One of the best ways to teach your kids about credit is to let them learn through experience.

Some parents want to give their kids credit cards as a learning tool or to help them out if they’re in a position where they suddenly need money.

Pro tip: This is more complicated than it sounds. Banks won’t extend credit to anyone under 18. The only way to get a credit card for a kid younger than 18 is to add them as an authorized user on your own account.

However, there are plenty of debit cards available for kids and families.

| Debit card | Best for… | Cost |

| GoHenry | Best overall | First month free, then $3.99 per month |

| Greenlight | Best for learning the basics | $4.99 per month |

| Chase First | Best for families that bank with Chase | Free if parents have Chase checking |

| Copper | Best no-cost service | Free |

| Current | Best for instant transfers | Free but has an out-of-network ATM fee |

| Jassby | Best for parental controls | $4.99 for a physical debit card |

| FamZoo | Best for learning as a family | $5.99 per month |

| BusyKid | Best for instant notifications | $3.99 per month |

| Purewrist | Best wearable technology | $25 |

| Jelli | Best for “jar” system | Free |

Table of Contents

Why Kids Can’t Have Credit Cards

To open up a credit card account, you have to be able to sign a legal contract. In the United States, you must be eighteen before your signature will be considered legally binding. Teens younger than 18 are still considered minors. This is why it is possible for parents to add their younger kids to their existing credit card accounts but cannot open an account in their child’s name.

Even if your fourteen-year-old did have a legally binding signature, they likely wouldn’t meet the minimum criteria required by the credit card issuer. In addition to the ability to enter a contract, that criteria can include minimum independently earned income requirements, an existing credit score, an established credit history, etc. You can find out more by checking out the CARD Act of 2009.

However, because your credit score doesn’t start at zero, your teen must establish a baseline credit score. This will be a big help when your child needs to apply for a car loan, get a cell phone, apply for a student loan or get a credit card of his/her own. While starting out with no credit is not as bad as having bad credit, it’s a big advantage to start building a credit score early.

READ MORE: Credit cards for college students

10 Best Debit Cards for Kids

Your own bank or financial institution is probably going to be your first stop when trying to set up a debit card or “credit” card for your kids. But what if your bank doesn’t offer this product? Or what if you don’t like the way the program works? There are a lot of options out there. How do you choose which one is right for your family?

This is where research skills come in handy. Take some time to explore the options available in your area. Check the cardholder agreements. Are there monthly or annual fees? Find out what kind of terms and conditions are associated with each card. Which banks back these cards? What do the reviews say? Here are some of our favorites to help you start your search.

Best Overall: GoHenry Mastercard Debit Card

GoHenry is a trailblazer in the world of personal finance for kids, and not just because they used crowdfunding to get up and running. The app was created by parents to help parents. Their focus isn’t just to provide a receptacle for your kids’ allowance — any prepaid debit card can do that. GoHenry wants kids to actually learn from their app.

Fees

The first month is free and then it’s $3.99 per month every month after that, for as long as you are a member.

Ratings/Reviews

- iOS (Apple) Store Rating: 4.6 of 5 stars

- Google Play Rating: 4 of 5 stars

- TrustPilot Rating: 4.1 of 5 stars

- Better Business Bureau: A+

Noteworthy features

GoHenry isn’t just a debit card that parents can fund and monitor. Obviously, those features are there, but the team at GoHenry wanted their apps actually to help kids learn about money management. They do this via “money missions.” When your kids complete these missions, they earn badges and points.

The app/card also offers families the ability to set savings goals. GoHenry offers real-time spending notifications every time your kid uses their card or makes a withdrawal so you can monitor the card balance. The debit card also offers a variety of parental controls — including the ability to lock the card. Another fun feature is that GoHenry allows you to customize each card with your child’s first name and an image based on one of their hobbies or interests, giving them a sense of ownership.

