Freedom Debt Relief is a for-profit debt settlement company. Debt settlement will hammer your credit, but if you’re faced with a pile of debt that you can’t pay, it can be a viable alternative to bankruptcy.

Table of Contents

Freedom Debt Relief: What You Need to Know

Freedom Debt Relief claims to be the largest debt settlement company in the country. The company was founded in 2002 and claims to have served over 650,000 clients and settled over $10 billion in debt. They have offices in California and Arizona.

Freedom Debt Relief cannot serve customers in Connecticut, Georgia, Hawaii, Illinois, Kansas, Maine, Mississippi, New Hampshire, New Jersey, North Dakota, Oregon, Rhode Island, South Carolina, Vermont, Washington, West Virginia, and Wyoming.

Like most debt settlement companies, Freedom Debt Relief works with unsecured debts, like credit card debt, medical debt, personal loan debt, payday loan debt, and store credit.

They will not be able to help you with secured debts, like a mortgage or car loan, or with federal student loan debt, tax debt, utility debts, or debt from lawsuits.

You will need to owe at least $7,500 in unsecured debt. You will also need to have experienced legitimate financial hardship, such as job loss, reduced income, medical issues, divorce, or unexpected costs.

Freedom Debt Relief at a Glance

| Do they offer a free consultation? | Yes |

| How to get started | Contact Freedom Debt Relief at 800-230-1553 or info@freedomdebtrelief.com to set up a free consultation. |

| Fees | No debt settlement fee until debt is actually settled. Your fee will be 18% to 25% of the amount of debt settled. There is a $9.95 fee to set up the dedicated account and a $9.95 monthly servicing fee. |

| How it works | Freedom Debt Relief negotiates with creditors to settle debts for less than you actually owe. |

| Who owns Freedom Debt Relief? | Bradford Stroh, CEO; Allyson Carothers, Marketing Director; Jeffrey Staley, Managing Partner |

| Company address and phone number | 2114 E Rio Salado Pkwy, Tempe, AZ 85281-6230800-253-1553 |

| BBB rating | Accredited, A+, 4.34 of 5 stars from 1,323 reviews |

| Trustpilot rating | 4.5 of 5 stars from 37,351 reviews |

| Minimum debt settled | $7,500 |

| Noteworthy features | No debt settlement fee charged until a debt is actually settled |

How Does Freedom Debt Relief Work?

Freedom Debt Relief uses a process similar to that of most debt settlement companies.

- A free initial consultation will determine whether debt settlement is the right course for you to take.

- You will stop paying your creditors. Instead, you will deposit money into a dedicated FDIC-insured account under your control.

- The company will negotiate with your creditors to settle your debts for less than what you owe.

- The settlements will be paid out of your dedicated account. Your settled debts are cleared and you will no longer owe anything.

- You will pay 18% to 25% of the amount settled as a fee to Freedom Debt Relief.

This process can be an effective way to reduce your debt load, but it also has risks.

- When you stop paying your creditors you may face accelerated collection efforts. Freedom Debt Relief will advise you on how to handle these calls but they won’t stop them.

- Late payments will be reported and accounts may be charged off or sent to collection agencies. Your credit score will be heavily affected.

- A creditor could sue you. Freedom Debt Relief will try to settle the debt out of court but they will not represent you in court. You will have to appear. If a judge rules against you, your wages could be garnished.

- Settled debts will be reported as settled for less than the full amount, doing additional damage to your credit.

- If you settle debts for less than you owe the amount forgiven must be reported to the IRS as income in the year the settlement occurred.

Debt settlement makes sense if you have more debt than you can possibly pay, you’re struggling to make even minimum payments, and you’re no longer concerned about your credit score. It’s the last resort before bankruptcy.

If it is possible for you to pay your debts, you may be better off with credit counseling and a debt management plan, which will allow you to get out of debt without damaging your credit.

Freedom Debt Relief is a founding member of the American Fair Credit Council.

Check out this video to learn more about the specifics of how Freedom Debt Relief works:

What makes Freedom Debt Relief Stand Out?

Freedom Debt Relief is the largest debt settlement company in the country and has an extensive track record. There are many sketchy players in the industry, so that track record is significant.

