It’s easy to get sucked into buying a timeshare, but once you sign on the dotted line, though, the fees kick in and you discover that you signed up for life. Timeshare Compliance promises a way out.

Timeshare Compliance promises to “legally and successfully achieve timeshare contract resolution.” Do they deliver on that promise?

Let’s find out.

Table of Contents

Who Is Timeshare Compliance and What do They Do?

Timeshare Compliance provides timeshare exit services. They work with frustrated timeshare owners who want to get out of their timeshare contracts but can’t. Timeshare Compliance is based in Aliso Viejo, Calif., that has been in business since 2012.

Timeshare Compliance says that they use a three-part process.

- Investigate: Timeshare Compliance specialists will review your case and decide whether they can help you.

- Advocate: a client specialist, case analyst, coordinator, and case representative will negotiate a way out of your timeshare agreement.

- Resolve: Timeshare Compliance considers a case resolved when you no longer have contractual timeshare liabilities.

Timeshare Compliance is not a law firm, but it does cooperate with outside law firms to manage any legal action required in the pursuit of cases.

If you contact Timeshare Compliance to inquire about timeshare exit services, they will ask you several questions.

- Did you feel pressured into your purchase?

- Do you owe a balance on your timeshare purchase?

- What are your approximate annual maintenance fees?

- Where did you purchase your timeshare?

The answers to these questions will help the company to decide whether they believe they can resolve your case. Many timeshare exit companies have similar policies, indicating that they will not accept every potential client that approaches them.

Should You Stop Paying?

Many timeshare exit companies recommend that clients stop paying their maintenance fees and their mortgage installments (if they are still paying a mortgage on their timeshare). This can encourage a resort to negotiate, but the resort could send these accounts to collections or even foreclosure. If that happens the owner’s credit score can take a beating.

Some timeshare exit companies consider a foreclosure to be an acceptable outcome, as it releases the owners from their contract. This may not be satisfactory to owners, who will have those entries on their credit reports for seven years. Discuss this possibility with any timeshare exit company before signing an agreement.

Timeshare Compliance’s Timeshare Exit Costs

Timeshare Compliance does not disclose the price of its services on its website. The closest they come is a statement that “costs and fees can vary depending on the case”. This is common in the timeshare exit industry. The work involved in resolving a case will depend on the specific requirements of that case.

Timeshare Compliance offers a free initial consultation. If they decide that they are willing to work with you, they will offer a free proposal. You will decide whether you wish to go ahead with the proposal.

Customer reviews sometimes cite the costs paid. That can be a rough guide to a timeshare exit company’s price range. Timeshare Compliance reviews mention payments of $1,000 up to “over $10,000.”

Some sources report typical fees of $4,000 to $8,000. This is typical of the timeshare exit industry.

Several reviews describe fees of $8,000 to over $10,000. We’re not sure we’d consider that “minimal cost”. The fee proposal lays out these charges, so you’ll be able to decide whether you’re willing to pay the price for their services. You can and should negotiate for a better deal: don’t take the first offer!

The average timeshare carries a $980 annual fee, and the fees usually go up every year. If you’re looking at 20 years of fees the price may be worth it.

Timeshare Compliance offers an escrow option. If you choose this option you can pay your fee into an escrow account. The Company won’t get the money until they resolve your case. The website also refers to a “loan financing program” that allows you to borrow money (with interest, of course) to pay your timeshare exit costs.

Can You Trust Timeshare Compliance?

Timeshare Compliance has been sued by timeshare resort operators — we’ll discuss that in more detail later — but we cannot find any record of regulatory action or lawsuits by any state or federal authority or lawsuits from customers or consumer advocates.

Many timeshare exit companies have been accused of deceptive marketing practices. These often include scare tactics like telling timeshare owners that their children will inherit their obligations (they won’t) and timeshare exit companies failing to suggest that potential clients simply ask the resort whether they can return their timeshare rights.

We can find no published claim that Timeshare Compliance uses these deceptive marketing practices, but you should be alert for them if you’re shopping for a timeshare exit company.

