“Real people, real savings,” promises Accredited Debt Relief’s web site.

The company says it can help you both reduce your monthly payments and reduce the overall total amount you owe, and clients have paid off more than $2 billion in debt.

Does it live up to those promises? Let’s take a look.

Featured Alternative: DebtHammer

- Can help with many types of debt, including payday and credit card

- Extremely transparent process, no shadiness

- Friendly and helpful customer support – no judgment

Table of Contents

Key Points

- Accredited Debt Relief is a legitimate debt settlement company

- It can help you if you’re overwhelmed by credit card debt or medical bills

- ADR says fees “generally range between 15% and 25%”

- ADR does not operate in 19 states

- The company has faced a few lawsuits

Accredited Debt Relief at a Glance

| Do they offer a free consultation? | Yes |

| How to get started | Set up a free consultation to explain your situation to a debt counselor |

| Fees | No upfront fees. Pay between 15%-25% of your total enrolled debt when your debts are settled |

| How it works | You will have a preliminary meeting to determine whether Accredited Debt Relief can help you |

| Who owns Accredited Debt Relief | Beyond Finance, LLC |

| Company address and phone number | 9525 Towne Centre Dr Ste 100 San Diego, CA 92121-1995; (855) 232-1194 |

| BBB rating | A+ |

| Trustpilot rating | 4.9 stars |

| Minimum amount of debt required to enroll | $10,000 |

| Noteworthy | Only works with unsecured credit, including payday loan debt No minimum credit score required |

READ MORE: Is debt settlement the cheapest way to get out of debt?

Accredited Debt Relief: What You Need to Know

Accredited Debt Relief is a debt settlement company. It was founded in 2011 and is a division of Beyond Finance, LLC, a tech-friendly debt relief company.

It offers debt consolidation, debt resolution and credit counseling services.

ADR says it can help you reduce your debt by up to 50% — but that will come at a cost. Fees range from 15% to 25% of the total debt enrolled in the program. However, you don’t pay anything at all until you’ve accepted settlement offers.

READ MORE: Debt settlement fees

Pro tip: ADR is not available in every state. Check to see if the company does business in your state before setting up a consultation.

According to the ADR website, the company’s goal is to “provide debt relief options and savings for individuals and families struggling with debt across the U.S.” They do this by negotiating with your creditors to lower your balances and interest rates and making sure those creditors’ payments are made on time until the debt is eliminated.

If you choose to enroll, you will send one payment to ADR every month. ADR takes that payment and portions it out to your creditors. Typically, the process takes 2-4 years.

Eligible Types of Debt

Note that Accredited Debt Relief only helps settle unsecured debts, such as:

- Credit card bills

- Medical debt

- Personal loans

- Payday loans

- Private student loans

Secured loans, like mortgages and auto loans, are not eligible for debt settlement.

READ MORE: Best debt settlement companies

What Makes Accredited Debt Relief Stand Out

There are a lot of debt relief companies out there. What makes Accredited Debt Relief’s services different?

Results

Accredited Debt Relief boasts some impressive results. ADR’s website says that the company has resolved more than half a billion dollars of debt for its clients. ADR has a track record of negotiating clients’ debts down to about half of what they originally owed (on average).