READ MORE: Here are the best debt settlement companies

No Credit Score Requirement

There’s no minimum credit score. Freedom Debt Relief will work with anyone with over $7,500 in unsecured debts and a legitimate financial hardship.

READ MORE: How to get a free credit score

Fixed Monthly Payment

You will make a fixed monthly payment to your dedicated account. This is your money and you control it. It won’t be released to a creditor until you approve a settlement and Freedom Debt Relief can’t withdraw it without your consent.

You can withdraw from the account, though this will slow down the settlement process. The money in the account will be used to pay settlements with your creditors.

No Upfront Fees

Freedom Debt Relief won’t charge you any debt settlement fee until they have actually settled debts. Federal law requires this, but some debt settlement companies try to evade the law.

READ MORE: How to get out of credit card debt without ruining your credit

How to Sign Up

You will start by contacting the company by phone or through their website. They will schedule a free initial counseling session. A counselor will evaluate your debt situation and help you decide whether debt settlement is the right choice for you.

Remember that this is a for-profit company and the counselor has the incentive to sign you up as a client. Don’t let yourself be pressured into a decision.

You will need to provide full information on your income, living expenses, and debts. You will also need to show that you have a verifiable hardship, like job or income loss, medical expenses, divorce, or other circumstances beyond your control.

READ MORE: Struggling with credit card debt? Get the help you need

How Does Freedom Debt Relief Work?

There are two major types of debt relief companies.

- Credit counseling companies are nonprofits. They offer counseling and debt management plans, which involve consolidating debts and negotiating better terms. You will pay your debts, usually at a reduced monthly payment, and protect your credit.

- Debt settlement companies are for-profit companies. They negotiate to reduce the total amount you owe and settle in a single payment. You will pay a percentage of the amount settled. There will be severe damage to your credit.

Freedom Debt Relief is a debt settlement company. You will stop paying your debts and pay into a dedicated account instead. When there’s enough money in the account to offer settlements, the company will negotiate settlements with your creditors.

The company states that the typical customer receives their first settlement six months after enrolling in the program and that if customers keep to the monthly payment schedule, they usually resolve their enrolled dents in two to five years.

This is a very similar time frame to that required by debt management plans.

Is Freedom Debt Relief a Scam?

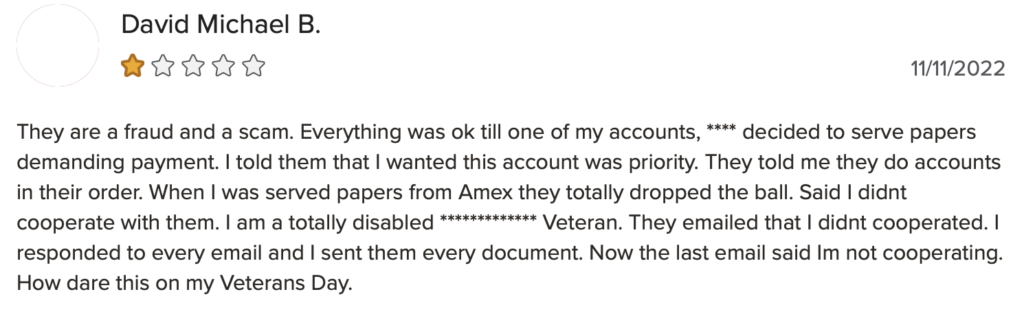

If you look at the few negative reviews of Freedom Debt Relief, you’ll see a few saying that the company is “a scam.” That does not appear to be the case. The company is an experienced player in a legitimate industry and generally has good customer feedback.

Here is an example of a review from someone who was unclear on the debt settlement process:

It’s important to understand that the debt settlement process has real risks and real downsides, and it’s not for everyone. Your experience may depend mainly on your expectations.

In November 2017, the Consumer Financial Protection Bureau filed a lawsuit against Freedom Debt Relief, alleging that the company charged upfront fees, failed to advise customers of rights, and charged fees for debts settled by customers, among other violations.

The suit was settled in 2019. The company paid a fine, reimbursed some customers, and agreed to change some business practices.