Other Top Debit Card Options for Kids

While GoHenry is a favorite, it is far from the only option out there. Here are other choices if GoHenry isn’t quite what you want.

Best for Learning the Basics: Greenlight Debit Card for Kids

- Fees: Start at $4.99/month, which includes up to 5 kids and 2 adults

- Apple Store Rating: 4.8 of 5 stars

- Google Play Store Rating: 4 of 5stars

- Amazon App Store Rating: 4 of 5 stars

- TrustPilot Rating: 4.3 of 5 stars

- Better Business Bureau Rating: B

Noteworthy Features

In addition to a spending account, kids earn interest on money they save. The app also teaches kids the basics of investing (if they want to explore that subject), has a financial literacy content library, and offers a cash-back perk that deposits 1% of what kids spend into savings. You can customize each card with your kid’s photo.

Best for Families that Already Bank with Chase: Chase First Banking

- Fees: No monthly fees, but parents must have a qualifying Chase checking account.

- Apple Store Rating: 4.8 of 5 stars

- Google Play Store Rating: 4.3 of 5stars

- TrustPilot Rating: 1.4 of 5 stars

- Better Business Bureau Rating: B- (TrustPilot and BBB reviews are for Chase Banking as a whole, not just Chase First debit card and mobile app)

Noteworthy Features

Chase also offers checking/spending accounts for teens over the age of 13. Everything can be monitored through the Chase app. In addition to a spending account, Chase also offers opportunities for saving and earning money—parents can set up specific tasks that are assigned a dollar value. As kids complete those tasks, the fee is deposited into their debit card account.

Best No-Cost Option: Copper Banking Teen Debit Card

- Fees: None

- Apple Store Rating: 4.9 of 5 stars

- Google Play Store Rating: 4.7 of 5 stars

- TrustPilot Rating: no rating yet

- Better Business Bureau Rating: no rating yet

Noteworthy Features

It’s FDIC insured, connects to parent’s bank account, offers rewards for referrals and can be used at ATMs.

Best for Instant Transfers: Current Teen Banking

- Fees: Out-of-network ATM fee

- Apple Store Rating: 4.7 of 5 stars

- Google Play Store Rating: 4.6 of 5 stars

- TrustPilot Rating: 4.1 of 5 stars

- Better Business Bureau Rating: B

Noteworthy Features

Parents can block specific merchants, monitor spending and transfer money instantly. It’s FDIC insured. Teens can use their card to fill up the gas tank and if they don’t have enough to cover the cost, the balance will be debited from their parent’s account, which eliminates overdraft fees.

Best for Parental Controls: Jassby Virtual Debit Card

- Fees: $4.99 to get a physical debit card

- Apple Store Rating: 4.3 stars

- Google Play Store Rating: 3.7 stars

- TrustPilot Rating: 3.7 stars

- Better Business Bureau Rating: A+

Noteworthy Features

The card includes financial literacy tools, rewards to use in the “Jassby Shop,” parental controls and has no monthly fees.

Best for Learning as a Family: Famzoo Prepaid Debit Card

- Fees: $5.99/month; membership covers every family member. $4.95 fee to reload a card using cash (via Greendot locations). $3 Card replacement fee.

- Apple Store Rating: 4.6 of 5 stars

- Google Play Store Rating: 4.8 of 5 stars

- TrustPilot Rating: No reviews yet

- Better Business Bureau Rating: Not listed

Noteworthy Features

Parents can lock/unlock a card as needed. The family billing plan can help parents show their kids how much bills, food, etc. actually costs.

Best for Instant Notifications: BusyKid Visa Prepaid Spend Debit Card

- Fees: start at $3.99/month.

- Apple Store Rating: 3.5 of 5 stars

- Google Play Store Rating: 3.8 of 5 stars

- TrustPilot Rating: 3.7 of 5 stars

- Better Business Bureau Rating: A

Noteworthy Features

The card is FDIC insured and offers kids opportunities for earning, sharing, and saving money. Parents must approve spending choices. Parents can also get real-time notifications for all activity on their kids’ accounts.

