2023 Average Credit Score Statistics: By Race,

Age, and Gender

Credit scores provide lenders an insight into the financial and credit history of loan seekers. Ever since its early days and establishment, the credit score system has regulated loans and other big purchases across the country. Despite the high significance of the credit score, many people remain uninformed regarding their records and how to improve their standing.

The statistics below will provide a view into key information regarding the most relevant credit score data.

Key Highlights

- The average FICO score for 2022 across America is 716.

- The average Vantage score in the U.S is 698.

- Only 8.6% of Americans check their credit scores often.

- 26 Million Americans are credit invisible, meaning they have no credit history.

- About 21% of Americans fall in the category of ‘exceptional credit score’.

- The highest average credit score in the country is in Minnesota, and the lowest average score can be found in Mississippi.

- Senior citizens over 75 have the highest average score of any age group.

- Black Americans have the lowest average score out of all race groups.

Credit Score at a Glance

Is the average FICO Credit Score for 2022. This constitutes as 'good'. This number shows an increase for the fourth year in a row.

51% of Americans don’t check their credit score at all, 39.7% do it from time to time, and only 8.6% check their credit score often.

Paying attention to the credit score is key for financial management, 72% of Americans agree the credit score is vital to their finances.

Economy increased by 6.9% in 2021 but inflation reached the highest peak in 4 decades. Consumers paid 7% more for goods and services.

There are about 26 million American adults who are ‘credit invisible’ meaning they have no history of credit cards, loans or other credit.

The credit card usage for the year 2021 was at 25.3%. Credit card delinquency was at 1.67%, which is a decrease from 2020.

How Credit Scores are Calculated

When it comes to determining the factors that go into calculating the credit score, respective credit companies use similar but different systems.

What is a good credit score and how many Americans have it?

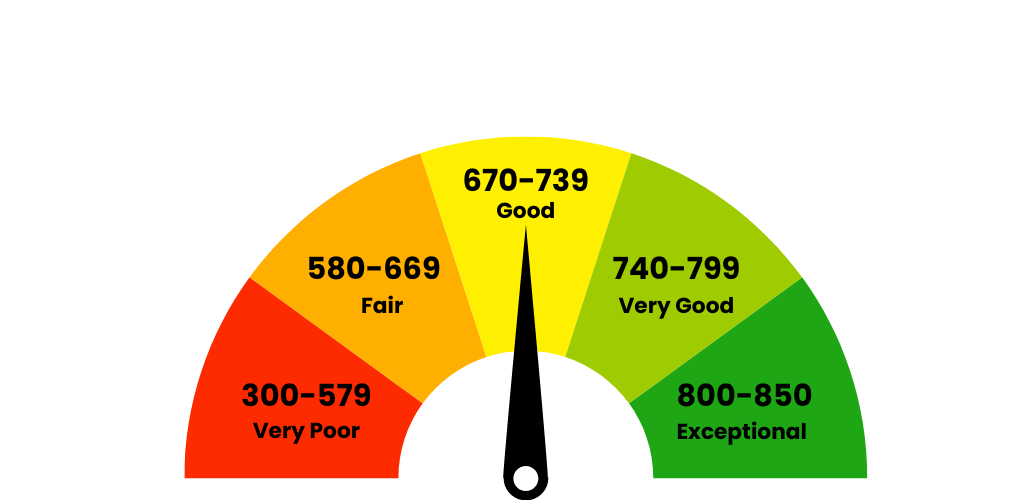

FICO measures and categorizes credit scores in the following manner:

