When money gets tight and the bills pile up, you need to act quickly, before your finances spiral out of control.

Americor calls itself “The Nation’s Leading Provider of Consumer Credit & Debt Relief Solutions.” Does it live up to that promise? Let’s take a look.

Featured Alternative: DebtHammer

- Can help with many types of debt, including payday and credit card

- Extremely transparent process, no shadiness

- Friendly and helpful customer support – no judgment

Table of Contents

Key Points

- Americor offers debt settlement and debt consolidation services

- Fees typically range from 15% to 25% of enrolled debt

- It’s important to realize that it will take several months after enrollment to see results

- Americor has an A+ rating from the Better Business Bureau

READ MORE: Best debt settlement companies

Americor At a Glance

| Do they offer a free consultation? | Yes |

| How to get started | Click the “Get Started Now” button on the website and follow the prompts |

| Fees | 15%-25% of total enrolled debt |

| How it works | See the “How to Sign Up” Section |

| Who owns Americor | Americor Funding, LLC |

| Company address and phone number | 18200 Von Karman Ave 6th Floor, Irvine, CA 92612866-333-8686 |

| BBB rating | A+ |

| Trustpilot rating | 4.9 stars |

| Minimum debt settled | $7,500 in unsecured debt |

| Noteworthy features | Shorter average resolution period than competitors, no upfront payments |

READ MORE: How to choose a debt settlement company

Americor: What You Need to Know

Americor is not one of those small mom-and-pop style debt relief companies. Based in Irvine, California and with a satellite office in Meridian, Idaho, Americor has more than 500 employees. Those employees have helped customers save around two billion dollars via debt settlement.

Americor touts credentials from the Better Business Bureau, Consumer Affairs, the International Association of Professional Debt Arbitrators (IAPDA) and the American Association for Debt Resolution (formerly the American Fair Credit Council). The company also says that they are “in compliance” with the Federal Trade Commission (FTC) rules regarding upfront fees (in other words, they don’t charge any).

Then there’s the awards. The Orange County Register has named Americor in its Top Places to Work in the USA for multiple years. Top Places to Work is usually a key indicator of employee satisfaction, since companies that make the list are nominated each year by the workers themselves. Energage, the third-party company that compiles employee surveys for the project, says Americor ranks in the top 5% for, among other things, employee appreciation and company direction. Inc. even listed Americor in the top 25 of it’s 5,000 list.

That’s a lot of hype. What does any of it mean? Does the company live up to its reputation? You be the judge.

Is Americor a Legitimate Company?

Yes. Though initially, it might feel like a scam because it will take a few months before your creditors/lenders can start being paid. Rest assured, Americor is a legitimate company. You are not being scammed.

Americor has an A+ rating with the Better Business Bureau, earning 4.7 of 5 stars.

That said, there have been more than 50 complaints filed against Americor with the Consumer Financial Protection Bureau (CFPB), so not everyone walks away a happy customer.

Americor also appears in more than 30 lawsuits listed on CaseText.com.

However, many of the complaints seem to stem from clients who don’t understand the debt settlement process.

READ MORE: Is debt settlement the fastest way to get out of debt?

What Makes Americor Stand Out

Financial advisors and credit counselors are everywhere. So, what makes Americor different?

Debt Settlement

A “settlement” is when you and your creditor agree on how much money you will pay to the creditor so that you can close your account and be done with that creditor. Obviously, the creditor wants you to pay at least as much as you owe. Sometimes though, they will agree to “settle” the debt for less. They do this because they would rather get something from you than nothing.

Negotiating these settlements can be tedious and stressful, which is why Americor wants to do it for you. They take over the negotiation process while you make monthly payments into a third-party account. When there’s enough money in the account to settle the debt, Americor makes the payment. The process repeats for each debt you enroll in Americor’s program.

READ MORE: Is it better to settle a debt or pay in full?

Debt Consolidation Loans

Debt consolidation loans are exactly what they sound like: one loan you use to pay off multiple debts. These can be hard to get and are best for people who are able to make their minimum payments and who haven’t defaulted on any of their accounts.

Americor is not a lender. What they do is help match you to a lender who is likely to approve your loan request. Their network of lenders is vast, though, so if your financial counselor thinks this is a good option for you, you should consider doing it.

