There are thousands of lenders in America, and they come in all sorts of varieties. You can borrow money from international banks, local credit unions, online lenders, and even your peers these days. Before you commit to any lender, though, you need to do your homework. Taking on debt is a high-stakes game, and you need to make sure you only work with lenders that are both affordable and trustworthy. If you’re currently considering borrowing from Loan at Last, there’s a lot you need to know about their products and operation. Let’s take a look at Loan at Last before you decide whether or not they deserve your business.

Featured Alternative: DebtHammer

- Break the borrowing cycle

- Can help with many types of debt, including payday and tribal loans

- Friendly and helpful customer support – no judgment

Table of Contents

What is Loan at Last?

Loan at Last is an online, short-term installment lender. They offer loans to people with bad credit, allegedly to help them get through unexpected financial crises. They’re far more expensive than most other loan providers, though, so even they recommend that people use them only when absolutely necessary.

For example, they list “car repair bills, medical care, or essential travel expenses” as costs that might force people to need a loan from them. The idea is that, in these cases, money is no object. Unfortunately, they take full advantage of people in dire need and charge much higher rates than most people can reasonably afford, especially those who are low on funds in the first place.

If this strategy sounds familiar, it’s because it’s virtually identical to the tactics that payday lenders have been using for decades. They target people who have little to no other financial recourse and charge them astronomical interest rates for the privilege of borrowing a few hundred dollars.

Is Loan at Last Licensed?

Loan at Last’s headquarters is in Lac du Flambeau, Wisconsin. However, they don’t have a license from the state. Loan at Last is a tribal lender, which means they operate under the laws and regulations put forth by a Native American tribe. In this case, that tribe is the Lac Du Flambeau Band of Chippewa Indians, a Federally Chartered Sovereign American Indian tribe.

Native American tribes have special protection under federal law that they call “tribal immunity.” In simple terms, it means that it’s almost impossible to bring a lawsuit against them successfully. As a result, they can often get away with business practices that no other lender could, most notably, charging interest rates far above state limits.

Unlike many of their peers, Loan at Last is forthcoming about their tribal status, though they try to minimize its significance. They claim that tribal lenders are safe to work with because they abide by federal laws, but those do very little to protect consumers. It’s the state laws that restrict payday and installment lenders, and they make no mention of those.

Typical Loan Terms

Loan at Last doesn’t seem to want to publicize their loan terms. For example, they don’t disclose their rates on their website. Borrowers can’t learn the specifics of the loans until they apply and receive a loan agreement. Here are the few details they share upfront:

- Principal balances between $100 and $3,000

- First-time customers can only receive up to $1,200

- $20 late fee (5 days after the due date)

- Non-sufficient funds fee of $30

- No prepayment fees

The only way to get a clear understanding of their interest rates, repayment terms, or payment schedules is to apply and receive a loan agreement. It’s a risky choice to hand over personal information to a lender without knowing what they might provide in return. It’s probably better to find a lender who is more upfront with what they’re offering.

Online Reputation

Loan at Last has been around since at least 2015, so there’s quite a bit of information about the business online. There are plenty of Loan at Last review pages that have expert and customer opinions on them. To minimize the time needed to read through them all, here are some of the highlights.

Better Business Bureau

One of the best places to start researching any company is with the Better Business Bureau (BBB). They do a great job of making sure the complaints on their site are from legitimate customers. The BBB also studies the way businesses respond to complaints and rates the company’s customer service.

Loan at Last’s BBB rating is a B. That isn’t a terrible score, but it’s not exactly a great one either.

There have been more than 72 complaints against them over the last three years, which is higher than usual. They’ve responded to all but one of them, though, which is why their rating is still respectable. Of the complaints, most are about billing and collections issues, while about one-third are about problems with the loan product itself.

The user reviews on their profile aren’t quite so charitable. There are about 37 total, but they’re almost universally negative, leaving them with an average rating of 1.42 out of 5 stars. The positive reviews mostly say that even though Loan at Last is expensive, they give ample warning of that fact, so borrowers shouldn’t be upset about it.