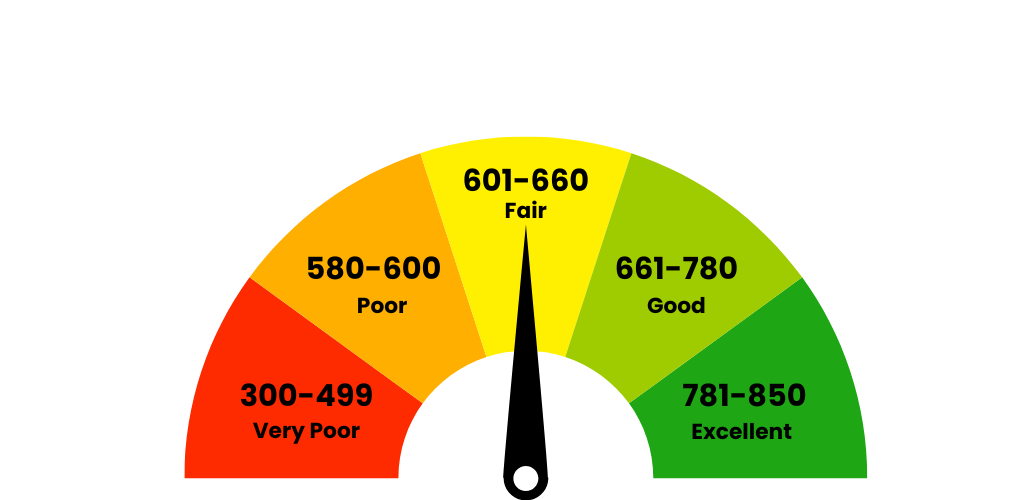

VantageScore measures and categorizes credit scores in the following manner:

Percentage of Americans in Each Category

Percentage for FICO

Percentage for VantageScore

Credit score factors

Credit scoring companies use different measures of calculating the credit score of their clients and base it on different factors by percentage.

The main difference between the scoring for FICO and Vantage score are the factors they take into account when calculating the credit score.

For Vantage Score, the most important factors in credit rating: Payment History (40%), Age and type of credit (21%), Percentage of credit limit used (20%), Total Balances (11%), Recent Credit Behavior (5%), Available Credit (3%)

FICO score factors

Credit Scores Across the Country

There’s generally no trend that can be observed across the U.S regarding average credit scores. Even in countries with higher costs of living, the credit score remains high. This standard remains about the same in states with a lower population as well.

However, according to reports by the Fed, there is a correlation between household income and credit score. Such a fact is reflected in the credit score data across the country. Considering that the top poorest states in the U.S are located in the south, it’s no surprise that the average credit scores for the south are lower than for other parts of the U.S.

States with the lowest and highest averge credit scores

According to Experian, the highest credit score in the country is in a retirement community in Florida known as The Villages, with an average score of 785, followed by cities in California such as Los Altos with an average of 777, and Saratoga with a score of 776.

How Credit Differs Based on Race, Age, and Gender

Considering the fact that there are disparities in wealth and income among the population, it is no surprise that the credit score is influenced by factors such as age, gender, and race.

Among different age groups, the silent Generation (Ages 75+) has the highest FICO scores, a whopping 758 on average, which puts them about 84 points ahead of their youngest counterparts.

Credit Score by Race

In terms of race, Asian Americans have the highest average FICO score at 745. White Americans have the second-highest average credit score at 734.

African Americans have the lowest average credit score of 677. Not only that, 54% of Black Americans are in the poor or fair category or have no visible credit.

Credit Score by Gender

There’s disagreement about whether or not there’s a gap in credit scores for men and women. However, data indicates that men have a slightly higher average score than women.

However, it’s observed that men have more debt than women, on average men have $125 more credit card debt than women.

The average FICO score for women is 704

The average FICO score for men is 705

Credit Scores for Women and Male-Owned Businesses Comparatively

Women-owned businesses had an average score of 597 compared to male-owned businesses, which had an average score of 620.

Credit Score and Income

Understandably the higher the income, the higher the credit score. Those with higher incomes can afford to pay back their credit at a higher rate and more frequently, thus contributing to a higher credit score. In turn, those with lower incomes have difficulties making payments on time and access to less credit contributing to lower credit scores and even less credit availability.

Approximate Credit Score by Income Earned

FICO scores that fall under 580 are considered to be poor scores. Such low credit scores make loan approval difficult and present other financial difficulties.

Low income individuals have less of a chance at having high credit scores, furthermore, 25% of them don’t have the financial literacy to start improving their scores.