READ MORE: Top debt consolidation loans and companies

Credit Counseling/Debt Management Plan

Credit counseling is what happens when you meet with a financial advisor/counselor. The two of you will go over your current financial situation: your earnings, your debts, your expenses, etc. Together the two of you will come up with a plan (the aforementioned debt management plan) to pay off your debt and get back on track.

Typically, your credit counselor is the person in charge of managing your DMP and debt payments. Here’s how it works: The counselor calculates a monthly payment that will cover all payments you must make to your creditors. You then send that monthly payment to your counselor. The counselor divides that up amongst your lenders and creditors.

Because counseling and planning are part of Americor’s financial services portfolio, it makes sense that they will be able to help you find a qualified counselor if credit counseling is your best option.

READ MORE: Debt settlement vs. debt management

Bankruptcy Options

Bankruptcy is the last-resort option. But if Americor can’t help you with debt settlement or finding lenders or counselors, they will help you find a lawyer to help you with your bankruptcy filing.

Remember: Americor is a debt settlement company. They partner with third parties for other services (like bankruptcy help). Their website footer says that some of their programs are provided by Highbee and Associates (aka Advantage Law). Don’t be surprised if you are sent to this firm before filing time.

READ MORE: Do I need an attorney for bankruptcy?

How to Sign Up

The first thing you need to do is set up your initial financial consultation. You can do this by following the prompts on the Americor website, emailing the company at info@americor.com, or calling them at 1-866-333-8686.

How Much Does Americor Charge?

Americor’s fees are based on a percentage of your enrolled debt at the time of starting the program and range from 14%-25% of your enrolled debt. Programs range from 20-48 months. However, you will not pay any fees to Americor until your debts are resolved.

For example, if you enroll $10,000 of debt in their program, and the settlement agreement is $6,000, after fees of 25% you’ll repay a total of $7,500, saving yourself about $2,500. This is true for all legitimate debt settlement companies.

Pros and cons

Every company has benefits and drawbacks. Here are some of Americor’s:

Pros

- You won’t pay any fees until services have been rendered.

- They only do soft pulls on your credit — if they need to run your credit at all.

- Web portal so you can track your progress

Cons

- Your credit will suffer in the beginning of your program.

- Customer service could be better.

- Web portal isn’t always available.

- Limited reach: Americor is only available in 30 states.

READ MORE: Debt settlement pros and cons

Who Should Use Americor

Do you:

- Have more debt than you can handle?

- Struggle to keep up with payments?

- Need help with settlement negotiations or program management?

If so, Americor might be a good fit for you.

Who Should Not Use Americor

Do any of the following sound familiar?

- You’d rather manage your own details than pay someone else to do it.

- Your debt is annoying but still manageable.

Then Americor probably won’t be able to help you.

READ MORE: How to pay off $50,000 in debt — fast

The Website

Americor’s website is packed with good and useful information. Site visitors are given all of the information they need about how the debt settlement process works, what credit counseling is, how bankruptcy works, how to consolidate debt, improve credit, etc. The website is very educational.

The site is designed well and it’s easy to navigate.

What the website lacks is any specific information about what Americor actually does. There are lots of promises to “work with you” and mentions that “every situation is different,” but nothing about exactly what will be covered in your initial consultation, what their different programs actually are, who their lender partners are, etc.

Customer Service

New customers can reach Americor via telephone or email. Existing customers are given a portal that they can use to communicate with the Americor team.

The reviews about customer service say that, during the initial consultations, the Americor reps were awesome. Once you’re onboarded, though, the customer service excellence starts to wane.

Is Americor Trustworthy?

Thankfully, Americor’s Privacy Policy is very straightforward. It spells out exactly which information they can legally use and how. Their Online Privacy Policy, however, is vague. It only says that Americor takes “reasonable security precautions” to protect customer data. There is nothing in the policy that defines what that means.

What are Customers Saying?

