GETTING A LOAN IS AS EASY AS 1.. 2.. 3!, Green Arrow Loans promises. But it may not be quite that simple.

If you’re considering a loan from Greenarrow Loans, here’s what you need to know.

Table of Contents

What Is Greenarrow Loans?

Greenarrow Loans offers web-based installment loans. Borrowers can qualify for up to $1,000. According to their website, applicants can be approved (or not) in minutes with fund dispersal happening on the next (business) day. The website says that all the documents can be signed and submitted online, that applicants can design their own installment repayment plan and that there is ample opportunity to save on finance charges.

Like many payday lenders, Greenarrow Loans does not require applicants to submit to a credit check. They do, however, have to agree to basic identity verification. The applications are processed quickly, and funds are dispersed via ACH on the next business day after an application is approved.

Unlike a typical payday loan, Greenarrow Loans allows borrowers to repay their loans in installments. All these factors make this loan look (on the surface, at least) like a fantastic option for someone with bad credit who might be facing a crisis. But there’s a big catch.

Featured Alternative: DebtHammer

- Break the borrowing cycle

- Can help with many types of debt, including payday and tribal loans

- Friendly and helpful customer support – no judgment

Is Greenarrow Loans Licensed?

Greenarrow Loans offers loans under a parent company called Green Arrow Solutions. Green Arrow Solutions is not licensed by the state of California (where it is located). It does have a lending license that was issued by Big Valley Band of Pomo Indians Consumer Financial Services Regulatory Authority, but this is essentially meaningless if you encounter problems with your loan.

Pro tip: The Big Valley Band of Pomo Indians is a self-governing tribe. This means that they have the power to write and enforce their own laws, regulate their own commerce and taxes, and have their own law enforcement system that operates independently of Lake County, Calif., (where the tribe is located).

What Is a Tribal Loan?

It is important to understand that this tribal license does not mean that Green Arrow Solutions is insured by the FDIC or is a federally or state-licensed lender. This is because they are a tribal lender and are not subject to the same regulations as lenders recognized at the federal and state levels.

A tribal loan works in the same way that a bank loan or a payday loan does. The primary difference is that the holders of the loans (in this case, the Big Valley Band of Pomo Indians) operate out of Native American reservations. This means that they are protected by tribal immunity.

What Is Tribal Immunity?

“Tribal immunity” refers to a legal construct known as “tribal sovereign immunity.” Basically, this means that the actions taken on sovereign tribal lands are not subjected to the same regulations and laws that govern the United States. This immunity applies to every level of the federal government from the fed itself all the way down to local city ordinances.

On the one hand, this can be good news for borrowers because it means that the terms and conditions for tribal lenders are often looser and easier for borrowers to meet. On the other hand, tribal lenders will use their ‘tribal immunity’ as an excuse to ignore laws that are in place to protect consumers. For example, they will:

- Charge interest rates that are far above state limits

- Provide loans with balances that are higher than state minimums

- Break the terms of their loan agreements

Because Greenarrow Loans is backed by the Big Valley Band of Pomo Indians, they answer only to that specific tribe. The tribe determines whether the loan terms are legal.

Pro tip: Both the Supreme Court and the Consumer Financial Protection Bureau are trying to crack down on predatory tribal lenders, but the process is slow going. Tribal leaders insist that the only laws they should be subject to are their own. While this dispute is far from resolved, lenders like Greenarrow Loans are able to offer loans that violate California’s laws and that can ruin a borrower’s financial well-being. Many of these borrowers have poor credit and are desperate for cash.

What to Expect from Green Arrow Loans

In general, here’s what to expect when taking out a loan from Greenarrow Loans:

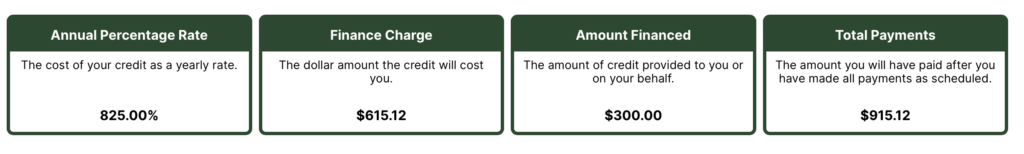

- An APR somewhere around 825%

- Principal balances between $200 to $300 for first-time borrowers

- Loans up to $1,000 available to repeat customers after they make enough successful payments

- Variable repayment schedules—you choose which plan is right for you

- No penalty for paying the loan off early

- Late fee of $30 tacked on to the balance of the loan if you miss a payment

- Incredibly high finance charges

These loans are billed as “flexible” loans. This means that, as the applicant, you have some say in your borrowing and repayment terms. Typically, payments are deducted from your bank account on a biweekly basis. That said, you will be offered some choice in how many payments you agree to make.

