Key Personal Loan Statistics to Know in 2023

In the last ten years, personal loans have become increasingly popular as Americans turn to them for quick cash. People rely on personal loans to consolidate existing debt, reduce their interest costs and cover personal expenses such as family vacations or events.

The following statistics gathered by Credit Summit will give you a better view of essential data regarding personal loans in the United States.

Key Takeaways

- In 2022, the total amount of personal loan debt in the U.S. increased by 5.9% (+$24.38B).

- Personal loan borrowers owed $178 billion in debt, the most significant amount ever recorded in the last 17 years.

- Personal loans still account for less than 1% of all American consumer debt.

- Paying off debts is the main reason Americans take out personal loans.

- With an average personal loan of $13,348.61, the silent generation borrowed the most money.

- Since 2020, the average balances in Washington, D.C., have increased 17% faster than in the 50 states.

- In the second quarter of 2022, 3.37% of personal loan borrowers were 60 days or more behind on their payments.

The Growth of Personal Loans in the U.S.

The COVID-19 pandemic marked an unprecedented drop in the yearly personal loan debt surge

In 2020, the personal loan balance decreased by 7.6%, the first dip since 2011. Nonetheless, it started to increase again in 2021, reaching a 15.2% growth. As of 2022, the personal loan balance in the U.S. increased by 5.9%

Many Americans have taken out personal loans

As many as 2.1 million Americans have taken out personal loans. The total outstanding consumer personal loan debt increased to $436.18 billion in the third quarter (Q3) of 2021, with unsecured loans totaling $133.17 billion and secured loans at $303 billion.

Personal loan borrowers set a new record in personal loan debt in 2022

In 2022, personal loan borrowers owed $178 billion in debt, the most significant amount ever recorded in the 17 years for which data are available. In Q2 2022, total personal loan balances increased by 31% to $192 billion.

READ MORE: Consumer Debt Statistics

Average personal loan interest rates

Personal loan interest rates depend on borrowers' credit score, but are usually lower than credit card interest rates.

740 and above: Below 8%

670 to 739: About 14%

580 to 669: About 18%

Below 579: About 30%

In 2021, the average personal loan balance was $17,064. This applies to 25.8 million secured loans and 22.4 million unsecured loans. Moreover, personal loans have relatively low interest rates, making it possible for borrowers with good credit to get a bargain. That is why personal loans account for less than 1% of all American consumer debt.

In contrast, Americans owe $841 billion on their credit cards -- or 5.3% of all outstanding debt. With mortgages removed from the equation, personal loans represent 4.1% of non-housing debt.

READ MORE: U.S. Credit Score Statistics

Reasons Behind Personal Loans

It's important to be aware that debt can indicate confidence just as much as difficulty. Now that the pandemic supply chain issues are mostly over, Americans are prepared to spend all the money they could not over the past two years.

Many people will turn to personal loans for assistance when making large purchases

Some of the main reasons Americans turn to personal loans are upgrading their home, starting a business, organizing a wedding or vacation, and other similar endeavors. Additionally, they seek personal loans to help them manage their credit card debt.

Personal Loan Size

Overall, loans for starting a business are typically larger than others. Startup expenditures can easily exceed $10,000, and since these loans are frequently secured by collateral, it is simpler to be approved for bigger sums.

Social distancing has changed people's desire for gathering events

Other noteworthy changes show how social distancing affects ordinarily pricey events. Wedding loans were down by around $5,000, and funeral loans were down by over $2,000 in 2021.

Personal Loan Statistics By Generation

Average personal loan balances are similar to average debt levels throughout generations. Approximately 56.9% of Gen Xers (born between 1965 and 1980), followed by 53.9% of baby boomers (born between 1946 to 1964), and 51.8% of the silent generation (born before 1945), took out a personal loan. However, only 50.6% of millennials (born between 1981 and 1996) reported taking out a loan, and only 32.2% of adult Gen Z members (born between 1997 and 2012) said they had done the same.

Younger borrowers grow at the highest rate, but older borrowers typically have higher sums

With an average personal debt balance of $18,922, Generation X is approximately $2,000 above the national average. As for the personal loan size, the silent generation borrowed the most money, with an average personal loan size of $13,348.61. Baby boomers are second with an average of $11,496.40, followed by Generation X with $10,720.73.

Personal Loan Statistics By State

Average personal loan balances are similar to average debt levels throughout generations. Approximately 56.9% of Gen Xers, followed by 53.9% of baby boomers, and 51.8% of the silent generation, took out a personal loan. However, only 50.6% of millennials reported taking out a loan, and only 32.2% of adult Gen Z members claimed they had done the same.