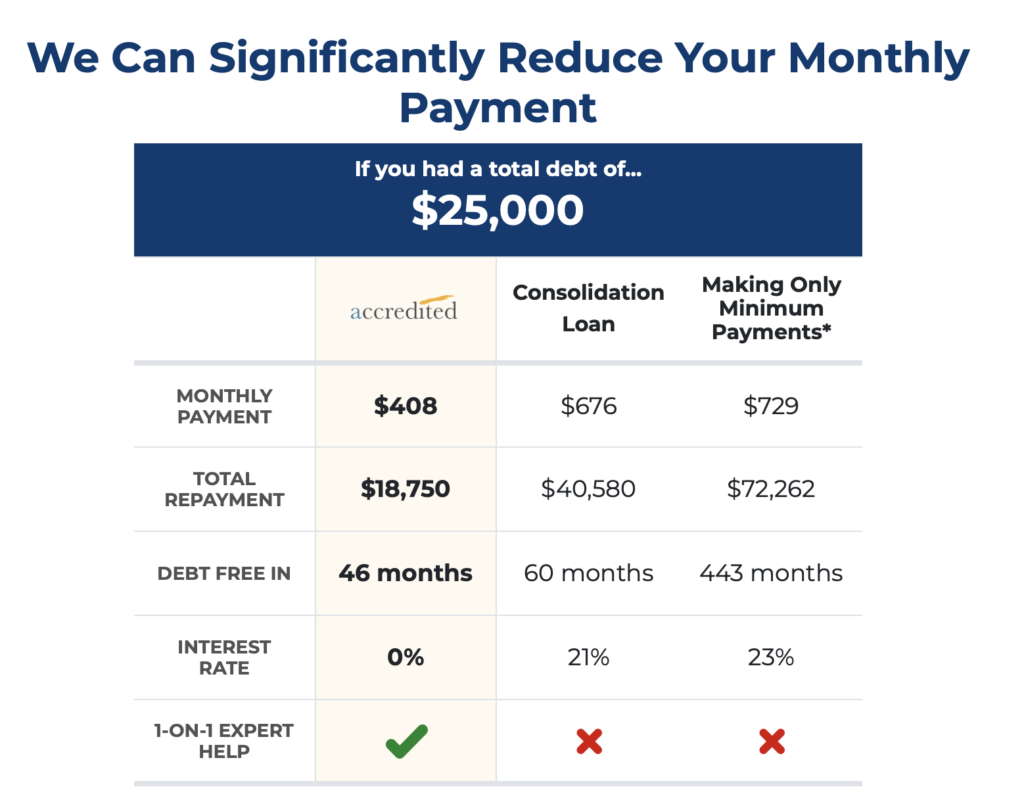

Pro tip: Debt settlement clients end up repaying significantly less than they would with consolidation loans or by simply making their minimum payments directly to their creditors.

READ MORE: Got $50,000 in debt? Here’s how to pay it off fast

Fixed Monthly Payment

Accredited Debt Relief takes over the payments to your lenders. You simply put a single fixed payment into your dedicated savings account each month. ADR uses the funds in that account to pay your creditors for you.

READ MORE: Is it better to settle a debt or pay in full?

Dedicated Savings Account

ADR will help you set up this account (with an FDIC-insured bank). The idea here is that you are separating the money for your debt resolution plan from the money you use for your other expenses.

Pro tip: If there is any money left over in that dedicated account after you successfully complete your program and paid your fees, that money will be yours to use however you want.

READ MORE: Debt settlement pros and cons

How to Sign Up

The first step to signing up with Accredited Debt Relief is to call the company to schedule your free consultation. You can also set up your consultation via the ADR website.

Pro tip: During this consultation, you will meet with a certified debt specialist and explain your situation. The specialist will review your finances with you, so you’ll want to ensure you have current statements from each of your creditors, proof of your identity (driver’s license, passport, etc.) and proof of your income. Proof of income can be copies of tax returns, a copy of your W-2, bank records, etc. Gather all of this information together before the consultation to ensure the process is as smooth as possible.

If your specialist thinks an ADR program is best for you, they will help you enroll.

READ MORE: Debt settlement qualifications

Step-by-Step Breakdown of How Accredited Debt Relief Works

First you will meet with a certified debt specialist to go over your current debt/financial situation. The consultant will help to determine whether debt consolidation services or debt settlement are viable options. If you both agree that Accredited Debt Relief’s plan is right for you, you will officially enroll in the program your specialist sets up for you.

After enrollment, you’ll follow these steps

- Stop making your monthly debt payments

Set up an FDIC-insured savings account (ADR will help you with this) and start making monthly deposits based on your settlement plan - Wait while your specialist negotiates with your creditors. This process will take some time, maybe even up to a year before settlement negotiations start

- Once settlement agreements are reached, ADR will contact you for approval. You will personally approve every settlement

- Use the funds in your dedicated savings account to pay off your loan (and your fee)

- The process repeats until repayment of all settlements is complete or debts are deemed ineligible (i.e. the creditor is unwilling to negotiate

Pro tip: The reason you’ll be told to stop making your monthly payments is that most credit card companies (or other creditors) aren’t willing to consider settlement offers until the debt has been charged off as bad debt. This will cause your credit score to plummet. It won’t rebound until settlement offers are paid.

READ MORE: How does debt settlement affect your credit score?

Depending on the amount of money you owe, the program can be completed in as little as a year. On average, though, the process takes 2-4 years.

Accredited Debt Relief includes the following chart to compare some different debt relief options, including debt consolidation loans.

READ MORE: Debt settlement vs. debt consolidation

Is Accredited Debt Relief Legitimate?

Yes. Accredited Debt Relief is a legitimate company well-regarded in the financial sector. It is not a scam.

The company is accredited by It’s accredited by the American Association for Debt Resolution (formerly known as the American Fair Credit Council or AFCC).

That said, ADR’s record isn’t 100% perfect. Several lawsuits have been filed against the company.

Legal Challenges

Terrado et al V. Accredited Debt Relief, LLC. et al

This lawsuit was filed in 2017 by three ADR employees. The employees alleged that ADR violated both the Fair Labor Standards Act and California labor laws. According to the employees, ADR failed to pay the company employees for the time they actually worked. The suit also alleges that ADR was only paying employees on a commission-only basis and failed to accurately calculate time worked, particularly with regard to overtime.