Online Reputation

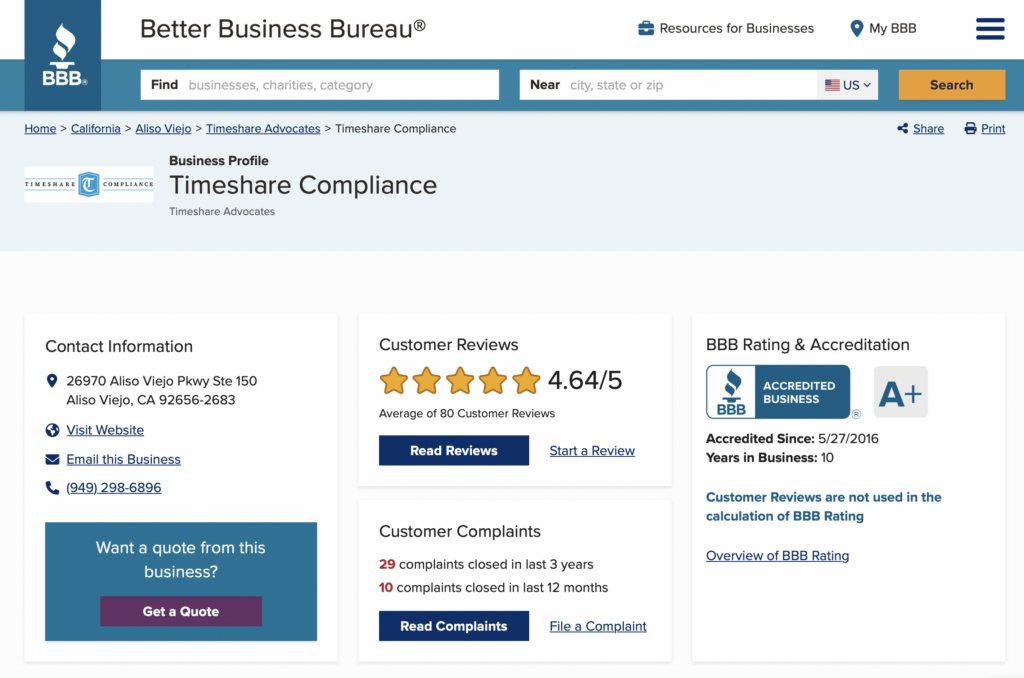

Timeshare Compliance has numerous online reviews, and most of them are very positive. For example, Timeshare Compliance is accredited by the Better Business Bureau (BBB) with an A+ rating and an average of 4.64 out of a possible 5 stars from 80 reviews.

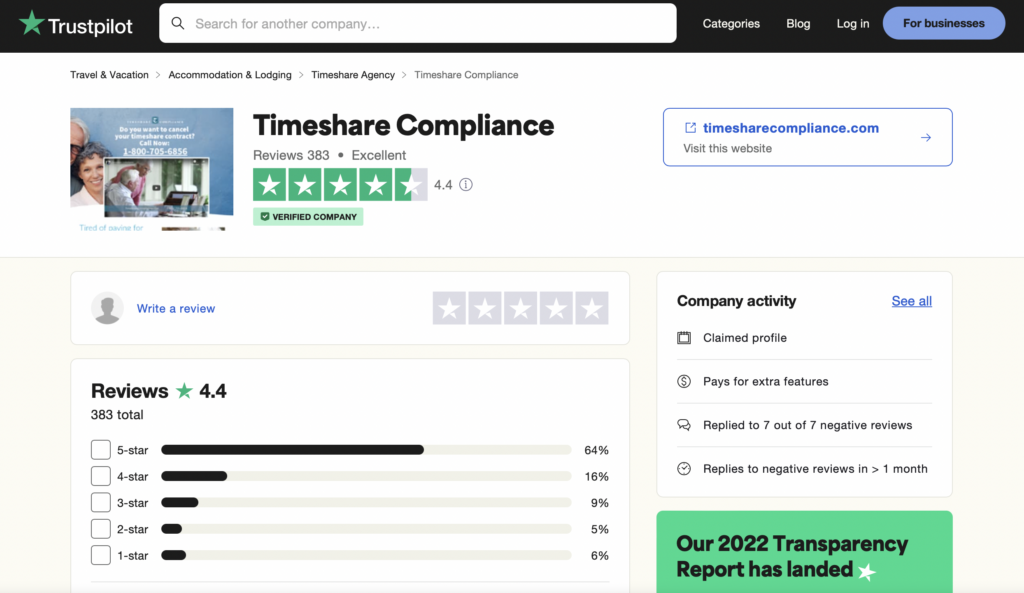

Timeshare Compliance has a 4.4 rating on Trustpilot from 383 reviews.