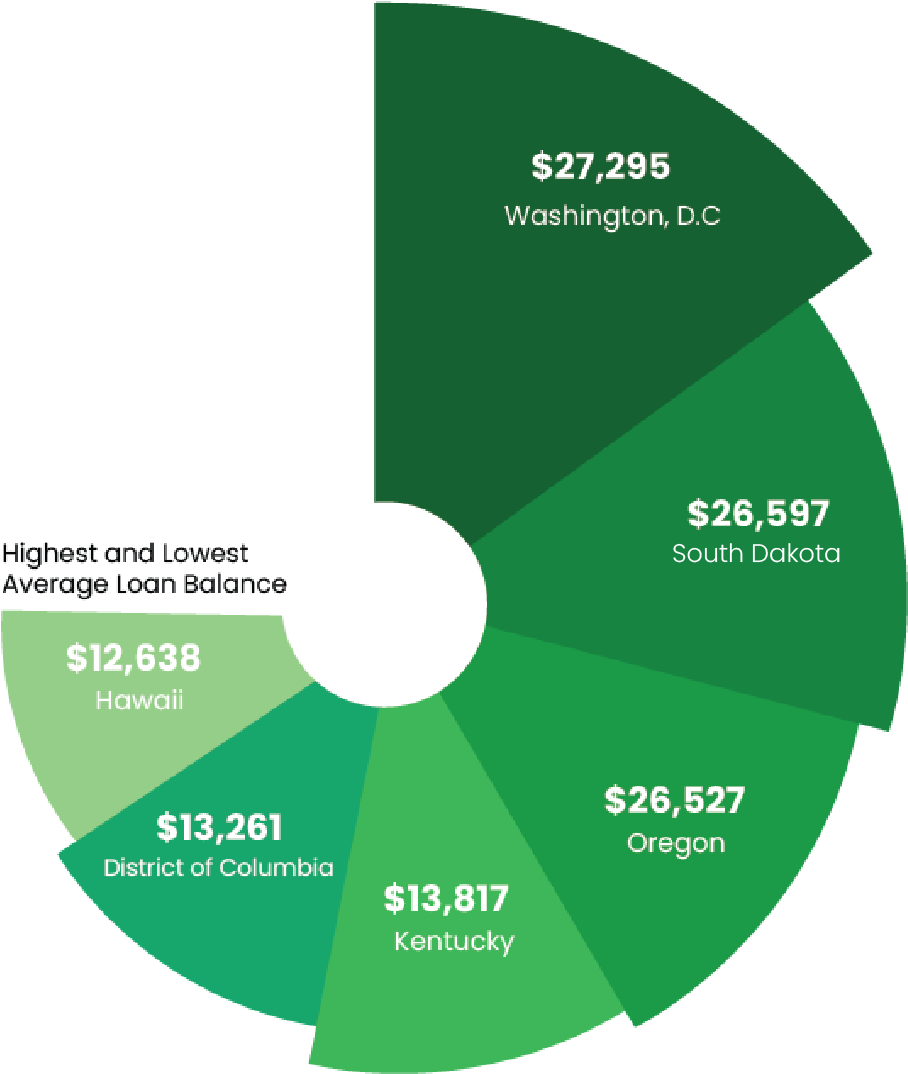

On average, personal loan balances rose in 44 states in 2021. In Washington, D.C., the average balances have increased 17% faster than in each other state since 2020.

This is why the nation’s capital takes first place, with the highest average loan balance ($27,295). Second in line comes South Dakota, with an average loan balance of $26,597, followed by Oregon, with an average of $26,527.

On the other hand, Hawaii has the lowest average personal loan balance, at $12,638, preceded by the District of Columbia ($13,261) and Kentucky ($13,817).

Personal Loan Delinquency Rates

The loan becomes delinquent when borrowers don't fulfill their commitments on time. Due to the limits put in place during the first two years of the COVID-19 pandemic, the personal saving rate in the United States shot up, likely contributing to the decline of the delinquency rate.

As more Americans deal with rising inflation, increased interest rates, and general economic instability, delinquency rates are likely to continue to grow

The hardest hit by 2022's record-breaking inflation were consumers with poor credit and tight budgets, which boosted the delinquency rates for personal loans. More than 1.6% of all consumer loans made by commercial banks in the U.S at the beginning of 2022 were past due. From 2.28% a year earlier, an increase was seen as of the second quarter of 2022, with the delinquency rate for personal loans being 3.37% (60 days or more past due).

The Bottom Line

These data show growth in American interest in personal loans. Consider a personal loan if you require additional funds to pay for home improvements, cover wedding expenses, or consolidate high-interest debt.

Personal loans may have experienced a surge due to the COVID-19 pandemic, but they are currently experiencing an unprecedented increase.