What’s the Difference Between a Tribal Loan and a Payday Loan?

When it comes to the application process, not much is different from a payday loan.

But tribal loans are significantly more dangerous than payday loans. Though payday loan fees are expensive, if you pay your loan off as scheduled, you won’t suffer as much long-term financial damage. Tribal loans, however, shock even the most experienced payday loan borrowers. They’re designed to look affordable, but it is almost impossible for borrowers to keep up with the payments because the interest accrues so quickly.

Typical Loan Terms of Loans from Greenarrow Loans

The company does not spell out any specific rates for interest, finance charges, etc. To learn what those are, you must apply and be approved for the loan. That’s when the company will tell you what the loan’s terms and conditions are. If you are okay with those terms, you can sign. If you aren’t, you can back out.

What is vital for borrowers to understand a few key things about Green Arrow’s interest rates. First, interest rates are calculated over a one-year term. Because your loan won’t be that long, your interest rate will be significantly higher than it appears at first glance. That interest also isn’t calculated on a monthly basis. It is calculated on a daily basis. This means that you are being charged interest for every single day that you owe the company money. And that interest is based on the balance of the loan, not the original loan amount. So, you’ll effectively be paying interest on your interest charges as well as your original loan amount.

Pictured above is Greenarrow Loans’ own example of a typical loan. If you borrow $300 from them, your interest rate will be 825%. If you make all of your payments as scheduled, you’ll have paid back a total of $915.12, meaning the loan will cost you a whopping $615.12 in interest and fees, in just nine easy payments of $101.68 every other week over the course of about four months.

Pro tip: Greenarrow currently does not issue loans in offer loans to customers in Arkansas, Colorado, Connecticut, Georgia, Illinois, Maryland, Minnesota, Montana, New Hampshire, New York, North Carolina, Pennsylvania, Vermont, Virginia, Washington, West Virginia and Puerto Rico.

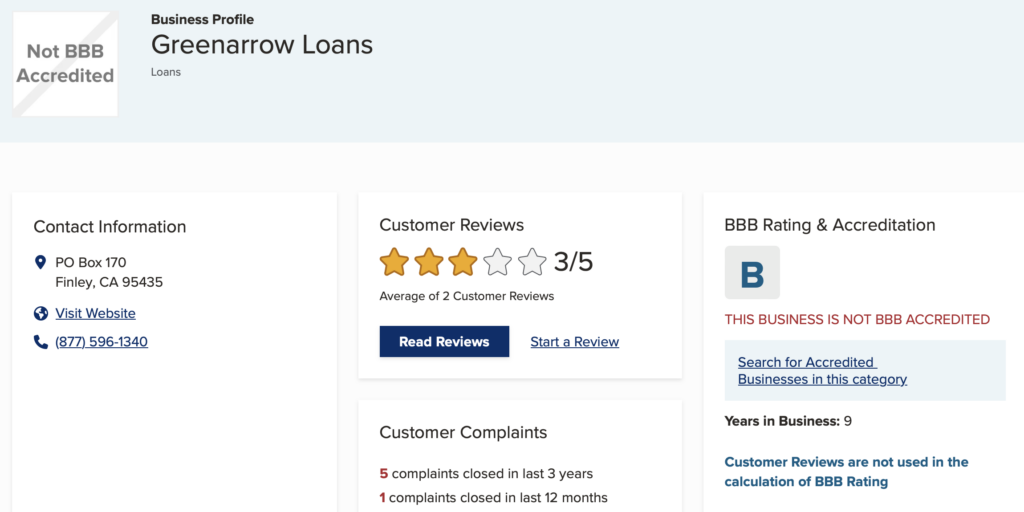

Customer ratings and reviews

Greenarrow Loans has a B rating at the Better Business Bureau, but the company is not accredited by the BBB. It’s also worth noting that the BBB does not factor customer complaints into the overall grade it gives to a company. There were five complaints levied against Greenarrow Loans to the BBB in the last year.

