Roughly 9.9 million Americans own one or more vacation timeshares. A study conducted by the University of Central Florida concluded that 85% of them regret their purchase. Getting out of a timeshare is harder than getting in: many contracts tie owners to the property for life. Timeshare exit companies like Wesley Financial Group promise to get owners out of these contracts… for a fee, of course.

The average annual timeshare maintenance fee is $980. That makes it worth paying something to get rid of a timeshare that you don’t want or use. But do they deliver on its promise of timeshare freedom?

Let’s take a closer look.

Table of Contents

Who is Wesley Financial Group and What Do They Do?

Wesley Financial Group is a timeshare exit company. Timeshare exit services are their only business: they help unhappy timeshare owners legally escape from their timeshare contract obligations. The Company is based in Franklin, Tenn., and has offices in Nashville, Tenn, and Las Vegas. They also do business as timesharecancellations.com and icanceltimeshares.com.

Wesley Financial group was founded in 2012 by a former timeshare salesman. It has grown from a two-person office to a national company with more than 300 employees. The Company claims to have canceled over 16,000 timeshares and saved owners over $250 million in timeshare mortgage debt.

Like many other timeshare exit companies, Wesley Financial Group will not work with just any client. They serve owners who have evidence that they were pressured, misled, or deceived into buying a timeshare. That’s because timeshare exits involve challenging contracts. That’s often only possible if there was deceit or duress involved in the contract process.

Wesley Financial Group states that they turn down 40% of their applicants. They also say that they have a 97% success rate with the clients they accept. They offer a 100% money-back guarantee and claim to have refunded over $1.8 million in fees to the 3% of customers that they could not help.

Wesley Financial Group’s Timeshare Exit Costs

Wesley Financial Group does not quote costs on its website. This is typical in the timeshare exit industry. Costs are based on the specific requirements of the case, so providers usually do not cite a cost range.

The company provides a free initial consultation, and you’ll get a free timeshare exit kit to help you decide whether to apply. After assessing your case, they will tell you whether they believe they can help you. If they believe that they can, they will offer a proposal. This will consist of an initial fee and a series of monthly payments.

Customer reviews indicate that initial fees typically range from $4,000 to more than $7,000, followed by up to 10 to 12 monthly payments of $300 to $600. This is typical for the timeshare exit industry. Wesley Financial Group offers a 100% money-back guarantee: if they can’t cancel your timeshare contract, they will refund your fees.

You can and should negotiate for a lower fee.

Can You Trust Wesley Financial Group?

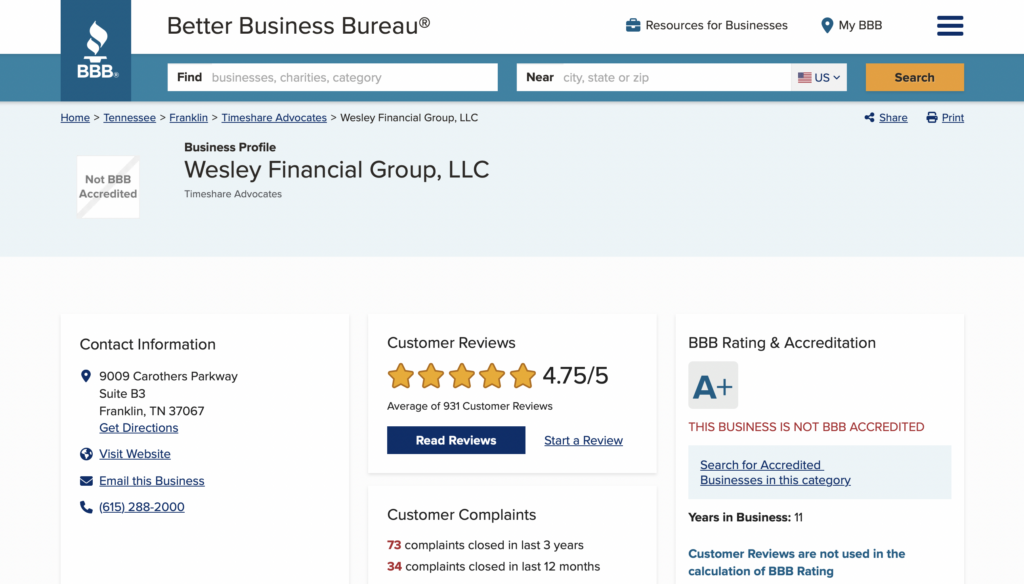

The Nashville Better Business Bureau (BBB) revoked Wesley Financial Group’s accreditation in 2019. Independent sources report that BBB lawyers found Wesley’s contracts “confusing” and noted that Wesley did not advise potential clients that they should find out if the resorts offered an exit program before retaining a timeshare exit company.

