There are two similar companies with very similar names.

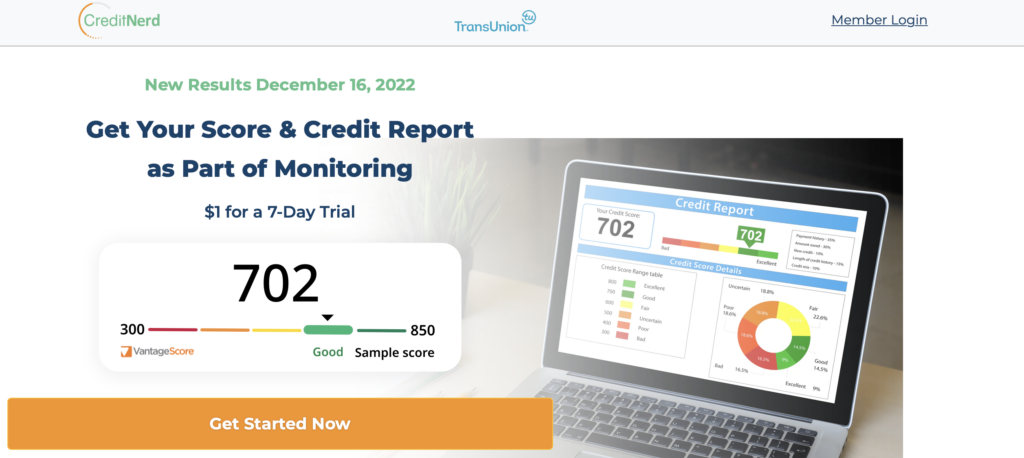

CreditNerd is a credit monitoring service that offers access to your TransUnion credit report and credit scores, along with other credit monitoring services.

Credit Nerds is a small, family-owned credit repair firm noted mainly for offering what they describe as a free credit repair service. Let’s look at what they offer and how they compare to their more prominent competitors.

This review examines both companies. If you’re looking for information on California-based CreditNerd or a comparison of the two, read on. If you’re looking for information on Arkansas-based Credit Nerds, scroll past the CreditNerd information.

Table of Contents

CreditNerd: What You Need to Know

CreditNerd links you to these credit monitoring services.

- Access to your credit score (VantageScore 3.0)

- Unlimited access to your TransUnion credit report

- Credit monitoring with alerts for suspicious activity

- Summaries of positive and negative credit score factors

- Seven-day trial for $1

The fine print at the bottom of the CreditNerd website makes it clear that the services are not provided by CreditNerd and CreditNerd does not actually charge you:

“Credit-Nerd.com is not a supplier of credit monitoring products or services and does not ever process payments or charge consumers directly for services. If you enroll in a service with TransUnion you will be charged by TransUnion in accordance with the terms and conditions presented to you at the time of enrollment.”

CreditNerd offers a single package: a $29.95 credit monitoring subscription with a $1 seven-day trial offer. If you do not cancel the trial offer, you will automatically be enrolled in the monthly subscription.

TransUnion itself offers a similar package for $29.95/month, but without the seven-day trial.

One potential concern is this line from the CreditNerd Terms of Service:

“We may disclose your personal information to a third party for a business purpose or sell your personal information, subject to your right to opt-out of those sales.”

This suggests that CreditNerd makes money in two ways: commissions from TransUnion for referring credit monitoring clients and the sale of user data to third parties. If you do sign up for CreditNerd’s services, we recommend using the opt-out feature.

The CreditNerd website provides very little information about the company. There’s a California address but the same address is advertised as a provider of virtual offices. There’s no phone number on the site.

There’s also no indication of who owns CreditNerd or how long the company has been in business. A California corporation search reveals no companies with that name or a similar name.

CreditNerd at a Glance

| Primary services | Credit monitoring from TransUnion |

| Cost | $24.95/month, 7-day trial for $1 |

| Web URL | credit-nerd.com |

| Company age | Unknown |

| Company address | 222 N Sepulveda Blvd Ste 2000El Segundo, CA 90245 |

| Phone number | Not Provided |

| Mobile app | No |

| Money-back guarantee | No |

| Live chat support | Yes |

| Notable features | Seven-day trial for $1 |

What Makes CreditNerd Stand Out?

Here are some of CreditNerd’s key selling points.

$1 Trial Offer

You can get seven days of CreditNerd’s services for $1. If you need to see your TransUnion credit report and you’ve already used your free annual credit report, this is a cheap way to do it.

If you use the free offer to get your credit report and that’s all you want, you’ll have to remember to cancel the service, or you’ll be subscribed automatically to the full package.

