Personal loans have been rising in the U.S. over the past decade. According to TransUnion, the total outstanding personal loan debt in the United States is $143 billion.

What’s the reason for the sudden increase? Debt consolidation.

According to one recent study, 39.7% of loan applicants with high credit scores used their personal loans to consolidate other debts. The average amount they borrowed came out to be $19,991.

There are several benefits to consolidating debts with a loan, but also a few drawbacks. Here’s a breakdown of the pros and cons.

READ MORE: How debt consolidation works

Table of Contents

Pros and Cons at a Glance

| Pros | Cons |

| Faster repayment | You may pay more over time to get out of debt |

| Simplified personal finances | Missing payments will have serious consequences |

| Fixed repayments | You may only qualify for higher interest rates |

| Lower interest rates | Doesn’t fix underlying spending issues |

| Improve your credit score | You will repay the full amount of your debts |

How Debt Consolidation Loans Work

Debt consolidation involves rolling multiple unsecured debts into one larger loan, ideally with a lower interest rate.

People use these new loans to pay off their credit card debts, medical bills, student loans, title loans, payday loans and other unsecured debts. That leaves them with one larger loan, and one fixed monthly payment.

It simplifies your finances, and the lower interest rate could help you make better progress in paying off your principal. Since you don’t have to juggle multiple payments and know exactly how much you need to pay each month, it will be easier to set up a budget and stick to it, and you’ll have more spending flexibility.

Pro tip: Use the money you’re saving on multiple monthly payments to start an emergency fund.

Gives the borrower more favorable loan terms, such as a more competitive interest rate.

READ MORE: How debt consolidation works

Pros of Debt Consolidation Loans

Debt consolidation has a few key advantages over other debt relief programs:

1. Get Out of Debt Faster

Depending on your total debt, you may be able to get out of debt faster. While credit cards don’t have a set repayment schedule – you just have to make the minimum payments each month – a debt consolidation loan will be on a fixed schedule, and you’ll have to pay a set amount each month.

Pro tip: The faster you can repay your debts, the less you’ll pay in total interest over the life of your loans.

READ MORE: How to consolidate payday loan debt

2. Simplify Your Budget

If you’re struggling to keep track of all of your monthly bills and some get overlooked or skipped, it triggers late fees. With a debt consolidation loan, you can solve this problem because you only have to worry about one monthly payment, and flexible loan repayment terms give you some control over how much you’ll pay each month.

Pro tip: This can help you get on track with budgeting so you don’t consistently overspend.

3. Lower interest rates

Credit card interest rates have steadily risen, with the average card charging about 15% to 20% APR. The average debt consolidation loan interest rate is about 12%. Though rates vary based on loan amounts, term lengths and your credit score, you likely will be able to find a debt consolidation loan with a rate lower than what you’re currently paying.

Pro tip: Debt consolidation works best for people with good credit (scores above 670) because those scores will qualify you for the most competitive personal loan rates. However, some lenders are designed to help bad credit borrowers, so they don’t have a credit score requirement. Even though the interest rates on those loans will be higher, it could still mean significant savings over what you’re currently paying, particularly if you have payday loan or title loan debt.

4. Fixed monthly payments

You’ll know exactly how much you owe each month and when your last payment will be. Credit cards have variable interest rates, while debt consolidation loans will have a fixed interest rate that’s good for the life of the loan.

5. Build credit

Debt consolidation may initially knock down your credit score a bit due to the hard credit inquiry when you apply for the new loan, but that impact will be brief and should only be about 10 points.

Over time you’ll establish a pattern of on-time payments, and payment history accounts for 35% of your overall credit score.

You will also have better credit utilization because of the additional credit you’ve gotten from the new loan. Credit utilization accounts for another 30% of your score.

For example, if you have $20,000 in credit card debt and a total of $40,000 in available credit, your credit utilization will be 50%. But suppose you apply for and are approved for a $20,000 debt consolidation loan and pay off those revolving lines of credit. In that case, your credit utilization ratio will decrease and your credit score will go up – as long as you keep your credit card accounts open.

Pro tip: If you want to close some credit card accounts once your current debts are paid off, make sure you only close the newest accounts. Age of credit history is a key factor in your credit score, so keep your oldest accounts open.

READ MORE: Does debt consolidation close credit cards?

Cons of debt consolidation loans

Debt consolidation also has a few major downsides:

1. You May Pay More to Get Out of Debt

There can be several fees associated with debt consolidation. These include:

- Annual fees

- Balance transfer fees

- Loan closing costs

- Loan origination fees

In addition, because you’re repaying the loan over a longer period of time, you could end up paying more in interest over the life of the loan, despite the lower interest rate.

Pro tip: Seek out preapproval for a debt consolidation loan, and before you choose the loan you want, be sure to ask about fees, including late payment fees or fees for paying your loan off early.

2. You May Not Qualify for Lower Interest Rates

If your credit score is on the lower end, you may end up paying more in interest or not qualify for a loan. In these instances, debt settlement could be a better option for you.

Your debt consolidation loan could come at a higher rate than what you currently pay on your debts. This can happen for a variety of reasons, including your current credit score. If it’s on the lower end, the risk of default is higher and you’ll likely pay more for credit.