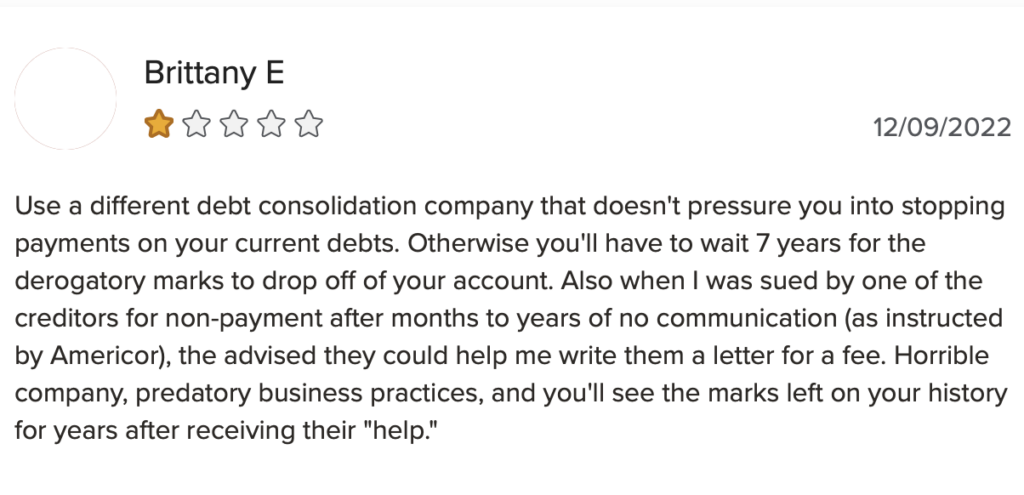

Americor has racked up more than its share of one-star reviews.

Some of those poor reviews say that Americor told them to stop paying their bills during the negotiation process, which is a common debt settlement strategy that will hurt your credit score for up to seven years.

Pro tip: It’s important to heed this warning. If you’re particularly worried about your credit score, hiring a professional debt settlement company may not be your best option. Learn more about how debt settlement can affect your credit score.

For example, the following complaint is from a customer who encountered the credit issue:

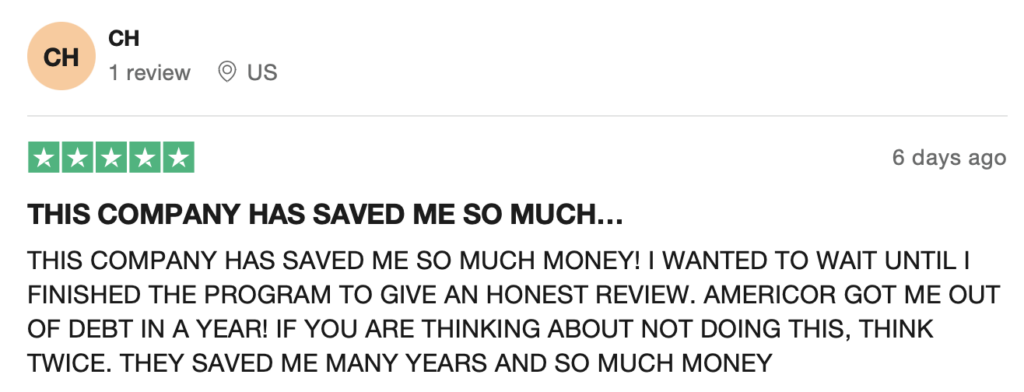

Americor has been reviewed more than 9,000 times on Trustpilot. The company’s rating there is 4.9 stars. Almost 90% of the reviewers gave the company five stars.

The Bottom Line

If you’re only going by professional evaluation, Americor seems nearly perfect. However, if you’re looking for details about how the company operates, they may have some issues. Before committing, make sure you’re fully aware of how debt settlement works and recognize that it could impact your credit score until your debt is paid off.

FAQs

When you enroll in an Americor debt settlement program, you will cease all communication and payments to your creditors and lenders. Because it takes months for you to build up your settlement funds, your creditors/lenders can report your missed payments to the credit bureaus. It’s possible you might also go into default on those accounts before they are settled.

Americor can settle virtually all types of unsecured debts, including credit card bills and medical bills. If you’re looking to get rid of credit card bills or other unsecured debts, learn about your five top options.

Americor boasts recommendations from several high-profile industry groups, but reviews show the service is basically on par with most other similar debt settlement companies. Learn more about our picks for best debt settlement companies.