In 2020, roughly 70% of Americans were living paycheck to paycheck. If their earnings were late by just a week, they’d have difficulty meeting their financial obligations. Operating on such a thin margin is what leads people to turn to companies like Evergreen Services. They promise easy and fast cash, but can you trust them? Would you be better off borrowing from another business? This Evergreen Services review will tell you everything you need to know to answer those questions.

Featured Alternative: DebtHammer

- Break the borrowing cycle

- Can help with many types of debt, including payday and tribal loans

- Friendly and helpful customer support – no judgment

Table of Contents

What is Evergreen Services?

Evergreen Services is a short-term installment lender that operates exclusively online. They market their loans as a means of support for people who need a little bit of cash to cover themselves in a financial emergency. The examples they list that might mean they’re worth using are “unexpected emergencies, automobile repair bills, or medical care.” In short, the times when money is supposedly no object.

They emphasize that they’re an expensive form of borrowing that’s not suitable for long-term financial needs. They’re not particularly forthcoming about their interest rates, but digging around elsewhere online reveals that they charge rates well into the upper triple digits, much like the rest of their peers.

Evergreen Services specializes in working with people who struggle with creditworthiness. They don’t check credit scores from the three main credit bureaus, so borrowers can qualify even if they’ve made mistakes in the past or are already struggling with significant amounts of debt.

Is Evergreen Services Licensed?

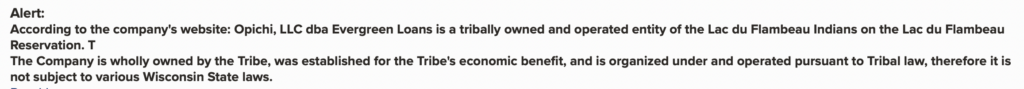

Evergreen Services’ headquarters are in Wisconsin, but they don’t have a license from the state. They do business out of the Lac du Flambeau reservation for Native Americans. While that’s technically in the state of Wisconsin, it is its own sovereign nation in the eyes of the law.

Evergreen Services is a tribal lender, which means that they operate under the laws that the tribe puts forth. Tribal lenders benefit from the tribal immunity of the Native American tribes that they’re extensions of, which essentially means that they’re immune to lawsuits. Evergreen Services is one of the many lending entities of the Lac du Flambeau Band of Chippewa Indians.

Tribal lenders like Evergreen Services can use their status to ignore state regulations in place to protect consumers. Most notably, they use it to get around interest rate limits. They will respect federal laws, but those don’t do nearly as much to regulate lenders in the United States.

Evergreen Services discloses what their status as a tribal lender means on their additional disclosures page.

It reads: “We are not required to follow State laws and you will be bound by the terms of the agreement with Evergreen Services including tribal laws.”

Typical Loan Terms

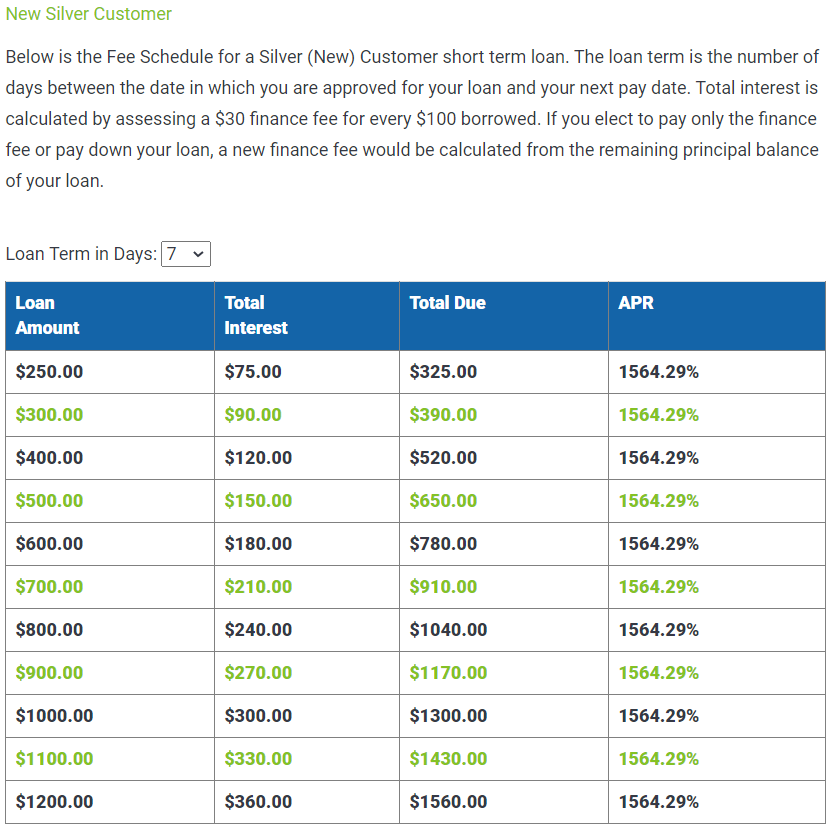

Evergreen Services has become less upfront about its lending terms in recent years. For example, their rates used to be shown publicly on their website, but they’ve since taken them down, likely in an attempt to make their products seem more appealing. However, using the Wayback Machine, it’s possible to pull up their old fee breakdown.