On Glassdoor (an employee satisfaction review site) Timeshare Compliance has an average 4.5 rating from 48 reviews, and 87% of the reviewers would recommend the company to a friend. You probably aren’t planning to apply for a job, but employee reviews can be a useful indicator of how well run a company is, and happy employees usually deliver better service!

Positive Reviews

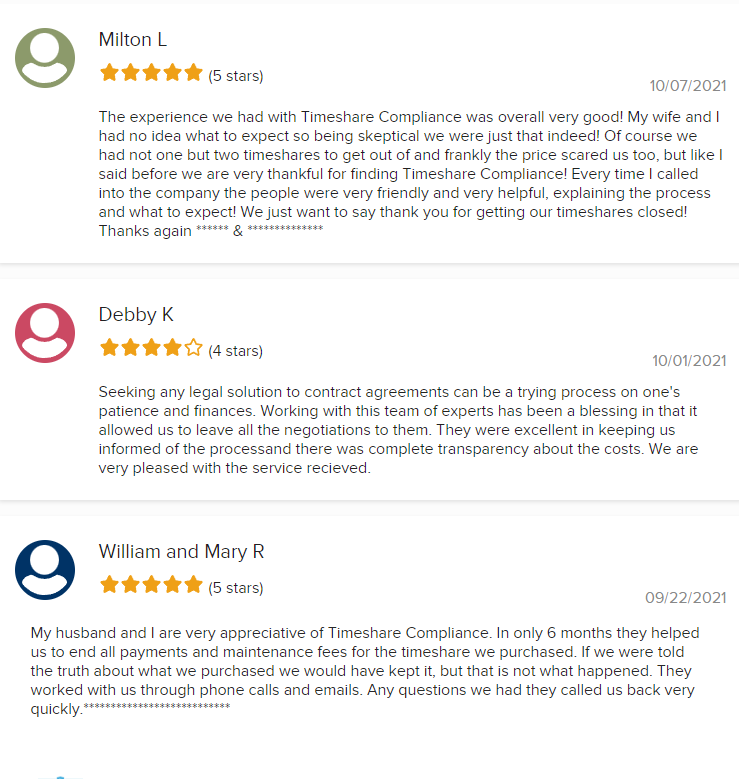

Positive reviews, have, as you’d expect, a consistent theme: good service, good results. Here are some examples from the BBB:

Negative Reviews

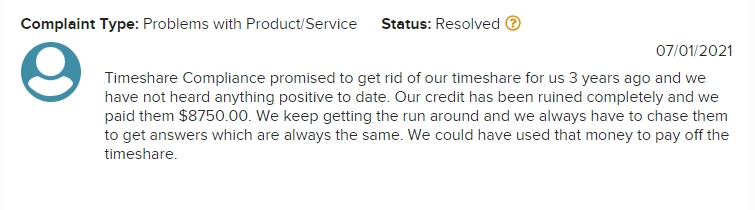

There are also negative reviews, and those have common features as well. Here are some complaints from BBB.

In each case, the complaints are the same: prolonged process, poor communication, and damage to credit. Several complaints also refer to a “class-action lawsuit.” We can find no records of any class-action lawsuit filed by Timeshare Compliance or any other timeshare exit firm.

Again, some timeshare exit companies treat a contract termination through foreclosure as a satisfactory outcome, because foreclosure releases the owner from the contract. This is rarely satisfactory to the client, as foreclosure can do serious damage to credit.

If a timeshare exit company promises to protect your credit, you should question that promise. It is very difficult to prevent a resort from reporting a late payment or foreclosure to the credit bureaus and even more difficult to force a credit bureau to remove a legitimate entry on your credit report.

The Balance: How Do Reviews Stack Up?

Online reviews are not 100% reliable. Review sites do everything they can to prevent companies from seeding positive reviews, but they don’t always succeed. Sometimes competitors or other hostile parties (like a timeshare resort) could seed negative reviews. It’s not always possible to tell which reviews are legitimate.

