When you’re in a panic over a financial emergency, borrowing money from whoever will lend it to you the fastest feels like the right thing to do. After all, you need the money right now! Like, yesterday would have been better, right? And if a company like Target Cash Now can give you the money you need as soon as you need it, what’s the harm?

But is Target Cash Now a good option, or does it miss the mark? Read on to learn more about the lender.

Featured Alternative: DebtHammer

- Break the borrowing cycle

- Can help with many types of debt, including payday and tribal loans

- Friendly and helpful customer support – no judgment

Table of Contents

What is Target Cash Now?

Target Cash Now is a financial services company that offers installment loans to people who need cash quickly. According to their website, they can sometimes even get you the money you need on the same day your application is approved. They also boast that, in addition to encouraging you to pay your loan off early, they offer incentives like bonus points, financial education and other resources to borrowers.

It all sounds great, right? And they provide several different ways to contact them, which is always a good sign.

READ MORE: How to make $500 fast

Is Target Cash Now Licensed?

To legally offer you a loan, a lender must be properly licensed. Licenses are usually provided by state authorities. With tribal loans, however, a lender is licensed by a tribal authority (more on that in a minute).

From the Target Cash Now website:

“Target Finance, LLC dba Target Cash Now (“Target Cash Now”) is an entity formed under the laws of the Fort Belknap Indian Community (the “Tribe”), a federally-recognized and sovereign American Indian Tribe. Target Finance, LLC is wholly owned by the Tribe. Target Finance, LLC is a licensed lender authorized under the Tribe’s Tribal Regulatory Authority.”

Did you catch that? This lender is owned by the same body that regulates it.

What’s the Difference Between a Tribal Loan and a Payday Loan?

The primary difference between a tribal loan and a payday loan is the body that governs it. Payday loans are subject to state and federal laws, while tribal loans often are not. Many states have made payday loans illegal (you can check the status of your state here), but if a lender is licensed by a tribe, they can thwart that state’s authority.

What You Need to Know about Tribal Loans

In most cases, financial lenders are subject to the laws and statutes of the Federal Trade Commission, the Consumer Finance Protection Bureau, and individual state-based authorities. These laws and statutes exist to protect you, the borrower.

Tribal loans, however, are only subject to the rules and regulations of the tribes that certify them. Many of these tribes claim tribal immunity to exempt them from having to follow federal and state laws and regulations.

What is Tribal Immunity?

The American Bar Association defines tribal immunity this way:

“Tribal sovereign immunity protects tribal officials and employees acting in their official capacity and within the scope of their employment, as well as shielding tribes from suits for damages and requests for injunctive relief (whether in tribal, state, or federal court) …Thus, tribal entitles retain immunity whether those contracts involve governmental or commercial activities and whether they were made on or off a reservation.”

Here’s an example: A tribe can decide that it is totally legal for a business to change the terms of a contract after that contract has been signed. State and federal authorities might hate this, but they can’t force the tribe to change its own laws.

Multiple tribal lenders take advantage of tribal immunity by using it as an excuse to thwart consumer protection laws. In addition to the very real example given above, tribal lenders will:

- Charge exorbitant interest rates

- Lend larger amounts of money than state minimums require

- Break the terms of their own loan contracts

Target Cash Now is a tribal lender. They are owned and regulated by the Fort Belknap Indian Community.

While the Supreme Court and the CFPB are working to crack down on the predatory practices of tribal lenders, the process is a slow one. Tribal lenders are sticking to their claims that the only laws they are subject to are their own. Meanwhile, lenders like Target Cash Now continue to offer loans that violate the laws of the state and that frequently decimate many desperate borrowers’ financial futures.

In General, Here’s What to Expect When Taking Out a Loan from Target Cash Now

- Principal balances up to $1,500 for first-time borrowers

- Loans up to $2,500 available to repeat customers

- No penalty for paying the loan off early

- Missed payments are charged a penalty fee equal to 10% of the payment missed.

- Returned/not-processed payments are charged a $35 NSF fee.

Like many installment loan providers, Target Cash Now does not give any exact information on its APR, repayment schedules or how long it will usually take someone to pay off a loan. To get this information, you need to fill out an application and submit it.

If you are approved (and the terms are very relaxed), you will be offered a loan and shown the interest rate, payment schedule, etc. At this point, you can either choose to accept those terms or stop the process.

That said, the Target Cash Now website does provide a “hypothetical” situation in which someone borrows $400. Here’s what you need to know about that loan:

- Original amount borrowed: $400

- Interest rate: 795%

- Repayment schedule: $127.50 every two weeks

In this hypothetical, it takes the borrower almost six months to pay off their $400 loan. By the time all is said and done, the borrower has paid $1,529.96 to Target Cash Now.

