Emergencies are usually expensive, which can be especially difficult if you’re living paycheck-to-paycheck and don’t have money set aside in a savings account. It can be tempting to turn to a company like Mobiloans for some quick cash. However, this company isn’t exactly what it seems. Read on to see if a loan with Mobiloans is really your best option.

Featured Alternative: DebtHammer

- Break the borrowing cycle

- Can help with many types of debt, including payday and tribal loans

- Friendly and helpful customer support – no judgment

Table of Contents

What Is Mobiloans?

Mobiloans has the slogan “fast cash for people on the go.” The company markets its loans to individuals who need emergency cash. What’s important for potential borrowers to know is that Mobiloans is a tribal lender that is not subject to state laws. The company is owned by the Tunica-Biloxi Tribe of Louisiana, which was federally recognized as an American Indian tribe back in 1981. It conducts its business online out of an office located on the tribe’s reservation.

The loans offered by Mobiloans are most similar to credit card cash advances, although they have higher interest rates that are more in line with a payday loan. In addition to cash advance fees and finance charges, Mobiloans hits its customers with an annual percentage rate (APR) between 206.14% and 442.31%.

Is Mobiloans Licensed?

Because Mobiloans is federally recognized as a tribal lender, they are not subject to the laws in the states in which they operate or offer services. This means they do not have to obtain a license in order to act as a lender. They also don’t need to follow your state’s set limitations on fees and interest rates.

Let’s say you live in New Mexico and want to obtain a loan through Mobiloans. The state of New Mexico recently implemented a 36% interest rate cap on payday loans. So it’s likely you could take out a loan from Mobiloans under the assumption that the interest isn’t more than 36%, only to discover later that it is 425%. You have no recourse against the company, as they don’t have to abide by the laws in your state.

Mobiloans does have a Policy on Responsible Lending, which promises to provide transparency on all costs associated with their loans. They state that they follow Federal lending laws, as long as those laws do not conflict with their own tribal sovereignty. Some of the laws listed include the Truth in Lending Act, the Fair Credit Reporting Act, and the Electronic Fund Transfer Act.

Typical Loan Terms of Loans from Mobiloans

The loan provided by Mobiloans is actually a line of credit. Borrowers are approved for a certain amount, let’s say $2,000, but aren’t charged until they actually draw from the approved amount. A borrower may opt to withdraw $200 from the $2,000 or the whole $2,000. Just like other typical loans, the company does perform a credit check on all applicants.

Below are the specific terms you’ll find when taking out a loan with Mobiloans:

- Ability to borrow as little as $200 and as much as $2,500.

- Weekly, bi-weekly, semi-monthly, and monthly repayment plans.

- Interest rates between 206.14% and 442.31%.

- Cash advance fees of $30 to $125.

- If the balance of the Mobiloan isn’t paid in full at the end of the first billing cycle, a finance charge kicks in. This charge is between $10 and $125 each billing cycle.

Online Reputation

Since Mobiloan has been in business for several years, you can do a little research and quickly uncover what previous borrowers have to say about their experience with the company.

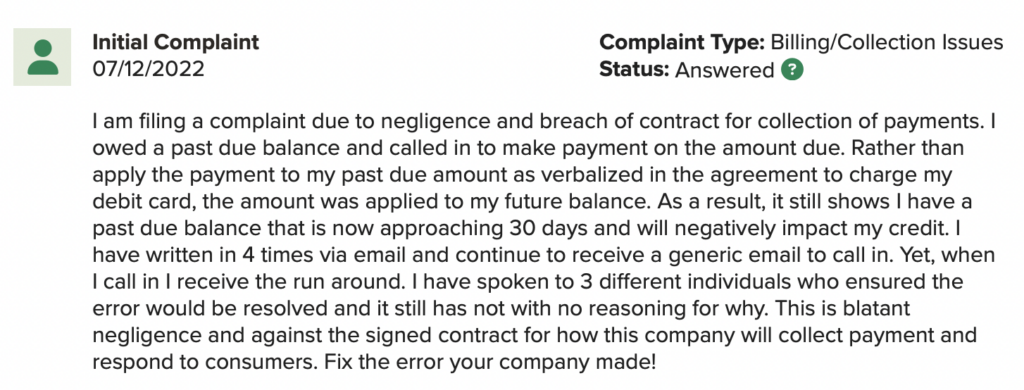

The Better Business Bureau (BBB) is the best place to start. According to the BBB, Mobiloans is not BBB accredited. The organization assigned Mobiloans the grade of A; however, customers rated Mobiloans with 1.6 stars out of five. In the complaints, customers reported multiple issues with Mobiloan’s customer service team, the inability to pay off their remaining balance in full, and balances that never seem to go down because of the exorbitant fees and interest rates.

