum or maximum?

- Interest rates: APRs can differ wildly, ranging from single to double digits

- Origination fees: These can total up to 8%

- Other fees: Are there prepayment penalties or late fees?

- What are the repayment terms? They can vary from two to five years.

- How long will it take to receive the loan funds?

The Bottom Line

Peer-to-peer lending can be a sound financial option for borrowers who need unsecured personal loans. They’re more affordable than other loan options from a traditional lender and certainly a better option than payday loans.

To take advantage of P2P lending, borrowers first need to do their research to find the platform that fits their needs. They then must follow the application process to become pre-approved and receive loan offers from potential lenders.

Finally, before committing to a loan, borrowers should carefully read each offer’s terms and conditions so they can choose the most competitive offer and fully understand their repayment responsibilities.

FAQs

Because traditional financial institutions don’t back these, they might seem riskier than other borrowing options. However, the bulk of the risk is taken on by the investors, not the borrowers. If you have bad credit, these can be a good option if you don’t otherwise qualify for a traditional loan.

While people with credit scores of 600 or higher have the best chance of matching with a lender, borrowers have qualified with credit scores in the 550 range.

Yes. Payday loans must be repaid from your next paycheck, and the interest rates and fees are very high. It can be unrealistic to repay a loan that quickly. Peer-to-peer loans have longer terms, so the monthly payment is lower, and the interest rates will almost always be better than what would be on offer from a payday lender.

A debt consolidation loan consolidates your smaller debts into one bigger loan, ideally with a lower interest rate. They can lower their monthly debt costs and eliminate the need to juggle different repayment schedules with multiple lenders, lessening the risk of late fees. But most debt consolidation loans require fair credit. There are, however, a few options for borrowers with bad credit.