Average Retirement Savings Statistics

Last updated: 2023

Fear and uncertainty about how we'll finance our retirement are not new. For decades now, average American families have had to use savings strategies to stockpile enough money to ensure that their basic needs are met. The ideal scenario is to have enough money stashed away to guarantee a comfortable lifestyle. However, amid recessions, rising inflation, fluctuating markets, a global pandemic and countless other uncertainties, the need to tackle your retirement planning early is essential.

In this article, we’ve curated a selection of key retirement statistics that everyone should know in 2023.

Key Findings

- The median retirement savings for individual accounts across all ages is $65,000.

- The median retirement savings for households of all ages is $93,000.

- Women have almost 50% less in retirement savings than their male counterparts.

- While 60% of white households have individual retirement accounts, only 45% of Black families and 34% of Hispanic families have these accounts.

- Hawaii has the highest average retirement income necessary to live comfortably, at $1.84 million.

- The average savings in 401(k) plans across America totals approximately $109,600.

- The total savings needed for retirement in the U.S. vary from over $600,000 to almost $2 million.

- 7 out of 10 Americans now want to live to 100 years old, making the amount needed for retirement even higher.

- The average retirement age in the U.S is 64.

General Retirement Savings Statistics

Average Retirement Savings

In 2019, Americans had a median of $65,000 in retirement savings, a 2% increase from 2016.

Household Retirement Savings

The median household retirement savings across workers of all demographics is an estimated $93,000.

U.S Household Average Income

The average amount of income for a U.S. household was $255,200 in 2019, a 5% increase from the reported 2016 data.

Households with Saving Plans

37.3% of U.S. households had an IRA (Individual Retirement Account) as of mid-2020.

Average Household Debt

The average American household owes a whopping $155,622 in debt, including mortgages and credit card debt.

National Retirement Deficit

The retirement deficit in the United States was estimated to be at $3.68 trillion at the start of 2020.

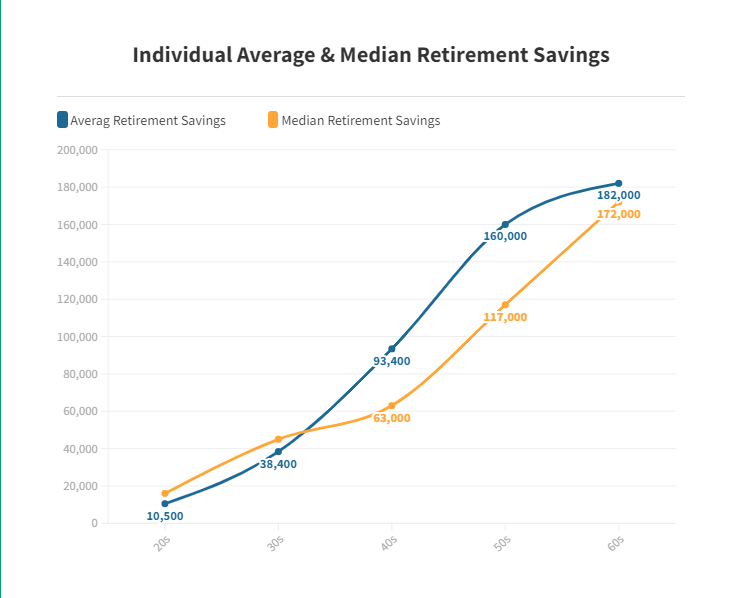

Average & Median Retirement Savings by Age

Americans in different age groups have set aside total retirement savings that correspond to their lifestyles, though naturally, the numbers differ based on age and work experience.

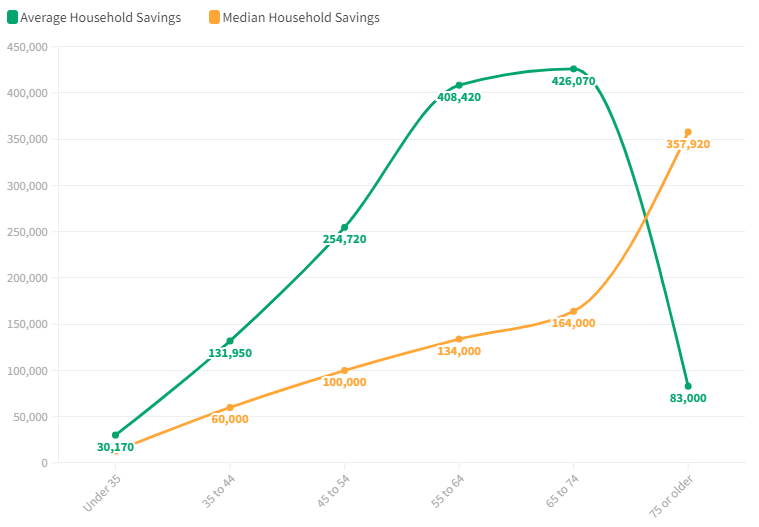

Household Average & Median

Retirement Savings

The retirement savings situation differs by household, usually because more than one person -- and sometimes employers -- contribute to the accounts. Other factors such as education also play a part in these numbers.

Retirement Savings Demographics

It comes as no surprise that there's a big difference in savings between demographic groups in the U.S. Age, experience, education and more are essential factors when it comes to retirement savings.

Between different races, genders and regions, retirement savings totals vary significantly.