The same source reports that Wesley Financial Group claimed that timeshare contract obligations would be inherited by the owner’s children. They allegedly made the claim in an advertisement and to an undercover shopper. The claim is not correct: If an owner dies while still owning a timeshare, it does become part of the estate and obligations are passed onto your next-of-kin or the estate’s beneficiaries. However, they are not legally obligated to accept it.

Several timeshare resort companies have sued Wesley (more on that later), but we have found no record of legal or regulatory action from any government agency, client, or consumer group.

Online Reputation

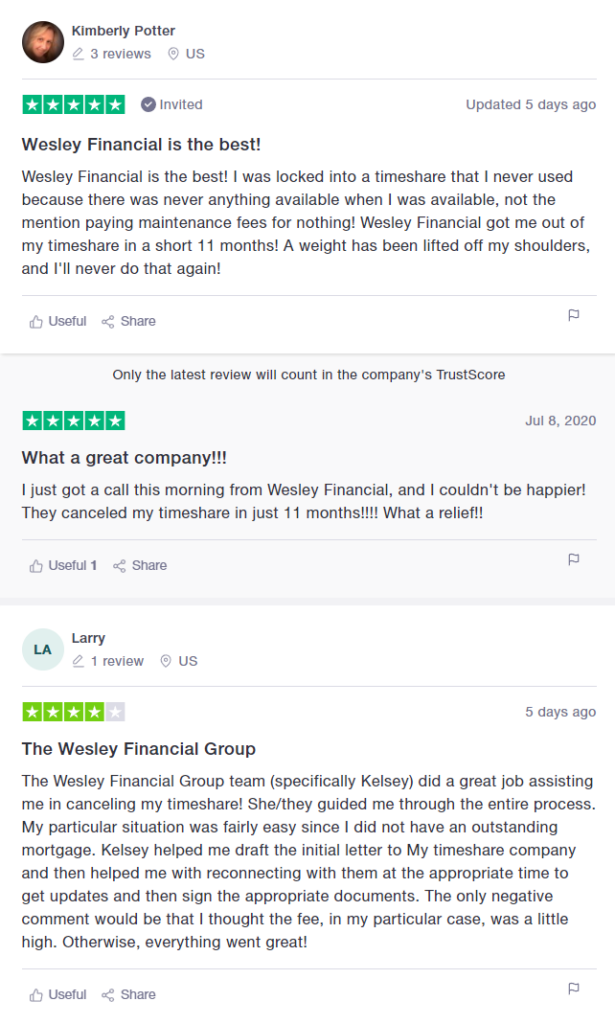

Wesley Financial Group has large numbers of user reviews online, notably with the BBB, Trustpilot, and Google Reviews. These reviews are overwhelmingly positive.

- Wesley Financial Group has an average 4.75 out of 5 stars from 931 ratings on the BBB page.

- The company shows 4.7 out of 5 stars from 820 reviews on the Trustpilot page.

- Wesley has 4.6 out of 5 stars from 730 reviews on Google.

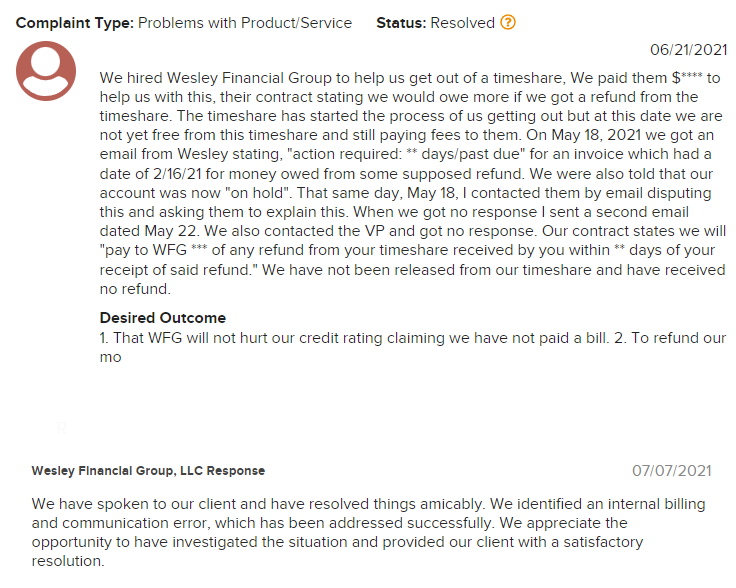

There are 73 complaints on the BBB page. The Company has responded to all of them and resolved most. Here’s a typical example:

It is not possible to verify the authenticity of online reviews. Review sites try to prevent companies from seeding positive reviews but they do not always succeed.

Credible review sites generally will not remove negative reviews unless the company demonstrates that the review is fraudulent.

The low number of negative reviews and the high response rate to complaints does indicate that most customers are not complaining and that the Company is responsive to those who do.