Pros and Cons

Pros

- Has a lower minimum debt requirement than some competitors

- Earned top rating from the BBB and generally positive customer reviews

- Could help you eliminate your unsecured debts

Cons

- Freedom was sued by the Consumer Financial Protection Bureau (CFPB) in 2017

- Charges an average fee of 21.5%

- Only unsecured debts can be settled

- It could hurt your credit score

- Collection calls may increase

- A creditor could sue you

READ MORE: How much does a debt settlement lawyer cost?

Who Should Consider Freedom Debt Relief

Debt settlement is not the right choice for everyone. Look at your situation and see if it fits these criteria.

- Your debt is overwhelming and you see no way to pay it off.

- You’re struggling to keep up with even minimum monthly payments.

- You’re considering filing for bankruptcy but trying to avoid it.

- You want to settle debts on your own but you don’t have the knowledge or confidence to negotiate.

In that situation, debt settlement is an option you may want to consider.

READ MORE: Need help? A complete guide to debt relief programs

Who Should Not Consider Freedom Debt Relief

Here are some indications that debt settlement is not the right move for you.

- People who don’t want to pay for debt settlement

- People with a manageable amount of debt

- Those planning to make a major purchase – for example, apply for a mortgage or auto loan – soon

Remember that debt settlement will do serious damage to your credit. If that’s a problem for you, consider credit counseling and a debt management plan as an alternative.

READ MORE: Why did my credit score drop?

The Website

Freedom Debt Relief has a thorough, professional website with information on its debt relief program and an extensive collection of debt resources.

The site’s front page is heavily promotional, with promises to put your debt behind you. There’s no mention of credit damage, accelerated collection efforts, or the possibility of creditor lawsuits. Discussion of the tax consequences of debt settlement is hidden in the fine print at the bottom.

All of these issues are discussed on other pages of the website, many of them in the FAQ, but customers that only read the front page could miss out on important information.

If you’re considering using any debt settlement company we suggest doing detailed research on the pros and cons. Don’t just read the home page.

READ MORE: Debt settlement pros and cons

Customer Service

You can reach customer service by phone or through a dedicated client portal on the website. Customer reviews generally have quite positive comments on the customer service experience, saying it is positive and helpful.

Is Freedom Debt Relief Trustworthy?

When you sign up with Freedom Debt Relief you will provide them with potentially sensitive personal information. There’s always some risk in that. Even major financial firms have suffered serious data breaches.

There’s no indication that Freedom Debt Relief poses a high risk. They have an extensive record and there’s no indication that data has been compromised or that the company has sold personal information to marketing partners (yes, some firms do that).