Pro tip: Before you start seeking out a debt consolidation loan, review your credit reports and learn your credit scores. See if there are some strategies you can use to bump it up a bit.

3. It Won’t Fix Underlying Spending Issues

Debt consolidation won’t help in the long run if you continue overspending. Many people don’t have the willpower when they see a slew of empty credit cards. In order to get total control of your finances, it’s important to address the issues that led to the debt in the first place. Pack your cards away, remove them from your digital wallet and make using them more difficult. Save one for true emergencies or to cover day-to-day expenses, but make sure you pay that one off in full at the end of each month.

Pro tip: The best way to make debt consolidation work for you is to sit down and map out a monthly budget once your consolidation loan payment is set. If you simply don’t earn enough to cover your monthly expenses without taking on debt, it’s time to do a reality check and either cut your expenses or find a new job or side hustle to increase your income.

4. Missed or Late Payments Could Make Your Situation Worse

This ties into the last point, but if you can’t make the monthly payments on your debt consolidation loan, you will not only rack up late fees but you could end up paying higher interest rates, which means it will cost you more each month and over the life of your loan.

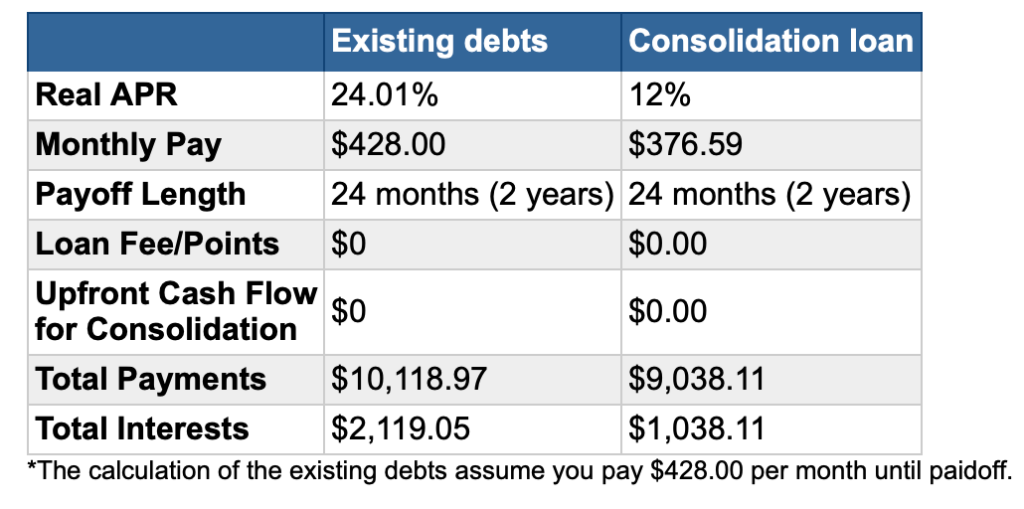

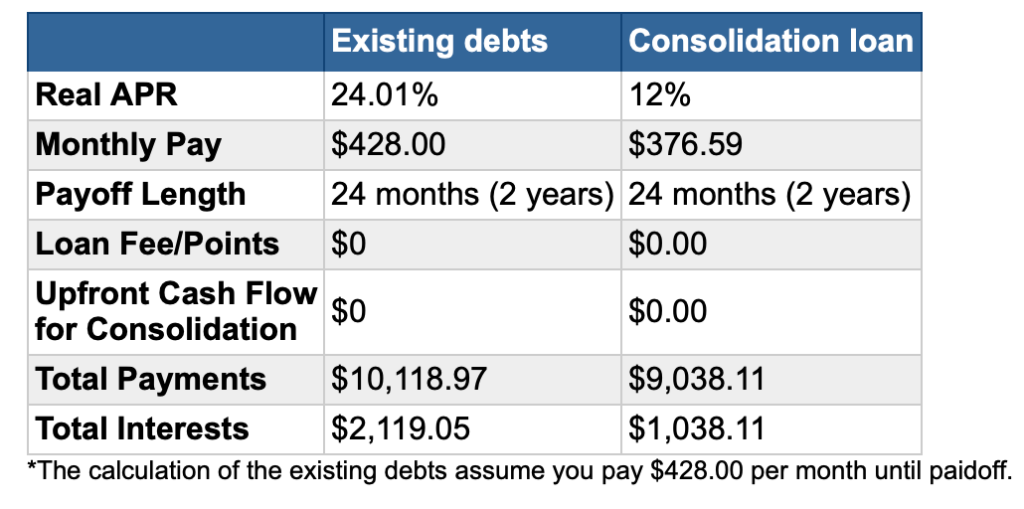

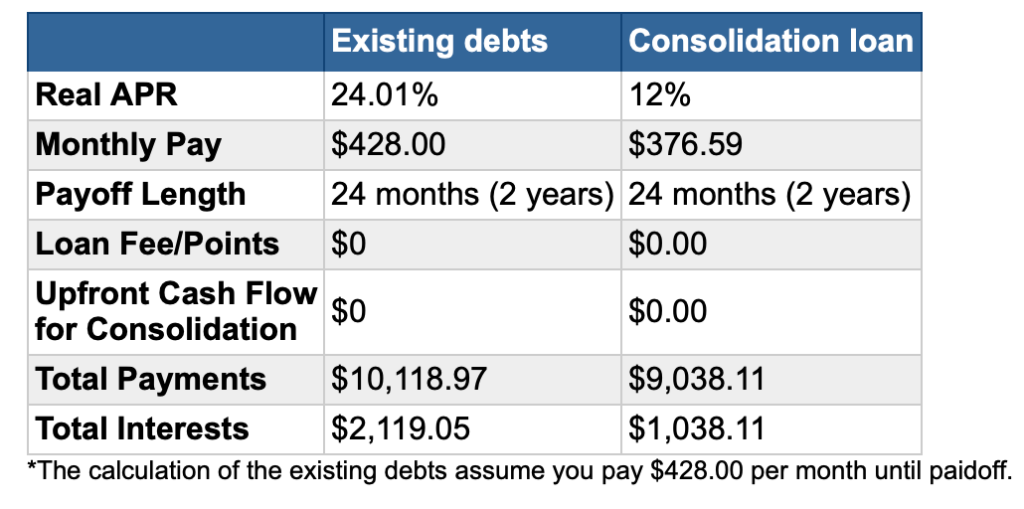

Here’s an example of how much you could save with a debt consolidation loan if you have four credit cards totaling $8,000.

5. You Will Repay the Full Amount of Your Debts, Plus More

With a consolidation loan, not only will you repay your debts in full, you will also tack on some additional fees and interest. With other methods, like debt settlement, you may be able to get out of debt faster and at a lower overall cost.

READ MORE: Credit card refinancing vs. debt consolidation

How Debt Consolidation Loans Can Save You Money

In this example, the borrower has four credit cards to pay off at varying interest rates.

Let’s say the borrower wants to pay these off in 24 months. That person would spend $2,119 in interest. But if they’re approved for an $8,000 personal loan with an APR of 12%, they will save $51 per month in monthly payments and the interest costs will drop by more than $1,080 over that same 12 months, despite the lower monthly payment. This is because they’re paying off higher-interest loans with one lower-interest one.

Here’s how it breaks down:

There are Three Primary Ways to Consolidate Debt

These are the three most effective ways to consolidate debts.

1. Debt Consolidation Loan

Borrowers apply for a new personal loan from a lender. The loan should be equal to or higher than the total debt they want to consolidate. There are multiple options for borrowers at all different credit score levels.