Customer Review Sites

The BBB website is great for getting a baseline understanding of a company, but there are usually fewer user reviews there than at other crowdsourced review sites. It’s usually worth checking out the others as well.

Unfortunately, the Loan at Last review page on Trustpilot is the only other one with any significant insights. The scores on that page are much more positive than those at the BBB, but Trustpilot can sometimes be unreliable. It allows businesses to have too much control over their profiles, and there are ways companies can manipulate things to make themselves look better.

Here are some of the reasons Trustpilot isn’t very trustworthy:

- Businesses can pay Trustpilot to protect themselves from negative reviews (Loan at Last is one of these premium members).

- Businesses can inflate their scores by directly inviting ratings from people that are inclined to give positive reviews.

- Anyone can post a review on the site with few to no filters or verification of identity.

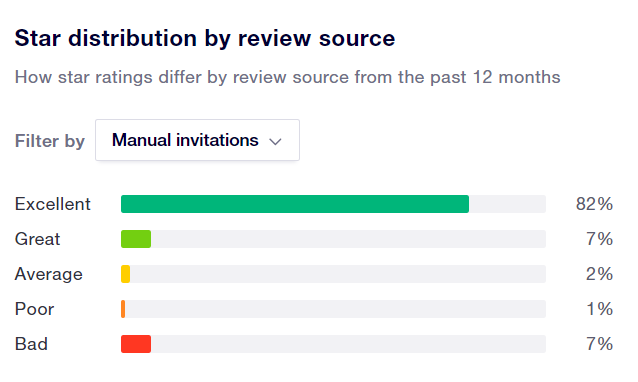

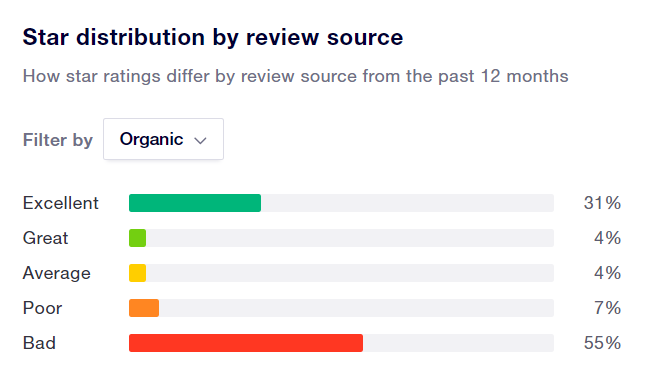

For these reasons, Trustpilot is the preferred review site for many tribal lenders. There are ways to get a better picture of what’s happening, though. For example, filtering reviews by source reveals that the average score is much lower for organic reviews than it is for invited views.

Also, it’s clear that Loan at Last puts a lot of effort into maintaining their score on this page, given that of the 1300+ reviews present, more than 90% are from manual invitations.

Lawsuits

It’s also a good idea to double-check whether a lender is involved in any kind of lawsuit over their business practices before working with them. Unfortunately, Loan at Last has at least one legal battle in the public record.

Like many tribal lenders, they have a class-action suit against them for their outrageous loan prices. In 2019, a plaintiff alleged that Loan at Last charged interest rates nearing 700%, which was far higher than the legal limit in their state of Pennsylvania.

Pros

It’s rarely a good idea to borrow money from a tribal lender, and Loan at Last is no exception. That said, it’s completely understandable that so many people choose to do so. They’ve refined their marketing and business strategy down to a science and lure people in with the following:

- A short and simple application process that people can fill out entirely online

- Virtually nonexistent qualification requirements that almost any working adult can meet

- Short turnaround times when it comes to applications and balance transfers

- Flexible principal balances that can cover most unexpected cash emergencies

Especially given how cagey Loan at Last is about their specific interest rates, their installment loans look like a great alternative to payday loans. Once people find out that the cost is far higher than they expected or understood, it’s often too late.