What’s Good About Wesley Financial Group

- Wesley Financial Group does challenge timeshare contracts and there are strong (though not 100% verifiable) indications that they do succeed much of the time.

- The Company does not accept all clients, which indicates that they are only accepting cases they feel they can resolve.

- Wesley uses its own resources and employees. Many timeshare exit companies subcontract cases to outside law firms, retaining most of the fee and often providing limited supervision.

- Wesley offers a 100% money-back guarantee if they cannot resolve a case. We cannot verify that all unresolved cases lead to refunds but reviews indicate that customers do get money back.

What’s Bad About Wesley Financial Group

- Some reviews report that Wesley representatives insisted that they stop paying annual fees or making mortgage payments. This can encourage a company to resolve a case. It can also lead to foreclosure, accounts going to collections, and damage to the owner’s credit.

- Reports indicate that Wesley has told clients to stop communicating with the timeshare company and requires them to deny that they are working with a timeshare company. Wesley staff may impersonate the timeshare owner when communicating with the company.

- Some customer reviews report that the company failed to deliver promised services and that communication was poor. Others make opposite claims.

- Credible reports indicate that the Company has made inaccurate claims in advertising and to potential clients. Specifically they have claimed that timeshare holder’s children will inherit their contract obligations. This is not exactly the case.

What happens to your timeshare when you die? Here are a few of the legal specifics:

Lawsuits Against Wesley Financial Group

On June 9, 2020, Diamond Resorts Inc. filed a lawsuit against Wesley Financial Group. Diamond Resorts is the largest single timeshare operator in the country, with 370 resorts worldwide.

The lawsuit accuses Wesley and its CEO, Chuck McDowell, of encouraging consumers to break legitimate contracts, false advertising, and deceptive business practices. It states that Wesley’s business practices “drive timeshare owners into foreclosure and financial ruin”.

The lawsuit makes these specific claims.

- Wesley instructs timeshare owners to breach contracts by stopping payments.

- Foreclosure or or forfeiture of the timeshare interest is an acceptable outcome, despite financial risks to the owner.

- Wesley conceals online complaints.

- The Company instructs clients to lie about their relationship with Wesley. Clients may forfeit fees and refunds if they reveal the relationship.

- Wesley employees impersonate timeshare owners when communicating with timeshare companies.

The lawsuit also alleges that McDowell has financial issues in his past, including bankruptcies, tax liens, debt collection lawsuits, civil lawsuits, bad checks, and association with a timeshare exit that was shut down for fraudulent activities.

Wesley’s Response

Wesley Financial Group has responded publicly to the lawsuit. McDowell admits that he’s had financial issues in the past, but states that the company’s activities are legal and help consumers extract themselves from abusive contracts.

What Does That Mean?

We will not comment on the merit of the charges or Wesley’s defense. The courts will determine that. We do observe, however, that Wesley is not being sued by a government regulator, a dissatisfied client, or a consumer advocate. The suit comes from a timeshare operator with a reputation for aggressive and inappropriate sales tactics.

Diamond Resorts has had legal issues of its own.

- In 2017 Diamond paid a $800,000 settlement to the Arizona Attorney General’s office after over 500 complaints alleging deceptive sales practices and abusive contracts.

- Diamond is facing a $1 billion class action suit in Nevada, accusing it of elderly abuse, fraud, and false promises.

- Diamond has been charged in an Arizona court with illegally inflating its maintenance fees to pass operating costs on to consuners.

- Wesley is not the only timeshare exit company that Diamond has sued. Diamond is pursuing legal action against numerous timeshare exit companies.

Is Diamond trying to protect consumers from fraud or are they simply trying to keep the revenue from reluctant customers flowing? That’s for the court to decide, but there’s reason to doubt Diamond’s motives.

Other Lawsuits

Diamond is not the first timeshare resort operator to sue Wesley Financial Group.

- In 2012 Wesley Financial Group was sued by Wyndhan Vacation Ownership, at that time the world’s largest timeshare company. A jury found in Wesley’s favor after only 20 minutes of deliberation.

- Wesley financial group is also defending itself against a lawsuit by Westgate Resorts Ltd. in Tennessee.

These lawsuits could indicate a pattern of illegal activity. They could also indicate that timeshare resort operators are trying to use the law to prevent timeshare exit companies from interfering with an exploitative business model. Again, it’s up to the courts to decide.