Credit Monitoring

CreditNerd provides access to TransUnion’s credit monitoring package at a discount: the package is $29.95/month from TransUnion and $24.95 from CreditNerd.

You’ll get alerts of changes in your credit reports, instant alerts when there’s a credit application in your name, access to identity theft specialists, $1 million in identity theft insurance, and other features.

If you are at risk of identity theft and looking for a credit monitoring service, this may be worthwhile.

Credit Compass

TransUnion’s Credit Compass feature analyzes your credit report and provides clear, actionable recommendations to help you get the credit score you want. It’s designed not only to show you where you are but to help you get where you want to go.

Unlimited Credit Score and Report Access

You will have unlimited access to your TransUnion credit report and credit score while you are subscribed to CreditNerd.

You should be aware that the credit score you receive will be a VantageScore 3.0. This is not the score most lenders will use to assess your creditworthiness (most lenders use FICO scores). It is also available for free from many providers.

Pros and Cons of CreditNerd

As with any credit-related service, there are pros and cons to consider before signing up with CreditNerd.

Pros

- Instant email alerts if there’s a credit application in your name

- Lock and unlock your TransUnion and Equifax credit reports (you can do this yourself)

- Personalized debt analysis and credit score trending

- Toll-free access to ID theft specialists

- Up to $1,000,000 in ID theft insurance

Cons

- Only partners with TransUnion

- No customer testimonials

- No money-back guarantee

- No mobile app

- Uses VantageScore but not FICO

- You must remember to cancel before the trial ends if you don’t want to keep paying for the service

You’ll also have to consider the fact that there is very little information available about the company, its ownership, or its location.

How to Sign Up for CreditNerd

To sign up for CreditNerd, you will need to provide your name, payment method, and personal information, including your Social Security number. You will be signed up for a seven-day trial and charged $1.

If you do not cancel the trial, you will automatically be subscribed to the credit monitoring service and charged $24.95 each month until you unsubscribe.

CreditNerd App

CreditNerd does not offer a mobile app.

Credit-Nerd.com

CreditNerd’s website is very basic. There’s a home page explaining the services CreditNerd offers and a single link with some very basic information about credit scores and credit monitoring.

The fine print at the bottom offers links to a privacy policy and terms of service. There’s a disclaimer stating that CreditNerd does not actually provide credit monitoring services and that services are only available to US residents.

The website is most notable for what it does not contain. There’s no phone number listed. There’s no indication of who owns or manages CreditNerd.

Is CreditNerd Trustworthy?

No information is available on the measures CreditNerd uses, if any, to secure customer data. It is only described as “state of the art” technology. Any time you provide personal information to a third party, there is some risk that the information will be compromised in a data breach.

CreditNerd’s Terms of Service state that they can sell your personal information to other parties unless you instruct them not to by using the opt-out feature. We would strongly advise opting out.

There is a detailed list of the information it gathers.

CreditNerd provides almost no information about itself or its owners, which could be considered a trust issue.

What are Customers Saying about CreditNerd?

CreditNerd has no presence on the Better Business Bureau website, Trustpilot, or any other review site that we were able to locate. No customer feedback is available.

The Bottom Line

CreditNerd could be useful in two circumstances.

- If you’re looking for credit monitoring, CreditNerd connects you to TransUnion’s service at a $5/month discount. Remember that many financial products provide credit monitoring for free: check your bank and credit card providers!

- If you just need to see your TransUnion credit score, CreditNerd’s $1 trial is a cheap way to do it if you cancel before the seven days are up.

Paying for access to a VantageScore is not a good idea: there are many ways to get it for free.

You will also be handing sensitive personal information to a company that won’t tell you who owns it, what its phone number is, or even give you a real address. You’ll have to decide whether that’s something you want to do!

Credit Nerds: What You Need to Know

Credit Nerds offers two services: credit repair and “lending and financing.” Credit Nerds is not a lender: the lending and financing service involves connecting clients with other lenders.

Credit Nerds claims that its credit repair service is free. That is technically true. They do, however, require that clients open a three-bureau credit monitoring account that costs $39.95 per month. Credit Nerds states that most clients use their services for four to six months.

The credit repair service includes offerings similar to those of most other credit repair companies:

- Unlimited negative items

- Unlimited bureau disputes

- Unlimited creditor disputes

- 24/7 online access portal

Unlike many larger credit repair companies, Credit Nerds does not print and send your dispute letters for you. You will have to do that yourself.

They also offer an optional one-time “credit audit” for $97. Credit Nerds says this involves a detailed analysis of your credit reports with recommendations for improving them.

The Credit Nerds lending and financing service charges 9.99% of the sum you borrow, capped at $4,995. This is in addition to any fees charged by the lender.