Credit Reports and Credit Utilization

Credit Reports give a more detailed outlook on purchases and credit utilization. It's the most efficient way of getting concrete information on how credit has been used so far which in turn can help with planning on how to increase the overall score.

Another reason why it’s important to check up on the credit score, and require credit reports, is to spot possible mistakes. Mistakes on credit reports are not only very common, they could potentially affect the credit score negatively.

More than 300,000 complaints regarding credit reports issues have been filed in 2021 alone.

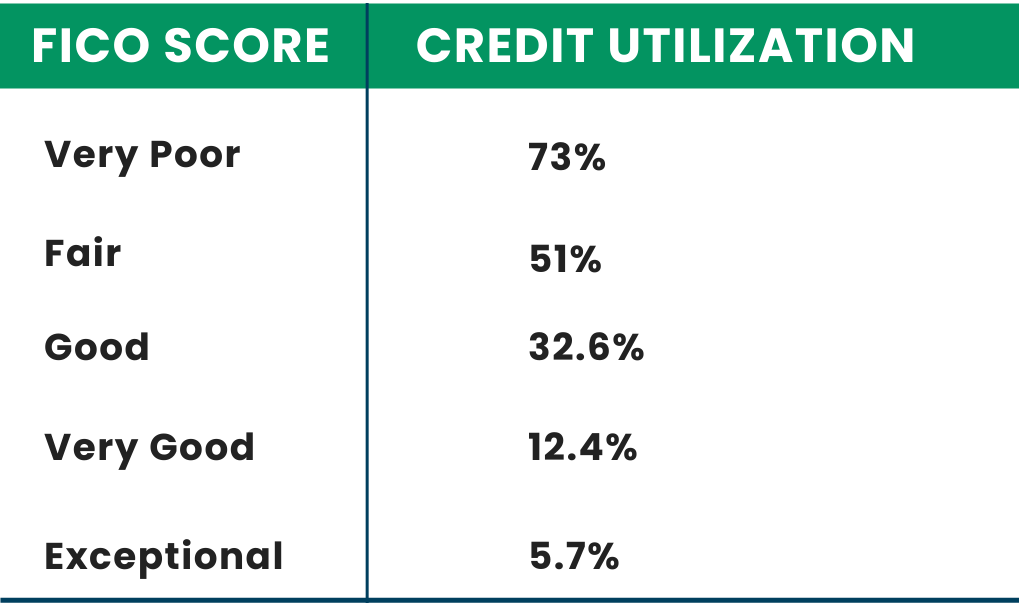

Correlation between the credit score and credit utilization

As a general rule, people who fall in the ‘poor’ category for FICO scores, tend to have a very high credit utilization rate at about 73%. This is a stark comparison with those who have exceptional scores, whose credit utilization rate sits at only 5.7% on average.

What You Can Do To Improve Your Credit Score

As established, the credit score is crucial for future purchases.

There are a lot of instances that would require credit score checks. Common entities that might do a credit score check are: Credit Car Companies, Mortgage Lenders, Auto Lenders, Student loan lenders, Insurance Companies, Collection Agencies, Landlords.

Paying Bills in Time

This ensures that the payment history remains clean and shows responsibility in managing credit.

Keeping Credit Card Balances Low

Paying credit card balances on time keeps them low, keeping the credit utilization rate at the preferred level is also crucial.

Become an Authorized User for Other Accounts

Specifically for accounts that have high credit scores and a good balance. This could benefit your personal credit score and help increase it.

Check the Credit Score Often

By doing so, you can dispute possible errors on it that could bring the credit score down. You can also request a detailed credit report.

Only Apply for Credit when Really Necessary

While taking up loans can help build up credit, too many credit applications can have a temporary negative impact on credit score.

Lenders often check applicants' credit score by using hard checks or soft checks. Hard checks happen primarily in applications for mortgage loans, and they require the applicant’s approval. Soft checks do not affect the credit score and are usually utilized when companies do a background check before lending or approving loans.

The process of increasing the credit score number might seem intimidating at first, whether you’re just starting out with having credit or simply want to improve your standing. It’s important to keep in mind that the earlier you start on this journey, the better for your future financial endeavors.