Opploans offers “online loans designed for you” with same-day funding to borrowers with bad credit in 37 states.

But is Opploans legitimate, or just another payday loan lender that will leave you trapped in a cycle of debt?

Featured Alternative: DebtHammer

- Break the borrowing cycle

- Can help with many types of debt, including payday and tribal loans

- Friendly and helpful customer support – no judgment

Table of Contents

Opploans at a Glance

| APR Range | 5.99% to 35.99% |

| Loan terms | Six months to three years |

| Loan amount | $400 to $5,000 |

| Does Opploans run a hard credit check? | No, and there is no minimum credit score requirement |

| Time to loan funding | As soon as the same business day if final approval occurs before 12:00 PM CT on a business day. Otherwise, funds may be received as soon as the next business day |

| Origination fee | None |

| Autopay discount | None |

| How to set up payments | You can pay by ACH payment, by paper check or by debit card. The due date is two to four weeks from the loan origination date |

| Notable features | Opploans only uses a soft credit check; reports to all three credit bureaus |

| Prepayment penalty | None |

Is OppLoans Legitimate?

Does Opploans Help with Credit?

It reports your payments to all three major credit bureaus, which can help improve your score by building a positive payment history. It also has a standard privacy policy and safety features to help protect your identity. OppLoans also offers a blog featuring multiple financial tips to help you navigate your money issues.

OppLoans Review: What You Need to Know

What is a Payday Loan?

A payday loan is usually repaid in a single payment on the borrower’s next payday, or when income is received from another source like a pension or Social Security. The due date is two to four weeks from the loan origination date. The specific due date is set in the payday loan agreement.

OppLoans vs. Payday Loans

Applying for a loan isn’t a one-size-fits-all option. OppLoans can only be obtained through an online application, while payday loans can be obtained online or at a physical location.

Also, though OppLoans is an online lender, it’s only obtainable in 37 states. According to the National Conference of State Legislatures, payday loans are also technically limited to 37 states, although tribal payday loans are a loophole that sidesteps state payday loan laws.

Both types of loans offer fast access to money. Payday loans are usually issued on the same day, and OppLoans funds are available by the next business day.

There are five specific areas where OppLoans and payday loans vary greatly:

Loan amount

Payday loans usually range between $100 and $1,000, depending on the individual’s paycheck, while OppLoans’s loan amounts range from $500 to $4,000.

Interest Rate

OppLoans says its annual percentage rates (APRs) range from 59% to 160%. That’s high, but not as high as the average payday loan APR of 391%. And some payday loans go even higher, particularly if you’re borrowing through a lender that’s affiliated with a Native American tribe.

READ MORE: Payday loan interest rates: Everything you need to know

Loan Terms

If you are approved for a payday loan, it must usually be repaid by your next paycheck, which is about 14 days later. OppLoans issues installment loans, which offer more flexibility. You can choose a repayment terms of up to 24 months. If you’re looking for a longer period to stretch things out, clearly OppLoans might be the answer vs. a regular payday loan. Of course, keep in mind that the longer the repayment term, the more you’ll pay in interest.

Ability to Build Credit

Credit, credit scores, and credit reports are all things that most of us need at some point in our lives. Whether it’s to show a property owner you’re good to make rent or trying to refinance your car loan.

Required Collateral

Your payday loan will need to be secured by your next paycheck, which can lead to more stress if you can’t make the payment. But with OppLoans, there’s no collateral required to get approved for a loan. OppLoans will use the credit score obtained during the soft inquiry and your employment history to determine your eligibility for the loan.

READ MORE: Payday loans vs installment loans: What’s the difference?

Pros and Cons of OppLoans

If you are planning to apply for a loan through OppLoans, it’s smart to review the pros and cons that will be attached to the loan:

Pros

- You won’t find any application fees, origination fees, or prepayment penalty fees at OppLoans

- A low minimum loan amount is available

- Fast funding: OppLoans makes funds available the next business day after an application is approved

- The company provides an online tool that lets you check on the status of your application at any time

- Loans can be used for various emergencies, such as household repairs, medical bills, travel expenses, rent, books for college courses, and even debt consolidation

- No minimum credit score requirement.

- Refinancing is allowed if you’ve paid at least 15% or $400 of your loan balance and your account is not past due.