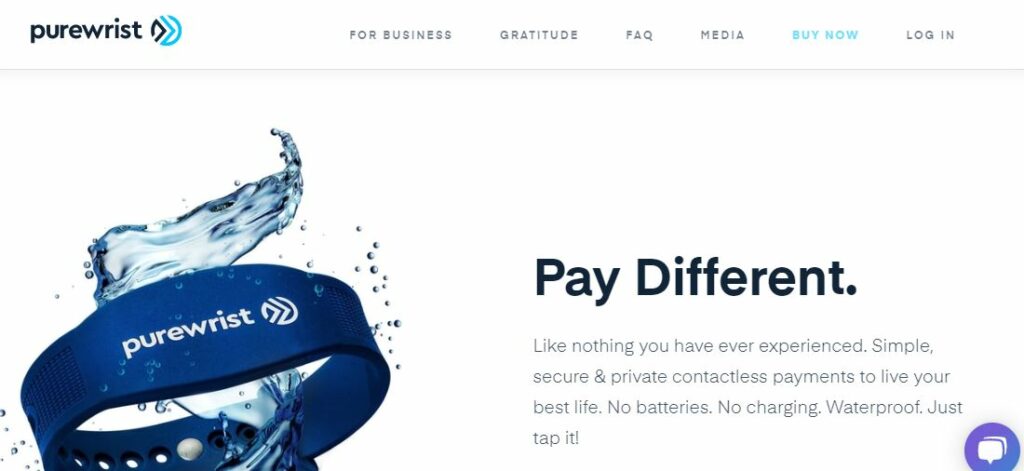

Best Wearable Technology: Purewrist

- Fees: Cost for the bracelet starts at $25.

- Apple Store Rating: 5 of 5 stars

- Google Play Store Rating: 4.9 of 5 stars

- TrustPilot Rating: Not rated yet

- Better Business Bureau Rating: Not rated yet

Noteworthy Features

This isn’t technically an app for teens or kids; it’s a wearable fintech device that can be used by parents as a prepaid “card” to help monitor/fund allowances, teach good spending habits, etc.

Best for the “Jar” System: Jelli

- Fees: None

- Apple Store Rating: 4.4 of 5 stars

- Google Play Store Rating: 3.4 stars

- TrustPilot Rating: Not rated yet

- Better Business Bureau Rating: Not rated yet

Noteworthy Features

Jelli offers FDIC insurance via Metropolitan Bank. The “jar” system allows users to save for several goals at once, making it a solid choice for older teens.

How Do Debit Cards for Kids Work?

A debit card for kids is a card that connects to an existing funding source. This can be your bank account, a bank account that you help them set up, or even a prepaid card that you fund and closely monitor.

The card functions a lot like your debit card functions. The biggest difference is that the parents have more control over debit cards for kids. They can set spending limits. They can block stores or online shops. The list goes on.

Benefits of Debit Cards for Kids

The biggest benefit of setting up debit cards for your kids and teens, of course, is that it provides a tool to help kids understand — in a hands-on way — how money management works. Do you remember when your parents tried to teach you about spending by making you help them balance their checkbook? Setting your kids up with a debit card is a step up from that.

The reason helping your parents balance their checkbook didn’t hit home is because you were still working with someone else’s money. And credit cards (and credit) offer many advantages in adulthood.

Sure, you might give your kids an allowance, but how often do you really think your kids will use cash as adults? Getting them into the practice of managing money with a debit card helps them understand how, even when money isn’t tangible, it is very easily spendable. It’s important to watch your numbers carefully!

Want more information on no-fee debit cards for kids? Check out this video:

Why Can’t Kids Have Credit Cards?

Like opening a credit card, setting up an independent bank account requires the ability to legally sign a contract. The minimum age to sign a contract in the U.S. is 18. That age requirement limits your options, but there are a couple of workarounds.