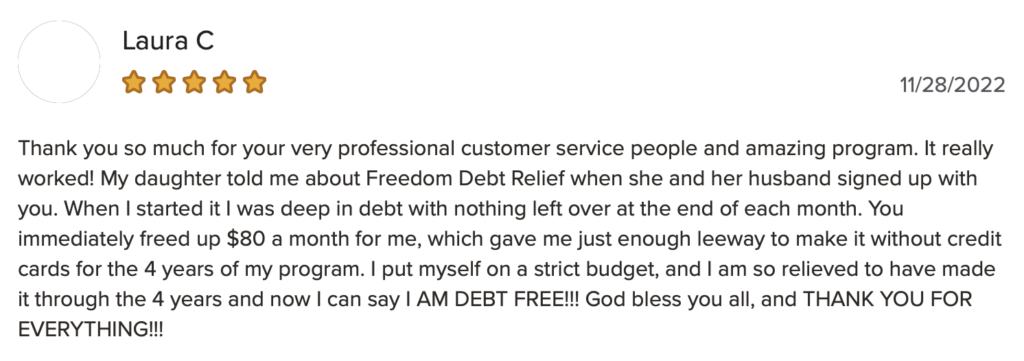

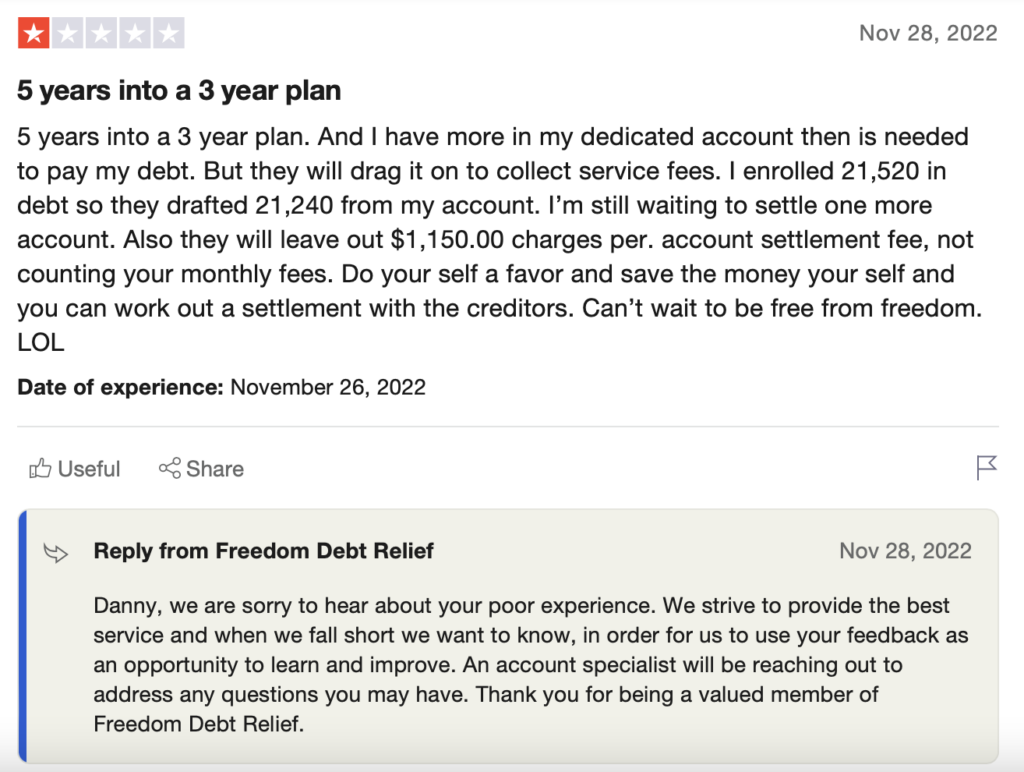

What are Customers Saying?

Freedom Debt Relief is accredited by the Better Business Bureau (BBB) with an A+ rating, indicating that it is highly responsive to customer complaints. The Company gets 4.34 out of 5 stars from 1,323 customer reviews.

On Trustpilot, the Company has 4.5 out of 5 stars from 37,351 reviews. 79% of the reviews are five-star and 12% are four-star, indicating that 91% of reviewers were happy with their experience. The company replies to all negative reviews.

For example:

Many of the negative reviews appeared to be from customers who had unrealistic expectations or did not appear to fully understand the risks and the limitations of the program and debt settlement in general. It’s worth noting that customers can absolutely attempt to settle debts on their own to save the fees one would be required to pay a debt settlement company.

If you’re considering any program of this type, it is important to be fully aware of the downsides and of what can happen.

The Bottom Line

Debt settlement is not for everyone. It’s the last resort before bankruptcy for people who cannot pay their debts and need a significant reduction.

If you’re in that situation, Freedom Debt Relief is an option to consider. It’s an established company with an extensive track record, and it can reduce your debts. Just be sure that you understand the process and the potential risks involved!

FAQs

When you start the program, you will stop paying your debts and pay into a dedicated account instead. Your late payments will be reported and some accounts may be charged off or sent to collections. This will harm your credit score.

When debts are settled, they will be reported as settled for less than what was owed. This will do additional damage to your credit.

Freedom Debt Relief works with unsecured debts, like credit card debt, medical debt, personal loan debt, payday loans, and store credit. They cannot settle federal student loans but may be able to work with private student loans.

They will settle some business debts on a case-to-case basis.

Most debt settlement companies use essentially the same process. Freedom Debt relief is distinguished mainly by its size – it’s the largest debt settlement company in the country – and its extensive track record. Fees are slightly higher than those of some competitors.