Here’s what borrowers can expect from them:

- Principal balances between $250 and $2,000

- First-time customers can only receive up to $600

- A fee per $100 of principal that ranges from $15 to $30

- Annual Percentage Rates (APRs) that range from 273% and 1564%

- Repayment terms between a few months and a year

- Payment schedules that can be intervals of 7 to 20 days

- Fees for late or nonpayment

- No fees for paying loan balances off early

Evergreen Services may have changed their rates in the past couple of years, but they’re probably not very different from what they were in 2019 when they were public. Unfortunately, borrowers can’t know for sure unless they apply and receive a loan agreement.

Online Reputation

Before committing to doing business with a lender, it’s always a good idea to get an understanding of their track record. The internet makes this a lot easier, especially for online lenders like Evergreen Services. They’ve been around since 2016, so they’ve established an easily verifiable reputation online.

Customer Reviews

The Better Business Bureau (BBB) is a great place to start looking for customer reviews. The site does a better job than most at screening for legitimate reviews and uses the customer information (and business’s responses) to rate the companies in question.

Evergreen Services’ BBB profile only has a handful of customer reviews, but they’re all universally negative. They each give the lowest score possible: 1.17 out of 5 stars. While such a limited sample size can’t provide as much authority as a deeper profile, there are quite a few more complaints against the business that can help shed some light.

There have been more than 42 complaints against Evergreen Services with the BBB over the past three years. Of those, 20+ have to do with the company’s billing and collections process, which isn’t a great sign for a business whose only service is lending.

The details of the complaints raise even more issues, including:

- Unwillingness to accommodate borrowers who are struggling financially due to external factors (like the COVID-19 pandemic) until customers complain publicly

- Rude or unhelpful customer service representatives

- Confusing or conflicting messages about loan terms, including interest rates and repayment schedules

The following alert appears on the BBB page:

Despite these issues, the BBB gives Evergreen Services a B for their customer service. Evergreen Services answers all of the complaints that customers make on the site. They also seem to be willing to forgive loans when customers complain publicly, which is good to know for people who are already in trouble with them.

Lawsuits

Lawsuits are another significant red flag that consumers should make sure to look for when they’re considering borrowing from a lender. There are no results for lawsuits against Evergreen Services itself, but consumers have sued their owners before: the Lac du Flambeau Band of Chippewa Indians.

It’s difficult to effectively bring a lawsuit against a tribal lender, but people still make attempts. Usually, the best strategy is to demonstrate that the lender in question isn’t an extension of a Native American tribe as they claim. That would eliminate their tribal immunity and allow the courts to hold them responsible for the laws they’ve broken.

Unfortunately, the lawsuit against the Lac du Flambeau tribe didn’t use that strategy since the plaintiff went after the tribal leaders. The courts had no choice but to upload the precedent of their tribal immunity.

Pros

Taking out a loan from Evergreen Services is going to be a costly mistake for most borrowers. Even those who can afford to pay off the balance of their loans on their following payday are going to incur expensive fees.

Allowing the loan to play out its full repayment term is definitely the fast track to financial ruin.

Even Evergreen Services admits to this, stating: “Our installment loans are best suited for customers who plan to pay off their principal balance within 1 – 3 months, if not sooner.”

Still, there are reasons that lenders like Evergreen Services continue to do business. Here’s what they have to offer:

- A short and easy application that borrowers can do entirely online

- Low qualification requirements that make them viable for people with bad credit

- Loans for balances as low as $250, which prevents people from feeling like they’re overborrowing

- The ability to transfer loan funds as soon as the following business day

If it weren’t for the outrageously high fees and interest on these loans, they would be genuinely helpful for the financially distressed. As it is, though, they can only really make a bad situation worse.

Cons

There are a lot of great reasons to stay away from Evergreen Services and the rest of the tribal lending industry. These are some of the most notable:

- The effective APRs on their loans are easily more than ten times that of even an expensive credit card (something like 36%).

- Their illegal interest rates set a precedent of breaking the state laws that are only in place to protect consumers.

- Their tribal immunity means that borrowers can’t sue them if they do end up breaking other state laws.

For these reasons, it’s best to avoid taking out a loan from Evergreen Services whenever possible. If a new customer were to borrow $600 from them and somehow repay it in just seven days (highly unlikely), it would still end up costing them $180 in fees. That’s a staggering APR of 1,564%. If the loan were to remain outstanding for even longer, it would get much worse.