Cons

- APR can be as high as 199%

- Not available in every state

- Maximum loan amount of $4,000 depending on where you reside

- The maximum loan amount may not be enough to meet your needs, especially if you have a large medical bill or you’re trying to consolidate your debts

- Some military members are not eligible – Covered borrowers under the Military Lending Act will not qualify

- Reports payments to all three credit bureaus

- Rates are high compared with other bad-credit lenders

- Does not allow borrowers to choose a payment due date but may allow borrowers to change their payment date

- Short maximum repayment terms of up to 18 months in many states

OppLoans Eligibility Requirements

- You must be 18 years or older (19 in Alabama)

- Have a bank account (checking or savings account)

- Have a regular source of income (from employment. or benefits including Social Security)

- Receive paychecks through direct deposit (residents of New Mexico are exempt from this requirement)

- Reside in one of the 37 states in which OppLoans currently operates — Alabama, Georgia, Nevada, or Wisconsin; or the following states, which originate through OppLoans loan partners: Alaska, Arizona, Arkansas, California, Delaware, Florida, Hawaii, Idaho, Indiana, Kansas, Kentucky, Louisiana, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, New Mexico, North Dakota, Ohio, Oklahoma, Oregon, Rhode Island, South Carolina, Tennessee, Texas, Utah, Virginia, Washington or Wyoming

According to OppLoans’ website, its lending partners are:

- FinWise Bank in Sandy, Utah

- First Electronic Bank in Salt Lake City, Utah

- Capital Community Bank in Provo, Utah

OppLoans Financial Tools and Resources

OppLoans offers its clients several financial tools and resources such as financial education on building and maintaining credit through OppU. The website says it has courses where you can learn the essentials of financial literacy with fun, practical, and easy-to-understand courses. The OppU course curriculum is aligned with national financial education standards; best of all, it’s free! Visit the website here. Credit, debt and loans, budgeting and savings, and spending are some topics available.

OppLoans Customer Reviews

OppLoans reviews are mainly positive. There are many good reviews regarding its customer service, simple application, quick process, and comparatively competitive rates. However, some borrowers report issues with OppLoans incorrectly processing payments — and note the total cost of borrowing is still high.

Some of these reviews might be useful to potential customers as they explore the options of doing business with OppLoans.

On Google Reviews, there are currently close to 17,000 reviews with a 4.9 rating out of 5 stars:

Smooth

It was very user-friendly, minimal questions were asked, and it help me get noticed by other lenders. So, they’re the real deal if u wanna build ur credit. Great job

Easy and efficient

They are a great company to work with. Their process is easy and efficient. Yes, they have high interest on their loans, but it helps when others say no.

An option for Fair Credit Score People trying

The application process was easy, fast…applied in less than 1 hour, was approved 1 hour after. Funds were in my bank account the next morning. Yes, the loan is at a higher interest rate, although I appreciate OppLoans giving me a repayment term and payment amount that fits my budget, and I can repay in a short time. Needed this for emergency specialist/medical procedure, but I was not sure how I was going to be able to pay the out-of-pocket expenses that insurance did not cover. Thank you Credit Karma too for really recommending options even when having fair credit, that I am working on the best I can.

OppLoans personal loan reviews on Trustpilot

At Trustpilot, there are more than 2,000 reviews with a 4.7-star rating out of 5 stars.

I have used Opp Loans in times of urgent need, and I have never had a problem, always appreciate can do this in the privacy of my home and get a reply quickly.

I didn’t realize until it was too late that you’d be taking money out on the day I get paid. There’s one major problem with that scenario in that I haven’t been paid yet and you pulled from my account at the stroke of midnight, I borrowed from you to give me a little breathing room. At this rate, I’ll be paying the bank overdraft fees equal to the loan before it’s done…

Better Business Bureau Reviews

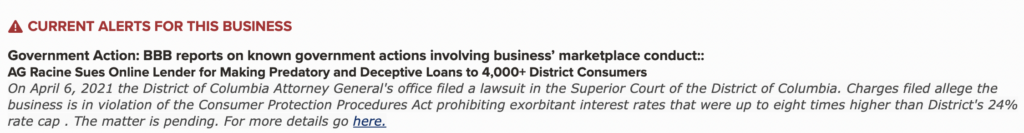

OppLoans is accredited by the Better Business Bureau and has earned an A+ rating, though the following alert appears on the Opploans page:

At the BBB OppLoans has more than 178 complaints closed in the last three years, with about 91 complaints closed in the last 12 months. There are more than 1,000 reviews with 4.55 stars out of 5.

OppLoans is fast if you need money While their interest rates may look high you can pay the loan off early without a penalty. My credit is not great, which is my fault. I needed some money to pay bills to keep my credit from getting worse. I have used this service several times and it has saved me late fees and having a significantly lowered credit rating which means that I don’t have to worry about high-interest rates on other credit products such as my car loan or credit cards. In the long run, it has saved me more money than the interest charges that I had to pay.

Still looking for more information on OppLoans? Check out this video to learn more:

How to Apply for an OppLoans Personal Loan

The application review process assesses a borrower’s ability to repay the loan with an emphasis on income.

Here are some things you need to qualify for a loan.

- Minimum credit score: None required

- Minimum monthly gross income: $1,500

- Have a bank account in your name with 40 days of history

- Receive your paychecks through direct deposit

- Live in a state where OppLoans operates

The lender offers loans directly in some states and services loans funded by FinWise, First Electronic, and Capital Community banks in many other states.

Alternatives to OppLoans Loans and Payday Loans

These alternatives may be cheaper than borrowing for you to explore before leaping in.

Cash Advance Apps

Like everything else, there are apps for cash advances, including companies such as Earnin, Dave, and Brigit. These will let you borrow a small amount from your next paycheck before you receive it.

These are just some examples that can be better options than a payday loan as apps are faster, don’t charge large fees and you don’t have to pay them back the next day.

This quick-fix may be helpful if you need cash in an emergency but do come with strings.

For instance, borrowing options such as credit cards or taking out a personal loan the cost of borrowing from an app isn’t expressed as an interest rate. The apps may charge subscription or expedited funding fees, and some request a tip.

Lenders and credit card issuers describe the cost of using their product as an annual percentage rate, which accounts for interest and any other fees they may charge.

Peer-to-Peer Lenders

Peer-to-peer loans can be found on online platforms including Lending Club and Prosper, that match up potential borrowers with lenders willing to issue the loans. Keep in mind however that peer-to-peer loans typically come with fees based on the percentage of the amount you’ve borrowed.

Payday Alternative Loans (PALs)

A Payday Alternative Loan, or PAL, is considered a short-term loan with high-interest rates and annual percentage rates, offering a fairly simple application process. To obtain a PAL, you must have proof of income and a bank account and be a federal credit union member.

PALs were created by the National Credit Union Administration in 2010 to assist borrowers in getting a small loan that could be used for important financial needs without the high interest rates and fast repayment requirements typical of traditional payday loans.

In September 2019, the NCUA approved a final rule letting federal credit unions offer a new second payday alternative loan or PALs II. The NCUA reports this loan doesn’t replace the original loan but is a second choice for its federal credit union members.

Home Equity Loans, Home Equity Line of Credit (HELOC) or Cash-Out Refinance

Because these loans are secured by your home’s equity, the interest rates are usually significantly lower than what you’d pay for an unsecured personal loan, particularly if you have bad credit. Even though mortgage interest rates are high right now, they’re still a bargain compared to OppLoans. However, if you can’t repay these loans, you’re putting your home at risk.

READ MORE: Step-by-step guide to payday loan consolidation

The Bottom Line

OppLoans offers installment loans for bad credit borrowers. However, its interest rates are inexpensive compared to similar lenders, but it’s still a high-interest loan.

You might consider OppLoans if you can’t qualify for a personal loan with lower interest rates. But, if you have good credit, you may be able to secure a more attractive loan from an online or local bank.

FAQs

No, OppLoans does not issue credit or debit cards; they are exclusively a lender.

If you have questions or concerns, you can contact the OppFi Customer Support Team by phone at (800) 990-9130, Monday – Friday, 7 a.m. – 11:30 p.m. and Saturday and Sunday between 9 a.m. – 5:00 p.m. Central Time, email at info@opploans.com or write to them at

Opportunity Financial, LLC

130 E Randolph St. Suite 3400

Chicago, IL, 60601

OppLoans is safe from a security standpoint. It is a legitimate lending company. But the high APRs could make it risky for your financial situation. Always weigh your options and do your homework before you choose any lender.