Overall, though, the balance of reviews seems positive enough to indicate that the company does succeed in getting clients out of timeshare obligations. They also have a good track record of responding to complaints: the BBB page indicates that the company responded to all complaints and resolved 8 of the 17 complaints with the consumer satisfied.

Some complaints may stem from unrealistic expectations, lack of clarity on the process, or simply customers who are never satisfied: there are always a few of those out there.

There are indications of some things to watch out for.

- If a timeshare exit company asks you to stop making payments on maintainace fees or a mortgage, be careful: your credit could suffer.

- Be skeptical of promises to protect your credit.

- If you feel like a company is neglecting your case, get in touch immediately and pursue it. Don’t wait.

- If a company talks about legal action, get specifics. Most timeshare exit companies negotiate but do not sue timeshare resorts.

These warnings apply to all timeshare exit companies, not just Timeshare Compliance.

What’s Good About Timeshare Compliance

- Timeshare Compliance has been in business for 12 years. That suggests that they do have a track record and they are not a fly-by-night group.

- Timeshare Compliance is selective. A timeshare exit company that will accept any case is usually more interested in the fee than the outcome.

- Clients can select a “credit monitoring and restoration” option. It is not clear what this involves.

- Timeshare Compliance has generally positive reviews and many report successful outcomes.

- The Company offers an escrow payment option, with an escrow company holding your fee until the Company resolves your case.

What’s Bad About Timeshare Compliance

- Several reviews indicated that clients were advised not to make mortgage or maintenance fee payments, and that their credit suffered as a result.

- Not all potential clients are accepted. Timeshare Compliance will only accept a client if they believe there’s a strong possibility that the case will be successful.

- Some users report poor communication and the feeling that their cases were neglected (many others report the opposite experience).

- There are unconfirmed indications that the company might make unreaslistic promises (e.g. class action suits) in marketing.

- It is not clear whether the Company advises potential clients to simply ask the resort about a return program before retaining a timeshare exit company.

- Fees may be high.

Lawsuits Against Timeshare Compliance

Timeshare Compliance is currently defending itself against a lawsuit from Diamond Resorts Inc., the largest timeshare resort operator in the country. The suit claims that Timeshare Compliance uses false advertising and interferes with contractual obligations. It also claims that the relationship between Timeshare Compliance and the law firms it uses is a civil conspiracy.

The lawsuit makes several specific allegations.

- Timeshare Compliance persuades timeshare owners to make large payments and fails to provide any actual service.

- The Company and its lawyers cause timeshare owners to violate their timeshare contracts, causing foreclosure and damage to their credit.

- Timeshare Compliance makes false claims, including claims that there is a legal way to cancel timeshare contracts, claims of a money-back guarantee, and the claim that timeshare obligations will be inherited by the owner’s children.

These claims will have to be verified and resolved by the court. We notice, however, that while Diamond Resorts claims that Timeshare Compliance damages its clients, the suit is not being filed by dissatisfied customers, consumer advocacy groups, or a federal or state consumer protection agency. It’s filed by a major timeshare resort owner.

It is not clear whether Diamond is trying to protect the interests of its timeshare owners, as it claims, or whether it the Company is simply advancing its own interests.

Some Diamonds Don’t Sparkle

Diamond Resorts Inc. doesn’t just have an issue with Timeshare Compliance. They are after the entire timeshare exit industry: Diamond has filed over a dozen lawsuits against different timeshare exit companies.

Diamond has also faced legal action by both consumers and regulators.

- The Arizona Attorney General’s office took action against Diamond after receiving over 500 complaints. Diamond paid $800,000 to settle the enforcement action.

- A $1 billion class action suit filed in Nevada accuses Diamond of false promises, fraud, and elderly abuse.

- A case filed in Arizona accuses Diamond of passing operating costs on to consumers through inflated maintenance fees.

- A California case accuses Diamond of deceptive marketing and high-pressure sales tactics.

All of these legal actions were filed by disgruntled customers or government regulators, not competitors or businesses with competing interests.

It is possible that Timeshare Compliance has used deceptive marketing methods or otherwise stepped outside the law. That’s for the court to decide. Diamond Resorts is not the most credible accuser. Some people might say a lawsuit from Diamond indicates that Timeshare Compliance is doing its job.