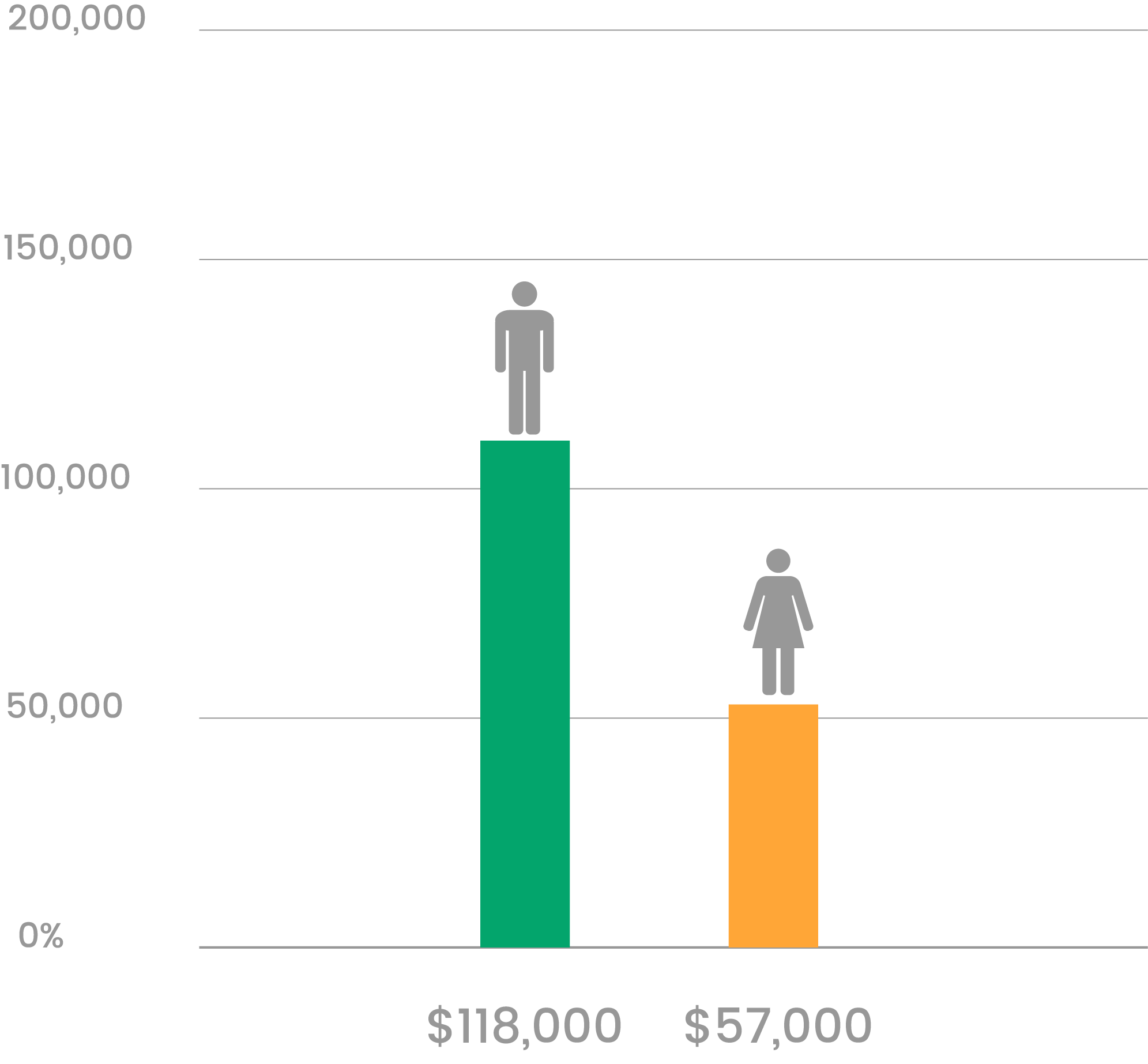

Savings by Gender

The gender pay gap is one of the main factors that contribute to the disparity between the retirement savings of men and women. Even seemingly insignificant differences between income and job titles make a big difference when added up throughout a career spanning 40 or more years.

Average retirement savings for women currently stand at $57,000, which is significantly less than those of men, which average $118,000.

Savings by Race

Race is another big factor that contributes to savings disparities and the disproportionate allocation of wealth, so it’s not surprising that it also impacts retirement savings. Even different economic crises have had different effects on people from different racial and ethnic backgrounds.

Though past recessions have affected the entire American population, the effects were felt primarily among people of color. The number of Hispanic families who had a retirement savings account went from 38% in 2007 down to 35% in 2016; for Black families, it went from 47% to 41%.

Top 10 States with the Most Savings Needed

For a Comfortable Retirement

Certain states have higher costs of living than others, and due to this, the income you earn can vary significantly based on where you live. This will also change the amount of money required for a comfortable retirement. All things considered, on average, Americans believe that they will need to save around $1.9 million in order to retire comfortably.

Distribution of 401(k) Savings Across Generations

A 401(k) is an employer-sponsored plan that helps Americans save for retirement while sheltering your savings from taxes. In 2022, the maximum annual contribution to a 401(k) can be up to $20,500, which is an increase of $1,000 from 2021.

How Much Should You Be Saving?

How much money will you need for a comfortable retirement? That's a difficult question that requires a different answer for each individual or household. The correct sum is based on many different factors and variables, so it’s impossible to pinpoint the amount and give a uniform answer. That said, there are ways to plan and calculate the approximate percentages needed to assure a comfortable future.

Ideal Savings at Every Age

To continue maintaining your current lifestyle after retirement, the average American will need a retirement income that's equivalent to about 70% to 90% of their annual salary at the time of retirement. Social Security can factor into this total.

Usually, it's ideal to save between 10% to 15% of your annual salary. That amount can include any percentage that will be contributed by your employer. The chart at right offers a savings guideline for where you should try to be during every decade you spend working.

Where Should You Start?

Even though the amount needed for a comfortable retirement will be different for everybody, here are some key strategies to follow: