As a prospective homebuyer, it’s important to understand your rights as a borrower and what lenders can — and cannot — legally do. That’s where the Truth in Lending Act (TILA) and its related disclosures come in.

The provisions of the federal law apply to most types of consumer credit, including car loans. But it is an important tool to protect homebuyers — and those seeking a second mortgage — from such predatory lending practices as unfair or inaccurate billing.

Table of Contents

Key Points

- The federal Truth in Lending Act requires all lenders to notify you of all charges and fees that accompany your loan.

- A credit card issuer is required to disclose interest rates, grace periods and annual fees, plus send you a notification before a yearly fee is charged.

- Auto lenders must inform you if the market value or actual cash value of a vehicle you’re trading in is less than the loan’s value.

- Home lenders must provide written information about the total cost of a residential mortgage loan. This includes the annual percentage rate (APR), total payments, and service charges.

- If your lender fails to provide the required information, you may be able to sue for damages.

Truth-in-Lending Protections

The Truth in Lending Act, or TILA, also called Regulation Z, requires lenders to inform you of all charges and fees you’ll pay on your loan. This federal law was established in 1968 to clarify the lending process by requiring lenders to disclose the borrowing costs.

The Truth in Lending Act offers borrower protections for many different types of loans, including:

- Credit cards

- Car loans

- Home loans and mortgage refinances

- Reverse mortgages

Let’s take a look at how the TILA protects you.

Credit Cards

The Truth in Lending Act (TILA) protects you against inaccurate and unfair credit billing and credit card practices.

A credit card issuer is required to disclose interest rates, grace periods and all annual fees. The issuer also must send you a reminder of an upcoming annual fee before the card is renewed.

Pro tip: If you miss your annual fee notification, many credit card issuers may be willing to refund the annual fee if you close the account and request a refund within. 30 days. It’s not guaranteed, but it never hurts to ask.

Regulation Z prohibits a credit card issuer from opening an account or increasing the credit limit on an existing account without considering the consumer’s ability to make the required payments under the new account’s terms.

Example of How It Works

Let’s examine how the TILA comes into play with credit cards.

For example, if you wanted to apply for the Discover It card, Discover discloses the APR (16.49%-23.49% based on creditworthiness), and an annual fee ($0+/-). The TILA requires that Discover discloses the various APRs for different kinds of transactions.

This can include:

- Balance transfers

- Cash advances

- Annual fees

- Other fees of interest

Auto loans

Auto lenders are legally obligated to inform you if the market value or actual cash value of a vehicle you’re trading in is less than the value of the loan on that vehicle (commonly referred to as being “upside down.”)

For example, if you purchase a car for $15,000 but when you go to trade in the vehicle it is valued at $7,000 but you still owe $9,000 on your loan, you will still owe $2,000 to repay the loan. This must be disclosed in the sales contract at the time you trade in the vehicle under “amount paid to others.”

Occasionally a shady car dealer may try to tell you that you’re getting a certain amount for your old vehicle, but in actuality, you’re paying an inflated price for the new car to cover the negative equity. This is illegal.

Examples of How It Works

Example of proper disclosure

- Price: $35,000 (No down payment, financing 100%)

- Trade-in value: $12,000

- Loan Payoff: $15,000

- Amount financed: $26,000

Example of Improper disclosure

- Price: $35,000 (No down payment, financing 100%)

- Trade-in value: $15,000

- Amount financed: $26,000

Home Loans and Second Mortgages

A Truth in Lending Disclosure Statement provides written information about the total cost of a residential mortgage loan. This includes the annual percentage rate (APR), total payments, and service charges.

It will usually come into play if you’re applying for any sort of home loan, including a mortgage, a mortgage refinance, a cash-out refinance, a mobile-home loan or a reverse mortgage.

When you apply for a mortgage, you’ll get a mind-boggling amount of paperwork. Buried in the stack will be a Loan Estimate and Closing Disclosure. It is important to review them carefully. A seemingly small difference in loan interest rates can add up to thousands of extra dollars in interest over the life of your loan.

During the home buying process, you should receive a Truth-in-Lending disclosure twice: Once when you apply for your loan and a final disclosure before closing. Your Truth-in-Lending form includes information about the cost of your mortgage loan, including your annual percentage rate (APR).

Pro tip: These Truth in Lending documents include key information about the cost and terms of your mortgage loan, such as the APR and monthly payment amount. They’re standardized and written in simple language to make it easier to understand exactly what you’re signing up for before you commit to the loan.

If anything is unclear or unreasonable, or if you’re looking for something more affordable, hold off on signing anything. Instead, shop around and compare loan offers from other mortgage lenders until you find what works for you.

Pro tip: When you buy or refinance a home, the final step of the process is known as the closing. During this meeting, you will finalize all the details of your purchase. You will be expected to sign several forms and likely will need to bring a cashier’s check for your down payment. This is when you will get your final loan disclosure. Be sure to look it over and ask any questions at that point before you sign it.

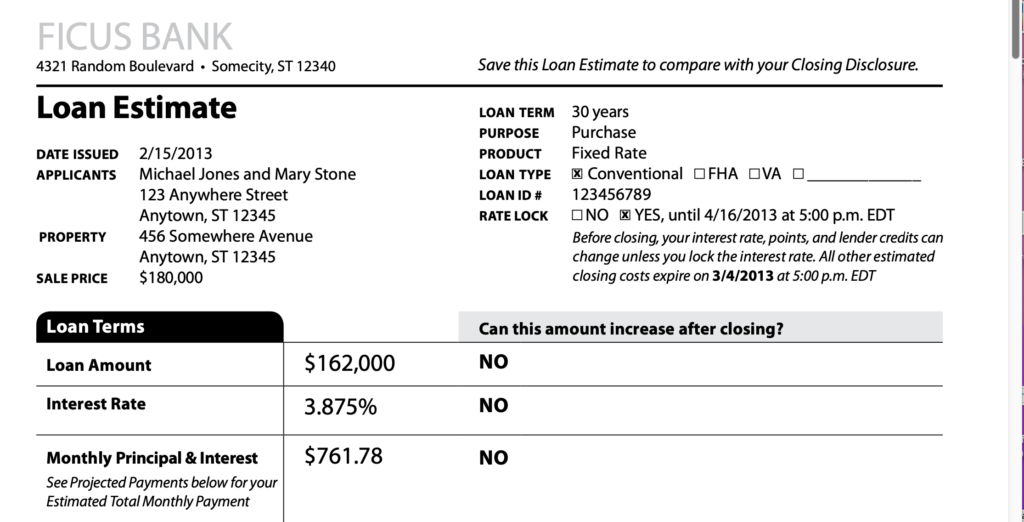

Loan Estimate

A three-page Loan Estimate is one of the documents you’ll get after applying for a mortgage. Before October 3, 2015, the Loan Estimate was actually two documents – a Good Faith Estimate and the Truth-in-Lending disclosure.

The Loan Estimate contains vital information about the loan, including the:

- Annual percentage rate (APR)

- Adjustments to the APR or initial loan balance

- Monthly payment amount

- Total number of payments (principal plus any charges like interest)

- Total sum financed / cost of credit

- Penalties or additional charges (ex. late or prepayment fees)

- Estimated property tax and homeowner’s insurance charges

- Cost of private mortgage insurance (if you put less than 20% down)

- Any other finance charges and important terms (ex. home inspection costs or other discretionary fees)

- Mandatory HOA dues or fees

Example

Here is an example of what a Loan Estimate looks like:

Pro tip: A mortgage lender must give you a Loan Estimate within three business days of receiving your loan application. This gives you the opportunity to compare costs with other lenders and get a realistic estimate of the total cost of the property. Since buying a home is one of the biggest purchases people make, it’s important to make an informed decision before choosing a loan.

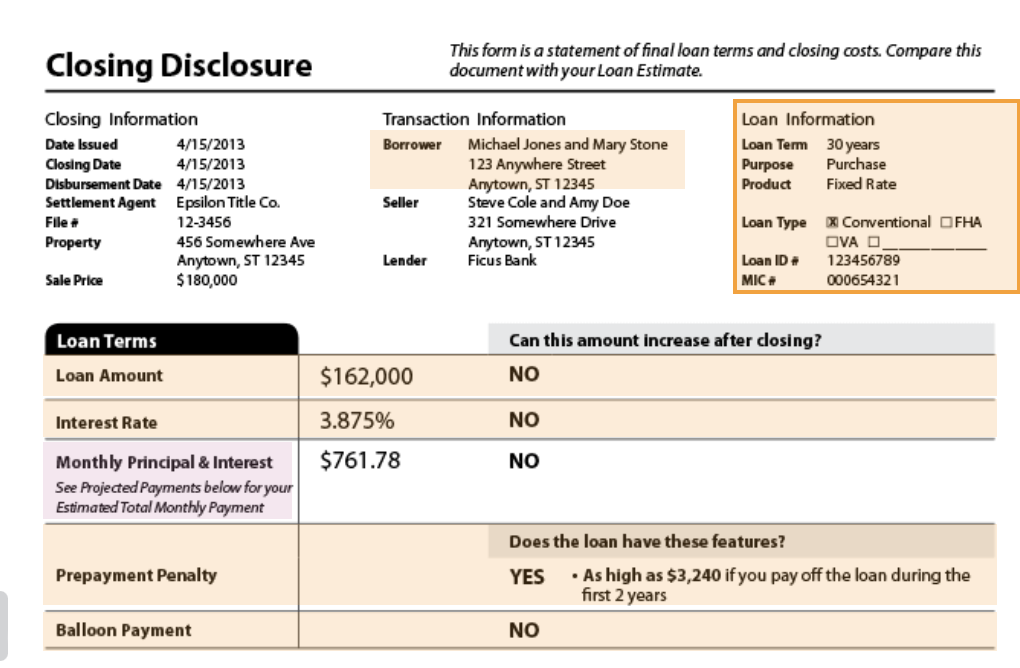

Closing Disclosure

Originally called the Truth in Lending disclosure, a Closing Disclosure is a five-page form containing the final details about your loan and a payment schedule. This document includes:

- Specific loan terms

- Monthly payments throughout the loan

- The total amount you’ll pay in fees and closing costs

Pro tip: A mortgage lender must provide the Closing Disclosure at least three business days before you close on the loan. Once you have this document, you can ask questions and compare the final terms and costs with those in the Loan Estimate.

Example

Here’s a sample of what a Closing Disclosure should look like:

Though the Loan Estimate and Closing Disclosure look similar, only the Closing Disclosure includes the final calculations. To learn more, visit https://www.consumerfinance.gov/owning-a-home/closing-disclosure/

To learn more about the differences between the documents, check out this video:

Who Is Affected By the Truth in Lending Act?

As mentioned, the Truth in Lending Act applies to almost all types of consumer credit, including credit cards, auto loans and mortgages. However, not all forms of credit are affected. The TILA doesn’t apply to:

- Agricultural businesses

- Other Entities

- Public Utilities

- Home fuel budgeting plans

- Some student loan programs

What if Your Lender Fails to Provide the Information?

If a lender violates the Truth in Lending Act, you may be able to:

- Sue for damages: If a lender doesn’t provide the required documents or disclosures, you could sue for any related real or statutory damages. Things that may be considered violations include improperly disclosed information about the APR, total number of payments, finance charges, etc.

- Void the mortgage loan: Without the Truth-in-Lending disclosures, you have up to three years from the date the loan was originated to try to rescind it. This essentially voids the loan, making it as though it never existed. It’s especially useful if you’re facing foreclosure.

What You Need to Know About the Truth in Lending Act

Enacted in 1968, the Truth-in-Lending Act is a federal law (15 U.S.C. §§ 1601-1667f as amended) that attempts to enforce “truth in lending.” It was implemented by the Federal Reserve Board’s Regulation Z (12 CFR Part 226).

The TILA’s disclosure requirements apply to nearly all forms of consumer credit, including:

- Closed-end credit (ex. auto loans and home mortgages)

- Open-end credit (ex. credit cards or HELOCs)

The Dodd-Frank Act gives the Consumer Financial Protection Bureau (CFPB) TILA rulemaking authority. Title XIV of the Dodd-Frank Act also includes several amendments to the TILA, which the CFPB implemented in 2013.

The TILA protects individuals against inaccurate or unfair credit billing and practices by requiring lenders and creditors to provide certain information. Under this act, lenders must provide loan cost information so you can compare loan offers and look for the best rates. This allows you to make an informed decision and, if necessary, back out of disadvantageous agreements.

What is Covered?

Under the TILA, lenders must provide clear information about the costs and terms of any loan product so you know what you’re getting before you commit to anything. Lenders must also use simple language about the loan so you can clearly understand the offer.

Among other things, lenders must include the following details:

- Annual Percentage Rate (APR): This is the interest rate, or cost of credit, expressed as a yearly percentage rate. The documents must also indicate the circumstances in which the terms or rates could change.