The Better Business Bureau (BBB) page on Credit Nerds indicates that the company has been in business since 2011, but has no complaints or reviews. Credit Nerds is not BBB accredited.

Eric and Stephanie Counts of Paragould, Arkansas are listed as co-owners, suggesting a family-owned business.

Credit Nerds at a Glance

| Primary services | Credit repair, connection to lenders |

| Cost | Credit repair: $39.95/month for 3-bureau credit monitoring. Credit Report Audit: $97 Lending: 9.99% of the amount you borrow. |

| Web URL | creditnerds.com |

| Company age | BBB file active since 2011 |

| Company address | 3008 W Kingshighway Suite 2, Paragould, AR 72540 |

| Phone number | (501) 441-2107 |

| Mobile app | No |

| Money-back guarantee | No |

| Live chat support | Yes |

| Notable features | Unlimited negative items, bureau disputes, and creditor disputes, low cost relative to most credit repair companies |

What Makes Credit Nerds Stand Out?

All credit repair services identify and dispute potentially removable items on your credit report. So what makes Credit Nerds special?

The Price

Credit Nerds states that their credit repair service is free. That is not quite the case – you have to pay $39.95 a month for a credit reporting service, and we’re pretty sure that some of that money finds its way back to Credit Nerds. That’s still quite a bit less than most competing services.

Let’s look at how Credit Nerds’ monthly pricing stacks up to some much larger competitors.

| Credit Nerds | Lexington Law | Credit Saint | Sky Blue Credit Repair | |

| Number of Plans | 1 | 3 | 3 | 1 |

| Monthly Price Range | $39.95/month | $95.95 to $139.95 | $79.99 to $119.99 | $79 |

Many services also have an initial fee, and Credit Nerds does not. It is not clear whether clients have to retain the credit monitoring service in order to start the process and receive an initial assessment.

Unlimited Disputes

Credit Nerds states that their service provides unlimited disputes with both credit bureaus and creditors. Many other services have limits to the number of accounts you can dispute, especially among the cheaper plans.

Unlimited disputes will only matter if you have a large number of disputable accounts. Rember that you will have to print and send your letters yourself if you use Credit Nerds.

Optional Audit

Credit Nerds offers an optional credit report audit for $97. It is not clear how this differs from the initial credit report assessment that most credit repair companies offer.

Some reviews state that Credit Nerds offers a free initial consultation and that the credit monitoring service includes up to $100,000 in identity theft insurance. These claims do not appear on the Credit Nerds website and cannot be independently verified.

Lending and Financing

Credit Nerds offers to connect clients to lenders that can provide personal and business financing. They claim to have helped customers obtain over $100,000,000 in financing. Credit Nerds charges $9.99% of the amount financed, up to a maximum charge of $4,995 (you’d have to borrow $50,000 to pay that much). This is in addition to any origination fee charged by the lender.

That’s a very substantial fee, and you can apply for loans yourself.

Partner Program

Credit Nerds has a partner program that will pay you to refer clients to them. The program has three tiers, and two of them are paid, at $225/year and $475/year. Unless you are in a position to refer large numbers of clients, paying for this program is probably not going to be profitable.

Pros and Cons of Credit Nerds

Pros

- Live help via chat

- Low prices

- Unlimited disputes

- Daily credit score and credit report updates

- Lock and unlock your credit reports with ease

Cons

- It isn’t really free

- Customer service hours are not disclosed

- No money-back guarantee

- No mobile app

- Hard inquiry disputes aren’t available

- Few customer testimonials

- Credit Nerds’ founder has an arrest record

Credit Nerds Founder: Legal Issues

Reports from local media in Arkansas indicate that Credit Nerds founder and co-owner Eric Counts was arrested in January 2021 in Jonesboro, Arkansas on serious criminal charges.

We can find no record of a trial and no indication of whether Mr. Counts was found guilty or not guilty, or even whether or not a trial has taken place. Prospective clients will need to research and decide for themselves whether the charges should influence their decision.

How to Sign Up for Credit Nerds

If you click “Start Here” on the Credit Nerds site you’ll be directed to an FTC-required page explaining your rights as a credit repair consumer. From here you’ll be directed to an information form where you’ll supply your name and contact details.

Once you submit the form, Credit Nerds will contact you.

The Credit Nerds App

Credit Nerds does not have a mobile app. This is a small family owned business and presumably does not have the resources to develop its own app.

CreditNerds.com Website

The Credit Nerds website is simple and straightforward. The only complication is that if you click “Get Started Now” you’ll be redirected to the “Services” page, where you’ll click on the service that interests you and select “start now”.