The Timeshare Compliance Website

You can access the Timeshare Compliance website at https://timesharecompliance.com/. It’s a convincing website: the pitch is right upfront.

If you scroll down you’ll see a list of glowing testimonials. The eligibility page asks a series of simple questions designed to qualify potential clients, and there’s a timeshare calculator to help you assess the current and future cost of your timeshare.

The “How We Work” page explains the timeshare resolution process in very general terms, without going into specific detail on how Timeshare compliance deals with resort operators. The “About Us” page gives a brief description of the problems timeshare owners face, a bit of information on the location and history of the Company, and more glowing testimonials.

There is advice on the site suggesting that timeshare owners try to approach the resort directly before engaging a timeshare exit company. This is a sensible first step to take, as many resorts do have exit programs. If that fails, a timeshare exit company might be your next step.

We did notice that this advice is a bit hard to find. You have to scroll to the bottom of the “About Us” page and click on an article titled “What You Can Do Before Talking to Timeshare Exit Companies”. Many site visitors probably don’t see it.

Social Media Presence

Social media are key marketing channels, and Timeshare Compliance maintains an active presence on Facebook, Instagram, YouTube, and LinkedIn. The Company does not use Twitter.

Timeshare Compliance updates its Facebook page almost daily, mainly with stories of timeshare problems and positive accounts of successful efforts. 683 people like the page and 726 follow it, but there are almost no comments, shares, or other forms of engagement.

The Timeshare Compliance Instagram page has 37,000 followers and 250 posts, but again there is little visible user engagement.

The Company’s YouTube page has over 20 short videos of customers explaining their cases and how Timeshare Compliance resolved them. Only 50 people follow the page. Most of the videos have been viewed less than 500 times, but one has 146,000 views.

The LinkedIn page contains a brief description of the company and its business and links to 23 employee pages. The page has 62 followers. There are regular updates, but little engagement.

The Bottom Line

Timeshares can be a huge burden. Many timeshare owners find that their lives change, their health condition starts affecting their travel plans, and they simply aren’t using their timeshare anymore. Many owners find that it’s almost impossible to schedule their use rights at a convenient time. Maintenance fees rise and become serious burdens.

If you’re in that position, you probably want to get out of your contract. Despite advertised policies allowing you to return your timeshare, many resorts make this difficult. Some make it close to impossible. If you’re struggling to get out of a timeshare contract you may be considering retaining a timeshare exit company like Timeshare Compliance.

The timeshare exit industry has a dodgy reputation. Some companies are outright scams. Some charge large sums, subcontract the cases to outside lawyers and provide little supervision or follow-up.

There are also timeshare exit companies that do provide real services and have successfully helped many people out of their timeshare contracts.

Timeshare Compliance has operated for 12 years and has earned a reputation as one of the more reputable timeshare exit companies. They aren’t perfect, but they do have significant numbers of satisfied customers.

If you’re considering retaining Timeshare Compliance — or any timeshare exit company — look into the industry and the way it operates first. Try to negotiate a deal with the resort owner. If you decide to go with a timeshare exit company listen carefully during your free consultation, ask questions, read every document in full, and follow up at once if you feel that your case is not progressing.

An educated, proactive consumer will get the best deal and have the best chance of success!

Read more: How to Get Out of a Timeshare Legally

FAQs

Timeshare Compliance is the operating arm of Pandora Marketing LLC, which is located at the same address as Timeshare Compliance. The only director or officer listed is William Wilson, Agent, with the same address given, Pandora Marketing is a Branch of Pandora Marketing, LLC, incorporated in Wyoming.

The Wyoming company has an address in Cheyenne but no registered agent name. Pandora Marketing LLC (Wyoming) also does business as Resort Advisory Group, a timeshare exit company based in Irvine, Calif.

The street address for Timeshare Compliance is 26970 Aliso Viejo Parkway Suite 150, Aliso Viejo, CA 92656.

You can call Timeshare Compliance from 7 a.m. to 8 p.m. Pacific Standard Time.

The telephone number for Timeshare Compliance is (949) 298-6896. You can fill out an email contact form at the Timeshare Compliance website.

We cannot find any record of any major consumer or other group endorsing Timeshare Compliance