When short on cash, a cash-advance app like Brigit can be a great alternative to a payday or title loan. But is Brigit your best option? Read on to learn what makes it stand out.

Table of Contents

Key Points

- Brigit is a legitimate app that offers small loans of up to $250

- To get cash advances, you must have a paid subscription, which costs $9.99 monthly

- Brigit’s free version will help with budgeting

- The app monitors your spending and deposits

- Brigit has an A+ rating from the BBB

- Brigit is a legitimate option for cash advances, though the monthly fee is higher than those charged by most other cash advance apps

November 2, 2023 update: After the Federal Trade Commission alleged that Brigit used deceptive advertising practices and made the paid subscription difficult to cancel, the company agreed to pay $18 million in customer refunds and to simplify the cancellation process. Read more here.

Brigit: What You Need to Know

Brigit is a budgeting app that connects to your bank account. Once paired with your bank account, the app will monitor your spending and deposits. It uses this information to help you see where your money is going, identify ways to save and spend less, put together a budget, etc. If you meet the app’s criteria, you can use it to help cover expenses between paychecks via their cash advance program.

At a Glance: How Brigit Works

| Physical locations | None |

| How to get started | Download the app and connect it to your bank account |

| Monthly service fee | Free version, or $9.99/month for Brigit Plus |

| Tips | None requested |

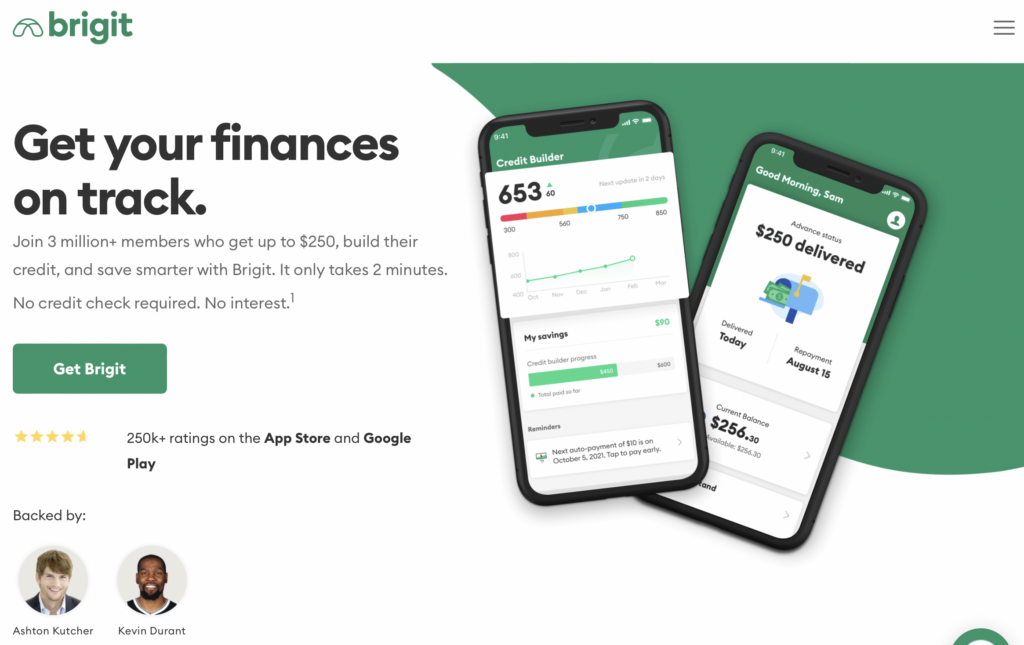

| Celebrity endorsements | Ashton Kutcher, Kevin Durant |

| Total loan amount | Advances range from $50 to $250 depending on your “Brigit Score” |

| How to get the advance | Funds are deposited directly into your bank account |

| How long it will take to get your advance | Free transfers are usually available within three business days. If you need the money instantly, you must subscribe to Brigit Plus. |

| Notable features | Budgeting tools, credit and identity monitoring, opportunities to earn more money |

| Sign-up bonus | Referral credit when you get someone to sign up for the app using your referral code. |

Pro tip: Like most financial apps, Brigit offers both free and paid versions of its program. The free version is about as basic as you can get. It offers free spending/deposit monitoring, some base-level insight into your spending habits, and access to Brigit’s knowledge center, where you can find tips and information on saving, budgeting, credit, etc. The free version also has links to opportunities for earning more money.

The paid version of Brigit offers more. Its $9.99 monthly membership fee makes it a bit more expensive than other options. It does, however, offer some impressive perks. In addition to all the stuff you get for free, the paid version of Brigit offers identity theft protection, automatic coverage if your account is in danger of over-drafting, credit-building products and flexible repayment on cash advances.

Brigit Cash Advances

Brigit offers paid members advances between $50 to $250. That said, not all paid members can borrow the full $250. Eligibility is based on your deposit and spending information and plugs it into an algorithm that determines how much of an advance it will offer.

To qualify for a cash advance, you must meet all of the following criteria:

- The checking account you connect to Brigit must be at least 60 days old

- It needs to have “sufficient activity.” To achieve this, Brigit recommends using the account as you usually would for a couple of weeks after connecting it to the app

- Your account must have at least some money in it (aka a balance above $0)

- You must have some money left in the account the day after your paycheck is deposited. In other words, don’t spend your entire paycheck the same day it arrives

- You must have at least three recurring qualifying deposits from the same source.

- Qualifying deposits must average out to be at least $400

- Qualifying deposits must total at least $1500

- Have a qualifying “Brigit Score”

“Qualifying” deposits are deposits that meet these criteria:

- Be around the same amount every time. Deposit amounts that very wildly will not qualify

- Be from the same source

- Happen on a schedule (weekly, bi-weekly, semi-monthly, or monthly). Irregular payments won’t qualify

- Are directly deposited into your account. Cash deposits, account transfers and paper checks will not qualify

Pro tip: In other words, Brigit may not be the best platform for you if you work inconsistent hours or handle a lot of freelance work through different payment methods.

Your “Brigit Score” is a number between 0-100. The higher the number, the better. Your score will be based on the following:

- The health of your bank account

- Your spending habits

- Your deposit/earnings profile

READ MORE: Here are the best cash advance apps

You Can Change Your Instant Cash Due Date

Instead of making a late payment, you can adjust your repayment date before agreeing to get an advance. Brigit also offers an extension to new users; members also earn an extension for each two consecutive advances they repay by the due date. Users are allowed to delay the repayment date up to 16 days. You can hold up to three extension credits at a time.

Brigit May Trigger an Overdraft Fee

If you don’t have funds in your bank account to repay your advance, Brigit could end up triggering an overdraft fee on your due date. However, the company offers partial repayment options.

What Makes Brigit Stand Out

Brigit might not have all the bells and whistles that some of the other cash advance apps have. Still, it does have some pretty awesome features that help make it a leader in its niche.

No Tips or Interest

While many cash advance apps encourage borrowers to “tip,” Brigit does not ask for a tip and also doesn’t charge interest. This may not seem like a big deal, but a $15 tip can drive the cost of borrowing up into the triple-digit APR range.

“Holistic” Approach

Launched in 2019 by Zuben Mathews and Hamel Kothari, Brigit was created as “a holistic financial health app” that helps its users build a stable financial future.”

The company is based in New York, NY.

Unlike other financial apps and fintech platforms, Brigit does not offer banking services. It does not offer spending or savings accounts. There is no Brigit-specific debit card or ATM network.

Credit-Builder Loan

A credit-builder loan is basically a reverse installment loan. You make monthly payments to the lender, and your recurring deposits are held in a savings account. The account is listed with the credit reporting bureaus as an installment loan. The balance of the loan is whatever savings goal you set. Over time, as you deposit money into this account, those deposits are reported as payments to the bureaus and help build your credit score.

At the end of the loan term, the account balance is yours to use however you want. A lot of people choose to use that balance to fund a secured credit card to help them keep building their credit.

These “loans” are great because if your credit score is less-than-ideal, they help you build credit without your having to risk defaulting on anything. If you have bad (or no) credit, these products can help you start to get back on track.

Pro tip: Brigit’s Credit Builder installment loans are issued by Coastal Community Bank, Member FDIC,

Credit Monitoring and Alerts

The biggest benefit of credit monitoring and alerts is they help you nip attempts at identity theft in the bud. They’re also a great way to ensure that your credit report remains error-free. When you get an alert, you tell the bureaus whether the action is legitimate or fraudulent. You can act quickly to keep the damage from escalating if the action is fraudulent.