- Finance charges: This is the cost of credit in a dollar amount. It includes the total amount of interest and certain fees you’ll pay over the life of the loan (if you make all payments on time).

- Amount financed: This is the total dollar amount of credit provided to you (normally the borrowed amount).

- Total sum of payments: This is the number of payments you’ll make over the course of the loan, including all charges.

Other things that are included in the TILA disclosures are:

- Monthly payment amount

- Late payment fees or prepayment penalties

- Service charges

The TILA also gives borrowers the right of rescission, a three-day window to back out of the loan without losing money. The right of rescission only applies to specific types of loans. This includes HELOCs, home equity loans, reverse mortgages, and refinanced loans.

What Is Not Covered?

Although the Truth in Lending Act covers many types of financing, it does not cover:

- Business loans

- Student loans

- Loans over $25,000 made for purposes other than housing

Besides this, this act does not tell banks how much interest they can charge. It also does not require them to grant consumer loans. These lending decisions are determined by the borrower’s credit score, debt-to-income ratio, and other factors.

Remember, the Truth in Lending disclosures are typically provided as part of the home loan contract. If the lender does not automatically provide the TILA disclosure, ask them for it. You may be given the entire contract to review, depending on the situation.

Be sure to review the documents carefully before signing any loan contract. Keep an eye out for any errors (ex. personal information), omissions, or additional fees (ex. late fees).

Reverse Mortgages

You will not receive a closing disclosure when applying for a reverse mortgage. Instead, you’ll receive two forms:

- HUD-1 Settlement Statement: This form includes all credits and charges involved in the home buying, selling, or refinancing process. If you’re refinancing, you may instead get a brief HUD-1A document.

- Final Truth-in-Lending Disclosure: This form also includes the details of the total loan costs, including the annual percentage rate.

HELOCs or Manufactured Housing Loans Not Secured by Real Estate

With certain other types of loans, you’ll get a Truth-in-Lending disclosure. These loans include:

- Home equity line of credit (HELOC): This is a type of home equity loan with a revolving line of credit. With one, you can use the equity in your home to pay for things like home renovations or consolidate debt. HELOCs have an initial draw period (when you can withdraw money) and a repayment period (which is when you must repay what you borrowed).

- Manufactured housing loan not secured by real estate: Many manufactured homes have their own rules when it comes to lending. Some lenders don’t offer financing for this type of property.

- Home loans offered through certain homebuyer assistance programs: If you’re going through a program, check their rules and regulations. Depending on the program, you may not qualify for a Closing Disclosure.

Because of the amendment made effective on October 3, 2015, the names of certain forms have changed. That said, the purposes of these documents are still largely the same.

Still, if you took out a mortgage before this date, you may not be familiar with the new terminology. When in doubt, ask your loan originator which type of loan applies to you – and which forms go with it.

READ MORE: Best lenders for purchasing a mobile home with bad credit

The Bottom Line

The TILA helps safeguard individuals from unfair or deceptive lending practices, particularly when they’re applying for a mortgage or other form of financing. Reviewing the Truth-in-Lending disclosures allows you to make an informed decision before agreeing to a home loan. You can also better understand the loan contract and gain important insight into the exact terms and fees.

FAQs

The TILA does not cover private student loans under $50,000. This means that lenders don’t have to provide the same TILA disclosures or information about these loans.

A payment schedule — sometimes also called an amortization table — shows you the loan payments, including principal plus interest, from the date of the loan until the final payoff date. This gives you a breakdown of each monthly payment and how much of the payment goes towards interest vs. the principal balance.

Home equity loans and home equity lines of credit (HELOCs) both let you borrow against the equity in your home. The funds can be used for things like home improvements or debt consolidation. A home equity loan lets you borrow a lump sum, while a HELOC acts like a credit card with a set draw period followed by a repayment period.

A cash-out refinance lets you convert some of your home equity into cash while you continue to pay off the mortgage. This negates the need to sell the property to access equity. However, a cash-out refinance comes with its terms and interest rates.

The OCC is the Office of the Comptroller of the Currency. This independent bureau in the U.S. Department of the Treasury regulates and supervises national banks and federal savings associations. It also controls federal agencies and branches of foreign banks. The OCC also offers resources on the Truth in Lending Act, which you can find here.