Best Credit Card Option for Kids: Add Them as Authorized Users

You can add your kids or other family members as authorized users to one of your own credit card accounts. If it’s an account you don’t use regularly, you can ask to have your credit reallocated to a different card to keep the credit limit on the kids’ card low.

Other Banking Options for Kids

Open a Sub-Account from Your Own Bank Account

Some banks allow account holders to set up “sub” accounts that piggyback off of their central accounts. These sub-accounts can come with debit cards, and they are a great way to help your younger kids get used to the idea of managing their allowances. Just make sure that, if your child tries to spend more than they have that there are blocks in place to keep that transaction from going through!

Open a Joint Banking Account

Many banks allow people under the age of 18 to open their own bank accounts by having a parent or legal guardian act as a co-signer on the contract. Going this route means that you have joint control over the account. That does not mean, however, that you’ll have access to tools like setting spending limits, blocking merchants, etc.

A joint account is a good idea for older teens who you trust to have at least a basic understanding of how money works.

The other benefit to a joint account is that, once your child turns eighteen you can take your name off of the account and voila! Their first independent bank account is ready to go.

How Credit Cards Stack Up Against Prepaid Debit Cards

Unlike credit cards, prepaid and debit cards for kids do not require a credit score. They usually have no effect on your or your child’s credit score at all. This makes them safer because if your child messes up and spends too much, they can learn how to fix their mistakes without the prospect of having to deal with the fallout for years.

When your child is in high school and has more recurring payments like car payments, payments for streaming services, etc., finding a card that will report those on-time payments to the credit bureaus is a great way to help them begin building a top-notch credit score and payment history.

Debit Cards Usually Don’t Build Credit

There is one downside: with just a few exceptions, debit cards do not help young people build credit. They are still very useful tools, though! Debit cards can offer practical experience in:

- Money management

- Tracking one’s spending

- Managing an account balance

- Setting up and following a budget

- The importance of avoiding fees and high interest rates on purchases

Tips to Teach Credit Use at a Young Age

American Express offers the following financial education tips to help your kids learn good money habits.

- Go through their statements and talk about each purchase

- Make sure they understand how interest rates and other fees work

- Teach them about credit card debt and how quickly it can add up

- Teach them about prioritizing their spending. Using a color scheme works well. For example, using green for purchases that must be made (e.g., school supplies), yellow for purchases that would be nice but aren’t absolutely necessary (like new clothes for school or work), and red for purchases that you don’t actually need but only want to make (video games, toys, etc.)

American Express also recommends that, when they have proven that they can handle money responsibly, that you add your child to your credit card account. Adding them to your account will help them begin to establish their own credit score and history. This will come in handy later when applying for loans or other types of financing.

The Bottom Line

Your kids are never too young to start learning about financial responsibility. It’s easy enough to begin these lessons with a simple allowance payment each week. As your kids get older, however, it’s good to teach them about fees, interest rates, how to save money, budgeting for multiple things at the same time, investing, etc. Credit cards and debit cards for your kids allow you to teach them in a hands-on, practical way. That is, after all, how children learn best!

FAQs

While Discover does offer a checking account, it requires all account holders to be over the age of eighteen. They do not offer a debit card for kids at this time.

The best way to start a savings account is to open a savings account and stick to it. Your current bank likely has savings accounts that you can set up with just a few mouse clicks. If you’ve done that, and you want to ramp up your savings, you’ll have to do some research. Figure out exactly what you want from your savings — to earn a high interest rate, to be untouchable for a fixed number of years, etc. Then compare the different options that are available. Set up the amount you want to put in it to electronically deposit each week or month. It’s easier to build savings if the money goes directly into an account so you can’t spend it.

You need good credit to qualify for everything from renting an apartment to getting a car loan. The earlier you begin building up a positive credit history, the better. After all, the better your credit score/history, the lower your rates and fees will be and the more likely you are to get your funding requests approved.