Identity Theft Protection

Identity theft protection protects you against fraudulent spending. It’s very helpful in getting your bank to reimburse your account for fraudulent expenses. It also makes canceling and replacing your ID and credit cards much simpler.

Cash Advances of Up to $250

If you meet the criteria for a cash advance, you can use these to keep your bank account in the black even if your paycheck runs out before your next payday. This will prevent your account from being charged overdraft or returned service fees, which can really add up!

No Physical Branches

Remember, Brigit is not an actual bank. It is a cash-advance/budgeting app. This means that it has no physical branches, accounts, etc. If you’re looking for an app with banking options, Brigit probably can’t help you.

Brigit Legal Challenges

On November 2, 2023, the FTC announced actions against Brigit for alleging that promises of “instant” cash advances of up to $250 were deceptive and that the company made the $9.99 monthly membership exceptionally difficult to cancel.

Brigit, also known as Bridge It, Inc., agreed to settle the FTC’s charges, resulting in a proposed court order that would require the company to pay $18 million in consumer refunds, stop its deceptive marketing promises, and end tactics that prevented customers from cancelling.

“Brigit trapped those consumers least able to afford it into monthly membership plans they struggled to escape from,” said Sam Levine, Director of the FTC’s Bureau of Consumer Protection. “Companies that offer cash advances and other alternative financial products have to play by the same rules as other businesses or face potential action by the FTC.”

The proposed settlement order, which still must be approved by a federal judge, requires Brigit to pay $18 million to the FTC. The money will be used to refund Brigit customers. In addition, Brigit will be prohibited from using misleading language and required to simplify the cancellation process and make clear disclosures about its products.

Pros and Cons of Brigit

There are some key advantages and disadvantages.

Pros

- If you qualify for a cash advance, that advance is going to be much cheaper than paying payday loan interest rates

- Brigit advances will cost you less than you’d pay in overdraft or returned item fees

- Transfers happen automatically — so if you need some quick cash, Brigit is faster and easier to deal with than payday or title lenders

- Identity theft protection is pretty sweet

Cons

- You’ll have to allow the app near-constant access to your bank account

- It takes several weeks’ worth of qualifying deposits before you’re eligible for any cash advance

- The paid membership is more expensive than other cash advance apps charge

- Your advance repayments won’t be reported to the credit bureaus

- Could create a habit of relying on money you don’t have

- Brigit isn’t compatible with Chime

Pro tip: If Brigit isn’t the right loan app for you, check out Dave, MoneyLion and Earnin. All three are reputable options that offer comparable services.

Does Brigit Offer Cash Back?

No. Remember, Brigit is not a bank and is not partnered with any banks. You won’t get the same perks with a traditional bank or spending account.

Brigit App Review

Technically speaking, Brigit is a fintech app. While the company has a web presence, you’ll need to download the app if you want to use its services.

Currently, Brigit is available in Google Play and the Apple App Store, where it ranks very well. Google users give it 4.6 stars. Apple users give it 4.8 stars.

Is Brigit Trustworthy?

According to the Brigit website, the app uses 256-bit encryption. This is the same level of encryption you’ll get with most of the major banks. They also use ID verification and multi-factor authentication and automatically log you out of the app when you close it. All of this helps to ensure that your information stays safe.

What are Customers Saying about Brigit?

Brigit has earned an A+ rating from the Better Business Bureau. User reviews there, however, only rate the app at 1.32 stars.

Here’s a review from one happy customer:

The majority of negative BBB reviews involve poor customer support, billing confusion and/or difficulties canceling the service.

TrustPilot’s customer reviews aren’t much better. Brigit only earns 2.4 stars on that platform, which is odd because none of the reviews award more than two stars.

The Bottom Line

Brigit is a great app for insight into your spending habits and (if you qualify) helping you bridge the gap between paychecks. However, if you’re hoping for more than monitoring, you’d be better off choosing one of the cash advance apps offering banking and credit services.

FAQs

Absolutely. Apps like Brigit are cheaper than Payday Loans. And, unlike Payday Lenders whose goal is to keep you trapped in the payday loan trap, cash Advance Apps are designed to help you eventually not need them.

A cash advance app is an app that links to your bank account and offers small-dollar advances when you need some extra cash.

Brigit uses the same encryption most banks use as well as several safeguards to protect against ID theft.