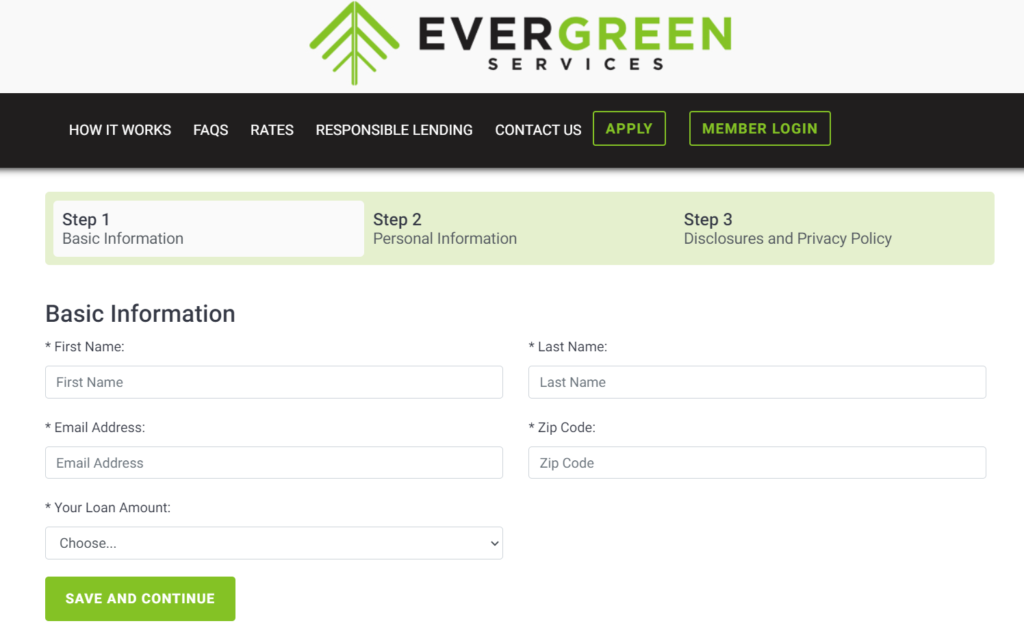

How to Apply for an Evergreen Services Loan

We would never recommend applying for an Evergreen Services loan, but it’s easy to do. They have few qualification requirements, and most working adults should be able to get a loan from them without much hassle.

For Evergreen Services to consider an application, the applicant must:

- Be at least 18 years old

- Have a bank account in their name

- Provide a working email address and phone number

- Be a U.S. citizen or permanent resident

- Not be active military

- Be receiving income

- Live in one of the states that they lend to (see their site for a full list)

These aren’t going to be an obstacle for most people. They don’t even list a minimum income level. In fact, they state that “individuals of all backgrounds and income may apply for an emergency personal loan.”

To fill out the application, consumers will only need to fill out the following sections:

- Basic Information: name, contact details, and loan amount

- Personal Information: income details, banking numbers, and references

- Disclosures and Privacy Policy: Social Security Number and Driver’s License details

Be careful not to complete the application for an Evergreen Services loan on a whim. Handing over this sensitive information is always risky, and they will aggressively pursue people who share even their contact information. As customers note in their BBB complaints, that might include calls at odd hours while sleeping or even while at work.

Better Alternatives to Evergreen Services

People tend to turn to lenders like Evergreen Services because they’re struggling financially and don’t have the credit scores to qualify for a traditional bank loan. While bad credit makes it harder to get a loan, it doesn’t necessitate borrowing from a tribal or payday lender. Here are some of the ways that people with bad credit can get funding without creating even greater financial distress:

- Paycheck Advance Apps: These cash advance apps don’t technically provide loans, but that’s actually a good thing. Users can tap into the earnings they’ve already accrued during a pay period and cash them out ahead of payday for a minimal monthly fee. For example, Brigit allows borrowers to take up to $250 of earnings per pay period.

- Credit Unions: There are many other types of lenders besides banks and tribal installment lenders. Credit unions are some of the most useful to borrowers and will often provide loans to their members at affordable rates, even if they have bad credit. PenFed is a federal union that’s available for anyone to join.

- Payday Alternative Loans (PALs): Another option that consumers can take advantage of from federal credit unions is their PALs, which are virtually identical in structure to payday loans but cost significantly less.

All of these would be superior to borrowing from Evergreen Services. They’re much more affordable and almost (if not equally) as accessible, even for people who have bad credit.

The Bottom Line

If you’ve skipped to the end to get an Evergreen Services review summary or simple recommendation, here you go: Take your business elsewhere if at all possible. Even in financial emergencies, taking out a loan from a tribal lender is probably only going to make matters worse. They’re a trap that many can’t find their way out of after it catches them.

The truth is that debt is almost always going to be a poor way to afford surprise cash emergencies. If you find yourself having to resort to borrowing consistently to make ends meet, something is wrong with your financial equation. Try to find new ways to spend less or earn more so that you don’t need to resort to debt in the first place. If you would like help turning your finances around, reach out to a credit counselor. Their services are free, and you can easily find one near you today!

FAQs

You can reach Evergreen at 866-328-2556 or by email at customerservice@evergreenloans.com.

Evergreen Loans is based in Lac Du Flambeau, Wisconsin.

Evergreen Services does not lend to residents of: Arkansas, Colorado, Connecticut, District of Columbia (D.C.), Georgia, Illinois, Maine, Maryland, Massachusetts, Minnesota, Montana, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Oregon, Pennsylvania, Wisconsin, Vermont, Virginia, Washington or West Virginia.