READ MORE: Best debt consolidation loans

2. Balance Transfer Credit Cards

Sometimes credit card issuers will offer new customers the opportunity to transfer existing debts onto the new card but pay 0% interest for an introductory period ranging from 12 to 21 months.

Using the same four loans as above, if a borrower rolls that $8,000 onto a credit card with an introductory offer, here is how much that person would save:

So in addition to paying $35 less per month, the $8,000 would be paid off and the borrower would save almost $2,000 in interest.

There are a few caveats, though. If you miss a minimum payment, you could lose the introductory rate and unless there is a separate offer, there is no grace period on additional purchases. Those will rack up interest at the traditional rate.

READ MORE: Best balance transfer credit cards

3. Home Equity Loan or Home Equity Line of Credit (HELOC)

If you’re a homeowner with some equity built up, it may make sense to consider a second mortgage for debt consolidation. Mortgage rates are on the high end right now, but can be as low as 7.75%, so using one of these could make a lot of sense.

READ MORE: What is a second mortgage?

Should You Consolidate Debts?

Maybe. There are plenty of debt relief options, but debt consolidation is a good option for some families:

- You have less than $7,500 in unsecured debt

- You have a credit score of at least 670

- You prefer making your own payments

- You want one payment

- You can afford to repay the loan

READ MORE: Does debt consolidation hurt your credit score?

How to Get a Debt Consolidation Loan

If you believe taking out a debt consolidation loan is the best option, take the following steps to get one:

- Review all of your bills and calculate your total debt

- Review your credit report and credit score

- Determine the total you need to borrow

- Research lenders

- Review loan offers

- Get prequalified

- Apply

- Wait for loan issuer to send your funds

- Use that money to pay your other bills in full

Types of Debt That Can Be Consolidated

- Medical bills

- Credit card debt

- Student loans

- Payday loans

- Title loans

Pro tip: Secured debts can be consolidated, but it usually won’t make good financial sense since interest rates for secured loans (like car loans) typically have lower interest rates than most personal loans.

Other Debt Relief Methods

- Debt settlement

- Debt Management Plan

- Bankruptcy

READ MORE: Debt consolidation vs. debt settlement

The Botton Line

The idea of taking on new debt to pay off your current debts may seem counterintuitive. But debt consolidation can be an effective debt-relief option, particularly for people who want to maintain their good credit score, don’t have enough debt to consider debt settlement and don’t want to declare bankruptcy.

If you’re disciplined and make all of your debt payments on time, this can be a low-cost way to pay everything off, stop juggling monthly payments and become debt-free.