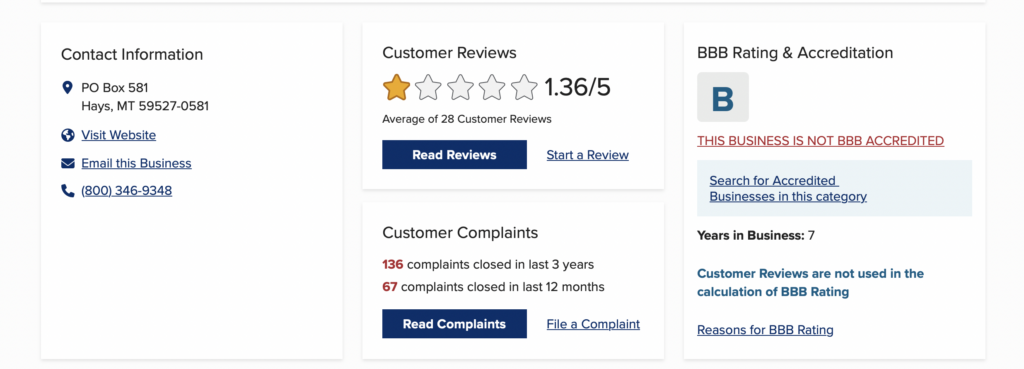

Online Reputation

Before you fill out a single application, it is vital to take some time to thoroughly vet a potential lender. Check out their rating with the Better Business Bureau. It is also very important that you take the time to read the reviews and complaints. Some companies will flood review sites with positive reviews to raise their average “grade,” so read them carefully, and be on the lookout for similar phrasing or very brief comments.

The Better Business Bureau page for Target Cash Now lists the following alert:

On June 17, 2020, Better Business Bureau recognized a pattern of complaints from consumers regarding the lending services provided by Target Cash Now. Consumers allege borrowing money from the business and having to pay back much more than they borrowed due to the interest rates attached to the loan.

The entire alert is too long to post, but you can read the full version here.

Here are just a few of the complaints we found about Target Cash Now:

“Target Financial LLC dba Target Cash Now allows “Identity Theft” Accounts to be opened and funded due to their lack of proper protocols to prevent this type of activity from occurring. I called TCN Customer Service repeatedly to identify that a fraudulent account was opened however, they have refused to transfer me to their fraud team and have even stated they do not have a fraud team. It is unconscionable that TCN refuses to speak with a person who has been a victim of ID Theft given that they pride themselves in having robust consumer protection requirements.” RP, Trustpilot

“You sent my file to collections on July 13th even though I have 10+ emails from your general email address confirming that I had a payment plan that wouldn’t start until July 23rd. I will be inquiring with the Better Business Bureau or whatever regulatory agency is available because you affected my credit after making an agreement with me. Definitely unlawful in my opinion.” S Mendoza, Trustpilot

“On January 4, 2021 I applied for a loan with a company called Target cash now. I got approved for a 1,200 loan. When I received the contract saying I will have to pay a regular payment of $414.81, when I called to clarify the amount the Company told me I will need to pay them weekly. Before they sent me the money, I told them to cancel the contract because, I can’t afford to pay this amount back. They denied me and sent the 1,200 anyway. The contract they sent me says I will owe them a total of 1,601.85. I new they were a fraud company. Now the Company is harassing me every day with persons of a foreign language. Today March 10, 2021 I received a email saying my case will be transferred to another company called zen resolve and I owe 2, 075.84 on a 1,200 loan is ridiculous.” –No Name Given, Better Business Bureau

What are the Pros and Cons of Tribal Loans

Obviously, there are a lot of reasons not to take out a tribal loan. Their ridiculously high interest rates and the fact that they aren’t regulated by the CFPB, or state authorities should make any borrower wary.

On the other hand, however, the borrowing requirements for most tribal loans are very relaxed. Typically, a borrower needs only be over 18, have a bank account that gets deposits regularly, and not be currently serving in any of the branches of the military.

Another good thing about tribal loans is that, when they check your application, they don’t necessarily do a hard pull with the major credit reporting bureaus (Equifax, TransUnion, Experian). Target Cash Now, for example, says it verifies information through Clarity, Factor Trust, and MicroBitt.

How to Apply for a Loan from Target Cash Now?

The Target Cash Now application is completed and submitted online. Here is the information it requires:

- Name

- Date of birth

- Social security number

- Physical Address

- Phone Number

- Rent or Own

- Duration at Current Address

- Employer Info

- Bank Info

Notice that you must provide your banking information (your routing and checking number) before you submit your application. Many installment lenders, payday lenders, and tribal lenders require this. They say it is so that they can get your funds to you as quickly as possible. Always be wary of any lender who requires access to your bank records before processing your application.

Better Alternatives to Tribal Loans

When you are desperate for cash, it’s easy to feel embarrassed. You might not want anybody to know about your situation, which is why you’re looking at a payday or a tribal loan. There are, however, plenty of other and better options out there. Here are some:

- OneMain Financial (a great online lender)

- Payday alternative loans (these are small loans offered by credit unions)

- Peerform (one of the highest rated peer-to-peer lenders)

- Borrowing from friends and family

- Credit card advance or low-interest balance transfer offer

- Home equity loan or home equity line of credit

- 401(k) loan

- MoneyLion (a top-rated paycheck advance app)

READ MORE: Hardship loans for bad credit

The Bottom Line

Financial emergencies are no fun. People experiencing them tend to panic. That panic can lead to some questionable decisions, like taking a loan from a payday lender or tribal lender because it’s faster and easier than going through the loan process with your existing bank or asking a friend or family member for money.

Target Cash Now aims to take advantage of desperate people who feel that they have no better option.

Try to remember that it’s okay to ask for help. It’s also important to remember that even though your financial situation seems grim, you have a few options left.

FAQs

Target Cash Now can be contacted by phone at 800-346-9348 or by email at CustomerService@TargetCashNow.com.

Target Cash Now is based in Hays, Montana.

Target Cash Now does not loan to residents of Arkansas, Connecticut, Montana, New York, Pennsylvania, Virginia and West Virginia.