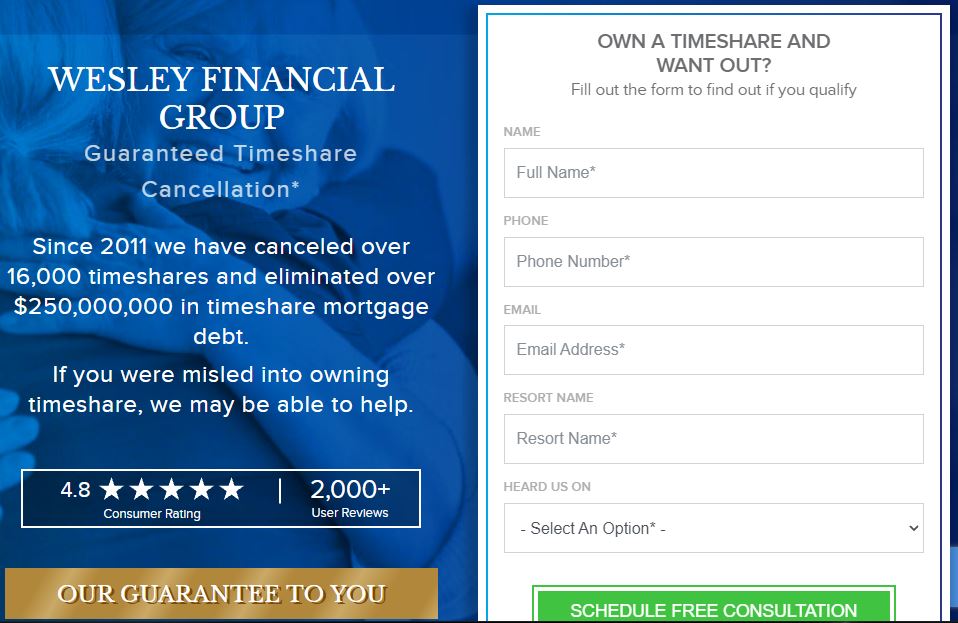

Wesley Financial Group’s Website

You can find Wesley Financial Group online at https://wesleyfinancialgroup.com. The website is straightforward and professional, offering a prequalification form, a free consultation option, and a chat window.

You’ll find these claims.

- “Since 2011 we have canceled over 16,000 timeshares and eliminated over $250,000,000 in timeshare mortgage debt.”

- “If you were misled into owning timeshare, we may be able to help.”

- “Guaranteed Cancellation and 100% Money Back Guarantee”

The website also cites reviews and links to review sites.

The site shows the company in a positive light (naturally) but the claims are consistent with the company’s other materials and there’s nothing visibly inaccurate. We wish we could verify the claimed 97% success rate, but we can’t verify that it’s false.

Social Media Presence

The Wesley Financial Group Facebook page is updated regularly, generally with timeshare horror stories and testimonials of Wesley’s success. No recent posts have any comments and sharing is minimal. Customers do not appear to engage with the page to any significant extent.

The Twitter page has 1,459 followers. It contains much of the same content visible on the Facebook page. Again, there are few comments and engagement is minimal.

On Instagram, Wesley has 217 posts and 2,757 followers. The content is very similar to that of the Twitter and Facebook pages: it appears that company social media managers cross-post the same material. Comments, shares, and other engagement metrics are low.

Wesley’s LinkedIn page has different posts, trending more toward analysis of the timeshare market and problems faced by timeshare holders. It provides more information about the company: new hires, links to employee accounts, and details on timeshare exit processes. There are 740 followers but little visible engagement.

The Bottom Line

The timeshare exit industry has a questionable reputation. It’s important to research different companies before you commit to a contract. Some will charge you simply to outsource cases to law firms with little follow-up or supervision.

Timeshare exit companies charge significant amounts of money, but if you’re locked into an expensive timeshare contract for life it may be worth it if the company delivers.

There are real questions about marketing practices. The Company does appear to recommend non-payment, which can lead to foreclosure and damage to your credit. If you choose to work with them, you’ll need to keep track of what you’re doing and ask questions. Make sure they’ve reviewed any possible financial repercussions before you agree to stop making payments.

Despite those issues, the company has been in business for some time and does appear to have significant numbers of satisfied customers. They do clearly succeed in some cases, and the complaint rate is relatively low. Dissatisfied customers do get refunds, though sometimes after some effort.

Wesley Financial Group appears to be one of the more reputable timeshare exit companies and is worth considering if you’re shopping for a timeshare exit. We recommend learning more about how timeshare exits work before dealing with any timeshare exit company. Knowing more about the process will help you get a better deal!

FAQS

Wesley Financial Group, LLC is a private company owned by founder and CEO Chuck McDowell.

Wesley Financial Group is based in Franklin, Tenn. and has offices in Nashville, Tenn., and Las Vegas.

Wesley Financial Group is rated 4.75 out of five stars on the Better Business Bureau website, 4.7 out of 5 stars on Trustpilot, and 4.6 out of 5 stars on Google.

Office hours are 9 a.m. to 5 p.m. Central time, though there are a few agents who will work up until 8 p.m.

We can find no record of institutional endorsements for Wesley Financial Group.

Website: https://wesleyfinancialgroup.com

Phone: 800-425-4081

Address: 9009 Carothers Parkway, Suite B337067, Franklin, TN 37067