The Credit Nerds website does not have an “About Us” page and provides very little information about the company. The site does make it clear that Credit Nerds can only dispute inaccurate, unverifiable, or outdated items and does not promise to improve your credit score.

Is Credit Nerds Trustworthy?

The Credit Nerds website gives no information on data security measures. The privacy policy states that they do not sell or rent personal information to third parties, but that they may share it as necessary to carry out agreed-upon services.

All of this is standard in the credit repair business. Any time you provide personal information to an outside party there is some risk that the information will be exposed in a data breach, and smaller companies may not have access to state-of-the-art data security.

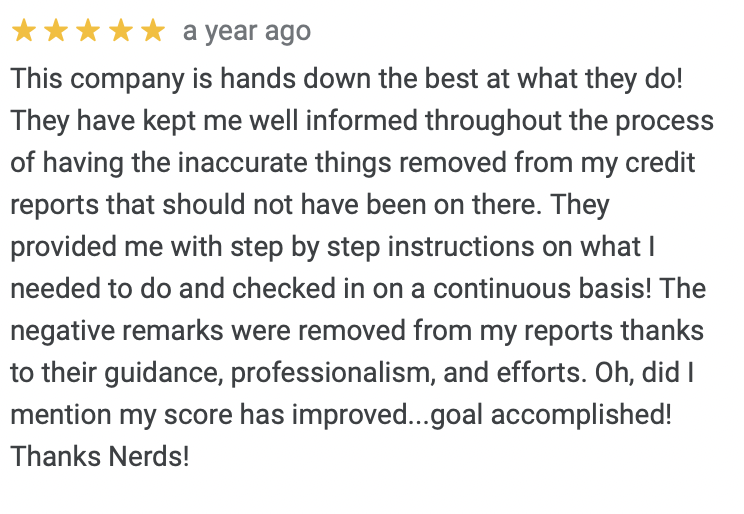

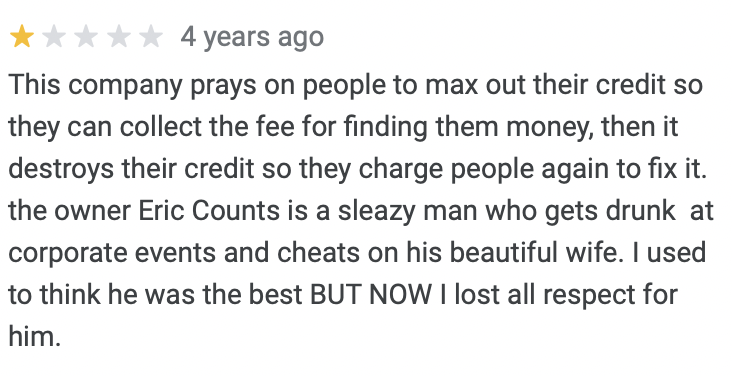

What are Customers Saying about Credit Nerds?

Credit Nerds is a relatively small company and online discussion is limited. There are no reviews on the BBB or Trustpilot sites.

Credit Nerds has 21 reviews on Google, with an average of 3.6 of 5 stars. There are several extremely positive reviews and also some very negative ones. For example,

Another review site, Best Company, gives Credit Nerds 4.5 of 5 stars from 35 reviews.

It’s difficult to accurately assess the honesty of reviews based on such a small sample. There are two fundamental realities of customer reviews in this business.

- Some companies do plant positive reviews of themselves, either through associates or using fake accounts.

- Some negative reviews come from customers who did not fully understand the business, had unrealistic expectations, or were simply impossible to satisfy.

We also note that Credit Nerds has an affiliate service that pays for referrals. People who have an affiliate relationship with Credit Nerds have an incentive to post positive reviews.

Given the limited number of reviews and the difficulty of knowing which reviews are legitimate, it’s difficult to draw any reliable conclusion, positive or negative, from the Credit Nerds reviews.

The Bottom Line

The Credit Repair business is dominated by large, nationally advertised firms. Credit Nerds is the opposite: a small family-owned business.

For potential clients that could have positive and negative implications. Working with a smaller company could give you a more personal experience, but a smaller company might not have the resources and connections to fully investigate or assess some problems or provide comprehensive data security.

If you’re considering using Credit Nerds you’ll have to first assess whether you really need a credit repair company or a loan broker – you can dispute credit report entries and apply for loans on your own – and you’ll have to do your research and compare Credit Nerds and its services to its better-known competitors.

If Credit Nerds actually does what it claims to do, its credit repair service would be a great deal. The lack of substantial customer feedback and the questions surrounding its owner’s legal record make it difficult to determine whether this is the case and whether the service is truly reliable.