Cons

Loan at Last has all the typical downsides of a tribal lender. They’re an unreasonably expensive form of borrowing, and most people would be better off with almost any other type of financing (except payday loans). Here are the problems with the company:

- They offer loans to people who will probably struggle to make payments, then charge steep fees that punish them for failing

- Their rates are far higher than other types of lenders that work with people who have bad credit

- As a tribal lender, it’s almost impossible to sue them for breaking the laws (which they’ve proven they’re not above doing)

In some ways, Loan at Last might be even more dangerous to work with than other tribal lenders. With most of them, it’s possible to gauge their rates ahead of time. Loan at Last won’t say how much their products cost (other than “expensive”) until an applicant has already given them their personal information.

How to Apply to Loan at Last

For those who still want to apply to Loan at Last, there is some good news: It’s incredibly easy to do, and the majority of applicants will probably receive the loan they want. These are the only requirements that borrowers need to meet to apply:

- Be at least 18 years of age

- Not be currently or plan to be a debtor in a bankruptcy case

- Have a valid checking account

Anyone who meets these requirements can apply for a loan from Loan at Last. The application will ask for the applicant’s contact, income, and checking account information.

The application is easy to fill out, and shouldn’t take more than a few minutes. Applicants will know whether or not they qualify within just a few minutes. If they do, they can expect to receive their funds in as little as a single business day after signing the loan agreement.

Applying for a loan from Loan at Last is a quick and easy process, but filing it out is still a significant commitment. Once they have a person’s personal data, there’s no telling how they’ll use it. Even if they don’t abuse it themselves, they may sell it or simply fail to protect it, so don’t apply without considering the risks.

Better Alternatives to Loan at Last

Anyone who reads this Loan at Last review will know that borrowing from the tribal lender is risky. Some people may do it anyway, though, because they don’t think they have a choice. They expect to pay high interest rates because of their lack of creditworthiness.

That doesn’t have to be the case. There are plenty of financing options out there for people with bad credit that don’t have interest rates in the triple digits. Here are some of the best choices for people who need some fast cash:

- Paycheck Advance Apps: Installment loans and payday loans all have principal balances that are designed to help people with minor emergencies. For those who just need a few hundred dollars, paycheck advance apps are a far better option. Apps like Earnin allow workers to take an advance on their paycheck at little to no cost.

- Credit Unions: Credit unions are often willing to provide loans to their members even if they have poorer credit scores than average. Their rates are far more affordable than a tribal lender’s installment loans. PenFed is a great option that anyone can join.

- Peer-to-Peer Lending: In the modern lending marketplace, individuals can connect with their peers to give or receive loans. Their rates vary wildly since each individual gets to decide what they want to charge, but some will lend to high-risk borrowers at reasonable rates. Peerform is a great option for someone who was considering Loan at Last since their personal loans start at $4,000.

All of these would be better options than borrowing from Loan at Last. They’re almost (if not just) as accessible, and they’re far more affordable.

The Bottom Line

If you just want a Loan at Last review that would give you a direct recommendation for or against the company, then we’re happy to give it to you: Stay away from them. Their loans are far too expensive to be competitive in the marketplace, even for borrowers with bad credit scores. Taking out a loan that you can’t afford to pay back is only going to delay your financial emergency. In fact, it’s probably going to turn it into a bigger one down the road.

If you can avoid taking on more debt in the first place, that’s an even better solution. Most of us could use a little optimization on our spending, if nothing else, which might be able to help you stay away from another loan. If you need some help getting your finances in order, a credit counselor can help you for free! Reach out to a service provider near you and get started today.

FAQs

You can reach Loan at Last by phone at (844) 676-8550 or contact them via live chat at loanatlast.com.

Loan at Last’s mailing address is PO Box 1193, Lac Du Flambeau, WI 54538

Loan at Last does not lend to residents of Arkansas, Connecticut, District of Columbia, Illinois, New Mexico, New York, Pennsylvania, Vermont, Virginia, West Virginia and Wisconsin. Loan at Last will lend only to returning customers who live in Maryland or Georgia.