One user on Ripoff Report warns borrowers not to take out a loan with Mobiloans. The reviewer pointed out that he drew $1,000 in cash from his Mobiloans loan. He didn’t realize just how much interest he was being charged until he sat down and crunched the numbers. To his surprise, he found that he was paying $1,265 in interest. That’s more than the amount borrowed.

In 2018, Legal Newsline ran a story about a class action lawsuit that was filed by consumers against Mobiloans. The consumers alleged that the company violated RICO, 18 U.S.C. § 1962(C) and (D), as well as Virginia and Indiana usury laws. This should be another red flag for potential borrowers.

Pros of a Mobiloans Loan

- Quick and easy online application.

- Funds available as soon as the next business day.

- Statements and email notifications to remind you when your next payment is due.

- Online loan cost and fees calculator in the FAQs section of the website.

- Ability to participate in Mobiloans Rewards, which allows borrowers to earn between 10% and 65% off their cash advance fees and fixed finance charges.

- Financial U tab filled with helpful tips, online courses, and interactive tools to help consumers develop healthy money habits.

Cons of a Mobiloans Loan

- Mobiloan does not serve a total of 21 states or the District of Columbia.

- Extremely high interest rates.

- Complex fee structure, which may be difficult for most borrowers to understand.

- The customer service team does not have a good reputation.

How to Apply for a Mobiloans Loan

If you’re interested in moving forward with Mobiloans, you’ll find that there are just four steps to applying for a loan.

- Create your account: Choose your state from the drop-down menu and create your username and password. You’ll also be required to enter your name and date of birth at this stage. *Note: Applicants who live in Alabama or Nebraska must be 19 in order to apply for a loan with Mobiloans. All other states have an age requirement of 18.

- Provide your personal information: Now it’s time to add your physical address, social security number and driver’s license number in the provided boxes.

- Provide your financial information: You’ll need to provide details about your employment, as well as information for one of your bank accounts. That bank account must allow for automatic withdrawals, as this is how your loan will be repaid.

- Submit the application: Take a minute to review the information you entered in the application to ensure that it is correct. Fix any errors and submit the application for review.

Better Alternatives to Mobiloans

Instead of contending with high interest rates and confusing fees, those in need would be better off going with one of these Mobiloans alternatives.

- Payday alternative loans: Credit unions offer these small loans as an alternative to predatory payday loans. Interest rates are capped, and borrowers have a longer repayment term, giving them some time to get their financial situation back under control.

- Credit card cash advance: Almost all credit cards have a cash advance option. If you already own one of these cards, you can call customer service and request a cash advance. You won’t have to worry about doing business with a shady company and the interest rate you’re charged won’t company anywhere close to three digits.

- Avant: Avant offers personal loans with an APR range of 9.95% to 35.99%, which is much much lower than Mobiloans. Borrowers will also have access to a larger sum of money, as the company lends between $2,000 and $35,000. There’s also the option to apply for a credit card with $300 to $1,000 credit limits.

- Borrow from family or friends: It can be hard to ask someone you know for help, but this is often the best way to go. When making the request, suggest offering to pay the loan back with interest. Research the average bank loan interest rate in the area to get an idea of how much to offer and then take the time to draw up a contract. This will show your friend or family member that you are serious about paying them back. They may even offer to loan you the money interest-free.

- Sign up for credit counseling: Check with your bank to see if they offer free credit counseling services. Most major banks and credit unions provide this service for their members. A credit counselor can help negotiate the balances of any medical bills, create a budget that will help you get back on track, and offer suggestions on how to develop healthy financial habits for the future.

- Start a side hustle: You may not have the time to take on a second full-time job, but you can probably carve out time for a side hustle that will produce enough money to cover your sudden financial needs. You could take on a few housecleaning or lawn maintenance jobs. You could offer tutoring services, dance lessons, or acting classes. The possibilities are endless. The best part is that you can stop the side hustle as soon as you meet your financial goal.

- Cash advance apps: Download a cash advance app (Earnin is a good one) right to your smartphone. It’s free. These apps allow customers to get an advance on their next paycheck. Users usually aren’t charged any interest or fees, instead they ask customers to leave a “tip” for the service.

The Bottom Line

Loans from lenders like Mobiloans should only be considered after every other option has been exhausted. Otherwise, you’re far better off to sign up for a payday alternative loan or try a cash advance app first. Otherwise you could end up trapped in a cycle of debt that you can’t escape.