On Trustpilot, Greenarrow Loans has a rating of 3.6. There are a handful of reviews, mostly saying the same thing: how fast and easy the application process was, how nice the staff is, and how the reviewer was approved at Greenarrow after being turned down everywhere else.

There is, though, one outlier that caught our eye. Linda Hutcherson writes about getting approved for a loan and then the company sent her funds to someone else! On top of that, she says:

“Not only are they very expensive they are incompetent and the only reason I accepted this loan is I was promised funds the next day and when I called them they said it would take 5 days to get the funds sent back from the wrong account they sent it to. I was desperate and needed the funds when I was promised I would get them. Instead of keeping their word they tried saying they sent the funds to the account I provided. After looking at my account they found out they messed up.”

Legal Action Against Green Arrow Loans

Green Arrow Loans has been named in at least four class action lawsuits:

| Case | State | Status |

| Hall et al. v. Green Arrow Solutions et al | Illinois | Settled out of court |

| Stewart v. Green Arrow Solutions | Indiana | Settled out of court |

| Rehfeldt v. Green Arrow Solutions | Indiana | |

| Toler vs. Green Arrow Solutions et al | Massachusetts | Settled out of court |

The suits allege that Green Arrow Solutions has loaned money residents of Illinois, Indiana and Massachusetts, which cap payday loan interest rates, have violated state laws by loaning money at excessive interest rates.

Pros and Cons of Green Arrow Loans

The only reason to get one of these loans is that their approval standards are incredibly lenient. Most people are approved if they meet the minimum requirements. If you make good money and can pay the loan off super-fast you won’t pay as much in fees or interest.

Everything else is a drawback. Daily compounded interest, high fees, and a lender who can change the terms of your loan without the fear of reprisal from the municipal government? Reports of staff trying to lie to borrowers? That, and the fact that the company’s only physical address is a post office box make this loan very risky — especially for the desperate borrowers who are most likely to apply.

Think twice when a potential lender doesn’t have a physical mailing address.

How Do You Apply for a Greenarrow Loan?

There are two ways to apply for a loan from Greenarrow Loans. You can fill out their online application, or you can call them directly. Calling them directly makes the process move faster. Make sure you meet the following criteria:

- Be steadily employed or be getting regular payments from somewhere

- Have an income of at least $1,000 per month

- Be at least 18 years old

- Have an active checking account

The website also lists “other requirements may apply” but doesn’t mention anywhere what those requirements might be.

If you meet the criteria, fill out a loan application online. You’ll be contacted by a loan representative when your application is received. Once you verify your information, your loan will be approved or denied. If it is approved, you can expect your funds to be deposited into your bank account on the following business day.

Note: You begin accruing interest on the day your funds are deposited. Make sure to keep this in mind when making your payments.

Better Alternatives to Greenarrow Loans

If you need money right now and you don’t want to try your luck with a tribal lender (when money gets super tight and the bills are piling up, it’s easy to feel like a payday loan is your only hope), there are plenty of better alternatives out there.

Here are a few:

- Bad credit loan

- Payday Alternative Loans

- Peer-to-peer lending platforms

- Borrow from friends and family

- Debt resolution program

- Bankruptcy

READ MORE: How to make $500 fast

More Options

If you have steady employment and good credit history, there are even more options available to you, like:

- a credit card advance or low-interest balance transfer offer

- a home equity loan or home equity line of credit (HELOC)

- a 401(k) loan

- a paycheck advance app, like Dave or Earnin.

The Bottom Line

When you are desperate for money, turning to a tribal lender might feel like your only option. The truth is that these lenders should only be approached as your absolute last resort. Don’t let yourself get preyed upon, especially when there are so many other great options out there.

FAQs

You can reach Green Arrow Solutions by email at cs@greenarrowloans.com or by phone at 877-596-1340.

Green Arrow Loans is based in Finley, California.

Green Arrow does not currently offer loans to customers in Arkansas, Colorado, Connecticut, Georgia, Maryland, Minnesota, Montana, New Hampshire, New York, North Carolina, Pennsylvania, Puerto Rico, Vermont, Virginia, Washington, and West Virginia.