Jones V. Accredited Debt Relief, LLC. et al

In 2019 Stanley Jones said that Accredited Debt Relief violated the Telephone Consumer Protection Act. They did this by sending unsolicited text messages to consumers and failed to respect consumers who had listed themselves on the Do Not Call Registry. Jones dropped his case 2020.

John Brooks and Anna Marinez filed a similar suit in 2017. They dropped it (with prejudice) in 2018.

Accredited Debt Relief has also run afoul of the National Advertising Division (NAD) of the BBB National Program for making specious claims about their success rates.

READ MORE: Best small loans, even if you have bad credit

Pros and Cons

Every company has its ups and downs. Here are the pros and cons of working with Accredited Debt Relief:

Pros

- Your initial consultation is free

- You will only pay ADR fees if your debt is actually reduced

- Solid customer reviews in multiple places

- There’s no minimum credit score requirement

- You can leave at any time without paying any penalty fees

Cons

- The service is not available everywhere: 19 states don’t allow ADR to operate within their borders

- High minimum debt requirement: You must have a minimum of $10,000 in unsecured debt to qualify for their debt relief program

- Charged-off debts will appear on your credit report until settlements have been paid

- No mobile app or online portal

- Your fee is based on the total debt you have when you enroll in the program, not in how much you owe after negotiations have lowered your total due

- Your credit score will take a hit

- Pricing isn’t transparent and fees can be high — 15%-25% of total enrolled debt

- Forgiven debts could be taxable

READ MORE: Struggling with debt? Get the help you need

Who Should Consider Accredited Debt Relief

Debt settlement and consolidation programs are not for everyone. These programs work best for people who are:

- Overwhelmed by their debt

- Struggling to make even minimum monthly payments

- Have at least $7,500 in unsecured debt

- Trying to avoid having to file for bankruptcy

- Uncomfortable trying to negotiate their debts on their own

READ MORE: Complete guide to debt relief programs

Pro tip: If you have less than $6,000 in debt, you won’t be eligible for most debt settlement programs. In that instance, your next best step would be to consult a nonprofit credit counseling agency. They can negotiate lower interest rates with your credit card companies and set up a Debt Management Plan (DMP) for you. However, you will pay a monthly fee to the agency to administer the plan. Be sure to ask about the fees in your initial consultation, and seek out agencies with the lowest monthly fees.

READ MORE: Debt settlement vs. debt management

Want to know more about debt settlement? Check out this video:

Who Should Not Consider Accredited Debt Relief

If any of the following describes you, Accredited Debt Relief might not be a good choice.

- You aren’t willing to pay someone else to handle debt negotiations

- Your debt is manageable (even though it might be annoying)

- You’re hoping to make a big purchase soon (i.e., applying for a home or auto loan)

READ MORE: Are you eligible for debt settlement?

The Website

Accredited Debt Relief’s website is easy to negotiate and explains the basics of debt settlement well. Their FAQ section and “How it Works” pages are lacking, though. There’s not much in the way of details, like how the fees actually work, why you need an extra bank account (your dedicated savings account) instead of just sending a payment in to ADR directly, etc.

Customer Service

Customers can reach Accredited Debt Relief’s customer service department by calling 1-800-497-1965. If they aren’t comfortable on the phone, they can ask questions via email by sending a message to customerservice@acrelief.com. ADR is also active on Facebook, Twitter, and Instagram.

There is no on-site chat function.

Is Accredited Debt Relief Trustworthy?

As of this writing, Accredited Debt Relief does not detail what kind of network security they use to protect your information on their servers. They do make their Privacy Policy readily available. It says that they will never share your social security number, but that they do reserve the right to sell your other information to third parties.

What are Customers Saying?

Customers who have opted in to Accredited Debt Relief programs seem to mostly be happy with their decisions. ADR has an A+ rating at the Better Business Bureau. Customer reviews at the BBB give ADR an average rating of 4.73 stars. Many reviews prompt responsiveness and reassurance.

Trustpilot reviewers love Accredited Debt Relief, too. ADR has more than four thousand reviews. Those reviewers give ADR an average of 4.9 stars.

The Bottom Line

If you are overwhelmed by debt and have trouble managing your payments, Accredited Debt Relief offers a potential path to becoming debt-free. The company is legit and well-regarded by financial experts. They have a solid track record of success. Their fees are a little high, though, and they may not operate in your state. Consider that when you’re making your decision.

FAQs

When you enroll in an ADR plan, they will instruct you to stop making payments and cut all contact with your creditors during the negotiation process. This could cause you to miss a payment or two, which can have an adverse effect on your credit score. Settling a debt for less than is owed can also ding your credit, though not by much.

ADR can work to settle unsecured debts. In other words, debts that do not have collateral (like a car or a house) attached to them. This includes medical bills and credit card debt.

It’s on par with the other legit debt settlement companies. For example, TurboDebt’s fees depend on the service provider you’re connected with. National Debt Relief and Freedom Debt Relief charge set fees. To learn more, check out these recommended debt settlement companies.